Elecon Engineering Co Ltd. - Nayan M Vala Securities Pvt. Ltd.

Elecon Engineering Co Ltd. - Nayan M Vala Securities Pvt. Ltd.

Elecon Engineering Co Ltd. - Nayan M Vala Securities Pvt. Ltd.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Telephones NAYAN M. VALA SECURITIES PVT. LTD.<br />

022-26105973/74/32549230/32448788 403-404, <strong>Co</strong>smos <strong>Co</strong>urt<br />

Fax.26124310/E-Mail: vala@bom3.vsnl.net.in<br />

Above Waman Hari Pethe Jewellers<br />

Website: www.nayanmvala.com<br />

S. V. Road, Vile-Parle (west)<br />

Mumbai-400056<br />

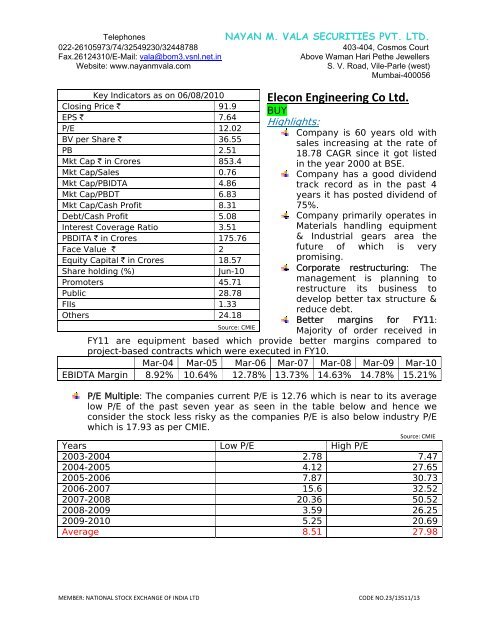

Key Indicators as on 06/08/2010<br />

Closing Price ` 91.9<br />

EPS ` 7.64<br />

P/E 12.02<br />

BV per Share ` 36.55<br />

PB 2.51<br />

Mkt Cap ` in Crores 853.4<br />

Mkt Cap/Sales 0.76<br />

Mkt Cap/PBIDTA 4.86<br />

Mkt Cap/PBDT 6.83<br />

Mkt Cap/Cash Profit 8.31<br />

Debt/Cash Profit 5.08<br />

Interest <strong>Co</strong>verage Ratio 3.51<br />

PBDITA ` in Crores 175.76<br />

Face Value ` 2<br />

Equity Capital ` in Crores 18.57<br />

Share holding (%)<br />

Jun-10<br />

Promoters 45.71<br />

Public 28.78<br />

FIIs 1.33<br />

Others 24.18<br />

Source: CMIE<br />

<strong>Elecon</strong> <strong>Engineering</strong> <strong>Co</strong> <strong>Ltd</strong>.<br />

BUY<br />

Highlights:<br />

<strong>Co</strong>mpany is 60 years old with<br />

sales increasing at the rate of<br />

18.78 CAGR since it got listed<br />

in the year 2000 at BSE.<br />

<strong>Co</strong>mpany has a good dividend<br />

track record as in the past 4<br />

years it has posted dividend of<br />

75%.<br />

<strong>Co</strong>mpany primarily operates in<br />

Materials handling equipment<br />

& Industrial gears area the<br />

future of which is very<br />

promising.<br />

<strong>Co</strong>rporate restructuring: The<br />

management is planning to<br />

restructure its business to<br />

develop better tax structure &<br />

reduce debt.<br />

Better margins for FY11:<br />

Majority of order received in<br />

FY11 are equipment based which provide better margins compared to<br />

project-based contracts which were executed in FY10.<br />

Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10<br />

EBIDTA Margin 8.92% 10.64% 12.78% 13.73% 14.63% 14.78% 15.21%<br />

P/E Multiple: The companies current P/E is 12.76 which is near to its average<br />

low P/E of the past seven year as seen in the table below and hence we<br />

consider the stock less risky as the companies P/E is also below industry P/E<br />

which is 17.93 as per CMIE.<br />

Source: CMIE<br />

Years Low P/E High P/E<br />

2003-2004 2.78 7.47<br />

2004-2005 4.12 27.65<br />

2005-2006 7.87 30.73<br />

2006-2007 15.6 32.52<br />

2007-2008 20.36 50.52<br />

2008-2009 3.59 26.25<br />

2009-2010 5.25 20.69<br />

Average 8.51 27.98<br />

MEMBER: NATIONAL STOCK EXCHANGE OF INDIA LTD<br />

CODE NO.23/13511/13

Telephones NAYAN M. VALA SECURITIES PVT. LTD.<br />

022-26105973/74/32549230/32448788 403-404, <strong>Co</strong>smos <strong>Co</strong>urt<br />

