CANADIAN MEDICAL DEVICES INDUSTRY - LifeSciences BC

CANADIAN MEDICAL DEVICES INDUSTRY - LifeSciences BC

CANADIAN MEDICAL DEVICES INDUSTRY - LifeSciences BC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CANADIAN</strong> <strong>MEDICAL</strong> DEVICE <strong>INDUSTRY</strong><br />

The medical device industry consists of firms that produce a wide range of products used for diagnosis and treatment of<br />

ailments, and which include the following: medical, surgical and dental equipment (including electromedical equipment<br />

and related software), furniture, supplies and consumables, orthopaedic appliances, prosthetics and diagnostic kits,<br />

reagents, and equipment. Firms that are active only in distribution are not included in this profile 1 .<br />

Size and Structure of the Industry<br />

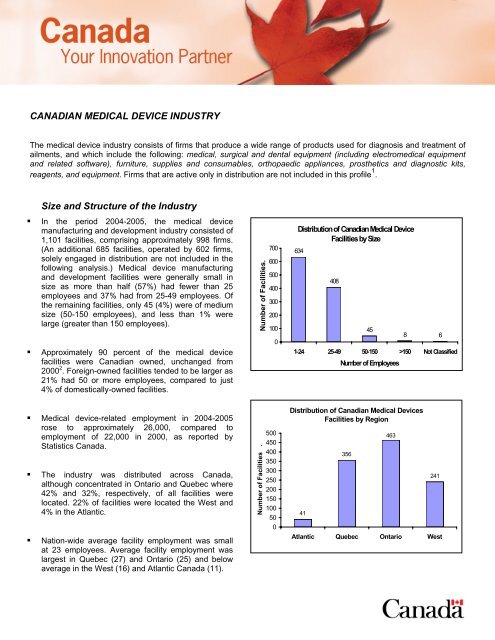

• In the period 2004-2005, the medical device<br />

manufacturing and development industry consisted of<br />

1,101 facilities, comprising approximately 998 firms.<br />

(An additional 685 facilities, operated by 602 firms,<br />

solely engaged in distribution are not included in the<br />

following analysis.) Medical device manufacturing<br />

and development facilities were generally small in<br />

size as more than half (57%) had fewer than 25<br />

employees and 37% had from 25-49 employees. Of<br />

the remaining facilities, only 45 (4%) were of medium<br />

size (50-150 employees), and less than 1% were<br />

large (greater than 150 employees).<br />

• Approximately 90 percent of the medical device<br />

facilities were Canadian owned, unchanged from<br />

2000 2 . Foreign-owned facilities tended to be larger as<br />

21% had 50 or more employees, compared to just<br />

4% of domestically-owned facilities.<br />

Number of Facilities.<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

Distribution of Canadian Medical Device<br />

Facilities by Size<br />

634<br />

408<br />

45<br />

8 6<br />

1-24 25-49 50-150 >150 Not Classified<br />

Number of Employees<br />

• Medical device-related employment in 2004-2005<br />

rose to approximately 26,000, compared to<br />

employment of 22,000 in 2000, as reported by<br />

Statistics Canada.<br />

• The industry was distributed across Canada,<br />

although concentrated in Ontario and Quebec where<br />

42% and 32%, respectively, of all facilities were<br />

located. 22% of facilities were located the West and<br />

4% in the Atlantic.<br />

• Nation-wide average facility employment was small<br />

at 23 employees. Average facility employment was<br />

largest in Quebec (27) and Ontario (25) and below<br />

average in the West (16) and Atlantic Canada (11).<br />

Number of Facilities .<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Distribution of Canadian Medical Devices<br />

