Going Offshore - Crowe Horwath International

Going Offshore - Crowe Horwath International

Going Offshore - Crowe Horwath International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Horwath</strong> MAK<br />

Member <strong>Crowe</strong> <strong>Horwath</strong> <strong>International</strong><br />

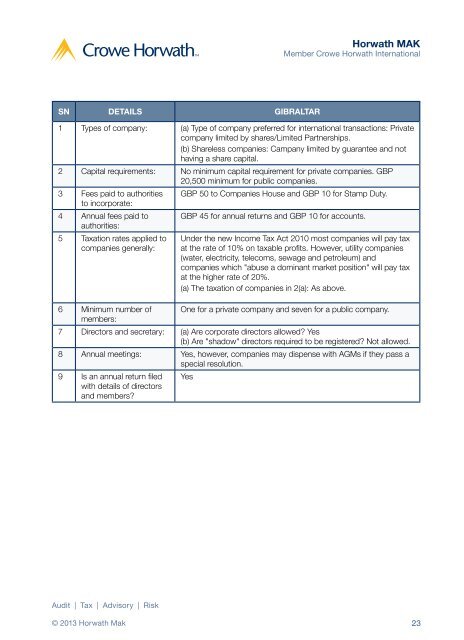

SN DETAILS GIBRALTAR<br />

1 Types of company: (a) Type of company preferred for international transactions: Private<br />

company limited by shares/Limited Partnerships.<br />

(b) Shareless companies: Campany limited by guarantee and not<br />

having a share capital.<br />

2 Capital requirements: No minimum capital requirement for private companies. GBP<br />

20,500 minimum for public companies.<br />

3 Fees paid to authorities GBP 50 to Companies House and GBP 10 for Stamp Duty.<br />

to incorporate:<br />

4 Annual fees paid to<br />

authorities:<br />

GBP 45 for annual returns and GBP 10 for accounts.<br />

5 Taxation rates applied to<br />

companies generally:<br />

Under the new Income Tax Act 2010 most companies will pay tax<br />

at the rate of 10% on taxable profits. However, utility companies<br />

(water, electricity, telecoms, sewage and petroleum) and<br />

companies which "abuse a dominant market position" will pay tax<br />

at the higher rate of 20%.<br />

(a) The taxation of companies in 2(a): As above.<br />

6 Minimum number of One for a private company and seven for a public company.<br />

members:<br />

7 Directors and secretary: (a) Are corporate directors allowed? Yes<br />

(b) Are "shadow" directors required to be registered? Not allowed.<br />

8 Annual meetings: Yes, however, companies may dispense with AGMs if they pass a<br />

special resolution.<br />

9 Is an annual return filed<br />

with details of directors<br />

and members?<br />

Yes<br />

Audit | Tax | Advisory | Risk<br />

© 2013 <strong>Horwath</strong> Mak 23