Whole of Life Application Form (W10243) - Legal & General

Whole of Life Application Form (W10243) - Legal & General

Whole of Life Application Form (W10243) - Legal & General

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

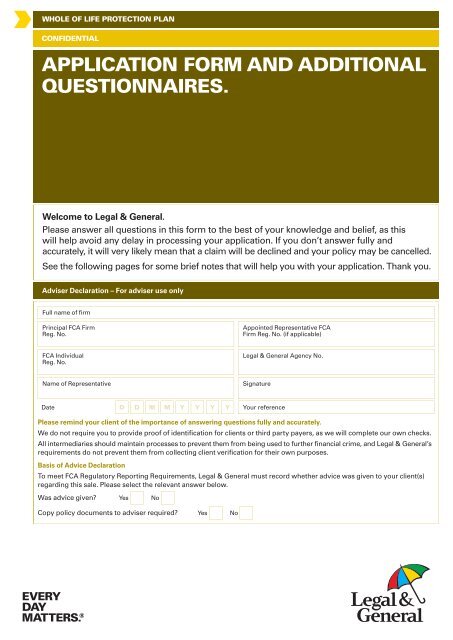

WHOLE OF LIFE PROTECTION PLANCONFIDENTIALAPPLICATION FORM AND ADDITIONALQUESTIONNAIRES.Welcome to <strong>Legal</strong> & <strong>General</strong>.Please answer all questions in this form to the best <strong>of</strong> your knowledge and belief, as thiswill help avoid any delay in processing your application. If you don’t answer fully andaccurately, it will very likely mean that a claim will be declined and your policy may be cancelled.See the following pages for some brief notes that will help you with your application. Thank you.Adviser Declaration – For adviser use onlyFull name <strong>of</strong> firmPrincipal FCA FirmReg. No.Appointed Representative FCAFirm Reg. No. (if applicable)FCA IndividualReg. No.<strong>Legal</strong> & <strong>General</strong> Agency No.Name <strong>of</strong> RepresentativeSignatureDateD D M M Y Y Y YYour referencePlease remind your client <strong>of</strong> the importance <strong>of</strong> answering questions fully and accurately.We do not require you to provide pro<strong>of</strong> <strong>of</strong> identification for clients or third party payers, as we will complete our own checks.All intermediaries should maintain processes to prevent them from being used to further financial crime, and <strong>Legal</strong> & <strong>General</strong>’srequirements do not prevent them from collecting client verification for their own purposes.Basis <strong>of</strong> Advice DeclarationTo meet FCA Regulatory Reporting Requirements, <strong>Legal</strong> & <strong>General</strong> must record whether advice was given to your client(s)regarding this sale. Please select the relevant answer below.Was advice given?YesNoCopy policy documents to adviser required?YesNo

NOTES TO HELP YOU WITH YOUR APPLICATIONThis form is divided into two main sections:– Section A: Client and product details– Section B: Full application details (to be completed by you – the ‘client(s)’ whose life, or lives, will be assured)Tips for completing this application formPlease be aware <strong>of</strong> the following:• You must use black ink and write in BLOCK CAPITALS throughout.• If you make any mistakes, please correct and initial any alterations.• Yellow parts must be completed.• Green parts are additional questionnaires which only need to be completed if you are instructed to do so within the form.• Both columns must be completed for joint life plans, unless instructed otherwise, but each client must complete theirown details.• Look out for this symbol, which highlights important guidance notes or instructions throughout the form.• If your financial adviser is going to complete this form on your behalf using the information you have provided, youmust read all <strong>of</strong> the questions and answers carefully before signing the Client Declaration and Consent at the end.Your financial adviser is acting on your behalf in this respect.To help you complete this application you will need:• Information relating to existing or previous life insurance.• Details <strong>of</strong> medication or treatment that you are currently having.• Your doctor’s practice name and address (including their postcode).• Your bank account details.Please be aware <strong>of</strong> the following points before proceeding with this application:Why it’s important that you give us the right informationYou must tell <strong>Legal</strong> & <strong>General</strong> everything they ask for as all answers may be taken into account when assessingacceptance <strong>of</strong> the application and in calculating the premium. Please remember that if you do not answer the followingquestions fully and accurately it will very likely mean that a claim will be declined and the policy or policies cancelled. Ifyou have given the information in the past, please provide it again.<strong>Legal</strong> & <strong>General</strong> will try to rely on the information that you tell them and you must not assume that they will always clarifythat information with your doctor (GP). However, <strong>Legal</strong> & <strong>General</strong> may, as part <strong>of</strong> their administrative procedures, requesta copy <strong>of</strong> your full health records from your doctor (GP) to check the medical information you provide.If any <strong>of</strong> your answers change AFTER you have completed the questions in this application form, but BEFORE your policystarts (see section opposite) you must tell <strong>Legal</strong> & <strong>General</strong> immediately. This is just as important as giving full, accurateand truthful answers in the first place.How we safeguard the information you give usConfidentiality<strong>Legal</strong> & <strong>General</strong> follow a strict confidentiality code about all medical information you give them, or which they getfrom any additional medical report. This means that your medical information is held securely and access is limitedto authorised individuals who need to see it.A copy <strong>of</strong> the confidentiality policy is available on request.The information you give <strong>Legal</strong> & <strong>General</strong>They will only use the information provided for the purposes <strong>of</strong> underwriting, processing and administering the policyor policies requested, or any subsequent policy(ies) and for statistical analysis. <strong>Legal</strong> & <strong>General</strong> will keep the informationfor the duration <strong>of</strong> any policy issued and for a period after the policy has ceased. They may also use the information inprocessing any claim under the policy or policies. If the application does not go ahead, the information will only be heldfor a limited period <strong>of</strong> time from the date <strong>of</strong> cancellation.Page 2<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

Your personal and medical information<strong>Legal</strong> & <strong>General</strong> will not pass any personal or medical information to a third party without your consent. This willonly be necessary in the following circumstances:• If <strong>Legal</strong> & <strong>General</strong> ask you to attend a medical screening or they need to get a copy <strong>of</strong> your full health recordsfrom your doctor.• If <strong>Legal</strong> & <strong>General</strong> need to send your personal and medical information to their reinsurer for its opinion oragreement on the acceptance terms to be <strong>of</strong>fered, and/or, at a later stage, for the purpose <strong>of</strong> administering yourpolicy. This will only be in accordance with <strong>Legal</strong> & <strong>General</strong>’s reinsurance business principles, details <strong>of</strong> whichare available on request.• If you ask <strong>Legal</strong> & <strong>General</strong> to send your medical information to another insurance provider to whom you areapplying, or that provider asks <strong>Legal</strong> & <strong>General</strong> for your medical information.• If <strong>Legal</strong> & <strong>General</strong> need to share information, at the time <strong>of</strong> a claim, with other insurance companies to preventfraudulent claims. This would be via a Register <strong>of</strong> Claims and a list <strong>of</strong> participants is available on request.If you would prefer, you may complete the medical questions in private and return the answers in a sealedenvelope directly to the Medical Officer at <strong>Legal</strong> & <strong>General</strong> Assurance Society Limited, City Park, The Droveway,Hove BN3 7PYConfirming your identityTo protect you and us from financial crime, we may need to confirm your identity from time to time. We may dothis by using reference agencies to search sources <strong>of</strong> information about you (an identity search). This will not affectyour credit rating. If this search fails, we may need to ask you for documents to confirm your identity.Please be aware <strong>of</strong> the following informationWhen your policy startsThe benefits provided by the policy or policies will not start until <strong>Legal</strong> & <strong>General</strong> have assessed and accepted yourapplication, you have agreed to any revised premium or revised policy conditions, the chosen start date has beenreached and the first premium has been paid.Complaints procedure<strong>Legal</strong> & <strong>General</strong> have a formal complaints procedure and details will be given to you when you receive your policydocumentation.The Contract will be governed by the law <strong>of</strong> England and Wales.<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 3

SECTION A QuoteInitial Client detailsFull name and titlePlease ensure you giveall <strong>of</strong> your middle names.Client oneMr/Mrs/Miss/Ms/Dr/Rev/OtherForename(s) and middle name(s) in fullClient twoMr/Mrs/Miss/Ms/Dr/Rev/OtherForename(s) and middle name(s) in fullSurnameSurnameGenderMaleFemaleMaleFemaleDate <strong>of</strong> birthD D M M Y Y Y YD D M M Y Y Y YHave you used cigarettes, cigars,pipes, or nicotine replacementsin the last 12 months – includingoccasional use?Yes NoYes NoA simple medical test may be required to check the validity <strong>of</strong> the answer to this question.Employment statusFull timeemployeeSelfemployedPart timeemployeeRetiredContractworkerStudentFull timeemployeeSelfemployedPart timeemployeeRetiredContractworkerStudentUnemployedHousepersonUnemployedHousepersonAbout your planClient one Client two JointWhat amount <strong>of</strong> cover do you want?orWhat is the premium amount?££ £OROR£ £ £ORIs this policy for:Family ProtectionInheritance Tax planningBusiness ProtectionIf this policy is for BusinessProtection, do you require the sumassured to be paid in instalments?Yes No Yes No Yes NoIf ‘Yes’, please select benefit payment option required:2 years3 years5 years2 years3 years5 years2 years3 years5 yearsPage 4<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