Fax.26124310/E-Mail: vala@bom3.vsnl.net.in<br />

Above Waman Hari Pethe Jewellers<br />

Website: www.nayanmvala.com<br />

S. V. Road, Vile-Parle (west)<br />

Mumbai-400056<br />

Investment Rationale:<br />

‣ Healthy order book: It has already bagged order worth of ` 578 crores till<br />

Q1FY11. The management expects new orders worth `10 and `6.5 billion<br />

from MHE and gears segments respectively in FY11. The company has live<br />

enquiries for orders worth ` 4000 crores as on 30 th June, 2010. This shows a<br />

visibility in earnings for the next 2 – 2.5 years.<br />

‣ Opportunity in Material Handling Equipment Industry: Traditionally the power<br />

sector has accounted for the largest constituent of <strong>Elecon</strong> <strong>Engineering</strong>’s order<br />

book and things are certainly flourishing in the power sector in India. Other<br />

sectors where too <strong>Elecon</strong> caters are STEEL & CEMENT both of which are<br />

seeing huge capacity expansion in the foreseeable future.<br />

‣ Diversified business: EEL has not laid all its egg in a single nest. Its product<br />

caters to various sectors as seen in the table below. Hence, the company’s<br />

growth story does not depend on the growth of a particular sector.<br />

Segment wise performance:<br />

MHE:<br />

Source: CMIE<br />

` in Crores Sales PBIT<br />

Material Handling Equipment 654.91 83.08<br />

Transmission Equipment 425.92 68.62<br />

Total 1080.83 151.7<br />

Products<br />

Stacker<br />

Wagons Tipplers<br />

Crushers & Impactors<br />

Trippers<br />

Apron, Vibrating& Paddle Feeders<br />

Screens, pulley, <strong>Co</strong>nveying system<br />

Wagons marshalling system<br />

Industry<br />

Power, Cement, Steel, Ports<br />

Power, Cement, Steel, Ports & Mining<br />

Power, Cement, Steel, Ports<br />

Open Cast Mines<br />

Power, Cement, Steel, Ports & Mining<br />

Power, Cement, Steel, Ports & Mining<br />

Power, Cement, Steel, Ports & Mining<br />

Industrial Gears:<br />

Products<br />

Helical<br />

Worms<br />

Lift Gears<br />

<strong>Co</strong>upling<br />

Industry<br />

Sugar Industry, MHE ( Stacker reclaimers), marine application,<br />

cooling towers in power plant, Wind mills, tube mills (steel)<br />

Rolling Mills (Steel), MHE(<strong>Co</strong>nveyor systems)<br />

Elevators<br />

MHE(<strong>Co</strong>nveyor systems)<br />

MEMBER: NATIONAL STOCK EXCHANGE OF INDIA LTD<br />

CODE NO.23/13511/13

Telephones NAYAN M. VALA SECURITIES PVT. LTD.<br />

022-26105973/74/32549230/32448788 403-404, <strong>Co</strong>smos <strong>Co</strong>urt<br />

Fax.26124310/E-Mail: vala@bom3.vsnl.net.in<br />

Above Waman Hari Pethe Jewellers<br />

Website: www.nayanmvala.com<br />

S. V. Road, Vile-Parle (west)<br />

Mumbai-400056<br />

‣ <strong>Co</strong>rporate restructuring: <strong>Elecon</strong> has initiated a corporate restructuring<br />

exercise with a view to consolidate the business with in the group companies.<br />

