before the company law board - Company Law Board Mumbai Bench

before the company law board - Company Law Board Mumbai Bench

before the company law board - Company Law Board Mumbai Bench

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

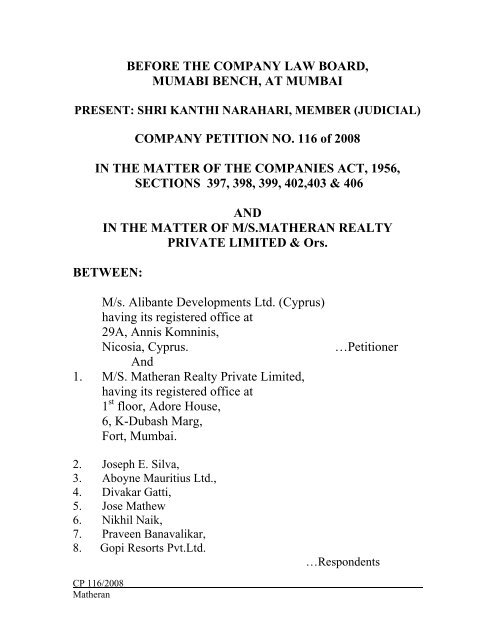

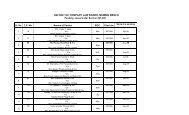

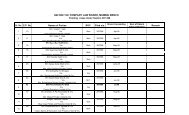

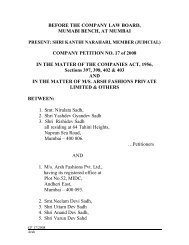

BEFORE THE COMPANY LAW BOARD,<br />

MUMABI BENCH, AT MUMBAI<br />

PRESENT: SHRI KANTHI NARAHARI, MEMBER (JUDICIAL)<br />

COMPANY PETITION NO. 116 of 2008<br />

IN THE MATTER OF THE COMPANIES ACT, 1956,<br />

SECTIONS 397, 398, 399, 402,403 & 406<br />

AND<br />

IN THE MATTER OF M/S.MATHERAN REALTY<br />

PRIVATE LIMITED & Ors.<br />

BETWEEN:<br />

M/s. Alibante Developments Ltd. (Cyprus)<br />

having its registered office at<br />

29A, Annis Komninis,<br />

Nicosia, Cyprus.<br />

And<br />

1. M/S. Ma<strong>the</strong>ran Realty Private Limited,<br />

having its registered office at<br />

1 st floor, Adore House,<br />

6, K-Dubash Marg,<br />

Fort, <strong>Mumbai</strong>.<br />

…Petitioner<br />

2. Joseph E. Silva,<br />

3. Aboyne Mauritius Ltd.,<br />

4. Divakar Gatti,<br />

5. Jose Ma<strong>the</strong>w<br />

6. Nikhil Naik,<br />

7. Praveen Banavalikar,<br />

8. Gopi Resorts Pvt.Ltd.<br />

…Respondents<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

2<br />

PRESENT FOR PARTIES;<br />

Shri S.V. Kamdar Sr. Counsel )<br />

Shri Rahul Chitnis, Advocate, )<br />

Shri Ameya Gokhale, Advocate ) … For Petitioner.<br />

Shri Chirag Mody, Advocate )<br />

Shri Saharan Jagtiani, Advocate )<br />

Ms. Anushka Sharda, Advocate )<br />

Shri Nikhil, Advocate ) … For Respondents.<br />

O R D E R<br />

The present petition is filed by invoking various<br />

provision of <strong>the</strong> Companies Act, 1956 (‘<strong>the</strong> Act’) alleging certain<br />

acts of oppression and mismanagement in <strong>the</strong> affairs of <strong>the</strong><br />

<strong>Company</strong> and sought various reliefs as prayed in para VII of <strong>the</strong><br />

petition. Shri Kamdar, Learned Sr. Counsel appearing for <strong>the</strong><br />

petitioner narrated <strong>the</strong> brief facts. He submitted that <strong>the</strong><br />

Respondent <strong>Company</strong> was incorporated on 27 th October, 2006 and<br />

engaged inter-alia in <strong>the</strong> business of real estate development and<br />

trading in properties and transferable development rights. The<br />

petitioner and Respondent No.2 were <strong>the</strong> promoters and<br />

shareholders of R 1 <strong>Company</strong> from its incorporation till 26 th July,<br />

2007. The petitioner, Respondent No.2 and 3 entered into Share<br />

Subscription Agreement (SSA) and Shareholder Agreement both<br />

dated 26 th July, 2007 wherein <strong>the</strong> R3 being an investment <strong>company</strong><br />

CP 116/2008<br />

Ma<strong>the</strong>ran

3<br />

agreed to invest a sum of Rs.131,20,00,000/- in <strong>the</strong> <strong>Company</strong> in<br />

various instalments. In return, <strong>the</strong> <strong>Company</strong> agreed to issue and<br />

allot 1,25,160 equity shares of Class A having face value of<br />

Rs.10/- each per share aggregating to a total economic interest of<br />

55% and voting rights of 44.99% of <strong>the</strong> total paid up share capital<br />

of <strong>the</strong> <strong>Company</strong>. In July, 2007 Mr.M.Fysh, <strong>the</strong> nominee Director<br />

of <strong>the</strong> petitioner in R1 <strong>Company</strong> was appointed <strong>the</strong> Chief<br />

Executive Officer of <strong>the</strong> said <strong>Company</strong>. The CEO suggested and<br />

began to arrange for external finance for affordable housing<br />

development from financial co-investment partners, <strong>the</strong> World<br />

Bank and o<strong>the</strong>r related institutions and also began to arrange for<br />

credit financing from Japanese and Korean institutions. R3 in<br />

contravention of <strong>the</strong> said SSA and SHA, started to interfere in day<br />

to day affairs and decision making of <strong>the</strong> <strong>Company</strong> including<br />

preventing <strong>the</strong> <strong>Company</strong> from raising any external finance for its<br />

development. R3 forced <strong>the</strong> <strong>Company</strong> to appoint a Local Chief<br />

Operational Officer and Head of Technical. Mr.Fysh, <strong>the</strong> CEO of<br />

<strong>the</strong> <strong>Company</strong> made several attempts to explain R2 to 7 <strong>the</strong><br />

strategies for enhancing shareholder value in <strong>the</strong> <strong>Company</strong> using<br />

external finance. Mr. Fysh had already identified potential<br />

investors and suggested to invite <strong>the</strong> said potential investors for<br />

financing <strong>the</strong> project of <strong>the</strong> <strong>company</strong>. The Respondent no. 2 & 3<br />

did not accept <strong>the</strong> said strategies. Fur<strong>the</strong>r, in contravention of <strong>the</strong><br />

CP 116/2008<br />

Ma<strong>the</strong>ran

4<br />

SSA and SHA, <strong>the</strong> R3 demanded counter signature rights for any<br />

payments to be made by <strong>the</strong> <strong>Company</strong> and for recruitment of staff<br />

by <strong>the</strong> <strong>Company</strong>. R3 was also interfering in <strong>the</strong> management and<br />

financial decisions of <strong>the</strong> <strong>Company</strong>. The R2, 4 to 7 were also<br />

accepting <strong>the</strong> unreasonable demands of <strong>the</strong> R3 in contravention of<br />

<strong>the</strong> provisions of <strong>the</strong> SSA and SHA to <strong>the</strong> detriment of <strong>the</strong> interests<br />

of <strong>the</strong> <strong>Company</strong>. As per <strong>the</strong> SHA and Articles of Association of<br />

<strong>the</strong> <strong>Company</strong>, <strong>the</strong> Directors appointed by <strong>the</strong> R3 were <strong>the</strong> non<br />

executive directors and would not be responsible for <strong>the</strong> day to day<br />

management of <strong>the</strong> <strong>Company</strong> and <strong>the</strong> Directors appointed by <strong>the</strong><br />

petitioner and R2 would be executive directors and would be<br />

responsible for day to day affairs of <strong>the</strong> <strong>Company</strong>. R2 and R3<br />

being in majority were taking all <strong>the</strong> decisions of <strong>the</strong> <strong>Company</strong><br />

without prior information and approval of <strong>the</strong> petitioner or <strong>the</strong><br />

CEO of <strong>the</strong> <strong>Company</strong>. In view of <strong>the</strong> complete deadlock created<br />

by <strong>the</strong> Respondents in functioning <strong>the</strong> <strong>Company</strong>, <strong>the</strong>refore <strong>the</strong><br />

CEO of <strong>the</strong> <strong>Company</strong> was constrained to resign from his post in<br />

February, 2008. In December, 2008 <strong>the</strong> <strong>Company</strong> agreed to<br />

purchase 100% of <strong>the</strong> shares of <strong>the</strong> R8 as <strong>the</strong> R8 was <strong>the</strong> owner of<br />

100 acres of land in Karjat. It is significant to note that <strong>the</strong> said<br />

purchase of 100% shares of R8 by <strong>the</strong> <strong>Company</strong> was done keeping<br />

in view <strong>the</strong> assets owned by R8 viz. 100 acres of land in Karjat, in<br />