About your plan continuedClient one Client two JointDo you require Waiver<strong>of</strong> Premium Benefit?YesNoYes No Yes NoIf ‘Yes’, which client?12BothDo you require Indexation?Yes No Yes No Yes NoIf you choose a joint life policy,under which <strong>of</strong> the followingcircumstances do you wantthe sum assured to be paid?1st Death2nd DeathStart DateAssuming that <strong>Legal</strong> & <strong>General</strong>accepts your application atstandard rates and all requirementsnecessary to put your policy onrisk are met we will start yourpolicy immediately. If you prefer analternative date, please state it inthe box opposite.If the date is not yet known pleaseindicate in the box opposite thatit is to be advised.D D M M Y Y Y YDate to be advisedPlease note: We cannot guarantee that we will make the first premium collection on this date. It is possiblethat we may collect the first two premiums together. If you choose the 29th, 30th or 31st, where these datesfall on a weekend, or a bank holiday or are not in the month we will collect your premium on the last workingday <strong>of</strong> the month.The requirements necessary to put your policy on risk are things such as a completed Direct Debit Mandateor a completed trust form.If any benefit you apply for is NOT accepted at standard rates we will contact either you or your FinancialAdviser for further instructions regardless <strong>of</strong> any date you give above.How <strong>of</strong>ten do you want to pay yourpremiums? Please note, you can payeither monthly by Direct Debit, orannually by Direct Debit or cheque.MonthlyAnnually<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 5

SECTION B Full application detailsPART 1 – ABOUT YOUClient oneClient twoWhat is your contact address,including postcode?Please check that you have filledin your postcode as this is essentialfor processing the applicationmore quickly.PostcodeAs Client 1PostcodeWhat is your home address,including postcode, if differentfrom the contact addressprovided above?Please check that you havefilled in your postcode.PostcodeAs Client 1PostcodeWhat are your contact details?Please ensure that youcomplete all details.Work phoneHome phoneMobile phoneEmail addressWork phoneHome phoneMobile phoneEmail addressIt may be necessary for us tocontact you to discuss yourapplication, which might includediscussing matters <strong>of</strong> a sensitivenature. Are you happy for us totelephone you in this event?Please note, we may recordand monitor calls.WORKYesNoIf ‘Yes’, which phone number and time is most suitable?WorkMon-Fri9am-11amMon-Fri2pm-4pmMon-Fri6pm-8pmHomeMon-Fri11am-2pmMon-Fri4pm-6pmMobileYesNoIf ‘Yes’, which phone number and time is most suitable?WorkMon-Fri9am-11amMon-Fri2pm-4pmMon-Fri6pm-8pmHomeMon-Fri11am-2pmMon-Fri4pm-6pmMobileIf you are a houseperson, retired, a student or unemployed, please ignore this question and proceed to the next question.Client oneClient twoDoes your job involve work in any<strong>of</strong> the occupations or environmentslisted opposite?If ‘Yes’, please tick all that apply.If ‘No’, please tick ‘None <strong>of</strong>the above’.Outside at heights <strong>of</strong> over 12 metres (40 ft) for more than 10% <strong>of</strong> the timeThe Armed Forces or member <strong>of</strong> the Army ReserveThe <strong>of</strong>fshore fishing industryThe <strong>of</strong>fshore oil or gas industryAs a full time barman, barmaid or landlord in a public houseFull time means working an average <strong>of</strong> 30 or more hours a week.UnderwaterUnderground, for example mining, tunnellingWith explosivesAs a sports pr<strong>of</strong>essionalNone <strong>of</strong> the aboveClient oneClient twoPlease also tell us your job titleif you have ticked one <strong>of</strong> theoccupations in this question.Job title*Job title**If you have more than one job, please give your main job title only.Page 6<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

SECTION B Full application details continuedTOTAL COVERClient oneClient twoIncluding this application, will thetotal amount <strong>of</strong> LIFE cover on yourlife exceed £1,500,000?Yes No Yes NoIf you have answered ‘Yes’ to the above question and this cover is for Business reasons please complete a Business AssuranceQuestionnaire (W1844) available on the Adviser Centre; you can copy this link into your browser: http://www.legalandgeneral.com/library/underwriting/underwriting-questionnaire/W1844.pdf, otherwise please complete a Personal Assurance Questionnaire (in Part 4)BEFORE continuing with the next question.TRAVELClient oneClient twoDuring the last five years haveyou lived, worked or travelledOUTSIDE the UK?Please ignore holidays for up toone month; business trips up toone week, provided they did nottotal more than 12 weeks in a year.In this context, UK includesEngland, Scotland, Wales,Northern Ireland, Isle <strong>of</strong> Manand the Channel Islands.YesNoIf ‘Yes’, please give the following details:Which country?In total, how longwere you there? years monthsHow long ago wasyour last visit? years monthsYesNoIf ‘Yes’, please give the following details:Which country?In total, how longwere you there? years monthsHow long ago wasyour last visit? years monthsDo you have anyother country(ies)to disclose?YesNoDo you have anyother country(ies)to disclose?YesNoIf ‘Yes’, please give the same details as above, for theother country(ies), in Part 8 (Additional Information)before continuing with this section.If ‘Yes’, please give the same details as above, for theother country(ies), in Part 8 (Additional Information)before continuing with this section.During the next two years, doyou intend to live, work or travelOUTSIDE the UK?Please ignore: holidays for up toone month; business trips up toone week, provided they will nottotal more than 12 weeks in a year;any service as a member <strong>of</strong> theArmed Forces.In this context, UK includesEngland, Scotland, Wales andNorthern Ireland.YesNoIf ‘Yes’, please give the following details:Do you plan to leave theUK permanently?YesNoIf ‘Yes’, please advise when you plan to leave the UKand where you will live.If ‘No’, will you be staying within the EuropeanUnion, United States <strong>of</strong> America, Canada,Australia or New Zealand?YesNoIf ‘Yes’, please give the following details:Do you plan to leave theUK permanently?YesNoIf ‘Yes’, please advise when you plan to leave the UKand where you will live.If ‘No’, will you be staying within the EuropeanUnion, United States <strong>of</strong> America, Canada, Australiaor New Zealand?YesNoYesNoHow long do you plan to be outside the UK orRepublic <strong>of</strong> Ireland during the next two years?How long do you plan to be outside the UK orRepublic <strong>of</strong> Ireland during the next two years?weeksdaysweeksdaysPlease list all the countries or islands outside theEuropean Union, United States <strong>of</strong> America, Canada,Australia or New Zealand that you are going to:Please list all the countries or islands outside theEuropean Union, United States <strong>of</strong> America, Canada,Australia or New Zealand that you are going to:<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 7

