Comprehensive Annual Financial Report - City of Cerritos

Comprehensive Annual Financial Report - City of Cerritos

Comprehensive Annual Financial Report - City of Cerritos

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>City</strong> <strong>of</strong> <strong>Cerritos</strong><br />

Notes to Basic <strong>Financial</strong> Statements, Continued<br />

For the year ended June 30, 2010<br />

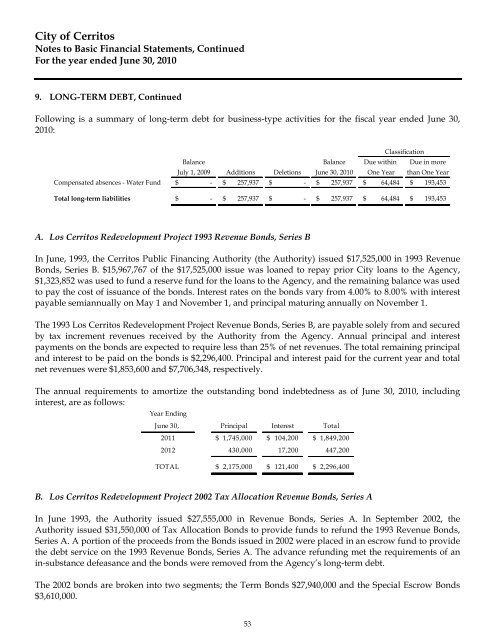

9. LONG-TERM DEBT, Continued<br />

Following is a summary <strong>of</strong> long-term debt for business-type activities for the fiscal year ended June 30,<br />

2010:<br />

Classification<br />

Balance Balance Due within Due in more<br />

July 1, 2009 Additions Deletions June 30, 2010 One Year than One Year<br />

Compensated absences - Water Fund $ - $ 257,937 $ - $ 257,937 $ 64,484 $ 193,453<br />

Total long-term liabilities $ - $ 257,937 $ - $ 257,937 $ 64,484 $ 193,453<br />

A. Los <strong>Cerritos</strong> Redevelopment Project 1993 Revenue Bonds, Series B<br />

In June, 1993, the <strong>Cerritos</strong> Public Financing Authority (the Authority) issued $17,525,000 in 1993 Revenue<br />

Bonds, Series B. $15,967,767 <strong>of</strong> the $17,525,000 issue was loaned to repay prior <strong>City</strong> loans to the Agency,<br />

$1,323,852 was used to fund a reserve fund for the loans to the Agency, and the remaining balance was used<br />

to pay the cost <strong>of</strong> issuance <strong>of</strong> the bonds. Interest rates on the bonds vary from 4.00% to 8.00% with interest<br />

payable semiannually on May 1 and November 1, and principal maturing annually on November 1.<br />

The 1993 Los <strong>Cerritos</strong> Redevelopment Project Revenue Bonds, Series B, are payable solely from and secured<br />

by tax increment revenues received by the Authority from the Agency. <strong>Annual</strong> principal and interest<br />

payments on the bonds are expected to require less than 25% <strong>of</strong> net revenues. The total remaining principal<br />

and interest to be paid on the bonds is $2,296,400. Principal and interest paid for the current year and total<br />

net revenues were $1,853,600 and $7,706,348, respectively.<br />

The annual requirements to amortize the outstanding bond indebtedness as <strong>of</strong> June 30, 2010, including<br />

interest, are as follows:<br />

Year Ending<br />

June 30, Principal Interest Total<br />

2011 $ 1,745,000 $ 104,200 $ 1,849,200<br />

2012 430,000 17,200 447,200<br />

TOTAL $ 2,175,000 $ 121,400 $ 2,296,400<br />

B. Los <strong>Cerritos</strong> Redevelopment Project 2002 Tax Allocation Revenue Bonds, Series A<br />

In June 1993, the Authority issued $27,555,000 in Revenue Bonds, Series A. In September 2002, the<br />

Authority issued $31,550,000 <strong>of</strong> Tax Allocation Bonds to provide funds to refund the 1993 Revenue Bonds,<br />

Series A. A portion <strong>of</strong> the proceeds from the Bonds issued in 2002 were placed in an escrow fund to provide<br />

the debt service on the 1993 Revenue Bonds, Series A. The advance refunding met the requirements <strong>of</strong> an<br />

in-substance defeasance and the bonds were removed from the Agency’s long-term debt.<br />

The 2002 bonds are broken into two segments; the Term Bonds $27,940,000 and the Special Escrow Bonds<br />

$3,610,000.<br />

53