Reports BHEL - Nayan M Vala Securities Pvt. Ltd.

Reports BHEL - Nayan M Vala Securities Pvt. Ltd.

Reports BHEL - Nayan M Vala Securities Pvt. Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

QUARTERLY INFORMATION 04/2011as of December 31, 2011Rudolf Schüpfer new Managing Director INNOVATIS (Suisse) AGRudolf Schüpfer takes over the position as Managing Director of INNOVATIS (Suisse)AG as per January 3rd, 2012. His experience in the banking industry, financialadvisory business and asset management will help to successfully positionINNOVATIS (Suisse) AG as a high quality asset manager on the Swiss market.He will be located at the offices of INNOVATIS in the Nüschelerstr. 30 in Zurich. Hiscoordinates are r.schuepfer@innovatis-suisse.com and +41 44 215 30 66. Thecompany website is accessible through www.innovatis-suisse.com.INNOVATIS and partners are to found two new companies in 2012 –ESC Holding and SB RealINNOVATIS (Suisse) AG acts as founding partner for a new Investment company which is called ESC(Holding) AG. East Square Capital (ESC) will be a Zurich based investment holding whose geographicalfocus will be Central Eastern Europe. The company will invest intersectorally and predominantly in listedcompanies. As a long-term cooperative investor the aim of ESC will be to buy significant stakes ofcompanies with strong assets in order to achieve long term entrepreneurial success and add value to it'sholding companies.2011 INNOVATIS IMMOBILIEN GmbH was founded as a 100% privately owned realestate company. Due to the strong interest and demand for real estate investmentsappearing within our network INNNOVATIS IMMOBILIEN GmbH has decided tobecome a stock company and change its name to SB REAL (Aktiengesellschaft). Inthis process SB REAL AG will strengthen its capital base in order to expand the realestate portfolio later on. The strategy of SB REAL AG will be to build up a real estateportfolio as a long term investments of assets.SB REAL AG will follow a clear defined corporate positioning by focusing on properties in Germany andAustria. The regional positioning will be characteristically for SB REAL AG. The local expertise of thecompany will be a crucial value driver as we offer personal contacts for sellers, tenants and investors onsite. The transformation of the process is expected to be finished until March 2012.INNOVATIS launched NEW Website DesignINNOVATIS is happy to announce the re-launch of its website. The site upgrades -which will feature both enhanced content and a redesigned format - will provide abetter overall user experience and will enhance the company's information providingprocess. With the redesigned website, user access will also be greatly enhanced witha new login area.To find out more about INNOVATIS please visit innovatis-organization.com.Page 1 of 3This information report is intended for information purposes only.Copyright © 2011 INNOVATIS. All rights reserved

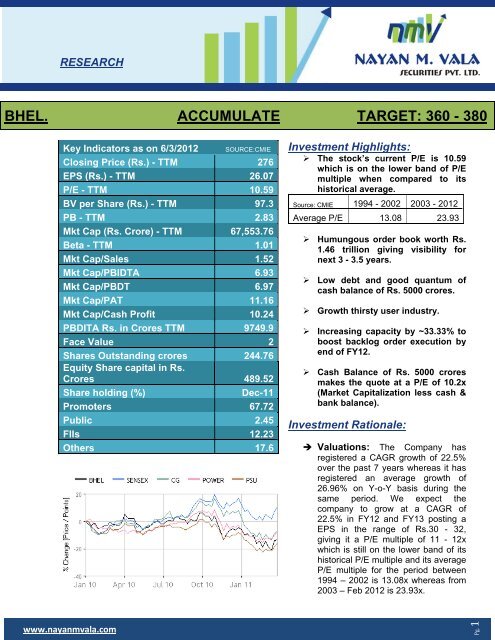

SOURCE:CMIE Mar-05 Mar-06 Mar-07 Mar-08 Mar-09 Mar-10 Mar-11Sales 10696.37 14772.21 19067.02 21775.67 28796.08 34918.79 44304.66PBIDTA net ofP&E and OI 1242.49 2201.64 3024.27 3077.59 3425.97 3326.15 7745.94PBIT net ofP&E and OI 1023.62 1955.71 2751.3 2780.38 3082.9 2865.89 7199.57PBT net of P&Eand OI 942.23 1896.96 2707.98 2744.96 3047.72 2829.2 7143.19PAT net of P&Eand OI 325.93 1015.35 1400.91 1185.68 1248.1 496.03 4049.42PAT net of P&E 645.34 1376 1946 2283.93 2260.9 1693.73 5086.73PBIDTA net ofP&E and OI 11.62% 14.90% 15.86% 14.13% 11.90% 9.53% 17.48%PBIT net ofP&E and OI 9.57% 13.24% 14.43% 12.77% 10.71% 8.21% 16.25%PBT net of P&Eand OI 8.81% 12.84% 14.20% 12.61% 10.58% 8.10% 16.12%PAT net of P&Eand OI 3.05% 6.87% 7.35% 5.44% 4.33% 1.42% 9.14%PAT net of P&E 6.03% 9.31% 10.21% 10.49% 7.85% 4.85% 11.48%50454035302520151050P/EMay‐03Sep‐03Jan‐04May‐04Sep‐04Jan‐05May‐05Sep‐05Jan‐06May‐06Sep‐06Jan‐07May‐07Sep‐07Jan‐08May‐08Sep‐08Jan‐09May‐09Sep‐09Jan‐10May‐10Sep‐10Jan‐11May‐11Sep‐11Jan‐12We recommend to accumulate the stock on dips with a one year price target of Rs. 360 -380/- Humungous order book: The companies order book stood at Rs.1,46,541 crores as on Q3FY12 of which Rs. 1,17,472 crores (80.16%)belongs to the power segment, Rs. 19,711 crores (13.45%) belongs toindustry segment and Rs. 9358 crores (6.39%) to internationaloperations.www.nayanmvala.comPg. 2