Facilities by Region<br />

41<br />

356<br />

463<br />

241<br />

Atlantic Quebec Ontario West

Industry Revenues Depend Significantly on<br />

Exports<br />

• In 2003, Canadian firms generated approximately<br />

$4.0 billion 3 from medical device sales in Canada<br />

and abroad, of which over half ($2.1 billion) were due<br />

to exports. With $3.8 billion in medical device<br />

imports, the size of the Canadian apparent medical<br />

device domestic market was just under $6.0 billion.<br />

• Canada’s exports of medical devices increased at a<br />

solid compound annual growth rate (CAGR) of 10.5%<br />

from 2000-2005 as exports increased from $1.6<br />

billion in 2000 to $2.4 billion in 2005. During the<br />

same period, import growth was also strong although<br />

lower at a CAGR of 6.5%. Despite the higher CAGR<br />

of exports compared to imports, the significantly<br />

higher level of imports resulted in the medical device<br />

trade deficit having increased slightly from $1.8 billion<br />

in 2000 to $1.9 billion in 2005.<br />

• The United States remains overwhelmingly the<br />

primary market for Canadian medical device exports<br />

and the destination for 76% of all medical device<br />

exports in 2005. However, there is an increasing<br />

diversification of destination markets for Canadian<br />

medical devices as the export share destined for the<br />

United States has decreased in each of the last three<br />

years and is down sharply from 87% in 2002. In<br />

2005, the other growing export markets for Canada<br />

were the United Kingdom, a destination for 4% of<br />

Canadian medical device exports, Germany (3%)<br />

and China (2%). Since 2000, the most rapidly<br />

expanding export markets, as measured by sales<br />

CAGR, were China (168%), Singapore (93%), South<br />

Africa (83%) and South Korea (79%).<br />

• Since 2000, there has also been a shift in the source<br />

of Canada’s medical device imports. Although the<br />

United States still accounted for over half of all<br />

imports in 2005 at 54%, the share is down from 68%<br />

in 2000. During this period, both Germany (8%) and<br />

China (6%) have doubled their share of the Canadian<br />

market by way of sales CAGRs of 27% and 29%,<br />

respectively. Higher average growth rates were also<br />

posted by imports from Ireland (65%), Mexico (36%)<br />

and Australia (29%), although their shares of total<br />

imports remain at 3% or less.<br />

• Canada’s trade in medical device products is<br />

categorized using the Harmonized System (HS). The<br />

accompanying tables list the top ten exports (using<br />

2<br />

$ Billions<br />

the 8-digit classification) and the top ten imports<br />

(using the 10-digit classification) according to dollar<br />

value and share of total dollar value.<br />

5.0<br />

4.0<br />

3.0<br />

2.0<br />

1.0<br />

0.0<br />

Canadian Medical Devices Exports and<br />

Imports<br />

1.6<br />

3.4<br />

1.8<br />

3.9 3.8 3.9 4.0<br />

1.9<br />

2.1 2.2<br />

2000 2001 2002 2003 2004 2005<br />

Exports<br />

Imports<br />

Canadian Exports of Medical Devices by HS Code, 2005<br />

Billions $<br />

Total Exports 2.40<br />

2.4<br />

4.3<br />

Share of Total<br />

Exports<br />

Top Ten Exports by HS code (8-Digit Level)<br />

Sanitary articles of paper, incl sanit towels & napkins (diapers) for babies 0.56 23%<br />

Mechano-therapy appl; massage app; psychological aptitude-testing apparatus 0.19 8%<br />

Opacifying prep, x-ray; diagnostic reagents, designed for admin to patients 0.19 8%<br />

Electro-diagnostic apparatus, nes 0.16 7%<br />

Composite diagnostic or laboratory reagents, nes, 0.15 6%<br />

Instruments and appliances used in medical or veterinary sciences, nes 0.12 5%<br />

Medical, surgical, dental or veterinary furniture and parts nes 0.11 5%<br />

Electro-cardiographs 0.10 4%<br />

Parts and accessories for app based on the use of X-rays or other radiations 0.07 3%<br />

Oxygen therapy, artificial respiration or other therapeutic respiration app 0.06 2%<br />

