Reports AMRUTANJAN HEALTH CARE Ltd - Nayan M Vala ...

Reports AMRUTANJAN HEALTH CARE Ltd - Nayan M Vala ...

Reports AMRUTANJAN HEALTH CARE Ltd - Nayan M Vala ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

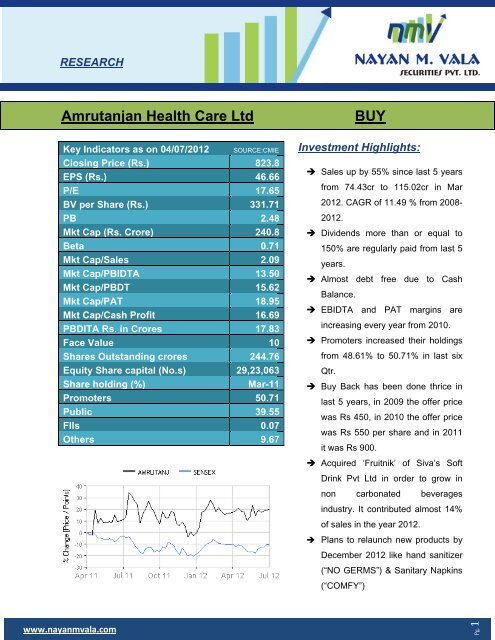

RESEARCH<br />

Amrutanjann Health<br />

Care<br />

<strong>Ltd</strong><br />

BUY<br />

Key Indicators as<br />

on 04/07/ /2012<br />

Closing Price (Rs.)<br />

EPS (Rs.)<br />

P/E<br />

BV per<br />

Share (Rs.)<br />

PB<br />

Mkt Cap (Rs. Crore)<br />

Beta<br />

Mkt Cap/Sales<br />

Mkt Cap/PBIDTA<br />

Mkt Cap/PBDT<br />

Mkt Cap/PAT<br />

Mkt Cap/Cash Profit<br />

PBDITA<br />

Rs. in Crores<br />

Face Value<br />

Shares<br />

Outstanding crores<br />

Equity<br />

Share capital (No.s)<br />

Share holding (%)<br />

Promoters<br />

Public<br />

FIIs<br />

Others<br />

SOURCE:CMIEE<br />

823.88<br />

46.666<br />

17.65<br />

331.711<br />

2.48<br />

240.8<br />

0.71<br />

2.09<br />

13.50<br />

15.62<br />

18.95<br />

16.69<br />

17.83<br />

10<br />

244.76<br />

29,23,0633<br />

Mar-111<br />

50.71<br />

39.555<br />

0.07<br />

9.67<br />

Investment Highlights:<br />

Sales up by 55% since last 5 years<br />

from 74.43cr to 115.02cr in Mar<br />

2012. CAGR<br />

of 11.49 % from 2008-<br />

2012.<br />

Dividends more than or equal to<br />

150% are regularly paid from last 5<br />

years.<br />

Almost debt free due<br />

to Cash<br />

Balance.<br />

EBIDTA and PAT margins are<br />

ncreasing every year from 2010.<br />

Promoters increased their holdings<br />

from 48.61%<br />

to 50.71%<br />

in last six<br />

Qtr.<br />

Buy Back has been done thrice in<br />

last 5 years, in 2009 the<br />

offer price<br />

was Rs 450,<br />

in 2010 the<br />

offer price<br />

was Rs 550 per share and in 2011<br />

it<br />

was Rs 900.<br />

Acquired ‘Fruitnik’ of<br />

Drink Pvt <strong>Ltd</strong> in order<br />

Siva’s Soft<br />

to grow in<br />

non<br />

carbonated<br />

beverages<br />

industry. It contributed almost 14%<br />

of sales in the year 2012.<br />

Plans to relaunch new products by<br />

December 2012 like hand sanitizer<br />

(“NO GERMS”) & Sanitary Napkins<br />

(“COMFY”)<br />

www.nayanmvala.com<br />

Pg. 1

Sales UP by 55%<br />

in last five years<br />

post change in<br />

leadership.<br />

Investment Rationale:<br />

Consistent increase in sales: Sales of the company have<br />

increased by 55% in last 5 years post change in leadership. The<br />

sales increased under the leadership of A Satish Kumar who came<br />

into effect from 25 th June 2009. Before Change in director the<br />

sales were growing at a very low rate.<br />

EARLIER LEADERSHIP<br />

(Rs. Cr) Mar ‘04 Mar ‘05 Mar‘06 Mar’07 Mar’08 CAGR (%)<br />

Net sales 68.04 66.85 70.15 72.39 74.43 2.26<br />

NEW LEADERSHIP<br />

(Rs .Cr) Mar’08 Mar’09 Mar’10 Mar’11 Ma’ 12 CAGR (%)<br />

Net sales 74.43 90.66 89.77 103.38 115.02 11.49<br />

Dividend yield is<br />

1.82%.<br />

Negligible Debt as<br />

Company has<br />

substantial Cash<br />

Balance<br />

EBIDTA Margins (<br />

excluding Other<br />

income) have<br />

increased from<br />

11.47 % to 15.5%<br />

More than 150% Dividend rate since 2008: The Company is<br />

giving un-interrupted dividend since past 5 years<br />

