Employer's contribution authority form for Self ... - Legal & General

Employer's contribution authority form for Self ... - Legal & General

Employer's contribution authority form for Self ... - Legal & General

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

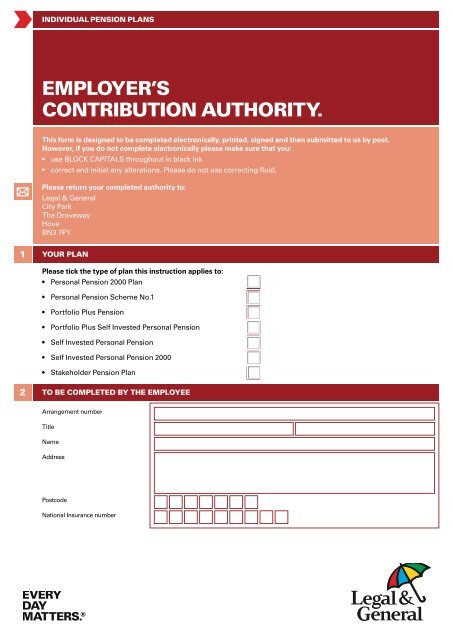

INDIVIDUAL PENSION PLANSEMPLOYER’SCONTRIBUTION AUTHORITY.This <strong><strong>for</strong>m</strong> is designed to be completed electronically, printed, signed and then submitted to us by post.However, if you do not complete electronically please make sure that you:• use BLOCK CAPITALS throughout in black ink• correct and initial any alterations. Please do not use correcting fluid.Please return your completed <strong>authority</strong> to:<strong>Legal</strong> & <strong>General</strong>City ParkThe DrovewayHoveBN3 7PY1YOUR PLANPlease tick the type of plan this instruction applies to:• Personal Pension 2000 Plan• Personal Pension Scheme No.1• Portfolio Plus Pension• Portfolio Plus <strong>Self</strong> Invested Personal Pension• <strong>Self</strong> Invested Personal Pension• <strong>Self</strong> Invested Personal Pension 2000• Stakeholder Pension Plan2TO BE COMPLETED BY THE EMPLOYEEArrangement numberTitleNameAddressPostcodeNational Insurance number

3TO BE COMPLETED BY THE EMPLOYERThe employee named in section 1 has completed an application to become a Member of a <strong>Legal</strong> & <strong>General</strong> pension plan.To make <strong>contribution</strong>s to this arrangement please complete all sections of this <strong><strong>for</strong>m</strong> and Direct Debit if applicable.Company nameHead office/Registered addressPostcodeCompany registered numberCompany contact nameCompany contact phone numberCompany contact address (ifdifferent from above)Employee <strong>contribution</strong>s by salarydeduction (if applicable)a) Deducted from your employee’s pay £Net monthly/yearly 1 and paid to usby Direct DebitThe net amount is the amount the employee wants to pay. Their contract is <strong>for</strong> the gross<strong>contribution</strong>, which is the amount stated plus basic rate tax relief (at the rate applicable whenthe first regular <strong>contribution</strong> is paid). Tax relief is not available <strong>for</strong> <strong>contribution</strong>s once theemployee reaches age 75. If basic rate tax relief changes, or the employee reaches age 75,the amount we collect by Direct Debit will there<strong>for</strong>e change and you will need to change theamount you deduct from your employee’s salary.£Net single <strong>contribution</strong> by cheque 2The net amount is the amount the employee wants to pay. Their contract is <strong>for</strong> the gross<strong>contribution</strong>, which is the amount stated plus basic rate tax relief (at the rate applicable whenthe single <strong>contribution</strong> is paid). Tax relief is not available <strong>for</strong> <strong>contribution</strong>s once the employeereaches age 75.b) At what rate should the amount collected by Direct Debit be automatically increased each year?(You may only choose ONE of the options.)NoneIn line with the RetailPrices Index 3By a fixed percentage%each year ofIn line with the annual increasein Average Weekly Earnings 3(only whole numbers up to 10%inclusive allowed)If your employee’s <strong>contribution</strong>s are to be automatically increased each year then the amount wecollect by Direct Debit will automatically increase. You will need to change the amount you deductfrom the employee’s salary in line with this.Employer <strong>contribution</strong>s, includingsalary sacrifice (if applicable)a) I wish to make a gross <strong>contribution</strong> to the above employee’s pension plan administeredby <strong>Legal</strong> & <strong>General</strong> as shown in Section 1.££Gross monthly/yearly 1 by Direct Debit ORSingle <strong>contribution</strong> by cheque 2The above <strong>contribution</strong>(s) will be invested in accordance with instructions given by the Member.b) At what rate would you like your employer regular <strong>contribution</strong>s to your employee’s plan tobe automatically increased by each year? (You may only choose ONE of the options.)NoneBy a fixed percentageeach year ofIn line with the RetailPrices Index 3This option is only available <strong>for</strong> regular <strong>contribution</strong>s paid by Direct Debit. Employer <strong>contribution</strong>scan be automatically increased differently from employee <strong>contribution</strong>s.%In line with the annual increasein Average Weekly Earnings 3(only whole numbers up to 10%inclusive allowed)1Delete as appropriate.2Please make cheques payable to <strong>Legal</strong> & <strong>General</strong>.3Contributions will only increase in line with the index/factor. If there is a decrease in the index/factor then the <strong>contribution</strong>s will remain the same.Employer’s Contribution Authority

