Rates Review - Brochure - City of Monash

Rates Review - Brochure - City of Monash

Rates Review - Brochure - City of Monash

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

To find out more How <strong>Rates</strong> Are Calculated based on 2009/10<br />

Council is conducting information sessions at the Rate Notice<br />

following locations:<br />

To calculate an approximate rate under the options<br />

• Mulgrave Community Centre<br />

Wellington Rd, Mulgrave<br />

on 10 August at 7pm<br />

being considered multiply the ‘Rate in Dollar’ with<br />

the Site Value (SV) and Capital Improved Value<br />

(CIV) on your 09/10 Rate Notice.<br />

outline<br />

CITY OF<br />

M O N A S H<br />

• <strong>Monash</strong> Civic Centre<br />

293 Springvale Rd, Glen Waverley<br />

on 12 August at 7pm<br />

• Oakleigh Seminar & Training Centre<br />

Atherton Rd, Oakleigh<br />

on 13 August at 7pm<br />

• Mt Waverley Community Centre<br />

Miller Cres, Mount Waverley<br />

on 17 August at 7pm<br />

• <strong>Monash</strong> Civic Centre<br />

(for commercial & industrial ratepayers)<br />

on 20 August at 7pm<br />

• Oakleigh Seminar & Training Centre<br />

(for commercial & industrial ratepayers)<br />

on 24 August at 7pm<br />

There will be regular updates in the <strong>Monash</strong><br />

Bulletin and on Council’s website over the<br />

coming months.<br />

Subject to the outcome <strong>of</strong> the information<br />

sessions and community consultation in August,<br />

a formal process for consultation may follow in<br />

October if Council decides to make a change to<br />

the rating system.<br />

Any change adopted by the Council would be<br />

reflected in the rates for the 2010/2011 rating year.<br />

For further information please:<br />

• Phone the <strong>Rates</strong> Info Hotline on 1 300 538 892<br />

• To express your view write to us at<br />

PO Box 1, Glen Waverley, VIC 3150 or<br />

• ‘Have Your Say’ on www.monash.vic.gov.au<br />

Eg. A property with a SV <strong>of</strong> $354,000 and CIV <strong>of</strong><br />

$500,000<br />

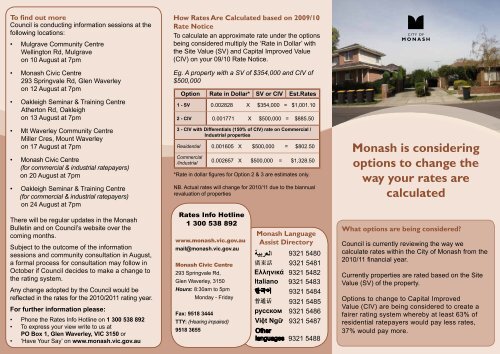

Option Rate in Dollar* SV or CIV Est.<strong>Rates</strong><br />

1 - SV 0.002828 X $354,000 = $1,001.10<br />

2 - CIV 0.001771 X $500,000 = $885.50<br />

3 - CIV with Differentials (150% <strong>of</strong> CIV) rate on Commercial /<br />

Industrial properties<br />

Residential 0.001605 X $500,000 = $802.50<br />

Commercial<br />

/Industrial 0.002657 X $500,000 = $1,328.50<br />

*Rate in dollar figures for Option 2 & 3 are estimates only.<br />

NB. Actual rates will change for 2010/11 due to the biannual<br />

revaluation <strong>of</strong> properties<br />

<strong>Rates</strong> Info Hotline<br />

1 300 538 892<br />

www.monash.vic.gov.au<br />

mail@monash.vic.gov.au<br />

<strong>Monash</strong> Civic Centre<br />

293 Springvale Rd,<br />

Glen Waverley, 3150<br />

Hours: 8:30am to 5pm<br />

Monday - Friday<br />

<strong>Monash</strong> Language<br />

Assist Directory<br />

Fax: 9518 3444<br />

TTY: (Hearing impaired)<br />

9518 3655 Other<br />

languages<br />

<strong>Monash</strong> is considering<br />

options to change the<br />

way your rates are<br />

calculated<br />

What options are being considered?<br />

Council is currently reviewing the way we<br />

calculate rates within the <strong>City</strong> <strong>of</strong> <strong>Monash</strong> from the<br />

2010/11 financial year.<br />

Currently properties are rated based on the Site<br />

Value (SV) <strong>of</strong> the property.<br />

Options to change to Capital Improved<br />

Value (CIV) are being considered to create a<br />

fairer rating system whereby at least 63% <strong>of</strong><br />

residential ratepayers would pay less rates,<br />

37% would pay more.