State of Maharashtra.<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

5<br />

2. On 20 th March, 2007 a <strong>board</strong> meeting of <strong>the</strong> <strong>Company</strong> was<br />

held, wherein petitioner’s nominee director was also present. At<br />

<strong>the</strong> said meeting it was agreed by <strong>the</strong> <strong>Board</strong><br />

to pursue <strong>the</strong> projects at Karjat and Kasara and expansion of land<br />

acquisition as per SHA with <strong>the</strong> funds of <strong>the</strong> <strong>Company</strong>. After <strong>the</strong><br />

said <strong>Board</strong> meeting, <strong>the</strong> R2, 4 to 7 had not given any notice to<br />

<strong>the</strong> petitioner for any of <strong>the</strong> <strong>Board</strong> Meetings of <strong>the</strong> <strong>Company</strong><br />

(except <strong>the</strong> meeting held on 19 th June, 2008) and R8 which is<br />

evidently a breach of clause 4.2(b) of SHA and clause 28(b) of<br />

Memorandum and Articles of Association of <strong>the</strong> <strong>Company</strong>. The<br />

petitioner vide its email dated 18 th Sept., 2008 sent on 22 nd Sept.,<br />

2008 requested R2, 4 to 7 to provide <strong>the</strong> full corporate information<br />

of <strong>the</strong> <strong>Company</strong> and Respondent No.8 and also all proposed <strong>board</strong><br />

meetings to be held or any meetings held after <strong>the</strong> <strong>board</strong> meeting<br />

of 20 th March, 2008. In spite of <strong>the</strong> said request, R4 to 7 failed to<br />

provide any details. The Petitioner is given to understand that<br />

<strong>Board</strong> meeting was called on 26 th Sept., 2008 to approve audited<br />

accounts of <strong>the</strong> <strong>Company</strong> and R8, but no proper notice or<br />

information was given to <strong>the</strong> petitioner’s nominee director. It was<br />

deliberate attempt on <strong>the</strong> part of <strong>the</strong> R2, 4 to 7 to restrain <strong>the</strong><br />

petitioner’s nominee director from attending <strong>the</strong> said <strong>Board</strong><br />

CP 116/2008<br />

Ma<strong>the</strong>ran

6<br />

Meeting with relevant and material information and to ensure that<br />

R2, 4 to 7 approve <strong>the</strong> accounts of <strong>the</strong> <strong>Company</strong> and R8.<br />

However, <strong>the</strong> petitioner came to know about <strong>the</strong> said meeting and<br />

Mr. Fysh attended <strong>the</strong> said meeting via teleconference. At <strong>the</strong> said<br />

meeting, <strong>the</strong> petitioner’s nominee director was informed that <strong>the</strong><br />

investment agreement dated 2 nd April, 2008 had been executed<br />

between <strong>the</strong> Respondent No. 3 & Respondent No. 8 wherein in <strong>the</strong><br />

Respondent No. 3 had directly invested some money in R8. The<br />

petitioner’s nominee director also requested <strong>the</strong> <strong>Company</strong> to<br />

provide <strong>the</strong> minutes of all <strong>the</strong> <strong>board</strong> meetings held after 20 th<br />

March, 2008 and also a copy of <strong>the</strong> purported investment<br />

agreement entered into between R3 and R8, nei<strong>the</strong>r of which has<br />

been provided despite being material subject matter of <strong>the</strong> business<br />

of <strong>the</strong> meeting.<br />

3. It is fur<strong>the</strong>r submitted that as per Articles of<br />

Association of <strong>the</strong> Respondent <strong>Company</strong>, <strong>the</strong> notice of all <strong>the</strong><br />

<strong>Board</strong> Meetings should be given to all <strong>the</strong> Directors of <strong>the</strong><br />

<strong>Company</strong>. The petitioner <strong>the</strong>refore states that <strong>the</strong> R2,4 to 7<br />

contravened <strong>the</strong> provisions of <strong>the</strong> Articles of Association of <strong>the</strong><br />

<strong>Company</strong>. The minutes of <strong>the</strong> <strong>Board</strong> meeting held on 26 th<br />

September, 2008 mentions that <strong>the</strong> petitioner’s nominee director<br />

attended <strong>the</strong> said meeting by telecom. In <strong>the</strong> said meeting <strong>the</strong><br />

audited profit and loss account, balance sheet of <strong>the</strong> <strong>Company</strong> and<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

7<br />

<strong>the</strong> auditors report were approved. No proper notice or information<br />

of <strong>the</strong> said meeting was served upon <strong>the</strong> petitioner or its nominee<br />

director. However, <strong>the</strong> petitioner came to know about <strong>the</strong> said<br />

meeting and petitioner’s nominee director attended <strong>the</strong> said<br />

meeting via teleconference. The agenda and information of <strong>the</strong><br />

meeting was not provided to <strong>the</strong> petitioner. After repeated requests<br />

to R4 to 7 by <strong>the</strong> petitioner, <strong>the</strong> said purported Investment<br />

Agreement was forwarded to <strong>the</strong> petitioner for <strong>the</strong> first time on 30 th<br />

Sept., 2008. The said agreement was never approved by <strong>the</strong><br />

petitioner and <strong>the</strong> R2 to 7 and deliberately concealed <strong>the</strong> said<br />

Agreement from <strong>the</strong> petitioner with an intention to dilute <strong>the</strong><br />

holding of <strong>the</strong> petitioner in <strong>the</strong> <strong>Company</strong> and R8, <strong>the</strong> R2 to 7 had<br />

deliberately not obtained any approval of <strong>the</strong> said Agreement from<br />

<strong>the</strong> petitioner. R3 without <strong>the</strong> consent and approval of <strong>the</strong><br />

petitioner subscribed directly to <strong>the</strong> shares of <strong>the</strong> R8. The<br />

petitioner is given to understand that <strong>the</strong> <strong>Board</strong> Meeting of R8 was<br />

called on 2 nd April, 2008 wherein in fur<strong>the</strong>rance of <strong>the</strong> said<br />

Investment Agreement, R3 was issued 476 class A shares (voting<br />

shares) and 19,99,524 class B (non voting shares but are given<br />

preferential rights on liquidation) of R8 aggregating to 32.24% of<br />

<strong>the</strong> total equity shares of R8. At <strong>the</strong> said meeting <strong>the</strong> <strong>board</strong><br />

approved and adopted new Articles of<br />

Association without any reference or authorization of R1 or <strong>the</strong><br />

CP 116/2008<br />

Ma<strong>the</strong>ran

8<br />

directors and shareholders of R1. The petitioner was never<br />

informed about <strong>the</strong> said meeting nor was any approval or consent<br />

taken from <strong>the</strong> petitioner for adopting <strong>the</strong> new Articles of<br />

Association of R8. By an e-mail of 1 st October, 2008 <strong>the</strong> petitioner<br />

was informed by <strong>the</strong> Respondents that a purported <strong>board</strong> meeting<br />

of <strong>the</strong> <strong>Company</strong> was held on 6 th Sept., 2008 and <strong>the</strong> Annual<br />

General Meeting of <strong>the</strong> <strong>Company</strong> was held on 29 th Sept., 2008.<br />

The consent of <strong>the</strong> petitioner was sought by <strong>the</strong> respondents for<br />

holding <strong>the</strong> AGM at a short notice i.e. in a period less than <strong>the</strong><br />

statutory notice provided by <strong>the</strong> provisions of <strong>the</strong> said Act. It is<br />

significant to note that <strong>the</strong> petitioner was kept completely in dark<br />

about <strong>the</strong> said AGM and only a post-facto information was<br />

provided. The minutes of <strong>the</strong> said AGM held on 29 th Sept., 2008<br />

<strong>the</strong> R2,5 to 7 have falsely recorded that <strong>the</strong> petitioner’s<br />

representative director, Mr. Max Fysh was present by telecom.<br />

This is completely false as <strong>the</strong> said director did not attend <strong>the</strong> said<br />

AGM by Telecom or o<strong>the</strong>rwise. Vide e-mail dated 28 th November,<br />

2008 <strong>the</strong> Director of <strong>the</strong> petitioner was given a notice that a<br />

meeting of <strong>the</strong> <strong>board</strong> of directors of <strong>the</strong> <strong>Company</strong> would be held on<br />

15 th December, 2008 at Corporate office at 10.00 a.m. and all <strong>the</strong><br />

directors were requested to attend <strong>the</strong> meeting in person. The<br />

agenda and <strong>the</strong> Note on item No.3 of <strong>the</strong> Agenda were attached to<br />

<strong>the</strong> said email. It is significant to note that in <strong>the</strong> said agenda, it is<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

9<br />

proposed inter-alia that to confirm <strong>the</strong> minutes of <strong>the</strong> previous<br />

meeting held on 26 th Sept., 2008.<br />

4. It is submitted that this <strong>Bench</strong> was pleased to pass an ex-parte<br />

interim order dated 15 th December, 2008 whereby <strong>the</strong> meeting of<br />

<strong>the</strong> <strong>Board</strong> of Directors of R1 dated 15 th December, 2008 was<br />

postponed till <strong>the</strong> petition was heard and R1 to 8 were directed to<br />

maintain status quo of <strong>the</strong>ir fixed assets, composition of <strong>Board</strong> of<br />

Director and shareholding pattern as on 15 th December, 2008.<br />

Despite <strong>the</strong> above order, <strong>the</strong> Respondents sought to approve<br />

matters with serious financial consequences to R1 and in <strong>the</strong> form<br />

of Circular Resolutions. Vide a circular resolution dated 14 th<br />

February, 2009, <strong>the</strong> R8 sought to, inter alia, open bank accounts<br />

for <strong>the</strong> purpose of availing loans and without any serious<br />

discussion on <strong>the</strong> issue. On 9 th March, 2009, <strong>the</strong> meeting of <strong>the</strong><br />