HAZARDOUS PURSUITSClient oneClient twoDo you regularly take part in any<strong>of</strong> the activities listed opposite, ordo you intend to do so within thenext 6 months?If ‘Yes’, please tick all that apply.If ‘No’, please tick ‘None <strong>of</strong>the above’.Caving or PotholingFlying (other than as a fare-paying passengeror cabin crew)*Hang glidingMotor car sportMotorcycle sportMountaineering or Rock climbingParachuting or Sky divingPowerboat racingSailing, other than inlandUnderwater divingAny Extreme sport, for example bungee orBASE jumping, canyoning, white water raftingNone <strong>of</strong> the aboveCaving or PotholingFlying (other than as a fare-paying passengeror cabin crew)*Hang glidingMotor car sportMotorcycle sportMountaineering or Rock climbingParachuting or Sky divingPowerboat racingSailing, other than inlandUnderwater divingAny Extreme sport, for example bungee orBASE jumping, canyoning, white water raftingNone <strong>of</strong> the above* Flying (other than as a fare-paying passenger) includes aviation either as a pastime, or as part <strong>of</strong> anoccupation, or both, but excludes cabin crew.If you have ticked any <strong>of</strong> the activities listed in the question above, please complete the Hazardous Pursuits Questionnaire (Part 5)BEFORE continuing with the next question.PART 2 – GENERAL HEALTH AND LIFESTYLEPlease don’t assume that wewill contact your doctor forconfirmation <strong>of</strong> medical details.Genetic Testing.The Association <strong>of</strong> British Insurers (ABI) have a policy on genetics and insurance. Currently, you only needto tell us about any genetic test results concerning Huntington’s disease, for life insurance over £500,000in total. This is because the Government’s Genetics and Insurance Committee (GAIC) has approved thistest for insurers to use. The total is for any life insurance application being made now together with anylife insurance you have already. You don’t need to tell us about any other genetic test result.However, you must tell us if you are experiencing symptoms <strong>of</strong>, or are having treatment for, a medicalcondition including any genetically inherited condition. You must also tell us <strong>of</strong> any family history <strong>of</strong> amedical condition as asked for in the relevant question in this application. If you want to tell us about anegative genetic test result, we’ll be willing to consider this when setting your premium. A copy <strong>of</strong> theABI Code <strong>of</strong> Practice on Genetic Testing is available from us on request or from the ABI websitewww.abi.org.ukWhat is your height(without shoes)?mORftinmORftinWhat is your weight(in indoor clothes)?kgORstlbkgORstlbIf you are pregnant, please give your weight immediately prior to this pregnancy.If you smoke cigarettes howmany do you, or did you,smoke on average each day?During the last 5 years have youused recreational drugs, otherthan cannabis, for exampleecstasy, cocaine, or heroin?These examples are not intendedto be a complete list.Cigarettes per dayCigarettes per dayIf you do not smoke cigarettes, and have not smoked cigarettes in the last 12 months, please enter ‘0’.YesNo<strong>Legal</strong> & <strong>General</strong> will only use the answer to this question in underwriting your application and at claimstage. Therefore there are no 'legal implications' in responding to this question.YesNoHave you ever tested positivefor HIV or are you waiting for theresult <strong>of</strong> an HIV test?A negative HIV test result will not,by itself, have any effect on youracceptance terms for insurance.Tested positive for HIVAwaiting result <strong>of</strong> HIV testNoTested positive for HIVAwaiting result <strong>of</strong> HIV testNoPage 8<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

PART 2 – GENERAL HEALTH AND LIFESTYLE continuedClient oneClient twoHow <strong>of</strong>ten do you have a drinkcontaining alcohol?Tick only one answer.NeverMonthly or lessfrequentlySpecialoccasions onlyTwo or threetimes a monthNeverMonthly or lessfrequentlySpecialoccasions onlyTwo or threetimes a monthWeeklyWeeklyIf weekly, tell us on how manydays during a typical week youdrink alcohol.No. <strong>of</strong> days:If you answered 2/3 times a month or weekly,please tell us how much beer, strong beer, wine,spirits and other alcohol you drink on a typical daywhen you have alcohol:No. <strong>of</strong> days:If you answered 2/3 times a month or weekly,please tell us how much beer, strong beer, wine,spirits and other alcohol you drink on a typical daywhen you have alcohol:Type <strong>of</strong> drinkNo. <strong>of</strong> drinks:Type <strong>of</strong> drinkNo. <strong>of</strong> drinks:Normal strength beer, lager or ciderNormal strength beer, lager or ciderStrong beer, lager or cider. Alcohol byvolume (ABV) content <strong>of</strong> 6% or more.Glasses <strong>of</strong> wine, fortified wine or spiritsOther alcoholic drinks e.g. alcopopsStrong beer, lager or cider. Alcohol byvolume (ABV) content <strong>of</strong> 6% or more.Glasses <strong>of</strong> wine, fortified wine or spiritsOther alcoholic drinks e.g. alcopopsHave you ever been medicallyadvised to reduce your alcoholconsumption or been referredfor specialist help to deal withalcohol consumption such as toan alcohol addiction unit or toAlcoholics Anonymous?Please ignore advice to reducealcohol given due to pregnancy.Tick all that apply.Yes – advised to reduce alcoholconsumptionYes – referred for specialist helpNoIf you answered ‘Yes’ to the previous question,please tell us:Who advised you to reduce your alcoholconsumption and when was this?Yes – advised to reduce alcoholconsumptionYes – referred for specialist helpNoIf you answered ‘Yes’ to the previous question,please tell us:Who advised you to reduce your alcoholconsumption and when was this?What was the reason for this advice?What was the reason for this advice?What was your alcohol intake at the time?What was your alcohol intake at the time?YOUR HEALTHWhen answering the following questions, if you are unsure <strong>of</strong> the relevance <strong>of</strong> any medical condition you have had, please let us know anyway.Where examples are shown, they are not intended to be a complete list. However there is no need to state the same medical condition morethan once when answering the questions.Client oneClient two1. Have you ever had:a) diabetes or a heart condition, for exampleangina, heart attack, heart valve problem orheart surgery?YesNoYesNob) Please ignore varicose veins,unless there is ulceration present.b) a stroke, mini stroke, transient ischaemicattack (TIA), brain haemorrhage or surgery toyour blood vessels?YesNoYesNod) Please ignore long andshort sightedness that havebeen corrected.c) any form <strong>of</strong> cancer, Hodgkin lymphoma,Non-Hodgkin lymphoma, leukaemia, skincancer, melanoma or a tumour, cyst orbenign growth in the brain or spine?d) multiple sclerosis, epilepsy, fits or visiondisturbances, for example optic orretrobulbar neuritis?YesYesNoNoYesYesNoNoe) muscular dystrophy, cerebral palsy, permanentbrain injury or any neurological condition, forexample motor neurone disease or Parkinson’sdisease?YesNoYesN<strong>of</strong>) any mental illness, anorexia or bulimia thathas required hospital treatment or referral toa psychiatrist?YesNoYesNoIf you have answered ‘Yes’ to ANY part <strong>of</strong> the above question, please complete one <strong>of</strong> the Medical Questionnaires (Part 6) BEFOREcontinuing with the next question.<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 9

YOUR HEALTH IN THE LAST 5 YEARSClient oneClient two2. Apart from anything you havealready told us about, during theLAST 5 YEARS have you seena doctor, nurse or other healthpr<strong>of</strong>essional for:c) Please ignore diarrhoea; foodpoisoning; indigestion; sickness orvomiting; stomach bug or upset;provided no hospital investigationhas been advised or completed.d) Please ignore chest infection; hayfever; pleurisy; upper respiratorytract infection (URTI); from whichyou have fully recovered.e) For <strong>Life</strong> only, please ignore backache; back spasm; cricked neck;fibrositis; frozen shoulder;lumbago; stiff neck; trapped nerveor operation to correct this.h) For <strong>Life</strong> only, please ignore deafness(partially or totally from birth); for allproducts, please ignore earache;ear infection; ear wax or syringing;glue ear; grommet insertion; otitis.i) Please ignore astigmatism; blackeye; blocked tear duct; conjunctivitis;dry eyes; long sighted; myopia(short sighted); squint; stye(s).j) Please ignore blood blister; boil;bunion; corn; ganglion; verruca;wart if no biopsy or hospitalinvestigation needed.k) Please ignore birthmarks whereno treatment or specialist referralhas been advised.m) Please ignore investigations relatedto pregnancy or infertility wherethe results have been confirmedas normal.n) Please ignore routine cervicalsmears and mammograms if theresults have been normal.a) raised blood pressure, raised cholesterol, orcondition affecting blood or blood vessels, forexample anaemia, excess sugar in the blood,blood clot, deep vein thrombosis?b) any condition affecting your kidneys, bladderor prostate, for example blood or protein inthe urine, stones, nephritis?c) any condition affecting your stomach,oesophagus, liver, pancreas or bowel, for exampleCrohn’s disease, ulcerative colitis, hepatitis?d) any condition affecting your lungs or breathing,for example asthma, sarcoidosis, emphysema?e) lupus, ankylosing spondylitis, gout or any form<strong>of</strong> arthritis, neck, back, spine or joint trouble, forexample rheumatoid arthritis, sciatica?f) anxiety, depression, any form <strong>of</strong> nervous ormental disorder needing treatment or counselling,chronic fatigue or persistent tiredness?g) any condition affecting your thyroid?h) any condition affecting your ears or hearing,for example Meniere’s disease, deafness?i) any condition affecting your eyes or vision,not wholly corrected by spectacles or lenses,for example cataract, blindness?j) a growth, lump, polyp or tumour <strong>of</strong> any kind?k) a mole or freckle?l) chest pain, palpitations, irregular heartbeat,paralysis, numbness, persistent tingling orpins and needles, tremor, facial pain otherthan dental pain, memory loss, dizzinessor balance problems?m) any other condition or symptom which hasneeded an angiogram, CT scan, ECG or MRI?Question 2n is applicable for females onlyn) a cervical smear or gynaecological disorder orbreast problem, for which you have needed furtherinvestigation, tests, advice, or for which you havenot yet been discharged from follow-up?Yes No Yes NoYes No Yes NoYes No Yes NoYes No Yes NoYes No Yes NoYes NoYes NoYes No Yes NoYes No Yes NoYes No Yes NoYes No Yes NoYes No Yes NoYes No Yes NoYes No Yes NoYes No Yes NoIf you have answered ‘Yes’ to ANY part <strong>of</strong> the above question, please complete one <strong>of</strong> the Medical Questionnaires (Part 6) BEFOREcontinuing with the next question.YOUR HEALTH IN THE LAST 12 MONTHSClient oneClient two3. Apart from anything you havealready told us about, during theLAST 12 MONTHS have you:a) Please ignore oral contraceptionpill; pregnancy; minor accidentsand injuries, for example musclestrain, pulled muscle, tornligament or tendon, or sprainedjoint, provided they have not keptyou <strong>of</strong>f work for 2 weeks for more.b) Please ignore investigationsrelated to pregnancy or infertilitywhere the results have beenconfirmed as normal.a) had any medical condition, illness or injuryfor which you have received treatment for acontinuous period <strong>of</strong> 4 weeks or more?b) had or been advised to have any investigationsin hospital, for example biopsy, CT scan, ECG,echocardiogram?c) had anything else for which you are awaitingreferral, investigations, results or treatmentor do you have any other symptoms for whichyou have not yet sought medical advice, forexample unexplained bleeding, weight loss,lump, growth, mole or freckle which hasrecently changed in appearance?YesYesYesNoNoNoYesYesYesNoNoNoIf you have answered ‘Yes’ to ANY part <strong>of</strong> the above question, please complete one <strong>of</strong> the Medical Questionnaires (Part 6) BEFOREcontinuing with the next question.Page 10<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