Percentage Mar 08 Mar 09 Mar 10 Mar 11 Mar 12<br />

Div Rate 470 170 150 150 150<br />

Borrowings: The Company increased their borrowings from<br />

1.26cr to 26.63cr from Mar 2010 to Mar 2011. The borrowings<br />

were made in order to acquire the ‘Fruitnik’ brand. Fruitnik had four<br />

percent market share in Tamil Nadu. However the company is<br />

effectively debt free due to its cash Balance of 14cr.<br />

(Rs. Cr) Mar 10 Mar 11 Mar 12<br />

Borrowings 1.26 26.63 18.91<br />

Cash bal 25.04 19.88 14.72<br />

EBIDTA and PAT Margins: Company’s EBITDA and PAT<br />

margins are growing and have shown a good increase in 2012.<br />

Particulars (Rs. Cr) Mar 09 Mar 10 Mar 11 Mar 12<br />

Total Income 178.37 97.76 108.21 115.02<br />

Net Sales 90.66 89.77 103.38 114.8<br />

Ebitda ex OI 10.4 12.22 13.1 17.84<br />

Ebidta margin ex OI (%) 11.47 13.61 12.67 15.50<br />

PAT ex OI 5.15 3.82 5.85 8.4<br />

PAT margin (%) 5.68 4.25 5.65 7.31<br />

www.nayanmvala.com<br />

Pg. 2

Promoters<br />

increased their<br />

holdings from<br />

48.61% to 50.71.<br />

Promoters increase their holdings: Promoters increased their<br />

shareholding from 48.61% to 50.71%.<br />

51<br />

50<br />

49<br />

48<br />

47<br />

48.31<br />

48.61<br />

% holding<br />

50.39<br />

50.71 50.71<br />

Mar‐11 Jun‐11 Sep‐11 Dec‐11 Mar‐12<br />

% holding<br />

Buy Back done<br />

thrice in last 5<br />

years.<br />

Acquiring Soft<br />

drink called<br />

Fruitnik which<br />

contributed to<br />

almost 14% of the<br />

total sales in<br />

2012.<br />

Buy back of shares: Buy Back has been done thrice in last 5<br />

years. In the year 2009 the offer price was Rs 450 and in year<br />

2010 the offer price was Rs 550 per share and in year 2011 it was<br />

Rs 900. Which is higher than C.M.P<br />

(Rs. Cr) Mar 08 Mar 09 Mar 10 Mar 11 Mar 12<br />

Paid up capital 3.2 3.1 3.03 3.03 2.92<br />

Acquired Fruitnik: Amrutanjan Health Care <strong>Ltd</strong> has informed<br />

BSE that the Company has entered into an agreement with M/s.<br />

Siva's Soft Drink Pvt <strong>Ltd</strong>., Chennai to acquire their soft drink and<br />

fruit based beverages business along with the brand, 'Fruitnik' for a<br />

total consideration of Rs 26.20 Crores. Fruitnik contribution to total<br />

sales was almost 14% in the year ended 2012.<br />

Areas of concern:<br />

The biggest risk facing the company today is price inflation of key raw materials. This is a<br />

broader trend that is affecting all FMCG companies resulting in margin pressure.<br />

The biggest threat going into FY 2011 is the intensive competition. Amrutanjan market share in<br />

India is about 10% which is behind Vicks 16% and Zandu Balm 12%.<br />

Upcoming products like Hand Sanitizer or Sanitary Napkins already have severe competition<br />

and penetrating the same may be difficult.<br />

Chemical business is a burden on the company as it continues to post losses since 5 years i.e.<br />

March 2008 – March 2012.<br />

Profit / Loss (Rs. Cr.) Mar-08 Mar-09 Mar-10 Mar-11 Mar-12<br />

Chemical Segment (1.65) (1.28) (3.45) (2.81) (3.43)<br />

www.nayanmvala.com<br />

Pg. 3

Company Profile:<br />

Amrutanjan Health Care <strong>Ltd</strong>, more than a century old legendary Indian brand since<br />