<strong>Board</strong> of Directors of R1 was convened vide which <strong>the</strong> R1 sought<br />

to confirm <strong>the</strong> minutes of <strong>the</strong> previous <strong>Board</strong> Meeting held on 26 th<br />

Sept., 2008. The Representative on <strong>the</strong> <strong>Board</strong> of R1, Max Fysh,<br />

pointed out that <strong>the</strong> said meeting held on 26 th Sept., 2008 was <strong>the</strong><br />

subject matter of <strong>the</strong> <strong>Company</strong> Petition No.116 of 2008 filed by<br />

<strong>the</strong> petitioner <strong>before</strong> this <strong>Bench</strong> and <strong>the</strong>refore dissented to any<br />

confirmation of <strong>the</strong> minutes of <strong>the</strong> said meeting. Despite <strong>the</strong><br />

dissent of <strong>the</strong> petitioner, which was both in accordance with <strong>the</strong><br />

CP 116/2008<br />

Ma<strong>the</strong>ran

10<br />

order of this <strong>Bench</strong> and in <strong>the</strong> interests of R1 and 8, <strong>the</strong> said<br />

Agenda items were approved by <strong>the</strong> <strong>Board</strong> of Directors, excluding<br />

Max Fysh, showing scant regard to <strong>the</strong> orders of this <strong>Bench</strong> and<br />

interests of R1 and 8. Fur<strong>the</strong>rmore, <strong>the</strong> petitioner’s repeated, fair<br />

and reasonable request for information on vital projects of <strong>the</strong> R1<br />

and 8 fell on deaf ear and no information has been provided to <strong>the</strong><br />

petitioner till date, for reasons best known to respondents.<br />

5. A meeting of <strong>the</strong> <strong>Board</strong> of Directors of R8 was also held on<br />

9 th March, 2009. Once again, R8 in cohorts with <strong>the</strong> o<strong>the</strong>r<br />

respondents, sought to adopt resolutions on items which were<br />

ei<strong>the</strong>r sub-judice or those for which no information was provided<br />

to <strong>the</strong> director Max Fysh and which authorized persons, who were<br />

massively conflicted to take vital decisions on behalf of R8.<br />

Fur<strong>the</strong>rmore, and once again showing complete disregard to <strong>the</strong><br />

orders of this <strong>Bench</strong> which required R8 to maintain a status quo of<br />

its fixed assets, it was also proposed that “Mr.Pravin Banavalikar,<br />

Director of <strong>the</strong> <strong>Company</strong>, be and is hereby authorized to exercise<br />

<strong>the</strong> powers and functions for and on behalf of <strong>the</strong> <strong>Company</strong>, to<br />

discuss, negotiate on behalf of <strong>the</strong> <strong>Company</strong>, for <strong>the</strong> transfer of<br />

land or o<strong>the</strong>r properties on <strong>the</strong> said land, in favour of MMRDA,<br />

subject to such restrictions and limitations as he may deem fit and<br />

proper in <strong>the</strong> interest of <strong>the</strong> <strong>Company</strong>.” Despite <strong>the</strong> dissent of Max<br />

Fysh <strong>the</strong> said agenda items were assented to by all <strong>the</strong> o<strong>the</strong>r<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

11<br />

directors, showing scant regard to <strong>the</strong> orders of this <strong>Bench</strong> and<br />

interests of R1 and 8. The respondents were aware that this <strong>Bench</strong><br />

vide its order dated 15 th December, 2008 and 10 th February, 2009<br />

had ordered <strong>the</strong> respondents to maintain status quo of <strong>the</strong><br />

composition of <strong>the</strong> <strong>Board</strong>s of R1 and 8. However, with scant<br />

regard to <strong>the</strong> orders of this <strong>Bench</strong> <strong>the</strong> R8 with active support of R2<br />

to 7, attempted to appoint one Mr.Arun Altekar as a director of R8.<br />

Mr. Max Fysh, <strong>the</strong>refore, dissented to <strong>the</strong> appointment of Mr.<br />

Altekar and reminded <strong>the</strong> <strong>Board</strong> about <strong>the</strong> CLB orders and <strong>the</strong> fact<br />

that <strong>the</strong> Investment Agreement was under challenge. However, <strong>the</strong><br />

<strong>Board</strong> of R8 ignoring <strong>the</strong> valid objection of Mr. Max Fysh,<br />

approved <strong>the</strong> Resolution appointing Mr. Altekar as <strong>the</strong> director of<br />

R8. When <strong>the</strong> same matter was brought to <strong>the</strong> notice of this<br />

<strong>Bench</strong>, <strong>the</strong> <strong>Bench</strong> allowed <strong>the</strong> appointment of Mr. Altekar only on<br />

<strong>the</strong> <strong>Board</strong> of R1 and not on <strong>the</strong> <strong>Board</strong> of R8. Despite <strong>the</strong> orders of<br />

this <strong>Bench</strong>, Mr. Altekar has been projected as <strong>the</strong> director of R8<br />

and has been participating in <strong>the</strong> <strong>Board</strong> Meetings of R8 despite<br />

oral and written objection by Mr. Max Fysh. R8 vide Circular<br />

Resolution dated 25 th March, 2009 sought to, inter alia, avail of<br />

loans from Dewan Housing Finance Ltd. in <strong>the</strong> form of<br />

Advanced Disbursement Facilities. Once again this resolution was<br />

sought to be passed on <strong>the</strong> basis of little or no information given to<br />

Max Fysh despite repeated requests, underlying malafide<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

12<br />

intentions of <strong>the</strong> o<strong>the</strong>r directors in taking decisions which were<br />

inspired by reasons o<strong>the</strong>r than <strong>the</strong> best interests of R8 and <strong>the</strong>reby<br />

underlining <strong>the</strong> gross mismanagement of R8. Mr.Max Fysh, inter<br />

alia, pointed out to <strong>the</strong> <strong>Board</strong> that <strong>the</strong> purported supporting<br />

documents circulated along with <strong>the</strong> said circular resolution,<br />

revealed very little information about <strong>the</strong> Advance Disbursement<br />

and did not contain crucial information in relation to R8’s<br />

financial, accounts, land titles, personnel, agreements, master<br />

plans, development option documentation and financial forecasts<br />

relating ei<strong>the</strong>r to <strong>the</strong> whole TMC development or <strong>the</strong> part of <strong>the</strong><br />

development proposed to participate in <strong>the</strong> Advance Disbursement<br />

Facility scheme, which were earlier requested by <strong>the</strong> <strong>Board</strong> of<br />

Directors on 9 th March, 2009.<br />

6. It is fur<strong>the</strong>r submitted that <strong>the</strong> R8 & R3 filed <strong>Company</strong><br />

Applications No. 50 and 51 of 2009 respectively, praying for, inter<br />

alia, that <strong>the</strong> R1 be permitted to create mortgage in respect of <strong>the</strong>ir<br />

fixed assets in favour of lenders/banks/financial institutions and<br />

that R3 be permitted to appoint and/or nominate directors on <strong>the</strong>ir<br />

<strong>Board</strong> from time to time. The prayers in <strong>the</strong>se applications were<br />

also <strong>the</strong> subject matter of <strong>the</strong> aforesaid Circular Resolutions dated<br />

25 th March, 2009 and 26 th March, 2009. The respondents,<br />

<strong>the</strong>refore, ought to have waited for <strong>the</strong> disposal of <strong>the</strong> said<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

13<br />

applications ra<strong>the</strong>r than adopted <strong>the</strong> circular resolutions, knowing<br />

fully well that <strong>the</strong> matter was sub-judice. It is fur<strong>the</strong>r submitted<br />

that <strong>the</strong> petitioner had on numerous occasions, both orally and in<br />

writing requested <strong>the</strong> respondents to furnish vital information on<br />

<strong>the</strong> working of R1 and 8 to <strong>the</strong> petitioner/Max Fysh. The same was<br />

required by <strong>the</strong> petitioner as a shareholder and Max Fysh as a<br />

director to enable <strong>the</strong>m to take decisions which were in <strong>the</strong> best<br />

interests of R1 and R8. However, <strong>the</strong> petitioner and Mr.Max Fysh<br />

have been kept in <strong>the</strong> dark about <strong>the</strong> management and business of<br />

both R1 and R8 and <strong>the</strong> same was a serious cause of concern for<br />

both <strong>the</strong> petitioner as a major shareholder of R1 and Max Fysh<br />

who is a director with fiduciary duties to discharge. However, for<br />

reasons best known to <strong>the</strong>m, <strong>the</strong> respondents have till date not<br />

furnished any information requested made by <strong>the</strong> petitioner. A<br />

meeting of <strong>the</strong> <strong>Board</strong> of Directors of R1 was convened on 26 th<br />

June, 2009. During <strong>the</strong> meeting in relation to <strong>the</strong> discussion on <strong>the</strong><br />

“Progress of <strong>the</strong> TMC Project”, Mr.Fysh pointed out that no full<br />

information despite <strong>the</strong> same being reasonably requested by <strong>the</strong><br />

petitioner on various occasions had been provided and it is<br />

impossible <strong>the</strong>refore to comment or meaningfully discuss state of<br />

project, financing, contractors requirement for pace of construction<br />

or o<strong>the</strong>r requirements and appropriate course of action. Under<br />

explanatory notes for Agenda item No.5 of <strong>the</strong> said meeting being<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

