BNP Paribas Fortis North American energy monthly - Virtual Metals

BNP Paribas Fortis North American energy monthly - Virtual Metals

BNP Paribas Fortis North American energy monthly - Virtual Metals

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>BNP</strong> <strong>Paribas</strong> <strong>Fortis</strong>/VM Group October 2009 | <strong>BNP</strong> <strong>Paribas</strong> <strong>Fortis</strong> <strong>North</strong> <strong>American</strong> <strong>energy</strong> <strong>monthly</strong> | 9<br />

Crude oil<br />

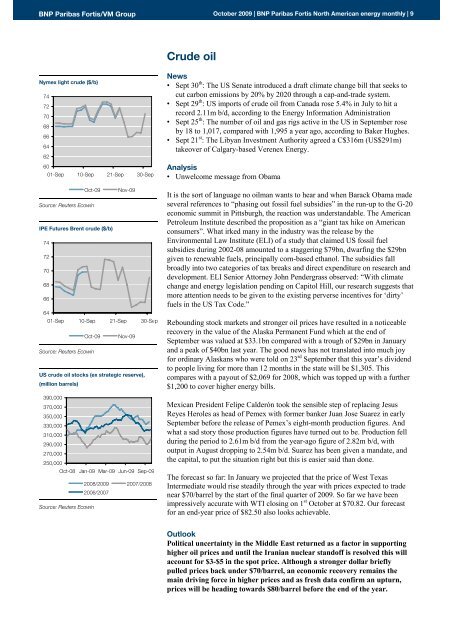

Nymex light crude ($/b)<br />

74<br />

72<br />

70<br />

68<br />

66<br />

64<br />

62<br />

60<br />

01-Sep 10-Sep 21-Sep 30-Sep<br />

Oct-09 Nov-09<br />

Source: Reuters Ecowin<br />

IPE Futures Brent crude ($/b)<br />

74<br />

72<br />

70<br />

68<br />

66<br />

64<br />

01-Sep 10-Sep 21-Sep 30-Sep<br />

Oct-09 Nov-09<br />

Source: Reuters Ecowin<br />

US crude oil stocks (ex strategic reserve),<br />

(million barrels)<br />

390,000<br />

370,000<br />

350,000<br />

330,000<br />

310,000<br />

290,000<br />

270,000<br />

250,000<br />

Oct-08 Jan-09 Mar-09 Jun-09 Sep-09<br />

2008/2009 2007/2008<br />

2006/2007<br />

Source: Reuters Ecowin<br />

News<br />

• Sept 30 th : The US Senate introduced a draft climate change bill that seeks to<br />

cut carbon emissions by 20% by 2020 through a cap-and-trade system.<br />

• Sept 29 th : US imports of crude oil from Canada rose 5.4% in July to hit a<br />

record 2.11m b/d, according to the Energy Information Administration<br />

• Sept 25 th : The number of oil and gas rigs active in the US in September rose<br />

by 18 to 1,017, compared with 1,995 a year ago, according to Baker Hughes.<br />

• Sept 21 st : The Libyan Investment Authority agreed a C$316m (US$291m)<br />

takeover of Calgary-based Verenex Energy.<br />

Analysis<br />

• Unwelcome message from Obama<br />

It is the sort of language no oilman wants to hear and when Barack Obama made<br />

several references to “phasing out fossil fuel subsidies” in the run-up to the G-20<br />

economic summit in Pittsburgh, the reaction was understandable. The <strong>American</strong><br />

Petroleum Institute described the proposition as a “giant tax hike on <strong>American</strong><br />

consumers”. What irked many in the industry was the release by the<br />

Environmental Law Institute (ELI) of a study that claimed US fossil fuel<br />

subsidies during 2002-08 amounted to a staggering $79bn, dwarfing the $29bn<br />

given to renewable fuels, principally corn-based ethanol. The subsidies fall<br />

broadly into two categories of tax breaks and direct expenditure on research and<br />

development. ELI Senior Attorney John Pendergrass observed: “With climate<br />

change and <strong>energy</strong> legislation pending on Capitol Hill, our research suggests that<br />

more attention needs to be given to the existing perverse incentives for ‘dirty’<br />

fuels in the US Tax Code.”<br />

Rebounding stock markets and stronger oil prices have resulted in a noticeable<br />

recovery in the value of the Alaska Permanent Fund which at the end of<br />

September was valued at $33.1bn compared with a trough of $29bn in January<br />

and a peak of $40bn last year. The good news has not translated into much joy<br />

for ordinary Alaskans who were told on 23 rd September that this year’s dividend<br />

to people living for more than 12 months in the state will be $1,305. This<br />

compares with a payout of $2,069 for 2008, which was topped up with a further<br />

$1,200 to cover higher <strong>energy</strong> bills.<br />

Mexican President Felipe Calderón took the sensible step of replacing Jesus<br />

Reyes Heroles as head of Pemex with former banker Juan Jose Suarez in early<br />

September before the release of Pemex’s eight-month production figures. And<br />

what a sad story those production figures have turned out to be. Production fell<br />

during the period to 2.61m b/d from the year-ago figure of 2.82m b/d, with<br />

output in August dropping to 2.54m b/d. Suarez has been given a mandate, and<br />

the capital, to put the situation right but this is easier said than done.<br />

The forecast so far: In January we projected that the price of West Texas<br />

Intermediate would rise steadily through the year with prices expected to trade<br />

near $70/barrel by the start of the final quarter of 2009. So far we have been<br />

impressively accurate with WTI closing on 1 st October at $70.82. Our forecast<br />

for an end-year price of $82.50 also looks achievable.<br />

Outlook<br />

Political uncertainty in the Middle East returned as a factor in supporting<br />

higher oil prices and until the Iranian nuclear standoff is resolved this will<br />

account for $3-$5 in the spot price. Although a stronger dollar briefly<br />

pulled prices back under $70/barrel, an economic recovery remains the<br />

main driving force in higher prices and as fresh data confirm an upturn,<br />

prices will be heading towards $80/barrel before the end of the year.