This will result in enhancing the shareholder’s value, synergy & will provide<br />

financial stability going forward. The process of restructuring would involve<br />

merging operating entities manufacturing similar equipment.<br />

<strong>Co</strong>mpany Name<br />

Eimco <strong>Elecon</strong><br />

Powerbuild<br />

Emitci <strong>Engineering</strong><br />

Ringspann <strong>Elecon</strong><br />

Prayas <strong>Engineering</strong><br />

<strong>Elecon</strong> Information Tech<br />

Operations<br />

Underground mining equipment<br />

Geared motors and gear boxes<br />

Selling agents of <strong>Elecon</strong> <strong>Engineering</strong><br />

Manufacturing and marketing transmission products<br />

Non ferrous castings<br />

Hardware, Software and networking technologies<br />

‣ Strong Client base: <strong>Elecon</strong> <strong>Engineering</strong> has been involved in the capital goods<br />

and engineering space for over 5 decades now so clearly, the company<br />

knows its territory well, having accumulated considerable experience over<br />

the years. During this time period, the company has carved a niche for itself<br />

by designing and manufacturing specialized and hi-tech material handling<br />

equipment in addition to power transformers (gears). This had lead to the<br />

company being the preferred choice for some high profile companies in<br />

sectors as diverse as the sugar industry to the power industry. <strong>Elecon</strong>’s list of<br />

clients include Reliance Power and NTPC from the power sector, Steel<br />

Authority of India and Indian Iron and Steel from the steel sector, the Indian<br />

railways, Neyveli Lignite <strong>Co</strong>rporation and NMDC from the mining and coal<br />

sector and JK Cement and ACC Cement from the cement sector.<br />

‣ Peer <strong>Co</strong>mparison: EEL is in better position for FY10 when compared to its peer<br />

as seen in the table below:-<br />

Source: CMIE<br />

` in Crores <strong>Elecon</strong> <strong>Engineering</strong> <strong>Co</strong>. <strong>Ltd</strong>. T R F <strong>Ltd</strong>.<br />

Sales 1129.99 878.39<br />

EBIDTA 175.76 92.58<br />

EBIDTA Margin 15.55% 10.54%<br />

P/E 11.9 17.88<br />

Dividend Yield 1.87% 1.39%<br />

Market Capitalization 853.4 914.74<br />

Borrowings 521.55 216.63<br />

Minority Reserve 0 59.75<br />

Cash and cash equivalent 38.81 43.46<br />

Enterprise Value 1336.14 1147.66<br />

EV/EBIDTA 7.60 12.40<br />

MEMBER: NATIONAL STOCK EXCHANGE OF INDIA LTD<br />

CODE NO.23/13511/13

Telephones NAYAN M. VALA SECURITIES PVT. LTD.<br />

022-26105973/74/32549230/32448788 403-404, <strong>Co</strong>smos <strong>Co</strong>urt<br />

Fax.26124310/E-Mail: vala@bom3.vsnl.net.in<br />

Above Waman Hari Pethe Jewellers<br />

Website: www.nayanmvala.com<br />

S. V. Road, Vile-Parle (west)<br />

Mumbai-400056<br />

‣ <strong>Co</strong>nsistency in Financial Performance: The companies past performance can<br />

be inferred from the tables given below:-<br />

Source: CMIE<br />

` in crores Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 CAGR<br />

Income 191.33 325.63 516.07 847.69 960.18 1058.88 1155.5 29.29%<br />

Sales 187.7 322.57 507.74 839.46 950.38 1049.3 1130 29.23%<br />

PBIDTA 17.06 34.64 65.96 116.42 140.51 156.53 175.76 39.54%<br />

PBDTA 10.14 25.39 50.8 97.06 113.08 108.16 124.87 43.14%<br />

PBT 2.3 17.16 41.01 84.39 98.67 85.61 91.09 69.14%<br />

PAT 2.17 9.79 27.92 54.89 67.2 54.97 66.95 63.21%<br />

Source: CMIE<br />

Years ROCE % ROE % Dividend Yield % Dividend Rate %<br />

2003‐2004 1.05 1.55 0 10<br />

2004‐2005 10.81 16.47 0.34 25<br />

2005‐2006 19.14 31.49 0.25 50<br />

2006‐2007 24.17 35.89 0.2 75<br />

2007‐2008 21.32 30.64 1.12 75<br />

2008‐2009 13.38 22.24 3.32 75<br />

2009‐2010 13.64 21.78 1.65 75<br />

Areas of <strong>Co</strong>ncerns:<br />

‣ Raw material price: <strong>Co</strong>mpanies majority contracts do not have any price<br />

variation clause so any increase in the raw material prices would hamper<br />

company’s margin.<br />

‣ Delay in execution of projects: Delay in execution of the projects on account<br />

any resource constraints or otherwise might impact the revenue of the<br />

company.<br />

<strong>Co</strong>mpany Profile:<br />

<strong>Elecon</strong> <strong>Engineering</strong> <strong>Co</strong>. <strong>Ltd</strong>. (EEL) was incorporated on 11 January 1960 in<br />