14<br />

“replacing Mr. Jose Ma<strong>the</strong>w’s signature, for bank account<br />

operations”, <strong>the</strong> names of Mr. Divakar Gatti and Mr. Nirav Shah<br />

were proposed as <strong>the</strong> signatories instead of Mr. Jose Ma<strong>the</strong>w. The<br />

nomination of Mr. Gatti and Mr. Shah to be <strong>the</strong> signatories of R1<br />

reflects <strong>the</strong> state of gross mismanagement of R1. During <strong>the</strong><br />

meeting on 26 th June, 2009, Mr. Fysh dissented to <strong>the</strong> names of<br />

Mr. Gatti and Mr. Shah. However, on such dissent, Mr.Anto Jacob<br />

and R7 Mr. Pravin Banavalikar, were appointed as signatories<br />

despite R7 being in a massively conflicted position. It is fur<strong>the</strong>r<br />

submitted that a meting of <strong>the</strong> <strong>Board</strong> of Directors of R8 was<br />

convened on 26 th June, 2009. During <strong>the</strong> said meeting it was, inter<br />

alia, proposed that confirmation be accorded to an inaccurate<br />

version of <strong>the</strong> minutes of <strong>the</strong> previous meeting of <strong>the</strong> <strong>Board</strong> of<br />

Directors dated 9 th March, 2009 which failed to record vital<br />

discussion that took place during <strong>the</strong> said <strong>Board</strong> Meeting.<br />

Fur<strong>the</strong>rmore, in relation to agenda item No.4, it was proposed Mr.<br />

Arun Altekar be appointed as <strong>the</strong> nominee of R3 on <strong>the</strong> <strong>Board</strong> of<br />

R8 despite <strong>the</strong> fact that R3 had no right to nominate anyone as a<br />

director and <strong>the</strong> same had to be done by R1 which held 100% of<br />

<strong>the</strong> shares in GRPL. During <strong>the</strong> meeting of <strong>the</strong> <strong>Board</strong> of Directors<br />

of R8 on 26 th June, 2009 it was proposed that a “Steering<br />

Committee” be constituted for “proper guidance of <strong>the</strong> day to day<br />

workings of <strong>the</strong> <strong>Company</strong>”. Many of <strong>the</strong> items under “Proposed<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

15<br />

Rights and Responsibilities to be given to <strong>the</strong> Steering Committee<br />

contained right of appraisal of and action on information that had<br />

been repeatedly and reasonably requested by <strong>the</strong> petitioner and<br />

Max Fysh and had been denied to <strong>the</strong>m.<br />

The entire idea of constituting <strong>the</strong> purported “Steering Committee”<br />

was inspired by <strong>the</strong> fact that <strong>the</strong> respondents wish to keep <strong>the</strong><br />

petitioner and Max Fysh out of <strong>the</strong> working of R1 and R8 which<br />

clearly shows <strong>the</strong> gross mismanagement of R1 and 8 with <strong>the</strong><br />

malafide intention of gaining personal benefits at <strong>the</strong> expense of<br />

<strong>the</strong> interest of <strong>the</strong> petitioner.<br />

7. It is submitted that to Mr. FYSH’s surprise, and for<br />

reasons best known to him, Mr. Naik <strong>the</strong> R6 herein said that<br />

attendance by teleconference would not be allowed by him and<br />

said that attendance of <strong>Board</strong> Meetings of Indian Companies by<br />

teleconference was not allowed in <strong>Law</strong>. Mr. FYSH disagreed with<br />

R6 proposal. R6 said that <strong>the</strong> proposed weekly meetings would not<br />

be <strong>Board</strong> Meetings but that all directors were required to attend.<br />

The petitioner submitted that <strong>the</strong> motive of above discussion was<br />

to deny <strong>the</strong> petitioner chance to be part of <strong>the</strong> working of R1 & R8.<br />

It is submitted that <strong>the</strong> affairs of <strong>the</strong> R1 and R8 are being carried<br />

out in violation of <strong>the</strong> orders of this <strong>Bench</strong>. The actions of <strong>the</strong><br />

directors amount to gross mismanagement of <strong>the</strong> affairs of R1 and<br />

8 and are oppressive and detrimental to <strong>the</strong> interests of <strong>the</strong><br />

CP 116/2008<br />

Ma<strong>the</strong>ran

16<br />

petitioner. In fact, Mr. Max Fysh despite repeated oral and written<br />

requests for vital information in respect of <strong>the</strong> functioning and<br />

business of R1 and 8 has been repeatedly denied such information<br />

and <strong>the</strong>refore has not been in any position to constructively take<br />

part in any decision making of R1 and 8.<br />

8. It is submitted that subsequent to filing of <strong>the</strong> first<br />

amendment application, vide <strong>the</strong>ir email dated 4 th September,<br />

2009, through <strong>the</strong>ir <strong>Company</strong> Secretary Mr. Anto Jacob,<br />

Respondent Nos. 1 and 8 circulated Forms DD- A and 24 AA. The<br />

contents of <strong>the</strong> forms in respect of both Respondent Nos. 1 and 8<br />

were incorrect inter alia in respect of <strong>the</strong> shareholding patterns of<br />

<strong>the</strong> Companies. The Petitioner states that vide an email dated 13 th<br />

November, 2009, Respondent No. 1 through Mr. Anto Jacob<br />

forwarded a circular resolution dated 13 th November, 2009 to Mr.<br />

Max Fysh for his assent <strong>the</strong>reon. Vide <strong>the</strong> said circular resolution,<br />

it is pertinent to note, that it was claimed that “because of preoccupation,<br />

it may not be possible for Mr. Pravin Banavalikar to be<br />

in office, all <strong>the</strong> time, Cheques are to be issued to<br />

customers/creditors/for expenses, in time. Hence it is proposed that<br />

one more person should be authorised to operate <strong>the</strong> bank accounts<br />

of <strong>the</strong> <strong>Company</strong>.” As Mr. Banavalikar’s alternative, <strong>the</strong> name of<br />

one Mr. Prakash K. Bangera was proposed. The Petitioner submits<br />

that Mr. Bangera is nei<strong>the</strong>r a director nor an officer of Respondent<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

17<br />

No. 1. Max Fysh, vide his letter dated 17 th November, 2009 sent<br />

under cover of his email dated 17 th November, 2009 dissented to<br />

<strong>the</strong> nomination of Mr. Bangera. The Petitioner submits that an<br />

attempt was made even in <strong>the</strong> Draft Minutes of <strong>the</strong> Meeting of<br />

<strong>Board</strong> of Directors of Respondent No. 1 dated 25 th June, 2009, to<br />

propose <strong>the</strong> names of persons who, nei<strong>the</strong>r directors nor officers of<br />

Respondent No. 1, to sign on bank documents/papers on behalf of<br />

Respondent No. 1. In that instance <strong>the</strong> names of Mr. Diwakar Gatti<br />

and Mr. Nirav Shah were proposed as signatories to <strong>the</strong><br />

<strong>Company</strong>’s bank accounts. During <strong>the</strong> meetings of <strong>the</strong> <strong>Board</strong> of<br />

Directors of Respondent Nos. 1 and 8 held on 7 th December, 2009,<br />

<strong>the</strong> Petitioner discovered that Mr. Pravin Banavalikar had resigned<br />

from <strong>the</strong> <strong>Board</strong>s of both Respondent Nos. 1 and 8 on 20 th October,<br />

2009 and that in fact a letter dated 12 th November, 2009 has been<br />

received from Mr. Joe Silva, nominating one Mr. Prakash Bangera<br />

as his “personal nominee director” on <strong>the</strong> <strong>Board</strong> of Directors of<br />

Respondent No. 1. The Petitioner states that on 12 th December,<br />

2009 Mr. Max Fysh received an email, with Notice for Annual<br />

General Meeting to be held on 31 st December, 2009 from Mr. Anto<br />

Jacob whereby receiving, considering and adoption of Balance<br />

Sheet as on 31 st March, 2009 toge<strong>the</strong>r with <strong>the</strong> reports of <strong>the</strong><br />

Directors and Auditors <strong>the</strong>reon was one of <strong>the</strong> transactions to be<br />

made at <strong>the</strong> Annual General Meeting. The Petitioner vide his letter<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

18<br />

dated 21 st December, 2009 dissented to this transaction as <strong>the</strong><br />

documents and information required by it to check <strong>the</strong> correctness<br />

of <strong>the</strong> Balance Sheet and <strong>the</strong> reports were not provided. The above<br />

facts clearly reflect <strong>the</strong> oppression tactics being used by <strong>the</strong><br />

Respondents.<br />

9. The Petitioner states that it received <strong>the</strong> Construction<br />

Agreement from Respondent no. 8 very recently which was<br />

entered into on 1 st August, 2009 between Respondent no. 8 and<br />

Sterling Construction System Pvt. Ltd. The said Construction<br />

Contract is very poorly drafted, leaving a lot of loopholes in it<br />

which in future could prove to be absolutely fatal to <strong>the</strong> <strong>company</strong>.<br />

