Employer's contribution authority form for Self ... - Legal & General

Employer's contribution authority form for Self ... - Legal & General

Employer's contribution authority form for Self ... - Legal & General

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

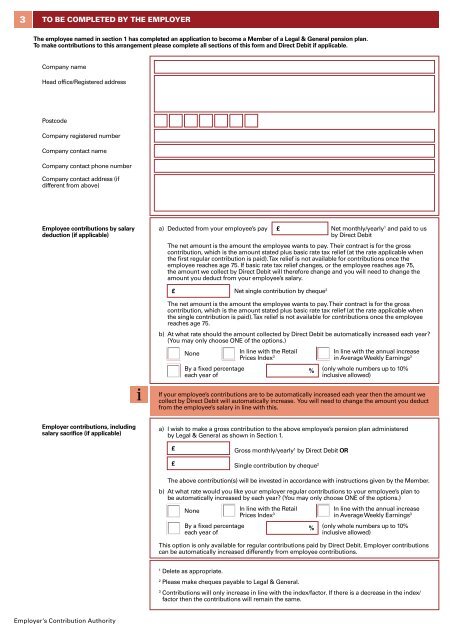

3TO BE COMPLETED BY THE EMPLOYERThe employee named in section 1 has completed an application to become a Member of a <strong>Legal</strong> & <strong>General</strong> pension plan.To make <strong>contribution</strong>s to this arrangement please complete all sections of this <strong><strong>for</strong>m</strong> and Direct Debit if applicable.Company nameHead office/Registered addressPostcodeCompany registered numberCompany contact nameCompany contact phone numberCompany contact address (ifdifferent from above)Employee <strong>contribution</strong>s by salarydeduction (if applicable)a) Deducted from your employee’s pay £Net monthly/yearly 1 and paid to usby Direct DebitThe net amount is the amount the employee wants to pay. Their contract is <strong>for</strong> the gross<strong>contribution</strong>, which is the amount stated plus basic rate tax relief (at the rate applicable whenthe first regular <strong>contribution</strong> is paid). Tax relief is not available <strong>for</strong> <strong>contribution</strong>s once theemployee reaches age 75. If basic rate tax relief changes, or the employee reaches age 75,the amount we collect by Direct Debit will there<strong>for</strong>e change and you will need to change theamount you deduct from your employee’s salary.£Net single <strong>contribution</strong> by cheque 2The net amount is the amount the employee wants to pay. Their contract is <strong>for</strong> the gross<strong>contribution</strong>, which is the amount stated plus basic rate tax relief (at the rate applicable whenthe single <strong>contribution</strong> is paid). Tax relief is not available <strong>for</strong> <strong>contribution</strong>s once the employeereaches age 75.b) At what rate should the amount collected by Direct Debit be automatically increased each year?(You may only choose ONE of the options.)NoneIn line with the RetailPrices Index 3By a fixed percentage%each year ofIn line with the annual increasein Average Weekly Earnings 3(only whole numbers up to 10%inclusive allowed)If your employee’s <strong>contribution</strong>s are to be automatically increased each year then the amount wecollect by Direct Debit will automatically increase. You will need to change the amount you deductfrom the employee’s salary in line with this.Employer <strong>contribution</strong>s, includingsalary sacrifice (if applicable)a) I wish to make a gross <strong>contribution</strong> to the above employee’s pension plan administeredby <strong>Legal</strong> & <strong>General</strong> as shown in Section 1.££Gross monthly/yearly 1 by Direct Debit ORSingle <strong>contribution</strong> by cheque 2The above <strong>contribution</strong>(s) will be invested in accordance with instructions given by the Member.b) At what rate would you like your employer regular <strong>contribution</strong>s to your employee’s plan tobe automatically increased by each year? (You may only choose ONE of the options.)NoneBy a fixed percentageeach year ofIn line with the RetailPrices Index 3This option is only available <strong>for</strong> regular <strong>contribution</strong>s paid by Direct Debit. Employer <strong>contribution</strong>scan be automatically increased differently from employee <strong>contribution</strong>s.%In line with the annual increasein Average Weekly Earnings 3(only whole numbers up to 10%inclusive allowed)1Delete as appropriate.2Please make cheques payable to <strong>Legal</strong> & <strong>General</strong>.3Contributions will only increase in line with the index/factor. If there is a decrease in the index/factor then the <strong>contribution</strong>s will remain the same.Employer’s Contribution Authority