4PAYMENT DUE DATEYou are required by law to pay <strong>contribution</strong>s to your employee’s pension plan by the ‘payment due date’. We, as the personal pension provider,are required to report any employer who does not do this to the Pensions Regulator who may then fine the employer. If we do not reportemployers that do not pay or pay late we will be liable to penalties.You will become a late or non-payer if your <strong>contribution</strong>s have not been received by <strong>Legal</strong> & <strong>General</strong> on the 19th of the month following themonth on which you were due to pay it to us. This is known as the ‘payment due date’. For example, <strong>contribution</strong>s due to <strong>Legal</strong> & <strong>General</strong> on5 May must be received no later than 19 June.If you are deducting <strong>contribution</strong>s from employee’s pay you will become a late or non-payer if this <strong>contribution</strong> is not received by us on the19th of the month following the deduction from pay.The Pensions Regulator also requires you to provide us with a Record of Payments to ensure that we know when to expect payments from you.This <strong><strong>for</strong>m</strong> will become the Record of Payments <strong>for</strong> this purpose. If you alter your payment you must complete a new <strong><strong>for</strong>m</strong>.5RECORD OF PAYMENTSI want collections to start from D D M M Y Y Y Y6SIGNATURESigned <strong>for</strong> the employerName of signatory (please print)Position in companyDateD D M M Y Y Y Ywww.legalandgeneral.com<strong>Legal</strong> & <strong>General</strong> Assurance Society Limited. Registered in England and Wales No. 166055<strong>Legal</strong> & <strong>General</strong> Assurance Society Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authorityand the Prudential Regulation Authority.<strong>Legal</strong> & <strong>General</strong> (Portfolio Management Services) Limited. Registered in England and Wales No. 2457525<strong>Legal</strong> & <strong>General</strong> (Portfolio Management Services) is authorised and regulated by the Financial Conduct Authority.Registered office: One Coleman Street, London EC2R 5AAQ26344 08/13 NON ASDCut off here and keep the Direct Debit Guarantee somewhere safe.Employer’s Contribution Authority

7DIRECT DEBITInstruction to your bank or building society to pay by Direct Debit.Please make sure that you fully complete all of the boxes and that this instruction is signed and dated.To <strong>Legal</strong> & <strong>General</strong>, <strong>Legal</strong> & <strong>General</strong> House,Kingswood, Tadworth, Surrey KT20 6EUService User Number8 0 6 1 6 27.1 Name and fullpostal addressof your bank orbuilding societybranchNameAddressPostcode7.2 Name(s) of account holder(s)7.3 Bank or building society account number7.4 Branch sort code7.5 Instruction to your bank or building societyPlease pay <strong>Legal</strong> & <strong>General</strong> Assurance Society Limited Direct Debits from the accountdetailed in this instruction subject to the safeguards assured by the Direct Debit Guarantee.I understand that this Instruction may remain with <strong>Legal</strong> & <strong>General</strong> Assurance SocietyLimited and, if so, details will be passed electronically to my bank or building society.SignatureDateD D M M Y Y Y YCut off here and keep the Direct Debit Guarantee somewhere safe.The Direct Debit Guarantee – this Guarantee should be detached and retained by the payer.• This Guarantee is offered by all banks and building societies that accept instructions to pay Direct Debits.• If there are any changes to the amount, date or frequency of your Direct Debit, <strong>Legal</strong> & <strong>General</strong>Assurance Society Limited will notify you five working days in advance of your account being debitedor as otherwise agreed. If you request <strong>Legal</strong> & <strong>General</strong> Assurance Society Limited to collect a payment,confirmation of the amount and date will be given to you at the time of the request.• If an error is made in the payment of your Direct Debit, by <strong>Legal</strong> & <strong>General</strong> Assurance Society Limited oryour bank or building society, you are entitled to a full and immediate refund of the amount paid fromyour bank or building society.– If you receive a refund you are not entitled to, you must pay it back when <strong>Legal</strong> & <strong>General</strong> AssuranceSociety Limited asks you to.• You can cancel a Direct Debit at any time by simply contacting your bank or building society. Writtenconfirmation may be required. Please also notify us.www.legalandgeneral.com<strong>Legal</strong> & <strong>General</strong> Assurance Society Limited. Registered in England and Wales No. 166055<strong>Legal</strong> & <strong>General</strong> Assurance Society Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authorityand the Prudential Regulation Authority.<strong>Legal</strong> & <strong>General</strong> (Portfolio Management Services) Limited. Registered in England and Wales No. 2457525<strong>Legal</strong> & <strong>General</strong> (Portfolio Management Services) is authorised and regulated by the Financial Conduct Authority.Registered office: One Coleman Street, London EC2R 5AAQ26344 08/13 NON ASD