The said Construction Contract also assigns a lot of role to Silvex<br />

Realty Pvt. Ltd. without <strong>the</strong> Respondent no. 8 having any formal<br />

contract with it. The main f<strong>law</strong> in <strong>the</strong> said Construction Contract is<br />

that Mr. Anto Jacob had signed on behalf of Respondent no. 8<br />

whereas Mr. Pravin Banavilkar was authorised by <strong>the</strong> <strong>Board</strong> to<br />

enter into <strong>the</strong> said Construction Contract on behalf of Respondent<br />

no. 8. Fur<strong>the</strong>r <strong>the</strong> Petitioner vide its letter dated 22 nd December,<br />

2009 addressed to Respondent no. 8 brought some of <strong>the</strong><br />

discrepancies to light in <strong>the</strong> said Construction Contract clearly<br />

envisaging <strong>the</strong> instability of <strong>the</strong> said Construction Contract and<br />

also requested for all those documents relating to <strong>the</strong> said<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

19<br />

Construction Contract which have been mentioned in <strong>the</strong> said<br />

Construction Contract but have not been provided to it till date.<br />

These facts clearly demonstrate that <strong>the</strong> following acts of<br />

oppression and mismanagement have been committed by R2 to 7<br />

as set out hereinafter.<br />

a) Interference by <strong>the</strong> Respondent No. 3 in day to day<br />

business and affairs of <strong>the</strong> <strong>Company</strong> making impossible<br />

for <strong>the</strong> CEO to function in accordance with <strong>the</strong> SHA<br />

and Articles of Association.<br />

b) Contravention of <strong>the</strong> provisions relating to Notice,<br />

taking management actions etc. as enumerated in <strong>the</strong><br />

SHA and Articles of Association of <strong>the</strong> <strong>Company</strong>.<br />

c) Breach of <strong>the</strong> Articles of Association of <strong>the</strong> <strong>Company</strong><br />

with regard to <strong>the</strong> preparation of <strong>the</strong> Minutes of <strong>the</strong><br />

<strong>Board</strong> meetings and AGM.<br />

d) Divesting <strong>the</strong> assets of <strong>the</strong> <strong>Company</strong>.<br />

e) Diluting <strong>the</strong> economic shareholding of <strong>the</strong> Petitioner in<br />

<strong>the</strong> <strong>Company</strong>.<br />

The aforesaid acts of deliberately not informing <strong>the</strong> Petitioner or its<br />

nominee Director of <strong>the</strong> <strong>board</strong> meetings and EOGM is clearly<br />

oppressive as well as amounts to mismanagement and is also in<br />

contravention of <strong>the</strong> provisions of <strong>the</strong> Articles of Association of<br />

<strong>the</strong> <strong>Company</strong>. It is fur<strong>the</strong>r submitted that <strong>the</strong> execution of <strong>the</strong><br />

CP 116/2008<br />

Ma<strong>the</strong>ran

20<br />

investment agreement without <strong>the</strong> consent and approval of <strong>the</strong><br />

Petitioner is oppressive as well as illegal. It is submitted that as a<br />

result of <strong>the</strong> said investment in Respondent No. 8, <strong>the</strong> economic<br />

interest of <strong>the</strong> Petitioner in Respondent No. 8 has significantly<br />

reduced. The said act was done by Respondent Nos. 2 & 3 with an<br />

intention to alienate <strong>the</strong> Petitioner and to take charge and control<br />

<strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong> and Respondent No. 8. The aforesaid<br />

instances also clearly demonstrate that <strong>the</strong> Respondent Nos. 2, 5, 6<br />

and 7 have violated <strong>the</strong>ir fiduciary duty for <strong>the</strong>ir personal gain.<br />

10. The Learned Senior Counsel in summarizing his<br />

arguments submitted that <strong>the</strong> Petitioner holds 42.24% and R2 holds<br />

12.77% and R3 holds 44.99% in R1 <strong>Company</strong>. The SSA dated 26 th<br />

July, 2007 is between <strong>the</strong> Petitioner 1 and Respondent No. 2 & 3.<br />

From <strong>the</strong> Petitioner <strong>the</strong>re is only one director and from R2 one<br />

director and from R3 two directors on <strong>the</strong> <strong>Board</strong> of <strong>the</strong> R1<br />

<strong>Company</strong>. The CEO suppose to be from Petitioner side. However<br />

<strong>the</strong> CEO resigned in February, 2008 and <strong>the</strong> <strong>Company</strong> is in<br />

deadlock situation. Clause 20 of AOA provides restriction on<br />

transfer of shares. Clause 20(B) provides first refusal. The R1<br />

holds 100% shares in<br />

R8 <strong>Company</strong>. The Respondent No. 3 entered in to an investment<br />

agreement dated 02.04.2008 with <strong>the</strong> said agreement <strong>the</strong> R3<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

21<br />

became 32.25% of <strong>the</strong> equity share holding in R8. The shares of<br />

R8 have not been offered to Petitioner. The R8 <strong>Company</strong> was<br />

having four directors and <strong>the</strong> Petitioner is one of <strong>the</strong> directors in<br />

R8. The <strong>Board</strong> Meeting of R8 was held on 02.04.2008 for which<br />

no notice was given to <strong>the</strong> Petitioner and no approval of <strong>Board</strong> of<br />

Directors of R1 ei<strong>the</strong>r for increase of capital of R8 or dilution of<br />

capital of R8. If <strong>the</strong> meeting is held without notice to <strong>the</strong> director,<br />

it is invalid as held in <strong>the</strong> matter of Sri Parmeshwari Prasad<br />

Gupta Vs. Union of India reported in (1973) 2SCC 543. It is held<br />

“ now, it cannot be disputed that notice to all <strong>the</strong> directors of<br />

meeting of <strong>the</strong> <strong>Board</strong> of Directors was essential for <strong>the</strong> validity of<br />

any resolution passed at <strong>the</strong> meeting and that as, admittedly no<br />

notice was given to Mr.Khaitan one of <strong>the</strong> directors of <strong>the</strong><br />

<strong>company</strong>, <strong>the</strong> resolution passed terminating <strong>the</strong> services of <strong>the</strong><br />

appellant, was invalid.” It is submitted that <strong>the</strong> R3 entered<br />

agreement with R8 surreptitiously. The agreement dilutes <strong>the</strong><br />

shareholding of R1. R1 is only a paper <strong>company</strong> whereas <strong>the</strong> R8 is<br />

<strong>the</strong> real <strong>company</strong>. No opportunity was given to o<strong>the</strong>r shareholders<br />

to subscribe to or for allotment in R8 <strong>Company</strong>. It is first Act of<br />

oppression and mismanagement.<br />

11. The Learned Senior Counsel submitted <strong>the</strong> second Act of<br />

oppression is that under <strong>the</strong> AOA <strong>the</strong> petitioner is having right to<br />

appoint director and CEO of R1 <strong>Company</strong> however <strong>the</strong><br />

CP 116/2008<br />

Ma<strong>the</strong>ran

22<br />

Respondents violated <strong>the</strong> Articles. It is submitted that <strong>the</strong><br />

Petitioner is challenging <strong>the</strong> resolution of <strong>the</strong> <strong>Board</strong> Meetings<br />

dated 09.09.2008, 26.09.2008. The Petitioner addressed several<br />

letters to <strong>the</strong> <strong>Company</strong> to provide information and details but <strong>the</strong><br />

Respondents have not allowed <strong>the</strong> Petitioner to inspect <strong>the</strong><br />

documents and records of <strong>the</strong> <strong>company</strong>. In this regard he placed<br />

reliance reported in Manu/MH/0116/1991 (High Court of<br />

Bombay) In <strong>the</strong> matter of Rajdhani Roller Flour Mills Private<br />

Limited vs. Mangilal Bagri & Ors. It is of <strong>the</strong> view “Whe<strong>the</strong>r<br />

Respondent entitled to photo copies of documents already<br />

inspected by <strong>the</strong>m – such copies required for proving case of<br />

respondent regarding mismanagement of companies fund – claim<br />

of appellant that only directors has got right to take copies of such<br />

book untenable – held, application for taking books of accounts<br />

maintainable since it will not be prejudicial to interest of appellant<br />

<strong>company</strong>.”<br />

12. The Learned Senior Counsel in fur<strong>the</strong>rance made some<br />

points and stated that <strong>the</strong> <strong>company</strong> is run by some o<strong>the</strong>r persons<br />

who are not connected to <strong>the</strong> <strong>company</strong> and <strong>the</strong> unauthorized<br />

persons operating <strong>the</strong> bank account viz. Mr. Prakash, who is not<br />

an employee of <strong>the</strong> <strong>company</strong>, which constitutes an Act of<br />

mismanagement. The Respondents want to hold <strong>the</strong> <strong>Board</strong><br />

Meetings at <strong>the</strong> site and <strong>the</strong> Respondents creating problems to <strong>the</strong><br />

CP 116/2008<br />

Ma<strong>the</strong>ran

23<br />

Petitioner who holds more than 40% stake in <strong>the</strong> <strong>company</strong>. The<br />

learned senior counsel relied upon <strong>the</strong> following citations on<br />

mismanagement. 1. (1981) 3 SCC 333 In <strong>the</strong> matter of Needle<br />