FAMILY HISTORYClient one3No. <strong>of</strong>relativesaffectedYoungestageaffectedSecondyoungestage affectedClient two3No. <strong>of</strong>relativesaffectedYoungestageaffectedSecondyoungestage affectedHave any <strong>of</strong> your natural parents,brothers or sisters, before theage <strong>of</strong> 65, been diagnosed with ordied from any <strong>of</strong> the conditionslisted opposite?If ‘Yes’, please tick all that apply.If ‘No’, please tick ‘None <strong>of</strong>the above’.If ‘unknown’, please answerthe unknown question on thenext page.For each condition selected,please give:• the total number <strong>of</strong> relativeswho had the condition• the ages(s) at the time <strong>of</strong>diagnosis or death (exceptwhere indicated) – but only theyoungest (lowest) age(s).The conditions listed opposite arenot always hereditary and we donot intend to imply that they are.Heart attack, Angina, Stroke or Type 2 DiabetesCancer <strong>of</strong> the BreastCancer <strong>of</strong> the OvaryCancer <strong>of</strong> the Colon (Bowel)Cancer <strong>of</strong> another siteIf ‘Cancer <strong>of</strong> another site’, for each relative pleasetell us the part <strong>of</strong> the body affected by the ‘primary’cancer, that is, where it first occurred in the body.Heart attack, Angina, Stroke or Type 2 DiabetesCancer <strong>of</strong> the BreastCancer <strong>of</strong> the OvaryCancer <strong>of</strong> the Colon (Bowel)Cancer <strong>of</strong> another siteIf ‘Cancer <strong>of</strong> another site’, for each relative pleasetell us the part <strong>of</strong> the body affected by the ‘primary’cancer, that is, where it first occurred in the body.Cardiomyopathy (primary disorder <strong>of</strong> the heart muscle)Cardiomyopathy (primary disorder <strong>of</strong> the heart muscle)Multiple SclerosisMultiple SclerosisN/AN/AN/AN/AIf ‘Multiple Sclerosis’, please tell us the familymember(s) affected.If ‘Multiple Sclerosis’, please tell us the familymember(s) affected.MotherFatherMotherFatherBrother(s)Sister(s)Brother(s)Sister(s)Myotonic (Muscular) DystrophyMyotonic (Muscular) DystrophyPolyposis coli (Familial adenomatous)Polyposis coli (Familial adenomatous)Polycystic Kidney DiseasePolycystic Kidney DiseaseMotor Neurone DiseaseMotor Neurone DiseaseHuntington’s DiseaseHuntington’s DiseaseParkinson’s DiseaseParkinson’s DiseaseAlzheimer’s DiseaseAlzheimer’s DiseaseYou can ignore short or long sight;colour blindness; asthma; high bloodpressure; heart murmur (other thanin connection with cardiomyopathy);dermatitis: eczema; rheumatoid orosteo arthritis.Any OTHER disorder which runs in your familyfor which you are receiving regular follow up orscreening.If ‘Yes’, please give details <strong>of</strong> the disorder(s) andthe results <strong>of</strong> any investigations.Any OTHER disorder which runs in your familyfor which you are receiving regular follow up orscreening.If ‘Yes’, please give details <strong>of</strong> the disorder(s) andthe results <strong>of</strong> any investigations.None <strong>of</strong> the aboveNone <strong>of</strong> the above<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 11

FAMILY HISTORY continuedClient oneClient twoIf you don’t know the details <strong>of</strong>the medical history <strong>of</strong> your parents,brothers and sisters please tellus why.Don’t know – AdoptedNo further contact with family membersDon’t know – OtherIf ‘Other’, please give detailsDon’t know – AdoptedNo further contact with family membersDon’t know – OtherIf ‘Other’, please give detailsPART 3 – ABOUT YOUR POLICYIs this policy that you’re applying forreplacing any existing policies heldwith <strong>Legal</strong> & <strong>General</strong>?We may need to get authority tocancel the policy if it is in trust orowned by someone else.YesNoIf ‘Yes’, what is the policy number(s) <strong>of</strong> your existing<strong>Legal</strong> & <strong>General</strong> policy(ies) that will be replaced?YesNoIf ‘Yes’, what is the policy number(s) <strong>of</strong> your existing<strong>Legal</strong> & <strong>General</strong> policy(ies) that will be replaced?Is this policy that you’re applyingfor to be issued under Trust?YesNoIf ‘Yes’, which policy(ies)?YesNoIf ‘Yes’, which policy(ies)?If you have answered ‘Yes’ to the above question, please contact your Financial Adviser about the type <strong>of</strong> trust most appropriate to you andyour circumstances.Is this policy that you’re applyingfor to be owned by anotherindividual or company?YesNoIf ‘Yes’, which policy(ies)?YesNoIf ‘Yes’, which policy(ies)?If you have answered ‘Yes’ to the above question, please fill out your doctor’s details below, then complete a Policy Owner Questionnairefor each policy (Part 7) BEFORE going straight to Part 9.Doctor’s detailsPlease include your doctor’spractice name or clinic, postcodeand telephone number as thisis essential for processing yourapplication more quickly.Doctor’s namePractice/clinic name and address(including postcode)Doctor’s namePractice/clinic name and address(including postcode)AsClient 1Please don’t assume that wewill contact your doctor forconfirmation <strong>of</strong> medical details.PostcodePostcodeTelephone numberTelephone numberThis now completes the mandatory question and answer part <strong>of</strong> your application.The following green sections are all additional questionnaires which you only need to complete if we’ve asked you to in one <strong>of</strong> theprevious questions, or if you need to provide us with additional information. Please now ensure you read and sign the Client Declarationand Consent in Part 9 and complete the Direct Debit instruction in Part 10.Page 12<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

PART 4 – PERSONAL ASSURANCE QUESTIONNAIREThis questionnaire only applies if you have answered ‘Yes’ to the Total Cover question on page 7.Client oneClient two1. Do you have, or are you applyingfor, any other <strong>Life</strong> cover withanother insurance company?This includes any <strong>Life</strong> coverprovided by your employer.If ‘Yes’ and you need morespace, please use the AdditionalInformation section in Part 8.Yes NoIf ‘Yes’, please give details:CompanyStart datePolicy typeYes NoIf ‘Yes’, please give details:CompanyStart datePolicy typeTermyearsTermyearsAmount <strong>of</strong> cover £Amount <strong>of</strong> cover £Reason for coverReason for coverWill this policy remain Yes Noin force/be going ahead?Do you have any other Yes Nopolicy(ies) to disclose?If ‘Yes’, please give the same details as above for theother policy(ies), in Part 8 (Additional Information)before continuing with this section.Will this policy remainin force/be going ahead?Do you have any otherpolicy(ies) to disclose?YesYesNoNoIf ‘Yes’, please give the same details as above for theother policy(ies), in Part 8 (Additional Information)before continuing with this section.2. Please give details <strong>of</strong> yourgross annual earned incomefor the last three years.Do not include anyunearned income, suchas investment income.Current yearLast yearPrevious yearEarnedIncome £EarnedIncome £EarnedIncome £Current yearLast yearPrevious yearEarnedIncome £EarnedIncome £EarnedIncome £If you are self employed – please give net taxable earnings after deduction <strong>of</strong> allowable business expenses.If your earned income for the current year is less than £10,000, please continue with the next question.Otherwise, please skip the next question.3. Please give details <strong>of</strong> all otherhousehold gross annual earnedincome for the last three years.Current yearLast yearEarnedIncome £EarnedIncome £Current yearLast yearEarnedIncome £EarnedIncome £Previous yearEarnedIncome £ £Previous yearEarnedIncome £4. What is the total value <strong>of</strong> yournet assets?£‘Net assets’ are your total assets (for example house, car, shares), less your total liabilities (for examplemortgage, outstanding debt). Where examples are shown, they are not intended to be a complete list.<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 13