The company hasorder book of 65GW intermsvoltage whichshows a visibilityfor the coming 3to 3.5 years.180000160000 148000154000 158000 161145 159600 16100014654114000012000010000080000600004000020000 6601.04 8490.659023.32 18380.572711 10743.0801.46 10545.51 acklog ordeCompany bookedorders worth Rs.152 billion inQ3FY12 of Rs. 94billion is frompower sector andRs 63 billion fromindustrysector.Cash balance is atRs. 5000 croreswhere as debt isRs.270 crores.Peak power deficitof 8.7%12 th 5 year planenvisagescapacityadditionOrder Book Net SalesThe company has lost orders worth Rs. 58 billionfrom its ba rbook which constituted of a large power order and other small change inscope. The orders were lost on account of coal linkages and change ofscope. The management doesn’t foresee any such orders in the nearfuture as it finds a ray of hope with PMO has started reviewing variousissues plaguing Indian power sector. RBI has started addressing theissue of high interest ratesby reducingthe CRR by 50 basis points. Low debt and good quantum of cash balance: <strong>BHEL</strong> is anunderleveraged company with its D/ E ratio as on 31.3.2011 stands at0.013 x with a cash reserve of Rs. 50 billion as on Q3FY12.Source: CMIE (Rs. In crores)Mar-09 Mar-10 Mar-11Borrowings166.56 148.33 270.17Cash and bank balance10329.469856.45 9706.4 Growth thirsty user industry: <strong>BHEL</strong> productscater to thedemand ofpower sector in India. As of March 31, 2011, India’s total annual powerproduction was811.1 billion kWh, including 5.6 billion kWh ofimport fromBhutan.Comparedto the world average per capitaaelectricityconsumption,India’s low per capita electricity consumptionn presents asignificant potential for sustainable growth in power demand in India.India has continuously experienced shortages in energy and peak powerrequirements.According to the CEAMonthly Review of Power Sectorpublished in June 2011, the total energy deficit for June2011 wasapproximately5.3% and the peak power deficit for June 2011 was 8.7% .GoI’s 12th Five- Year Plan envisages a tentative capacityaddition ofapproximately100,000 MW, with total investment in the Indian powerwww.nayanmvala.comPg. 3

of ~100GW withinvestments worthRs. 11000 billion.Adding 5GWcapacity by FY12totalling itscapacity to 20GW.sector in the next five years of approximately Rs. 11,000 billion. Theabove mentioned situation along with the topping of constituentperformance and experience of the company of installing generatingcapacity of 96 GW which is 62% of India’s power generating capacity ason March, 2011 illustrates a very promising future. Increasing capacity by ~33.33% to boost backlog order execution:The Company intends to complete its capacity enhancement plan by theend of Financial Year 2012, which will provide us with the capability todeliver power generation equipment of 20,000 MW per year. We believethat this will enable it to address the anticipated market demand for powergeneration equipment and to efficiently execute our existing Order Book. Constituently Dividend paying: The company has a track record ofpaying dividends constituently as seen from the table below:Constituentlypaying dividendsfrom past 10years with anaverage dividendrate of 141% witha FV of Rs. 10.Year Source: CMIE Div Rate (%)2012 3152011 255.52010 1902009 152.52008 1502007 1452006 1252005 802004 602003 402002 40Areas of concern:Price and availability of raw materials: The key raw materials of the company are steel, steelbasedproducts and copper are subject to substantial pricing cyclicality and periodic shortages ofsupply in India.Competition from global peers: The Company faces significant competition from certain Indiancompanies which have established manufacturing joint ventures with foreign partners, such as L&T –Mitsubishi Heavy Industries, Bharat Forge – Alstom and JSW – Toshiba. Several Chinesemanufacturers, such as Shanghai Electric Group Company Limited, SEPCO Electric Power, HarbinPower Plant Equipment Group Corporation and Dongfang Electric Corporation, have recently beenmaking inroads into the Indian power sector. Chinese competitors have recently been able to securesyndicated financing from Chinese financial institutions for power projects at relatively low cost,thereby providing them with an advantage over non-Chinese competitors in securing orders fromIndian power generation companies, which traditionally constitute our primary customer base in thissector. If Chinese competitors continue to have access to cheaper financing, it could result in anincrease in orders placed with Chinese manufacturers and loss of new orders for domestic equipmentmanufacturers.www.nayanmvala.comPg. 4