Top Ten Exports by HS Code 1.70 71%<br />

All other HS codes 0.69 29%<br />

Source: Statistics Canada, World Trade Atlas<br />

Canadian Imports of Medical Devices by HS Code, 2005<br />

Billions $<br />

Total Imports 4.33<br />

Share of Total<br />

Imports<br />

Top Ten Imports by HS code (10-Digit Level)<br />

Diagnostic reagent,w/n on a backing,for med diagnosis/mfr semi condu device/etc 0.36 8%<br />

Instruments & appliances used in medical,surgical,dental/veterinary science,nes 0.34 8%<br />

Bougies, catheters, drains and sondes, and parts and accessories thereof 0.24 5%<br />

Mechano-therapy appl; pwr-op message appl; psychological aptitude-testing app 0.18 4%<br />

Cannulae and the like, nes 0.16 4%<br />

Instruments and appliances, used in dental science, nes 0.15 3%<br />

Appliances which are worn or carried or implanted in the body nes 0.15 3%<br />

App based on the use of x-rays, for medical, surgical or veterinary uses, nes 0.13 3%<br />

Contact lenses 0.13 3%<br />

Pacemakers for stimulating heart muscles, excluding parts and accessories 0.11 2%<br />

Top Ten Imports by HS code 1.95 45%<br />

All other HS codes 2.38 55%<br />

Source: Statistics Canada, World Trade Atlas

Canadian Technology Strength Supports<br />

Innovation<br />

• The manufacturing of medical devices involves the<br />

application of diverse biomedical and engineering<br />

disciplines. The Canadian medical device industry<br />

benefits from the strengths of associated Canadian<br />

industries including biotechnology, advanced<br />

materials, microelectronics, telecommunications, and<br />

software and informatics.<br />

• In addition, the industry is able to draw on worldclass<br />

innovative research being conducted in<br />

Canadian universities, research institutes and<br />

hospitals. Nearly 10 percent of Canadian medical<br />

device firms are spin-offs of universities, other firms<br />

or laboratories 4 . A number of medical device firms<br />

work in collaboration with other organizations<br />

(universities, hospitals, smaller or larger firms,<br />

government departments, etc.).<br />

Medical Device Manufacturing Costs Lowest in G7<br />

• Total annual costs to establish and operate a medical<br />

device manufacturing facility in Canada are the<br />

lowest in the G7. (Source: Competitive Alternatives:<br />

KPMG’s Guide to International Business Costs, 2006<br />

Edition) Canada holds a 4.1 percent cost advantage<br />

over the United States in medical device<br />

manufacturing.<br />

• Canada’s lowest labour costs in the G7 contribute to<br />

this advantage. KPMG estimates that labour cost<br />

accounts for over 50% of location-sensitive cost in<br />

manufacturing and over 75% location-sensitive cost<br />

in services operations.<br />

Low R&D Costs<br />

• Canada offers the most favourable tax treatment for<br />

R&D among the G7 with a system of tax credits and<br />

accelerated tax deductions for a wide variety of R&D<br />

expenditures (including salaries, overhead, capital<br />

equipment and materials). (Source: Warda, Jacek,<br />

Rating Canada’s R&D Tax Treatment: A 2003<br />

Update, October 2003).<br />

• The federal and provincial tax-based incentives<br />

permit firms to significantly reduce R&D costs<br />

through direct investment or subcontracting in<br />

Canada.<br />

3<br />

Biotechnology<br />

Software and<br />

Informatics<br />

United Kingdom<br />

United States<br />

Canada<br />

Canada<br />

France<br />

Italy<br />

Japan<br />

Germany<br />

Telecommunications<br />

Medical Devices<br />

Advanced Materials<br />

Microelectronics<br />

G7 Medical Device Business Costs,<br />

(Index: US = 100)<br />

95.9<br />

96.6<br />

98.4<br />

98.5<br />

100<br />

106.1<br />

107.2<br />

90 95 100 105 110<br />

Source: Competitive Alternatives: KPMG's Guide to International Business Costs, 2006<br />