1893. The<br />

company is engaged in manufacturing and marketing of ayurvedic and allopathic products. The<br />

main product<br />

of the company is Amrutanjan pain balm which contributes to 80 % of sales. It<br />

has product offerings in the sectors of health care, food and medical care. The company has<br />

two health care products<br />

manufacturing units, one at Chennai and the<br />

other at Hyderabad. It<br />

also has a fine chemicals<br />

division in Tamil Nadu.<br />

Product Line<br />

of Amrutanjan healthh care <strong>Ltd</strong><br />

Product Line<br />

Pain<br />

Management<br />

Congestion<br />

management<br />

Products in<br />

purity<br />

Foods and<br />

beverages<br />

Comfy<br />

Balm<br />

Relief balm for<br />

cough<br />

No germs hand<br />

sanitizer<br />

(upcoming),<br />

Fruitnik<br />

Comfy sanitary<br />

napkins<br />

(upcoming)<br />

Aromatic Balm<br />

& Roll On<br />

Cold inhaler &<br />

mint<br />

Decorn corn<br />

caps<br />

Kitchen<br />

delights<br />

Revenue Mix: The revenue mix shows that beverages have started to sell and is almost 14% of<br />

total net saless in 2012.<br />

0%<br />

2012<br />

6%<br />

14%<br />

OTC<br />

Chemical<br />

Beverages<br />

80%<br />

Others<br />

www.nayanmvala.com<br />

Pg. 4

Quarterly Results – (Consolidated)<br />

(Rs. Crore) Source: CMIE Dec 10 Mar 11 Jun 11 Sep 11 Dec 11 Mar 12<br />

Total income 29.04 35.2 35.9 15.54 33.46 37.51<br />

Net sales 28.04 34.23 34.34 14.66 32.37 36.36<br />

Other income 1 0.97 1.56 0.88 1.09 1.15<br />

Extra-ordinary income<br />

Change in stock -1.06 1.9 0.07 -0.46 -0.01 1.5<br />

Total Expenses 24.84 33.9 30.38 14.88 29.92 34.69<br />

Cons. raw material 9.92 15.63 14.64 5.36 12.66 15.89<br />

Salaries & wages 4.01 4.49 4.52 3.5 4.41 4.31<br />

Other expenses 9.37 11.13 7.58 4.98 10.31 11.44<br />

Extra-ordinary expenses<br />

PBDIT 4.68 5.85 9.23 1.24 6.07 7.37<br />

Depreciation 0.42 0.64 0.52 0.51 0.69 0.59<br />

Interest 0.01 0.23 0.48 0.61 0.68<br />

PBT 4.26 5.2 8.48 0.25 4.77 6.1<br />

Tax 1.12 2 2.89 0.05 1.24 1.78<br />

PAT 3.14 3.2 5.59 0.2 3.53 4.32<br />

From NAYAN M. VALA SECURITIES PVT.LTD.RESEARCH<br />

By Dushant Y. Hedau & Mayur R. Nakhwa<br />

Disclaimer: The information contained herein is confidential and is intended solely for the addressee(s). Any unauthorized access; use,<br />

reproduction, disclosure or dissemination is prohibited. This information does not constitute or form part of and should not be construed as,<br />

any offer for sale or subscription of or any invitation to offer to buy or subscribe for any securities. The information and opinions on which this<br />

communication is based have been complied or arrived at from sources believed to be reliable and in good faith, but no representation or<br />

warranty, express or implied, is made as to their accuracy, correctness and are subject to change without notice. NAYAN M. VALA<br />

SECURITIES PVT.LTD. and/ or its clients may have positions in or options on the securities mentioned in this report or any related<br />

investments, may affect transactions or may buy, sell or offer to buy or sell such securities or any related investments. Recipient/s should not<br />

consider this report as only a single factor in making their investment decision. Neither NAYAN M. VALA SECURITIES PVT.LTD. nor any of<br />

its affiliates shall assume any legal liability or responsibility for any incorrect, misleading or altered information contained herein.<br />

MEMBER: NATIONAL STOCK EXCHANGE OF INDIA LTD CODE NO. 13511<br />

MEMBER: BOMBAY STOCK EXCHANGE LTD CODE NO. 6222<br />

MEMBER: THE CALCUTTA STOCK EXCHANGE ASSOCIATION LTD CODE NO. 506<br />

MEMBER: MCX-SX<br />

CODE NO.38300<br />

NAYAN M. VALA SECURITIES PVT.LTD. Tel: (+91-22) 2610 5973 / 2610 5974<br />

403-404, Cosmos Court, Fax. +91-22- 2612 4310<br />

Above Waman Hari Pethe Jewellers E-Mail: research@nayanmvala.com<br />

S. V. Road, Vile-Parle (West), Website: www.nayanmvala.com<br />

Mumbai – 400056. INDIA<br />

www.nayanmvala.com<br />

Pg. 5