LTA vs DTA Leaflet (W13407) - Legal & General

LTA vs DTA Leaflet (W13407) - Legal & General

LTA vs DTA Leaflet (W13407) - Legal & General

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

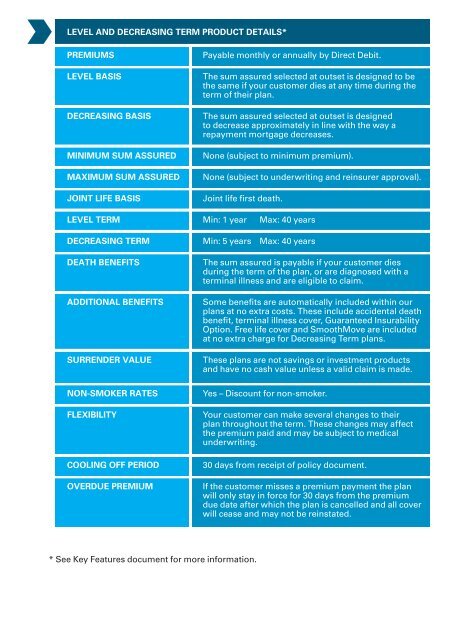

LEVEL AND DECREASING TERM PRODUCT DETAILS*<br />

PREMIUMS<br />

LEVEL BASIS<br />

DECREASING BASIS<br />

MINIMUM SUM ASSURED<br />

MAXIMUM SUM ASSURED<br />

JOINT LIFE BASIS<br />

Payable monthly or annually by Direct Debit.<br />

The sum assured selected at outset is designed to be<br />

the same if your customer dies at any time during the<br />

term of their plan.<br />

The sum assured selected at outset is designed<br />

to decrease approximately in line with the way a<br />

repayment mortgage decreases.<br />

None (subject to minimum premium).<br />

None (subject to underwriting and reinsurer approval).<br />

Joint life first death.<br />

LEVEL TERM Min: 1 year Max: 40 years<br />

DECREASING TERM<br />

DEATH BENEFITS<br />

ADDITIONAL BENEFITS<br />

SURRENDER VALUE<br />

NON-SMOKER RATES<br />

FLEXIBILITY<br />

COOLING OFF PERIOD<br />

OVERDUE PREMIUM<br />

Min: 5 years Max: 40 years<br />

The sum assured is payable if your customer dies<br />

during the term of the plan, or are diagnosed with a<br />

terminal illness and are eligible to claim.<br />

Some benefits are automatically included within our<br />

plans at no extra costs. These include accidental death<br />

benefit, terminal illness cover, Guaranteed Insurability<br />

Option. Free life cover and SmoothMove are included<br />

at no extra charge for Decreasing Term plans.<br />

These plans are not savings or investment products<br />

and have no cash value unless a valid claim is made.<br />

Yes – Discount for non-smoker.<br />

Your customer can make several changes to their<br />

plan throughout the term. These changes may affect<br />

the premium paid and may be subject to medical<br />

underwriting.<br />

30 days from receipt of policy document.<br />

If the customer misses a premium payment the plan<br />

will only stay in force for 30 days from the premium<br />

due date after which the plan is cancelled and all cover<br />

will cease and may not be reinstated.<br />

* See Key Features document for more information.