Edition<br />

U.S.<br />

Japan<br />

U.K.<br />

France<br />

Italy<br />

Germany<br />

Relative Generosity of R&D Tax Incentives*<br />

(Index: Canada = 100)<br />

0 20 40 60 80 100 120<br />

* Does not include Ontario's 2003 cuts to corporate income tax rates.<br />

Source: Warda, Jacek, Rating Canada's R&D Tax Treatment: A 2003 Update , October 2003.<br />

71<br />

71<br />

77<br />

80<br />

85<br />

84<br />

100

Regulatory Process Emphasizes Harmonization<br />

• Canada’s regulatory process for medical devices<br />

increasingly emphasizes harmonization and<br />

reciprocity. Canada has a risk-based system of<br />

regulation in keeping with international trends.<br />

• The Food and Drugs Act permits Canadian<br />

manufacturers to export product in accordance with<br />

the receiving country's laws, irrespective of domestic<br />

approval status. This export provision has prompted<br />

some foreign-owned companies to establish export<br />

manufacturing from a Canadian base.<br />

Supportive Network of Industry Associations<br />

• Companies in Canada’s medical device industry<br />

are supported by a number of national and regional<br />

associations, including: MEDEC - Canada’s Medical<br />

Device Technology Companies; Alberta Health<br />

Industry Alliance; Association of Health<br />

Technologies Industry (Quebec); BioNova (Nova<br />

Scotia); <strong>BC</strong> MedTech (British Columbia); Health<br />

Care Products Association of Manitoba; Ottawa Life<br />

Sciences Council; and Trillium Medical Technology<br />

Association (Ontario).<br />

Federally Funded Research Support Programs<br />

• Several federally-funded research programs and<br />

councils support health-related research in Canada:<br />

the Canadian Institutes for Health Research (CIHR);<br />

Networks of Centres of Excellence; National<br />

Research Council (NRC); and the Natural Sciences<br />

and Engineering Research Council (NSERC).<br />

Commercialization Initiatives<br />

• Sectoral initiatives to facilitate technology<br />

commercialization include efforts by organizations<br />

such as the Health Technology Exchange (HTX)<br />

(www.htx.ca), Westlink Innovation Network Ltd.<br />

(www.westlink.ca), and NRC’s Centre for<br />

Commercialization of Biomedical Technology<br />

(http://ibd.nrc-cnrc.gc.ca/ibd_external/ccbt/index.html).<br />

2 Statistics Canada, Medical Device Industry Survey 2000.<br />

3 Based on the average of estimates by Rozinski ($3.7 billion) and E&B<br />

Data ($4.5 billion).<br />

4 Statistics Canada, Medical Device Industry Survey 2000.<br />

<br />

<br />

<br />

<br />

<br />

Hot Links of Interest<br />

Industry Canada - Life Sciences Branch<br />

www.strategis.gc.ca/lsb<br />

Invest in Canada<br />

www.investincanada.gc.ca<br />

The Canadian Trade Commissioner Service<br />

www.infoexport.gc.ca<br />

Innovation in Canada<br />

www.innovation.gc.ca<br />

Medical Device Companies and Associations<br />

http://strategis.ic.gc.ca/epic/internet/inlsgpdsv.nsf/en/h_hn00041e.html<br />

Contacts: Mary Boreskie boreskie.mary@ic.gc.ca<br />

Robert Squires squires.robert2@ic.gc.ca<br />

1 Source of data unless otherwise specified: E&B Data collected in 2004 and<br />

2005 and Canadian International Merchandise Trade Database. The latter<br />

presents data using the Harmonized System (HS), thereby allowing for<br />

detailed analysis on a product/country basis.<br />

4