Goregaon, Mumbai. In 1966, the company shifted its registered office from<br />

Goregaon, Mumbai to Vallabh Vidaynagar, Gujarat. <strong>Elecon</strong> <strong>Engineering</strong> was<br />

promoted by Late Bhanubhai I. Patel his son - Prayasvin B. Patel, is the Chairman<br />

and the managing director of the company. The company manufactures<br />

engineering products for core industry sectors like steel, fertilizer, cement, mining,<br />

power, ports and defense. The company has three main business portfolios, namely,<br />

bulk material handling plant (contributes 60.59% to sales), industrial gears<br />

(contributes 39.41% to sales) and windmills. It designs and manufactures all type of<br />

bulk material handling equipments like belt conveyors, pusher cars, idlers and<br />

pulleys, ship loaders and unloaders, feeders. It also manufactures transmission<br />

gears like worm gears, parallel shaft and right angle shaft, helical and spiral bevel<br />

helical gears, fluid, geared & flexible couplings and planetary gear boxes. It set up<br />

an alternate energy division for manufacturing and supply of wind turbine<br />

generators in 1995. The company has a pan India presence and also has offices in<br />

the UAE, Singapore and South Africa.<br />

MEMBER: NATIONAL STOCK EXCHANGE OF INDIA LTD<br />

CODE NO.23/13511/13

Telephones NAYAN M. VALA SECURITIES PVT. LTD.<br />

022-26105973/74/32549230/32448788 403-404, <strong>Co</strong>smos <strong>Co</strong>urt<br />

Fax.26124310/E-Mail: vala@bom3.vsnl.net.in<br />

Above Waman Hari Pethe Jewellers<br />

Website: www.nayanmvala.com<br />

S. V. Road, Vile-Parle (west)<br />

Mumbai-400056<br />

Last six quarters results:<br />

Source: CMIE<br />

` in crores Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10<br />

Total Income 293.56 214.48 256.93 259.24 341.19 247.19<br />

Net Sales 293.54 214.48 256.93 251.23 332.44 247.18<br />

Other Income 0.02 0 0 8.01 8.75 0.01<br />

Change in stock 33.8 7.77 -12.22 -21.03 -9.19 5.84<br />

Expenditure 310.38 213.75 233.94 218.38 304.93 239.71<br />

<strong>Co</strong>nsp raw mat. 229.63 150.19 167.9 150.28 225.41 175.04<br />

Personnel cost 9.89 8.93 11.87 13.07 9.66 11.96<br />

Other expenses 37.81 28.35 27.45 28.19 41.56 28.11<br />

PBDIT 50.03 34.78 37.49 46.67 55.37 37.92<br />

Interest 15.82 14.42 13.4 11.34 11.73 9.85<br />

PBDT 34.21 20.36 24.09 35.33 43.64 28.07<br />

Depreciation 6.99 7.49 7.8 8.29 9.53 8.92<br />

PBT 27.22 12.87 16.29 27.04 34.11 19.15<br />

Tax 10.24 4.37 5.52 7.21 7.04 5.83<br />

PAT 16.98 8.5 10.77 19.83 27.07 13.32<br />

From NAYAN M. VALA SECURITIES PVT.LTD.RESEARCH<br />

By Dharmesh N. <strong>Vala</strong> & Harsh B. Chauhan<br />

Disclaimer: The information contained herein is confidential and is intended solely for the addressee(s). Any<br />

unauthorized access; use, reproduction, disclosure or dissemination is prohibited. This information does not constitute<br />

or form part of and should not be construed as, any offer for sale or subscription of or any invitation to offer to buy or<br />

subscribe for any securities. The information and opinions on which this communication is based have been complied<br />

or arrived at from sources believed to be reliable and in good faith, but no representation or warranty, express or<br />

implied, is made as to their accuracy, correctness and are subject to change without notice. NAYAN M. VALA<br />

SECURITIES PVT.LTD. and/ or its clients may have positions in or options on the securities mentioned in this report<br />

or any related investments, may effect transactions or may buy, sell or offer to buy or sell such securities or any related<br />

investments. Recipient/s should consider this report as only a single factor in making their investment decision. Neither<br />

NAYAN M. VALA SECURITIES PVT.LTD. or any of its affiliates shall assume any legal liability or responsibility<br />

for any incorrect, misleading or altered information contained herein.<br />

MEMBER: NATIONAL STOCK EXCHANGE OF INDIA LTD<br />

CODE NO.23/13511/13