PART 4 – PERSONAL ASSURANCE QUESTIONNAIRE continuedClient oneClient two5. What is the total value <strong>of</strong>your liabilities?£ £6. Please give details <strong>of</strong> the number<strong>of</strong> dependants you have and theirrelationship to you.If you need space for moredependants, please use theAdditional Information sectionin Part 8.7. If this application is required tocover a liability for InheritanceTax or Capital Gains Tax, pleasetick whichever applies.If neither <strong>of</strong> these apply,tick ‘Neither’.Inheritance TaxCapital Gains TaxNeitherInheritance TaxCapital Gains TaxNeitherIf you require this policy for Inheritance Tax, please continue with the next question. If you don’t require this policy for Inheritance Tax,please now return to Part 1 and continue with the Travel question on page 7.8. Please give details <strong>of</strong> theInheritance Tax liabilityand reliefs.Estimated InheritanceTax liability £How was your liability calculated?Estimated InheritanceTax liability £How was your liability calculated?Please state all reliefs, if any, that will be availablefor mitigation <strong>of</strong> Inheritance Tax.For example business property relief oragricultural property relief.Please state all reliefs, if any, that will be availablefor mitigation <strong>of</strong> Inheritance Tax.For example business property relief oragricultural property relief.Is this policy required tocover the Inheritance Taxin respect <strong>of</strong> a gift?YesNoIf ‘Yes’, please give the date and value <strong>of</strong> the giftIs this policy required tocover the Inheritance Taxin respect <strong>of</strong> a gift?YesNoIf ‘Yes’, please give the date and value <strong>of</strong> the giftPlease now return to Part 1 and continue with the Travel question on page 7.Page 14<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

PART 5 – HAZARDOUS PURSUITS QUESTIONNAIREThis questionnaire only applies if you have ticked any <strong>of</strong> the hazardous pursuits listed in Part 1.Client oneClient two1. What is the name <strong>of</strong> the activitythat you have ticked in thehazardous pursuits questionon page 8?If ‘Any Extreme sport’, pleasetell us which oneIf you have ticked more than one activity in the hazardous pursuits question on page 8, you will need tocomplete a separate Hazardous Pursuits Questionnaire for each one. Use this page to give details <strong>of</strong> thefirst activity and then use the Additional Information section (Part 8), or photocopy this page, to give thesame details for the other activity(ies).2. Do you take part in this asa pr<strong>of</strong>essional?Yes No Yes No3. Are you a member <strong>of</strong> arecognised club, associationor pr<strong>of</strong>essional body?YesNoYesNo4. Where is this activity carried out?If ‘Other’, please tell us whereUK onlyOtherEurope onlyUK onlyOtherEurope only5. Do you ever take part in thisactivity alone?YesNoYesNo6. Do you, or are you likely to, takepart in aerobatics, expeditions,record attempts, testing <strong>of</strong> anyequipment or underwater internalwreck exploration, in connectionwith this hobby or pursuit?YesNoYesNo7. On average, how many timesa year do you do this activity?8. On average, how many hours ayear do you spend on this activity?times a yearhours a yeartimes a yearhours a year9. If this activity is listed opposite,please answer these additionalquestions, as applicable.Motor car andMotorcyclesportType <strong>of</strong> motor sportMotor car andMotorcyclesportType <strong>of</strong> motor sportMaximum enginesize usedccMaximum enginesize usedccMountaineeringor RockclimbingMaximum heightyou climb tometresMountaineeringor RockclimbingMaximum heightyou climb tometresSeverity levelyou climb toSeverity levelyou climb toParachuting orSky divingDo you take part in free-fallparachuting, competitions,sky diving or sky surfing?Parachuting orSky divingDo you take part in free-fallparachuting, competitions,sky diving or sky surfing?YesNoYesNoSailingType <strong>of</strong> sailing – For example,<strong>of</strong>fshore category 1 or 2SailingType <strong>of</strong> sailing – For example,<strong>of</strong>fshore category 1 or 2Powerboatracing andExtreme sportsFull detailsPowerboatracing andExtreme sportsFull detailsUnderwaterdivingMaximum depthyou dive tometresUnderwaterdivingMaximum depthyou dive tometres10. Did you tick any otheractivity(ies) in thehazardous pursuitsquestion on page 8?YesNoIf ‘Yes’, please give the same details as above, forthe other activity(ies), in Part 8 (Additional Information)before returning to page 8 and continuing withPart 2.YesNoIf ‘Yes’, please give the same details as above, forthe other activity(ies), in Part 8 (Additional Information)before returning to page 8 and continuing withPart 2.Please now return to page 8 and continue with Part 2.<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 15

PART 6 – MEDICAL QUESTIONNAIREPlease only complete this if you have answered yes to any health questions on page 9 or 10. If you have more than one condition to tellus about, use this page to give details <strong>of</strong> the first condition, use the next questionnaire for the second, and then either use the AdditionalInformation section on page 19 or photocopy this page to give us the same details for any further conditions.MEDICAL QUESTIONNAIRE 11. What health question number(for example 1a, 1b, 2c) does thisinformation relate to?Client onePart 2: QuestionClient twoPart 2: Question2. Name <strong>of</strong> actual medicalcondition, illness or injuryIf growth or lump, also state thepart <strong>of</strong> body affected.3. How long ago did the conditionfirst occur?yearsmonthsyearsmonths4. How <strong>of</strong>ten do you havesymptoms?Please tick appropriate box – donot enter anything else in the box.No symptoms nowYearlyMonthly Weekly DailyNo symptoms nowYearlyMonthly Weekly Daily5. How long ago was your last majorattack? This means a suddenincrease in the severity <strong>of</strong> symptoms,or need for treatment other thanyour usual medicine or tablets.Never had amajor attackCurrently orat presentOther years monthsNever had amajor attackCurrently orat presentOther years months6. In the last 5 years, have youhad surgery or an operation, orany other hospital admission(including an overnight stay) forthis condition?Please answer both parts <strong>of</strong> thisquestionSurgery or operationIf ‘Yes’, how long ago? years monthsOther hospital admission(including overnight stay)YesYesNoNoIf ‘Yes’, how long ago? years monthsSurgery or operationIf ‘Yes’, how long ago? years monthsOther hospital admission(including overnight stay)YesYesNoNoIf ‘Yes’, how long ago? years months7. In the last 5 years, in total, howmuch time <strong>of</strong>f your normal work ordaily activities have you had forthis condition?8. If you have had time <strong>of</strong>f, how longago was the most recent occasion?Not applicable if you haveanswered ‘0’ to the question above.weeks daysIf you haven’t taken time <strong>of</strong>f, please enter ‘0’.years monthsIf you are currently <strong>of</strong>f work, please enter ‘0’.weeks daysIf you haven’t taken time <strong>of</strong>f, please enter ‘0’.years monthsIf you are currently <strong>of</strong>f work, please enter ‘0’.9. Do you expect to have, or are youcurrently waiting for, surgery oran operation, any other hospitaladmission (including an overnightstay) or referral to a specialist forthis condition?Please answer all three parts <strong>of</strong>this questionSurgery or operationIf ‘Yes’, when?Other hospital admission(including overnight stay)If ‘Yes’, when?YesYesNoNoSurgery or operationIf ‘Yes’, when?Other hospital admission(including overnight stay)If ‘Yes’, when?YesYesNoNoReferral to a specialistYesNoReferral to a specialistYesNoIf ‘Yes’, when?If ‘Yes’, when?10. Are you currently receivingtreatment for this condition?YesNoIf ‘Yes’, please give the name <strong>of</strong> medicine or tablet, ordetails <strong>of</strong> other treatment, for example physiotherapy.If more than one treatment, please state them all.YesNoIf ‘Yes’, please give the name <strong>of</strong> medicine or tablet, ordetails <strong>of</strong> other treatment, for example physiotherapy.If more than one treatment, please state them all.11. Do you have any more medicalconditions to disclose as aresult <strong>of</strong> answering ‘Yes’ toa health question in Part 2?Yes No Yes NoIf ‘Yes’, please complete the second MedicalQuestionnaire overleaf before returning to Part 2.If ‘Yes’, please complete the second MedicalQuestionnaire overleaf before returning to Part 2.Page 16<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