The rating options being considered<br />

1. Site Value (SV) calculates your rates based on<br />

the land value.<br />

2. Capital Improved Value (CIV) calculates rates<br />

on the total value <strong>of</strong> the property including all land,<br />

buildings and improvements.<br />

3. CIV with Differentials (150% <strong>of</strong> CIV) allows for<br />

various levels <strong>of</strong> rates for different property categories<br />

eg. residential, commercial and industrial.<br />

For example, on the right are four<br />

identical blocks <strong>of</strong> 800 sq/m land in<br />

a street.<br />

Under Site Value, all <strong>of</strong> these<br />

properties pay identical rates.<br />

Under Capital Improved Value,<br />

rates will be payable relative to the level<br />

<strong>of</strong> improvement to the property<br />

These illustrations are examples only<br />

Site Value does not reflect the property owner’s<br />

capacity to pay rates.<br />

Capital Improved Value more closely reflects the<br />

capacity to pay, 60% <strong>of</strong> ratepayers would pay less<br />

rates, 40% would pay more.<br />

Under CIV with Differential (150% <strong>of</strong> CIV) on<br />

commercial/industrial properties, 74% <strong>of</strong> mainly<br />

residential ratepayers would pay less rates, 26%<br />

would pay more.<br />

Three-bedroom house<br />

SV value $354,000 CIV value $500,000<br />

<strong>Rates</strong> SV $1,001<br />

<strong>Rates</strong> CIV $885<br />

<strong>Rates</strong> CIV + Diff<br />

(150%) $802<br />

Four storey block with 12 units<br />

SV value $354,000 CIV value $250,000 per unit<br />

<strong>Rates</strong> per unit SV $83<br />

<strong>Rates</strong> per unit CIV $443<br />

<strong>Rates</strong> per unit CIV + Diff<br />

(150%) $401<br />

New four-bedroom + study house<br />

SV value $354,000 CIV value $700,000<br />

<strong>Rates</strong> SV $1,001<br />

<strong>Rates</strong> CIV $1,240<br />

<strong>Rates</strong> CIV + Diff<br />

(150%) $1,123<br />

Medical clinic with high income<br />

SV value $354,000 CIV value $1,000,000<br />

<strong>Rates</strong> SV $1,001<br />

<strong>Rates</strong> CIV $1,771<br />

<strong>Rates</strong> CIV + Diff<br />

(150%) $2,657<br />

Frequently Asked Questions<br />

Why is Council looking at changing its<br />

rating strategy?<br />

To ensure we have a fair rating system for all<br />

ratepayers.<br />

There are currently many inequities in the rating<br />

system that can be demonstrated by looking at<br />

the rates paid by a single dwelling compared to<br />

a multi-dwelling (block <strong>of</strong> units), a commercial<br />

property or a significantly improved property.<br />

Will this mean Council will collect more<br />

rates?<br />

A change to CIV will not collect more rates. Any<br />

change would redistribute the total amount <strong>of</strong><br />

rates collected in a different way.<br />

Who will be worse <strong>of</strong>f by a change to CIV?<br />

Those properties with a higher level <strong>of</strong> capital<br />

improvement on their land eg. commercial,<br />

industrial and high value residential.<br />

Currently the commercial and industrial sectors<br />

enjoy especially low rates in comparison to the<br />

residential sector and other municipalities. They<br />

can also claim rates as a tax expense, while<br />

residential ratepayers cannot.<br />

How will Pensioners be affected?<br />

75% <strong>of</strong> pensioners would pay less rates, 25%<br />

would pay more, with a change to a uniform<br />

CIV rate.<br />

As part <strong>of</strong> this review process, Council is<br />

considering a further pensioner rebate <strong>of</strong> either $50<br />

or $100 in addition to the State Government rebate.