Comprehensive Annual Financial Report - City of Cerritos

Comprehensive Annual Financial Report - City of Cerritos

Comprehensive Annual Financial Report - City of Cerritos

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

Notes to Basic <strong>Financial</strong> Statements, Continued<br />

For the year ended June 30, 2010<br />

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, Continued<br />

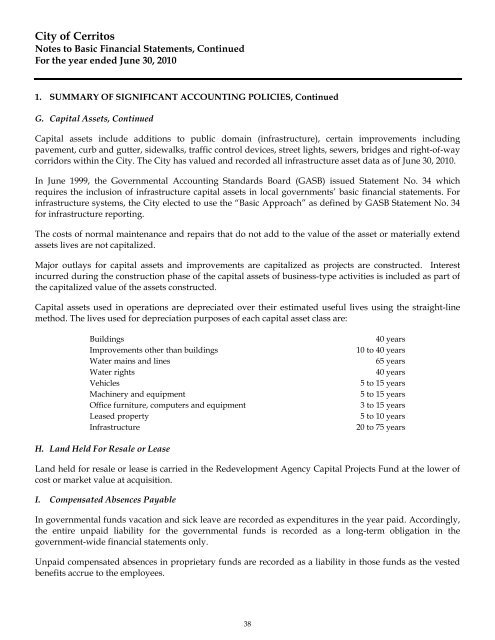

G. Capital Assets, Continued<br />

Capital assets include additions to public domain (infrastructure), certain improvements including<br />

pavement, curb and gutter, sidewalks, traffic control devices, street lights, sewers, bridges and right-<strong>of</strong>-way<br />

corridors within the <strong>City</strong>. The <strong>City</strong> has valued and recorded all infrastructure asset data as <strong>of</strong> June 30, 2010.<br />

In June 1999, the Governmental Accounting Standards Board (GASB) issued Statement No. 34 which<br />

requires the inclusion <strong>of</strong> infrastructure capital assets in local governments’ basic financial statements. For<br />

infrastructure systems, the <strong>City</strong> elected to use the “Basic Approach” as defined by GASB Statement No. 34<br />

for infrastructure reporting.<br />

The costs <strong>of</strong> normal maintenance and repairs that do not add to the value <strong>of</strong> the asset or materially extend<br />

assets lives are not capitalized.<br />

Major outlays for capital assets and improvements are capitalized as projects are constructed. Interest<br />

incurred during the construction phase <strong>of</strong> the capital assets <strong>of</strong> business-type activities is included as part <strong>of</strong><br />

the capitalized value <strong>of</strong> the assets constructed.<br />

Capital assets used in operations are depreciated over their estimated useful lives using the straight-line<br />

method. The lives used for depreciation purposes <strong>of</strong> each capital asset class are:<br />

Buildings<br />

Improvements other than buildings<br />

Water mains and lines<br />

Water rights<br />

Vehicles<br />

Machinery and equipment<br />

Office furniture, computers and equipment<br />

Leased property<br />

Infrastructure<br />

40 years<br />

10 to 40 years<br />

65 years<br />

40 years<br />

5 to 15 years<br />

5 to 15 years<br />

3 to 15 years<br />

5 to 10 years<br />

20 to 75 years<br />

H. Land Held For Resale or Lease<br />

Land held for resale or lease is carried in the Redevelopment Agency Capital Projects Fund at the lower <strong>of</strong><br />

cost or market value at acquisition.<br />

I. Compensated Absences Payable<br />

In governmental funds vacation and sick leave are recorded as expenditures in the year paid. Accordingly,<br />

the entire unpaid liability for the governmental funds is recorded as a long-term obligation in the<br />

government-wide financial statements only.<br />

Unpaid compensated absences in proprietary funds are recorded as a liability in those funds as the vested<br />

benefits accrue to the employees.<br />

38