MEDICAL QUESTIONNAIRE 2Use this page to give details <strong>of</strong> a second condition and then use the Additional Information section (Part 8), or photocopy this page, to givethe same details for any further medical condition(s).1. What health question number(for example 1a, 1b, 2c) does thisinformation relate to?Client onePart 2: QuestionClient twoPart 2: Question2. Name <strong>of</strong> actual medicalcondition, illness or injuryIf growth or lump, also state thepart <strong>of</strong> body affected.3. How long ago did the conditionfirst occur?yearsmonthsyearsmonths4. How <strong>of</strong>ten do you havesymptoms?Please tick appropriate box – donot enter anything else in the box.5. How long ago was your lastmajor attack? This means asudden increase in the severity<strong>of</strong> symptoms, or need fortreatment other than yourusual medicine or tablets.6. In the last 5 years, have youhad surgery or an operation,or any other hospital admission(including an overnight stay)for this condition?No symptoms nowMonthly Weekly DailyNever had amajor attackYearlyCurrently orat presentOther years monthsSurgery or operation Yes NoIf ‘Yes’, how long ago? years monthsOther hospital admission(including overnight stay)YesNoIf ‘Yes’, how long ago? years monthsNo symptoms nowMonthly Weekly DailyNever had amajor attackYearlyCurrently orat presentOther years monthsSurgery or operation Yes NoIf ‘Yes’, how long ago? years monthsOther hospital admission(including overnight stay)YesNoIf ‘Yes’, how long ago? years months7. In the last 5 years, in total, howmuch time <strong>of</strong>f your normal workor daily activities have you hadfor this condition?8. If you have had time <strong>of</strong>f, how longago was the most recent occasion?Not applicable if you have answered‘0’ to the question above.weeks daysIf you haven’t taken time <strong>of</strong>f, please enter ‘0’.years monthsIf you are currently <strong>of</strong>f work, please enter ‘0’.weeks daysIf you haven’t taken time <strong>of</strong>f, please enter ‘0’.years monthsIf you are currently <strong>of</strong>f work, please enter ‘0’.9. Do you expect to have, or are youcurrently waiting for, surgery oran operation, any other hospitaladmission (including an overnightstay) or referral to a specialist forthis condition?Surgery or operation Yes NoIf ‘Yes’, when?Other hospital admission(including overnight stay)If ‘Yes’, when?If ‘Yes’, when?YesNoReferral to a specialist Yes NoSurgery or operation Yes NoIf ‘Yes’, when?Other hospital admission(including overnight stay)If ‘Yes’, when?YesNoReferral to a specialist Yes NoIf ‘Yes’, when?10. Are you currently receivingtreatment for this condition?Yes No Yes NoIf ‘Yes’, please give the name <strong>of</strong> medicine ortablet, or details <strong>of</strong> other treatment, for examplephysiotherapy. If more than one treatment, pleasestate them all.If ‘Yes’, please give the name <strong>of</strong> medicine ortablet, or details <strong>of</strong> other treatment, for examplephysiotherapy. If more than one treatment, pleasestate them all.11. Do you have any more medicalconditions to disclose as aresult <strong>of</strong> answering ‘Yes’ toa health question in Part 2?Yes No Yes NoIf ‘Yes’, please give the same details as above, forthe other medical condition(s), in Part 8 (AdditionalInformation) before returning to Part 2.If ‘Yes’, please give the same details as above, forthe other medical condition(s), in Part 8 (AdditionalInformation) before returning to Part 2.Please now return to Part 2 and complete the remaining medical questions.<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 17

PART 7 – POLICY OWNER QUESTIONNAIREThis questionnaire only applies if you have answered ‘Yes’ to the third question in Part 3 on page 12.• The Policy Owner is the person who will be the owner <strong>of</strong> any benefits paid out on the policy.• Please note, if the Policy Owner is not the Client(s) they must be over 18 and have an insurable interestin the Client(s).• Please consult your Financial Adviser if you wish to assign your policy to someone else once the policyhas been accepted and issued.• Your Financial Adviser can help you to complete this section.Policy OwnerSecond Policy Owner (if applicable)1. Is the Policy Owner anindividual or a business?For Joint cover, use the ‘Policy Owner’ column foranswers in this Part.An individualA businessAn individualA business2. What is the name <strong>of</strong> thePolicy Owner?Give the full name or businessname as applicable.Mr/Mrs/Miss/Ms/Dr/Rev/OtherForename(s) and middle name(s) in fullMr/Mrs/Miss/Ms/Dr/Rev/OtherForename(s) and middle name(s) in fullorSurnameBusinessnameorSurnameBusinessname3. Contact name within theorganisation?4. What is the Policy Owner’srelationship to the Client(s)?SpouseBusiness PartnerEmployerEx-spouseSpouseBusiness PartnerEmployerEx-spouseCohabiting PartnerEx-partnerCohabiting PartnerEx-partnerRegisteredCivil PartnerTrusteeRegisteredCivil PartnerTrusteeCreditorOtherCreditorOtherCo-shareholderCo-shareholder5. What is the Policy Owner’scurrent address?Please give the full address(including postcode) <strong>of</strong> theperson or business who is toown the policy(ies).PostcodePostcode6. What are the Policy Owner’scontact details?If the policy is to be owned bya business, please give thecontact details <strong>of</strong> the business’srepresentative.Work phoneHome phoneMobile phoneWork phoneHome phoneMobile phone7. Declaration <strong>of</strong> the Policy Owner(s)(who is not the Client(s))This Declaration should beread, confirmed, signed anddated by the Policy Owner,not by the Client(s).Page 18I declare that the answers given are, to the best <strong>of</strong> my knowledge and belief, true and complete.Use <strong>of</strong> personal information: <strong>Legal</strong> & <strong>General</strong> takes client privacy very seriously. I understand that<strong>Legal</strong> & <strong>General</strong> will use the personal information collected via this application and any other informationthat I provide to <strong>Legal</strong> & <strong>General</strong> (“my information”) for the purposes <strong>of</strong>:1. Providing me with <strong>Legal</strong> & <strong>General</strong> products and services and dealing with my enquiries and requests;2. Underwriting and administering my policy including processing claims; and3. Carrying out market research, statistical analysis and client pr<strong>of</strong>iling.I understand that given the global nature <strong>of</strong> <strong>Legal</strong> & <strong>General</strong>’s business, it may be necessary to transfermy information to countries outside the European Economic Area in order to provide <strong>Legal</strong> & <strong>General</strong>’sservices to me.<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