Macro Economic factors: The Company faces some problems with regard to order inflow becauseof some macro concerns like higher interest rate, delay in environmental clearances, lack of fuelsecurity caused by some pricing issues in the main coal supplying countries like Indonesia andAustralia and the resultant higher domestic prices.Quarterly Results – (Standalone)(Rs. Crore) SOURCE:CMIE Sep-10 Dec-10 Mar-11 Jun-11 Sep-11 Dec-11Total income 8,656.41 9,176.26 18,621.61 7,520.11 10,765.37 10,939.10Net sales 8,490.65 9,023.32 18,380.50 7,271.46 10,545.51 10,743.08Other income 161.99 152.94 163.43 248.65 219.86 196.02Extra-ordinary income 3.77 0 77.68 0 0 0Change in stock 393.15 275.9 -666.95 430.59 447.85 474.54Expenditure 7,907.28 8,048.93 15,156.62 7,135.19 9,801.19 9,981.03Consp. raw mat. 5,357.21 5,085.69 8,293.19 4,580.56 6,565.82 6,488.24Personnel cost 1,264.09 1,348.66 1,459.91 1,300.95 1,349.14 1,337.68Other expenses 630.11 793.17 3,666.85 707.31 1,119.20 1,311.25Extra-ordinary exp. 0 0 0 0 0 0PBDIT 1,798.15 2,224.64 4,534.71 1,361.88 2,179.06 2,276.47Interest 5.93 14.47 30.5 8.8 9.64 14.5PBDT 1,792.22 2,210.17 4,504.21 1,353.08 2,169.42 2,261.97Depreciation 134.1 144.69 138.44 170.91 188.81 186.14PBT 1,658.12 2,065.48 4,365.77 1,182.17 1,980.61 2,075.83Tax 515.84 662.25 1,567.73 366.66 568.58 643.22PAT 1,142.28 1,403.23 2,798.04 815.51 1,412.03 1,432.61Company Profile:<strong>BHEL</strong> is an integrated power plant equipment manufacturer and one of the largest engineering andmanufacturing companies. It is engaged in the design, engineering, manufacture, construction,testing, commissioning and servicing of a wide range of products and services in power and industrysegments. In the power segment, it offers a wide range of products and systems for coal-basedthermal, gas-based thermal, nuclear and hydro power projects. These projects either on aturnkey/EPC basis or by engineering, supplying and executing main plant equipment, whichcomprises primarily boilers, turbines and generators, as well as auxiliary equipment such aselectrostatic precipitators (ESP), electrical equipment, control and instrumentation systems, pumpsand heaters. 79.9% of top line was contributed by this segment. In the Industry Segment, it designs,manufacture, supply and offer services for a broad range of systems and individual products for thefollowing business areas: captive power plants, power transmission, rail transportation, renewableenergy, industrial products (electrical and mechanical) and others. 20.1% of top line was contributedby this segment. It has the capability to deliver power generation equipment of 15,000 MW per yearwhich is being expanded to 20,000 MW.From NAYAN M. VALA SECURITIES PVT.LTD.RESEARCHBy Harsh B. Chauhanwww.nayanmvala.comPg. 5

Disclaimer: The information contained herein is confidential and is intended solely for the addressee(s). Any unauthorized access; use,reproduction, disclosure or dissemination is prohibited. This information does not constitute or form part of and should not be construed as,any offer for sale or subscription of or any invitation to offer to buy or subscribe for any securities. The information and opinions on which thiscommunication is based have been complied or arrived at from sources believed to be reliable and in good faith, but no representation orwarranty, express or implied, is made as to their accuracy, correctness and are subject to change without notice. NAYAN M. VALASECURITIES PVT.LTD. and/ or its clients may have positions in or options on the securities mentioned in this report or any relatedinvestments, may affect transactions or may buy, sell or offer to buy or sell such securities or any related investments. Recipient/s should notconsider this report as only a single factor in making their investment decision. Neither NAYAN M. VALA SECURITIES PVT.LTD. nor any ofits affiliates shall assume any legal liability or responsibility for any incorrect, misleading or altered information contained herein.MEMBER: NATIONAL STOCK EXCHANGE OF INDIA LTD CODE NO. 13511MEMBER: BOMBAY STOCK EXCHANGE LTD CODE NO. 6222MEMBER: THE CALCUTTA STOCK EXCHANGE ASSOCIATION LTD CODE NO. 506MEMBER: MCX-SXCODE NO.38300NAYAN M. VALA SECURITIES PVT.LTD. Tel: (+91-22) 2610 5973 / 2610 5974403-404, Cosmos Court, Fax. +91-22- 2612 4310Above Waman Hari Pethe Jewellers, E-Mail: research@nayanmvala.comS. V. Road, Vile-Parle (West), Website: www.nayanmvala.comMumbai – 400056. INDIAwww.nayanmvala.comPg. 6