Industries (India) Limited vs. Needle Industries Newey (India)<br />

Holding Limited & Ors. Para 49. 2. (2008) 6 SCC 750 In <strong>the</strong><br />

matter of M.S.D.C. Radharaman Vs. M.S.D. Chandrasekara<br />

Raja & Anr. Para 15. He fur<strong>the</strong>r submitted that <strong>the</strong> Petitioner is<br />

willing to exit <strong>the</strong> <strong>Company</strong> on payment of fair value. This <strong>Bench</strong><br />

has wide powers to pass orders in <strong>the</strong> interest of <strong>the</strong> <strong>Company</strong>.<br />

However, <strong>the</strong> valuation should be prior to 31.03.2008 and placed<br />

<strong>the</strong> following reliances: 3. (1980) CC Volume 50 page 771(High<br />

Court of Calcutta) in <strong>the</strong> matter of Debi Jhora Tea Co.Ltd. Vs.<br />

Barendra Krishna Bhowmick & Ors. It is held “it should be<br />

born in mind that when a Court passes an order under Sec.397,398<br />

and 402 as has been done in <strong>the</strong> instant case, <strong>the</strong>re could be no<br />

limitation on <strong>the</strong> Court’s power under <strong>the</strong> sections. Instead of <strong>the</strong><br />

winding up of a <strong>Company</strong>, <strong>the</strong> Court under <strong>the</strong> above mentioned<br />

sections has been vested with ample power to continue <strong>the</strong><br />

corporate existence of a <strong>company</strong> by passing such orders as it<br />

thinks fit in order to achieve <strong>the</strong> objective by removing any<br />

member or members of a <strong>Company</strong> or to prevent <strong>the</strong> <strong>Company</strong>’s<br />

affairs from being conducted in a manner prejudicial to <strong>the</strong> public<br />

interest.” 4. (2005) 11 SCC page 314 In <strong>the</strong> matter of Sangram<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

24<br />

Sinh P. Gaekwad & Ors. Vs. Shantadevi P. Gaekwad (Dead)<br />

through LRS & Ors. Para 181, 199. It is held “<strong>the</strong> jurisdiction of<br />

<strong>the</strong> Court to grant appropriate relief under Sec.397 of <strong>the</strong><br />

Companies Act, indisputably is of wide amplitude. The Court<br />

while exercising its discretion is not bound by <strong>the</strong> terms contained<br />

in Sec.402 of <strong>the</strong> Companies Act if in a particular fact situation a<br />

fur<strong>the</strong>r relief or reliefs, as <strong>the</strong> Court may deem fit and proper are<br />

warranted. Moreover, in a given case <strong>the</strong> Court despite holding<br />

that no case of oppression has been made out, may grant such<br />

relief so as to do substantial justice between <strong>the</strong> parties.”<br />

In <strong>the</strong> circumstances he prayed this <strong>Bench</strong> to grant reliefs.<br />

13. Respondent Nos. 3, 5 & 6 have filed <strong>the</strong>ir counter/reply.<br />

Shri Chirag Mody, Learned Counsel appearing for <strong>the</strong> respondents<br />

submitted that <strong>the</strong> present petition is filed by <strong>the</strong> petitioner with an<br />

ulterior motive and malafide intention and <strong>the</strong> real purpose of <strong>the</strong><br />

present petition is (a) to exit from R1 (MRPL) in whatever manner<br />

<strong>the</strong> petitioner can, including by pressurizing <strong>the</strong> respondents by<br />

stalling <strong>the</strong> only on going project under <strong>the</strong> development by R8<br />

(GOPI) and (b) to preempt any actions that <strong>the</strong> Respondents may<br />

take against <strong>the</strong> petitioners and/or <strong>the</strong>ir nominees for <strong>the</strong>ir<br />

nominee’s failure to perform as <strong>the</strong> CEO of R1 and for violations<br />

and breaches of <strong>the</strong> terms and conditions of <strong>the</strong> Shareholders’<br />

Agreement. The present petition is an abuse of <strong>the</strong> legal process<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

25<br />

and machinery of Sec. 397 and 398 of <strong>the</strong> Act, and hence ought to<br />

be dismissed with costs. The petition suffers from “suggestio<br />

falsi” and “suppressio veri” The petitioner having come to this<br />

<strong>Bench</strong> with unclean hands is not entitled to any relief whatsoever,<br />

much less <strong>the</strong> discretionary, equitable and/or extraordinary relief<br />

under Sec.397 and 398 of <strong>the</strong> Act. Without prejudice to <strong>the</strong><br />

aforesaid, <strong>the</strong> correct and relevant facts are that some time in <strong>the</strong><br />

end of 2006 and beginning of 2007 one Mr. Marcus John Hudson<br />

Fysh (Mr.Max Fysh) an Australian national approached R3 to<br />

invest in affordable housing and ancillary Urban Development<br />

projects. The said Max Fysh is <strong>the</strong> beneficial owner of one<br />

Wessex Capital Limited (Wessex) and <strong>the</strong> said Wessex is <strong>the</strong><br />

majority owner of petitioner herein. Max Fysh identified R1 as <strong>the</strong><br />

Indian <strong>Company</strong> for investment in <strong>the</strong> development of affordable<br />

housing in India. Max Fysh fur<strong>the</strong>r represented that R1 would<br />

carry out projects to develop and construct low income housing<br />

units for weaker sections of <strong>the</strong> society on outskirts of <strong>Mumbai</strong><br />

and required investment of monies for <strong>the</strong> said projects. As such<br />

said Max Fysh approached R3 to invest in <strong>the</strong> R1 to enable <strong>the</strong><br />

financing of projects. Accordingly, a Share Subscription<br />

Agreement (SSA) and Share Holders’ Agreement (SHA) were<br />

executed on 26 th July, 2007 by and between R1, R2, petitioner and<br />

R3. In terms of <strong>the</strong> said SSA and SHA which was executed by<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

26<br />

Max Fysh, land was to be acquired and <strong>the</strong> conditions of <strong>the</strong> said<br />

SSA and SHA were required to be complied with by Max Fysh<br />

and <strong>the</strong> petitioner against which R3 was to make <strong>the</strong> investment in<br />

tranches. As a matter of record till date R3 has already invested a<br />

sum of Rs.82 crores as against Rs.1.73 crores which was brought<br />

in originally by Max Fysh. The R3 has invested substantial<br />

amount in R1 on <strong>the</strong> false assurance and representations given by<br />

Max Fysh. The shares of R1 were initially subscribed by<br />

Mr.Divakar Gatti (R4) and by Mr.Prakash Bangera. Pursuant<br />

<strong>the</strong>reto Max Fysh through his holding in Wessex and Joseph<br />

E.Silva (R2) as <strong>the</strong> promoters invested in R1 and by virtue <strong>the</strong>reof<br />

R2 holds about 12.94% and <strong>the</strong> petitioner held about 42.06%<br />

equity in R1. Pursuant to <strong>the</strong> execution of SSA and SHA, R3 on<br />

29 th Sept., 2007 nominated Nikhil Naik (R6) and Jose Ma<strong>the</strong>w<br />

(R5) as <strong>the</strong>ir nominees on <strong>the</strong> BOD of R1. Subsequently R7 i.e.<br />

Pravin Banavalikar was appointed on <strong>the</strong> <strong>Board</strong> of R1 on 17 th<br />

July, 2008 as <strong>the</strong> alternate director to R4. In view of <strong>the</strong> above,<br />

<strong>the</strong> current status of shareholding in R1 is as follows:<br />

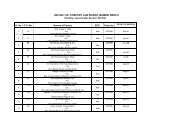

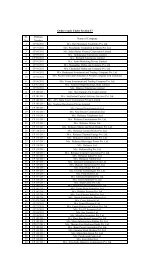

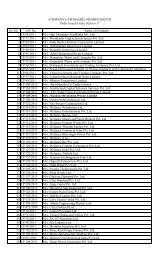

Name of Shareholder Number of shares %of shares.<br />

Divakar Gatti (R4) 1 0.00<br />

Max Fysh (Petitioner) 1,17,000 42.06<br />

Joe Silva (R2) 35,999 12.94<br />

Aboyne Mauritius (R3) 1,25,160 45.00<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

27<br />

Total 2,78,160 100.00<br />

14. Under Clause 41(a), (c) of <strong>the</strong> Articles of R1 and Clause<br />

4.1(a)(b) of <strong>the</strong> SHA, <strong>the</strong> BOD of R1 was to comprise of a<br />

maximum of four directors, out of which R3 as <strong>the</strong> investor and <strong>the</strong><br />

petitioner and R2 as promoters, were entitled to nominate two<br />

directors each. The nominee directors of R3 (investor) are <strong>the</strong> non<br />

executive directors and are not responsible for <strong>the</strong> day to day<br />

management. The nominee directors of petitioner and R2<br />

(promoters), are to be executive directors of R1, and responsible<br />

for <strong>the</strong> day to day management of R1. Mr. Max Fysh was<br />

nominated by <strong>the</strong> petitioner to <strong>the</strong> BOD of R1 on and from<br />

24.1.2007 as <strong>the</strong> Executive Director. By an agreement dated<br />

27.7.2007 R1 appointed Max Fysh as its Chief Executive Officer<br />

(CEO). Max Fysh inspite of being a promoter of R1 demanded<br />

salary, reimbursements, etc. as alleged services as <strong>the</strong> CEO of R1<br />

amounting to Rs.13.75 lacs per month. To <strong>the</strong> shock and surprise<br />

of <strong>the</strong> respondents, Max Fysh, as CEO and/or Executive Director,<br />

instead of carrying out <strong>the</strong> day to day management of R1 remained<br />

out of <strong>the</strong> country most of <strong>the</strong> time, leading to impaired<br />

management of R1.<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

28<br />

15. It is fur<strong>the</strong>r submitted that R8 a Private Limited<br />

<strong>Company</strong>, is duly incorporated and registered under <strong>the</strong><br />