PART 7 – POLICY OWNER QUESTIONNAIRE continuedDisclosures: I understand that <strong>Legal</strong> & <strong>General</strong> will disclose my information to other companies withinthe <strong>Legal</strong> & <strong>General</strong> group <strong>of</strong> companies, regulatory bodies, law enforcement agencies, future owners <strong>of</strong><strong>Legal</strong> & <strong>General</strong>’s business, suppliers engaged by <strong>Legal</strong> & <strong>General</strong> to process data on its behalf and whennecessary, to a reinsurer.If I have been dealing with a financial adviser, <strong>Legal</strong> & <strong>General</strong> will give them information about theproduct and, where appropriate, provide them with other information about my dealings with<strong>Legal</strong> & <strong>General</strong> to enable them to give me informed advice.Where I have been introduced to <strong>Legal</strong> & <strong>General</strong> by another company (e.g. a bank, insurer or buildingsociety), <strong>Legal</strong> & <strong>General</strong> may share my information with them to enable them to:(a) carry out market research, statistical analysis and client pr<strong>of</strong>iling; and(b) send me marketing information about their products and services and products and services<strong>of</strong> companies in the <strong>Legal</strong> & <strong>General</strong> group and <strong>of</strong> third parties whose products and services<strong>Legal</strong> & <strong>General</strong> <strong>of</strong>fers to its clients.By signing this Declaration I agree to receive the information as described in (b) above by post ortelephone, unless I indicate otherwise by writing with my full contact details to <strong>Legal</strong> & <strong>General</strong>P10290, 5 Gemini Business Park, Europa Boulevard, Warrington, Cheshire WA5 7YF.Access: I understand that I have the right to ask for a copy <strong>of</strong> my information in return for payment<strong>of</strong> a small fee. To obtain a copy <strong>of</strong> your information please write to <strong>Legal</strong> & <strong>General</strong> at UKSO BusinessStandards, <strong>Legal</strong> & <strong>General</strong> Assurance Society, <strong>Legal</strong> & <strong>General</strong> House, St Monica’s Road, Kingswood,Surrey, KT20 6EU.Approaching fraud prevention agencies: <strong>Legal</strong> & <strong>General</strong> will check my details with fraud preventionagencies. If false or inaccurate information is provided and fraud is identified details will be passed t<strong>of</strong>raud prevention agencies. Law enforcement agencies may access and use this information.<strong>Legal</strong> & <strong>General</strong> and other organisations may also access and use this information to prevent fraud andmoney laundering, for example, when:• checking details on applications for credit and credit related or other facilities;• managing credit and credit related accounts or facilities;• recovering debt;• checking details on proposals and claims for all types <strong>of</strong> insurance;• checking details <strong>of</strong> job applicants and employees.<strong>Legal</strong> & <strong>General</strong> and other organisations may access and use from other countries the informationrecorded by fraud prevention agencies.7. Declaration <strong>of</strong> the PolicyOwner(s) (who is not theClient(s))This Declaration shouldbe read, confirmed,signed and dated by thePolicy Owner, not bythe Client(s).I understand that I can contact <strong>Legal</strong> & <strong>General</strong> at Group Financial Crime, <strong>Legal</strong> & <strong>General</strong> House, Kingswood,Tadworth, Surrey KT20 6EU if I want to receive details <strong>of</strong> the relevant fraud prevention agencies.I request that <strong>Legal</strong> & <strong>General</strong> Assurance Society Limited issue the proposed policy in my name or thebusiness’s name and I understand that this request and Declaration, and any other statement signedby the Client(s) in connection with this application, will be used to determine whether to <strong>of</strong>fer a policyand to assess how much premium should be paid. Alongside the Policy Schedule and Policy Terms andConditions this information will form part <strong>of</strong> the legal relationship between us and if any <strong>of</strong> it is incorrectit may mean that a claim will be declined and the policy cancelled.Policy OwnerPolicy Owner signatureSecond Policy Owner (if applicable)Policy Owner signatureDateD D M M Y Y Y YDateD D M M Y Y Y YDate<strong>of</strong> birthD D M M Y Y Y YDate<strong>of</strong> birthD D M M Y Y Y YPlease now go straight to Part 9 (Client Declaration and Consent).PART 8 – ADDITIONAL INFORMATIONThis section only applies if you need more space to answer any questions. If you don’t need more space, please now go straight to Part 9.Client oneClient twoPart No. andQuestion No.Additional InformationPart No. andQuestion No.Additional Information<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 19

PART 9 – CLIENT DECLARATION AND CONSENT• Please ensure that you have read the notes at the beginning <strong>of</strong> this form.• You must read carefully the answers you have given to the questions before accepting the following Declaration.• If you have passed a half birthday while the application is being processed, the terms may differ from those originally quoted.• In most instances the payments will be as originally quoted. <strong>Legal</strong> & <strong>General</strong> may sometimes <strong>of</strong>fer revised terms and/or premiums and very occasionally may notbe able to <strong>of</strong>fer the benefits requested. <strong>Legal</strong> & <strong>General</strong> will inform you as soon as possible if this is the case.• Please remember that all items <strong>of</strong> information asked for in this application are taken into account when assessing acceptance <strong>of</strong> the application and incalculating the premium. Please also remember that if you do not answer the questions fully and accurately it will very likely mean that a claim will be declinedand the policy cancelled. If you have given information to <strong>Legal</strong> & <strong>General</strong> in the past, please provide it again. If necessary, please return to the questions andamend your answer in the appropriate place.• <strong>Legal</strong> & <strong>General</strong> will try to rely on the information you provide and you must not assume that they will always clarify that information with your doctor (GP). However,as part <strong>of</strong> their administrative procedures, <strong>Legal</strong> & <strong>General</strong> may ask for information from your GP to check the medical information you provide. <strong>Legal</strong> & <strong>General</strong> may askyou to contact your doctor if they are waiting for reports which they have asked for.• If <strong>Legal</strong> & <strong>General</strong> asks you to attend a medical examination, it may be necessary to share the application information with another company which they haveauthorised. If so, that company will make the arrangements for the examination to take place.All Clients – it is important that you read and accept all <strong>of</strong> the following paragraphs. If you are unsure <strong>of</strong> anything or have any queries please speakto your financial adviser.I/We declare that, to the best <strong>of</strong> my/our knowledge and belief all the statementsmade, including anything I/we may have said, are true and complete and havebeen recorded accurately in this application. I/We acknowledge that<strong>Legal</strong> & <strong>General</strong> will use the information I/we give in this application to determinewhether to <strong>of</strong>fer me/us a policy and to assess how much premium I/we must pay.Alongside the Policy Schedule and the Terms and Conditions, this information willform part <strong>of</strong> the legal relationship between us.I/We understand that if I/we do not give all <strong>of</strong> the requested information fullyand accurately it will very likely mean that a claim will be declined and the policycancelled.I/We agree to immediately inform <strong>Legal</strong> & <strong>General</strong> in writing if there are anychanges to any answers under the following categories given on the applicationbefore the policy or policies start:• medical information;• occupation;• pastimes;• country <strong>of</strong> residence (other than for holidays);• family history.I/We understand that failure to tell <strong>Legal</strong> & <strong>General</strong> <strong>of</strong> any change may mean thata claim will be declined and the policy or policies may be cancelled.I/We agree to <strong>Legal</strong> & <strong>General</strong> getting relevant information from anotherinsurance company about previous or concurrent applications for life, criticalillness, sickness, disability, accident or private medical insurance that I/we haveapplied for. I/We authorise them to give this information.I/We also agree to <strong>Legal</strong> & <strong>General</strong> sharing any medical information obtained inconnection with this application with another insurance company to whom I am/weare applying or may apply to in the future. Also, when necessary, sharing it witha reinsurer and/or third party administrator. See also the paragraph headed‘Sensitive data’.I/We understand that Insurers share information with each other to preventfraudulent claims via a Register <strong>of</strong> Claims and that a list <strong>of</strong> participants is availableon request. The information I/we supply in this application, together with thatprovided on any additional medical reports and any other information in the event<strong>of</strong> a claim, will be given to the Register and made available to other participants.I/We agree that if the policy is to be set up as joint lives, it will be owned jointlyby us or by the survivor <strong>of</strong> us.Data ProtectionUse <strong>of</strong> personal information: <strong>Legal</strong> & <strong>General</strong> takes client privacy very seriously.I/We understand that <strong>Legal</strong> & <strong>General</strong> will use the personal information collectedvia this application and any other information that I/we provide to<strong>Legal</strong> & <strong>General</strong> (“my/our information”) for the purposes <strong>of</strong>:1. Providing me/us with <strong>Legal</strong> & <strong>General</strong> products and services and dealing withmy/our enquiries and requests;2. Underwriting and administering my/our policy including processing claims;3. Carrying out market research, statistical analysis and client pr<strong>of</strong>iling; and4. Sending me/us marketing information (by post, telephone, email and SMS) aboutproducts and services <strong>of</strong> companies in the <strong>Legal</strong> & <strong>General</strong> group and <strong>of</strong> thirdparties whose products and services <strong>Legal</strong> & <strong>General</strong> <strong>of</strong>fers to its clients.Please tick this box if you DO Client one Client twowant to receive informationdescribed in 4.I/We understand that given the global nature <strong>of</strong> <strong>Legal</strong> & <strong>General</strong>’s business, it maybe necessary to transfer my/our information to countries outside the EuropeanEconomic Area in order to provide <strong>Legal</strong> & <strong>General</strong>’s services to me/us.Disclosures: I/We understand that <strong>Legal</strong> & <strong>General</strong> will disclose my/ourinformation to other companies within the <strong>Legal</strong> & <strong>General</strong> group <strong>of</strong> companies,regulatory bodies, law enforcement agencies, future owners <strong>of</strong> <strong>Legal</strong> & <strong>General</strong>’sbusiness, suppliers engaged by <strong>Legal</strong> & <strong>General</strong> to process data on its behalf andwhen necessary, to a reinsurer.If I/we have been dealing with a financial adviser, <strong>Legal</strong> & <strong>General</strong> will give theminformation about the product and, where appropriate, provide them with otherinformation about my/our dealings with <strong>Legal</strong> & <strong>General</strong> to enable them to giveme/us informed advice.Where I/we have been introduced to <strong>Legal</strong> & <strong>General</strong> by another company (e.g. abank, insurer or building society), <strong>Legal</strong> & <strong>General</strong> may share my/our informationwith them to enable them to:(a) carry out market research, statistical analysis and client pr<strong>of</strong>iling; and(b) send me/us marketing information about their products and services andproducts and services <strong>of</strong> companies in the <strong>Legal</strong> & <strong>General</strong> group and <strong>of</strong> thirdparties whose products and services <strong>Legal</strong> & <strong>General</strong> <strong>of</strong>fers to its clients.By signing this Declaration I/we agree to receive the information as described in(b) above by post or telephone, unless I/we indicate otherwise by writing with my/our full contact details to <strong>Legal</strong> & <strong>General</strong> P10290, 5 Gemini Business Park,Europa Boulevard, Warrington, Cheshire WA5 7YF.Access: I/We understand that I/we have the right to ask for a copy <strong>of</strong> my/our information in return for payment <strong>of</strong> a small fee. To obtain a copy <strong>of</strong> yourinformation please write to <strong>Legal</strong> & <strong>General</strong> at UKSO Business Standards,<strong>Legal</strong> & <strong>General</strong> Assurance Society, <strong>Legal</strong> & <strong>General</strong> House, St Monica’s Road,Kingswood, Surrey KT20 6EU.Approaching fraud prevention agencies: <strong>Legal</strong> & <strong>General</strong> will check my/our detailswith fraud prevention agencies. If false or inaccurate information is providedand fraud is identified details will be passed to fraud prevention agencies.Law enforcement agencies may access and use this information.<strong>Legal</strong> & <strong>General</strong> and other organisations may also access and use this informationto prevent fraud and money laundering, for example, when:• checking details on applications for credit and credit related or other facilities;• managing credit and credit related accounts or facilities;• recovering debt;• checking details on proposals and claims for all types <strong>of</strong> insurance;• checking details <strong>of</strong> job applicants and employees.<strong>Legal</strong> & <strong>General</strong> and other organisations may access and use from other countriesthe information recorded by fraud prevention agencies.I/We understand that I/we can contact <strong>Legal</strong> & <strong>General</strong> at Group Financial Crime,<strong>Legal</strong> & <strong>General</strong> House, Kingswood, Tadworth, Surrey KT20 6EU if I/we wantto receive details <strong>of</strong> the relevant fraud prevention agencies.Sensitive data: I/We consent to <strong>Legal</strong> & <strong>General</strong> using the medical and healthinformation provided in this application, and any other medical information providedin the course <strong>of</strong> this application, solely for the purposes <strong>of</strong> allowing <strong>Legal</strong> & <strong>General</strong>to underwrite and administer my/our policy and/or any subsequent policy andin connection with any claim. My/Our medical information (and other informationcollected via this application) may be disclosed to <strong>Legal</strong> & <strong>General</strong>’s reinsurer andto any doctor that <strong>Legal</strong> & <strong>General</strong> uses, including my/our own GP, and to any otherinsurance company I/we apply to for products or services.I/We confirm that I am/we are a UK resident.I/We have been told that <strong>Legal</strong> & <strong>General</strong> have a formal complaints procedure,details <strong>of</strong> which will be given to me/us when I/we receive the policydocumentation.I/We have been told that the contract will be governed by the law <strong>of</strong> Englandand Wales.I/We understand that the full terms and conditions <strong>of</strong> the policy and a copy <strong>of</strong> thecompleted application is available on request.Page 20<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

