CANADIAN MEDICAL DEVICES INDUSTRY - LifeSciences BC

CANADIAN MEDICAL DEVICES INDUSTRY - LifeSciences BC

CANADIAN MEDICAL DEVICES INDUSTRY - LifeSciences BC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

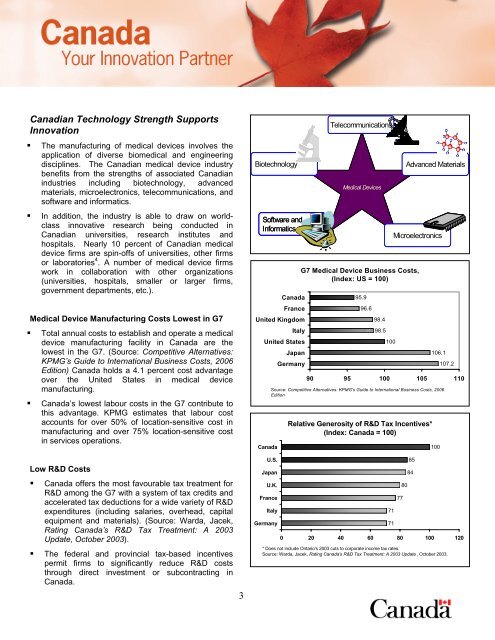

Canadian Technology Strength Supports<br />

Innovation<br />

• The manufacturing of medical devices involves the<br />

application of diverse biomedical and engineering<br />

disciplines. The Canadian medical device industry<br />

benefits from the strengths of associated Canadian<br />

industries including biotechnology, advanced<br />

materials, microelectronics, telecommunications, and<br />

software and informatics.<br />

• In addition, the industry is able to draw on worldclass<br />

innovative research being conducted in<br />

Canadian universities, research institutes and<br />

hospitals. Nearly 10 percent of Canadian medical<br />

device firms are spin-offs of universities, other firms<br />

or laboratories 4 . A number of medical device firms<br />

work in collaboration with other organizations<br />

(universities, hospitals, smaller or larger firms,<br />

government departments, etc.).<br />

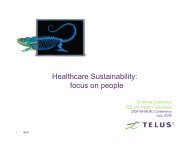

Medical Device Manufacturing Costs Lowest in G7<br />

• Total annual costs to establish and operate a medical<br />

device manufacturing facility in Canada are the<br />

lowest in the G7. (Source: Competitive Alternatives:<br />

KPMG’s Guide to International Business Costs, 2006<br />

Edition) Canada holds a 4.1 percent cost advantage<br />

over the United States in medical device<br />

manufacturing.<br />

• Canada’s lowest labour costs in the G7 contribute to<br />

this advantage. KPMG estimates that labour cost<br />

accounts for over 50% of location-sensitive cost in<br />

manufacturing and over 75% location-sensitive cost<br />

in services operations.<br />

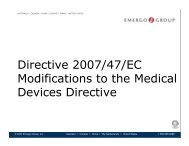

Low R&D Costs<br />

• Canada offers the most favourable tax treatment for<br />

R&D among the G7 with a system of tax credits and<br />

accelerated tax deductions for a wide variety of R&D<br />

expenditures (including salaries, overhead, capital<br />

equipment and materials). (Source: Warda, Jacek,<br />

Rating Canada’s R&D Tax Treatment: A 2003<br />

Update, October 2003).<br />

• The federal and provincial tax-based incentives<br />

permit firms to significantly reduce R&D costs<br />

through direct investment or subcontracting in<br />

Canada.<br />

3<br />

Biotechnology<br />

Software and<br />

Informatics<br />

United Kingdom<br />

United States<br />

Canada<br />

Canada<br />

France<br />

Italy<br />

Japan<br />

Germany<br />

Telecommunications<br />

Medical Devices<br />

Advanced Materials<br />

Microelectronics<br />

G7 Medical Device Business Costs,<br />

(Index: US = 100)<br />

95.9<br />

96.6<br />

98.4<br />

98.5<br />

100<br />

106.1<br />

107.2<br />

90 95 100 105 110<br />

Source: Competitive Alternatives: KPMG's Guide to International Business Costs, 2006<br />

Edition<br />

U.S.<br />

Japan<br />

U.K.<br />

France<br />

Italy<br />

Germany<br />

Relative Generosity of R&D Tax Incentives*<br />

(Index: Canada = 100)<br />

0 20 40 60 80 100 120<br />

* Does not include Ontario's 2003 cuts to corporate income tax rates.<br />

Source: Warda, Jacek, Rating Canada's R&D Tax Treatment: A 2003 Update , October 2003.<br />

71<br />

71<br />

77<br />

80<br />

85<br />

84<br />

100