Companies Act, 1956. R8 is engaged in business of real estate<br />

construction and development, more particularly low cost housing<br />

units under <strong>the</strong> Brand ‘Tanaji Malasure City’ for weaker section of<br />

<strong>the</strong> society in collaboration with MMRDA (as statutory body).<br />

The current BOD of R8 comprises of <strong>the</strong> following:<br />

Name of Director<br />

Date of appointment<br />

Max Fysh 24 th March, 2008<br />

Respondent No.6 24 th March, 2008<br />

Respondent No.5 24 th March, 2008<br />

Respondent No.7 9 th Sept., 2008<br />

Nirav Shah 9 th Sept., 2008<br />

The current paid up shareholding in R8 is as follows:<br />

Respondent No.1 1,000 (Class ‘A’)<br />

Respondent No.3<br />

476 (Class ‘A’ and<br />

19,99,524 (Class ‘B’)<br />

Max Fysh and R2 came up with <strong>the</strong> proposal of acquisition of R8<br />

(Gopi) and commenced development and construction so that at<br />

least some progress can be achieved and shown to R3 under <strong>the</strong><br />

SSA and SHA. It was also represented to <strong>the</strong>se Respondents that<br />

<strong>the</strong> land belonging to R8 was required to be developed on/or<br />

<strong>before</strong> 31 st March, 2008 failing which it would lose <strong>the</strong> tax benefits<br />

that it had obtained. Since R1 did not have any funds whatsoever,<br />

R3 (Aboyne) was requested to invest fur<strong>the</strong>r funds immediately for<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

29<br />

<strong>the</strong> development of <strong>the</strong> said 112 acres of land. Accordingly, <strong>the</strong><br />

BOD of R1 in its meeting held on 12 th December, 2007 (with Max<br />

Fysh as CEO) resolved inter alia to acquire R8 by taking over of<br />

equity of R8, however, development and construction activity was<br />

to be undertaken through R8 in order to avoid payment of<br />

additional stamp duty. It would not be out of place to mention<br />

that Max Fysh (as CEO and/or Executive Director) also failed and<br />

neglected in dealing, negotiating and/or concluding <strong>the</strong> acquisition<br />

of R8 from Wearology Limited. It was only due to efforts of R2<br />

that an Escrow Agreement was executed between Wearlogy<br />

Limited and R1 for acquisition by R1 of R8. Under <strong>the</strong> Escrow<br />

agreement, an advance of Rs.8 crores was paid by R1 to Wearlogy<br />

Ltd. and balance amount of Rs.32 crores was required to be paid<br />

by R1 to Wearlogy Ltd. on or <strong>before</strong> 6.3.2008, failing which <strong>the</strong><br />

advance of Rs.8 crores would be forfeited by Wearlogy Limited<br />

which amounts and investments were brought in by R3. The<br />

directors of R8 in <strong>the</strong>ir meeting held on 2 nd April, 2008 decided to<br />

accept investment from R3. Max Fysh did not attend or participate<br />

in <strong>the</strong> said <strong>Board</strong> meeting of R8 which was held on 2 nd April,<br />

2008. Notice of <strong>Board</strong> meeting was verbally given by<br />

representative of R8 to Max Fysh, however, he could not attend<br />

this <strong>board</strong> meeting as he was traveling. A Share Subscription<br />

and Share Holders’ Agreement (SSSHA) dated 2 nd April, 2008<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

30<br />

was duly executed between R8, R3 and R1 to record inter alia<br />

<strong>the</strong> terms and conditions for <strong>the</strong> financing operation and<br />

management of R8 and <strong>the</strong>ir mutual rights and obligations as<br />

shareholders of R8. Also <strong>the</strong> BOD of R8 by its meeting held on<br />

2.4.2008 duly resolved inter alia to and did issue to R3, 476<br />

class ‘A’ ordinary voting right equity shares and 19,99,524<br />

class ‘B’ non-voting participating equity shares of Rs.100/-<br />

each of R8. The Steering Committee of R1 (constituted under<br />

clause 41(h) of <strong>the</strong> Articles and Clause 4.1(g) of SHA recorded in<br />

its meetings that Max Fysh (as CEO and/or Executive Director)<br />

instead of carrying out day to day management in India of R1 was<br />

generally outside India leading to impaired management of R1.<br />

The BOD of R1 by its meeting held on 15 th Feb., 2008 discussed<br />

<strong>the</strong> findings of <strong>the</strong> Steering Committee of R1 that Max Fysh was<br />

not suitable to perform or handle <strong>the</strong> projects of R1 as CEO of R1.<br />

Max Fysh acknowledged said findings and offered to resign from<br />

<strong>the</strong> post of CEO of R1. As such <strong>the</strong> BOD of R1 duly resolved to<br />

accept <strong>the</strong> resignation of Max Fysh as CEO of R1. The BOD of<br />

R1 <strong>the</strong>n requested R2 to run <strong>the</strong> business of R1 until alternative<br />

arrangements are finalized by <strong>the</strong> BOD. The BOD of R1 by its<br />

meeting held on 20.3.2008 resolved iner alia to complete <strong>the</strong><br />

acquisition of R8 by R1 and develop <strong>the</strong> lands of R8. The meeting<br />

of BOD of R1 held on 20.3.2008 was <strong>the</strong> last meeting attended by<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

31<br />

Max Fysh (as Executive Director) in person. Thereafter Max Fysh<br />

despite being Executive Director and substantial shareholder<br />

(through petitioner) of R1 apparently forsook R1 and left India for<br />

abroad. As such Max Fysh kept himself aloof from responsibility<br />

of day-to-day management of R1 notwithstanding that he was<br />

Executive Director of R1 because he had decided to exit totally<br />

from <strong>the</strong> projects and run away from any responsibility<br />

whatsoever.<br />

16. The apparent withdrawal of Max Fysh from R1 is<br />

highlighted by <strong>the</strong> fact that Max Fysh did not direct <strong>the</strong> BOD of R1<br />

to appoint an alternate director for and in place of himself, even<br />

though Clause 41(d) of <strong>the</strong> Articles of R1 and Clause 4.1 ( c) of <strong>the</strong><br />

SHA executed by R1 provide for appointment of Alternate<br />

Director. Also Max Fysh did not provide R1 with a local<br />

forwarding address in terms of Sec.286 of <strong>the</strong> Companies Act,<br />

1956 read with Cluase 28(b) of <strong>the</strong> Articles and clause 4.2(b) of<br />

<strong>the</strong> SHA, to enable BOD of R1, to formally correspond with<br />

him. The BOD of R1, however, periodically kept Max Fysh<br />

notified or updated telephonically about <strong>the</strong> administration of<br />

R1. The impropriety of such forbearance by Max Fysh is more so<br />

as under clause 28(a) of <strong>the</strong> Articles and clause 4.2(a) of <strong>the</strong> SHA,<br />

<strong>the</strong> meetings of <strong>the</strong> BOD are to be held at least once in every three<br />

calendar months and least four such meetings are to be called<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

32<br />

every year. The said meetings are to be held at <strong>Mumbai</strong> unless<br />

o<strong>the</strong>rwise mutually agreed between <strong>the</strong> shareholders of R1. The<br />

directors of R1 and/or R8, however, continued to periodically keep<br />

Max Fysh abroad notified or updated telephonically about <strong>the</strong><br />

administration of R1 and/or R8. The BOD of R1 and/or R8 also<br />

entrusted Max Fysh with discharge of specified administrative<br />

duties, but no avail. It is pertinent that Max Fysh whimsically<br />

participated in some of <strong>the</strong> meetings of BOD of R1 by<br />

teleconference pursuant to clause 28(j) of <strong>the</strong> Articles and clause<br />

4.2 (g) of <strong>the</strong> SHA. However, all attempts made by R1 to seek<br />

confirmation from Max Fysh of <strong>the</strong> Resolutions passed by <strong>the</strong><br />

BOD of R1 were avoided and <strong>the</strong> resolutions disregarded by Max<br />

Fysh. Max Fysh had concluded his exit from <strong>the</strong> R1 by<br />

negotiating with Rheanta Corporation and respondents <strong>the</strong>refore<br />

had no reason to believe o<strong>the</strong>rwise, till <strong>the</strong> receipt of an E-mail<br />

from him dated 22.9.2008 to R1 and R8 and <strong>the</strong>ir directors<br />

respectively, alleging non receipt of notices, agendas or minutes of<br />

<strong>Board</strong> and steering committee meetings from R1 or R8 since<br />

20.3.2008. The R1 by E-mail dated 23.9.2008 notified Max Fysh<br />

about a meeting of BOD of R1 and AGM of members of R1 for<br />

inter alia approval of audited accounts of R1. Max Fysh, however,<br />

chose not to attend personally but participated by teleconference in<br />

<strong>the</strong> meeting on 26.9.2008 of BOD of R1 and in <strong>the</strong> AGM on<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