PART 9 – CLIENT DECLARATION AND CONSENT – continuedL&G use only:A NMedical Consent: <strong>Legal</strong> & <strong>General</strong> may gather relevant information from otherinsurers about any other applications for life, critical illness, sickness, disability,accident or private medical insurance that I/we have applied for.I/we authorise those asked to provide medical information when they see a copy<strong>of</strong> this consent form.I/we agree that this information can also be used to maintain managementinformation for business analysis.Your medical information – Subject Access Request: In order to process yourapplication <strong>Legal</strong> & <strong>General</strong> may need to obtain some information from yourdoctor and we’ll need your permission to do this. The most effective way for usto do this is a Subject Access Request, under the Data Protection Act 1998. If youcomplete the Subject Access Request <strong>Form</strong> (in Parts 10A/10B <strong>of</strong> this application)it gives us permission to contact your doctor on your behalf and receive a copy<strong>of</strong> your full medical records. If you do not want us to request a full copy <strong>of</strong> yourmedical records, we can as an alternative, ask your doctor for a medical report.This will require a separate consent, which will be sent to you if we requiresome information from your doctor. However if you don’t consent to either <strong>of</strong>these methods <strong>of</strong> obtaining the information, we won’t be able to progress yourapplication.<strong>Legal</strong> & <strong>General</strong> will ask your doctor not to reveal information about:• negative tests for HIV, hepatitis B or C;• any sexually-transmitted diseases unless there could be long-term effects onyour health; or• predictive genetic test results.The information you and your doctor provide about your health may resultin <strong>Legal</strong> & <strong>General</strong>:• refusing to provide insurance; or• setting exclusions; or• increasing premiums above standard rates; or• setting premiums at standard rates.If you have any questions about your rights under the Subject Access Request orquestions relating to the process <strong>of</strong> getting, assessing or storing medical information,please write to: Claims and Underwriting Director, <strong>Legal</strong> & <strong>General</strong> Assurance SocietyLimited, City Park, The Droveway, Hove, BN3 7PYPlease remember you must tell <strong>Legal</strong> & <strong>General</strong> everything they ask for as all the answers may be taken into account when assessing acceptance <strong>of</strong> the applicationand in calculating the premium. Please also remember that if you do not answer the questions fully and accurately it may mean that a claim will be declined andthe policy or policies cancelled. If you have given information to <strong>Legal</strong> & <strong>General</strong> in the past, please provide it again. If necessary, please return to the questions andamend your answer in the appropriate place.If you have not given full information to the questions asked or if you feel the information is incorrect, please return to the questions and answer in the appropriateplace.I/We confirm that I/we accept this Client Declaration and Consent, and the notes section at the beginning <strong>of</strong> this form.By signing this Declaration I/we agree to all <strong>of</strong> the contents.Client oneNameClient twoNameDate<strong>of</strong> birthD D M M Y Y Y YDate<strong>of</strong> birthD D M M Y Y Y YSignatureSignatureDateD D M M Y Y Y YDateD D M M Y Y Y YTo give your consent to a Subject Access Request (SAR) please complete parts 10A and 10B. A separate consent form is needed for each client.Please ensure you sign and date this form as well.<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 21

Page 22<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

PART 10A – SAR MEDICAL CONSENT FORM FOR CLIENT ONE.PATIENT REPRESENTATIVE AUTHORITY CONSENT FORMACCESS TO HEALTH RECORDS UNDER THE DATA PROTECTION ACT 1998 (SUBJECT ACCESS REQUEST).PLEASE COMPLETE, SIGN AND DATE THIS SUBJECT ACCESS REQUEST FORM.Patients authority for release <strong>of</strong> health records (Manual or Computerised Health Records)Details <strong>of</strong> the Data Subject(the person to whom theinformation relates).Full name:Date <strong>of</strong> Birth:D D M M Y Y Y YDear Doctor,I authorise <strong>Legal</strong> & <strong>General</strong> Assurance Society Limited to apply for a copy <strong>of</strong> my full health records (excluding predictive genetic test results) under theData Protection Act 1998 (the Act) within 12 months <strong>of</strong> the signature date and in order to process any future claim.I authorise you to provide the information in the format they request and to send the information directly to them.This is in addition to any other subject access requests I may have made previously.Signature:Date:D D M M Y Y Y Y<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 23

Page 24<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires

PART 10B – SAR MEDICAL CONSENT FORM FOR CLIENT TWO.PATIENT REPRESENTATIVE AUTHORITY CONSENT FORMACCESS TO HEALTH RECORDS UNDER THE DATA PROTECTION ACT 1998 (SUBJECT ACCESS REQUEST).PLEASE COMPLETE, SIGN AND DATE THIS SUBJECT ACCESS REQUEST FORM.Patients authority for release <strong>of</strong> health records (Manual or Computerised Health Records)Details <strong>of</strong> the Data Subject(the person to whom theinformation relates).Full name:Date <strong>of</strong> Birth:D D M M Y Y Y YDear Doctor,I authorise <strong>Legal</strong> & <strong>General</strong> Assurance Society Limited to apply for a copy <strong>of</strong> my full health records (excluding predictive genetic test results) under theData Protection Act 1998 (the Act) within 12 months <strong>of</strong> the signature date and in order to process any future claim.I authorise you to provide the information in the format they request and to send the information directly to them.This is in addition to any other subject access requests I may have made previously.Signature:Date:D D M M Y Y Y Y<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires Page 25

Page 26<strong>Whole</strong> <strong>of</strong> <strong>Life</strong> Protection Plan – <strong>Application</strong> <strong>Form</strong> and Additional Questionnaires