33<br />

29.9.2008 of R1. The BOD of R1 by its meeting held on<br />

26.9.2008 duly resolved inter alia to approve <strong>the</strong> audited accounts<br />

of R1 and obtain consent of all members [(including petitioner<br />

(through its beneficial owner, Max Fysh)] of R1 for holding <strong>the</strong><br />

AGM of R1 at short notice. R1 by E-mail dated 26.9.2008<br />

forwarded to Max Fysh <strong>the</strong> minutes of meeting of BOD of R1 held<br />

on 26.9.2008 for confirmation. It is pertinent that Max Fysh, after<br />

receipt of E-mail dated 26.9.2008, not only refrained from<br />

responding to R1 <strong>the</strong>reupon, but also did not allege against and<br />

complain to R1 except by later filing of <strong>the</strong> petition which is<br />

reflective on <strong>the</strong> petition as an afterthought stratagem. Max Fysh,<br />

however, chose not to personally attend but participated by<br />

teleconference in <strong>the</strong> AGM of R1 on 29.9.2008. The members of<br />

R1 by AGM held on 29.9.2008 duly resolved inter alia to approve<br />

<strong>the</strong> audited accounts of R1. The R1 by E-mail dated 28.11.2008<br />

notified Max Fysh about a meeting of BOD of R1 on 15.12.2008<br />

and requested Max Fysh to personally attend to resolve upon inter<br />

alia <strong>the</strong> E-mail by Max Fysh about non receipt of notices, etc. from<br />

R1 to R8. The E-mail dated 28.11.2008 noted that R1 had sent<br />

notices of meetings of BOD of R1 to every director present and<br />

having address in India, pursuant to Sec.286 of <strong>the</strong> Act. Also R1<br />

after receipt of said E-mail from Max Fysh had forwarded by E-<br />

mail on 27.9.2008 to Max Fysh copies of <strong>the</strong> minutes of meeting of<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

34<br />

BOD held after 20.3.2008, Moreover, Max Fysh participated by<br />

teleconference in <strong>the</strong> BOD meeting held on 26.9.2008 and <strong>the</strong><br />

AGM held on 29.9.2008 for adopting of audited accounts for year<br />

ending 31 st March, 2008. Max Fysh instead of responding to or<br />

participating in <strong>the</strong> meeting of BOD of R1 to be held on<br />

15.12.2008, malafidely filed <strong>the</strong> petition and applied on<br />

15.12.2008 ex-parte for and obtained interlocutory relief in <strong>the</strong><br />

petition, to harass and prejudice R1 and R8.<br />

17. It is pertinent to note that R8 and R1 (as holding<br />

<strong>company</strong> of R8) since about 26.3.2008 have been engaged in due<br />

and regular construction of low cost housing units under <strong>the</strong> brand<br />

‘Tanaji Malasure City’ on <strong>the</strong> land of R8 for weaker section of <strong>the</strong><br />

society in collaboration with MMRDA. The R8 and/or R1 through<br />

a system of computerized lottery, already accepted applications<br />

and have issued more than 3,500 letters of allotment for<br />

consideration, for such low cost housing units. The petition and its<br />

proceedings are not only misconceived and not maintainable but<br />

also vitiated by mala fides, which is apparent from <strong>the</strong> following<br />

amongst o<strong>the</strong>r preliminary points. (a) The petitioner willfully has<br />

not impleaded Max Fysh as a necessary and proper party, though<br />

he is <strong>the</strong> beneficial owner of <strong>the</strong> petitioner. As such <strong>the</strong> petition<br />

gravely suffers from non joinder of Max Fysh who indispensable is<br />

a necessary and proper party. (b) The fact that Max Fysh<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

35<br />

(beneficial owner of petitioner), has duly acknowledged his<br />

incompetence and resigned as <strong>the</strong> CEO of R1 and, shortly<br />

<strong>the</strong>reafter, being disgruntled, has shirked from R1 and/or R8 by<br />

exiting India for abroad even though it was incumbent upon him to<br />

be a Director in India or substantial shareholder, through<br />

petitioner, of R1 and/or R8 which are closely held private<br />

companies. (c) The fact that petitioner or Max Fysh, until <strong>the</strong><br />

filing of <strong>the</strong> petition, has not alleged or documented/recorded about<br />

any interference by R3 in affairs or business of R1 and/or R8. (d)<br />

The fact that petitioner or Max Fysh until <strong>the</strong> filing of <strong>the</strong> petition,<br />

has not alleged or documented/recorded about any oppression in<br />

affairs of R1 and/or R8. (e) The fact that petitioner or Max Fysh<br />

until filing of <strong>the</strong> petitioner has not alleged or<br />

documented/recorded about any mismanagement in affairs of R1<br />

and/or R8. (f) The fact that although <strong>the</strong> petition in its para No.25<br />

vaguely refers to “terms of separation” but suppresses receipt by its<br />

beneficial owner Max Fysh from R2 and his associates, substantial<br />

amounts towards complete exit by petitioner and Max Fysh from<br />

R1 and R8, under <strong>the</strong> understanding arrived at between petitioner<br />

and/or Max Fysh and R2 (on behalf of R1 and/or R8). The fact<br />

that <strong>the</strong> petitioner or Max Fysh, save and except <strong>the</strong> E-Mail of<br />

22.9.2008 from Max Fysh, has not alleged or<br />

documented/recorded any grievance regarding affairs of R1<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

36<br />

and R8 until <strong>the</strong> filing of <strong>the</strong> petition. The so called investment<br />

of petitioner No.1 in R1 was only to <strong>the</strong> extent of Rs.1.73 crores,<br />

<strong>the</strong> benefits of which Max Fysh had already reaped in <strong>the</strong> course of<br />

his position as CEO. The investment of R2 was to <strong>the</strong> extent of 11<br />

Acres of land approximately valued at Rs.1.70 crores, whereas <strong>the</strong><br />

investment of R3 is approximately Rs.82 crores, thus, <strong>the</strong> main<br />

interest was that of R3 in R1 which would have been severely<br />

jeopardized.<br />

18. The Learned Counsel for <strong>the</strong> respondents in nut shell<br />

contended <strong>the</strong> oppressive acts as alleged by <strong>the</strong> petitioner are that<br />

(a) no notice was given for <strong>the</strong> <strong>Board</strong> Meetings, (b) dilution of<br />

investment in <strong>the</strong> <strong>Company</strong> (c) too much interference by <strong>the</strong><br />

respondent No.3, nominee director, (d) no information is supplied<br />

to <strong>the</strong> petitioner or Max Fysh. The respondents have replied to<br />

each and every allegation in <strong>the</strong> pleadings and also during oral<br />

submissions. It is submitted that <strong>the</strong> petitioner attended <strong>the</strong> <strong>Board</strong><br />

Meeting and no prejudice was caused to <strong>the</strong> petitioner. The<br />

Learned Counsel for <strong>the</strong> respondents submitted that <strong>the</strong> petitioner<br />

has not made out any case ei<strong>the</strong>r on oppression or on<br />

mismanagement and relied upon <strong>the</strong> following decisions in its<br />

support:<br />

(1) AIR 1962 Calcutta 127. In <strong>the</strong> matter of Maharani<br />

CP 116/2008<br />

Ma<strong>the</strong>ran

37<br />

Lalita Rajya Lakshmi, M.P. Vs. Indian Motor <strong>Company</strong><br />

(Hazari Bagh) Limited & Ors. Para 6 (2) AIR 1965 SC 1535. In<br />

<strong>the</strong> matter of Shanti Prasad Jain Vs. Kalinga Tubes Para 18, 19.<br />

(3) (2008) 3SCC 363. In <strong>the</strong> matter of V.S. Krishnan & Ors. Vs.<br />

West Fort Hi-Tech Hospital Limited & Ors. Para 14.<br />

19. The Respondent No.1, 2, 7 & 8 have filed affidavits<br />

stating that whatever stated in affidavit in reply dated 19.1.2008 of<br />

R3, 5 & 6 is being adopted <strong>the</strong> same. Shri Jagtiani, Learned<br />

Counsel for <strong>the</strong> Respondent No.8 during <strong>the</strong> course of oral<br />

submissions submitted that <strong>the</strong> R8 is a subsidiary of R1. The R1<br />

holds 67.75% in R8 and <strong>the</strong> 3 rd respondent holds 32.25% in R8. In<br />

<strong>the</strong> <strong>Board</strong> Meeting held on 12 th Dec., 2007 of R1, it was decided to<br />

acquire R8. The contention of <strong>the</strong> petitioner that R1 shareholding<br />

in R8 was reduced because of issue of R8’s shares to R3 is<br />

concerned <strong>the</strong> petitioner is not a shareholder of R8 and he is not<br />

concerned with <strong>the</strong> affairs of R8. He contended that <strong>before</strong> issue<br />

of shares to R3 in R8 <strong>company</strong>, <strong>the</strong> R1 was holding 100% shares in<br />

R8. The petitioner had invested only Rs.1.6 crores in R1<br />

<strong>Company</strong>. The reliefs sought by <strong>the</strong> petitioner are completely<br />

against <strong>the</strong> interest of R8 on <strong>the</strong> ground that <strong>the</strong> petitioner has<br />

nothing to do with R8 and <strong>the</strong>y are completely strangulating <strong>the</strong><br />

business of R8. The petitioner contended that <strong>the</strong> respondents<br />

diluting <strong>the</strong> economic shareholding of <strong>the</strong> petitioner, is not correct.<br />

CP 116/2008<br />