Going Offshore - Crowe Horwath International

Going Offshore - Crowe Horwath International

Going Offshore - Crowe Horwath International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Horwath</strong> MAK<br />

Member <strong>Crowe</strong> <strong>Horwath</strong> <strong>International</strong><br />

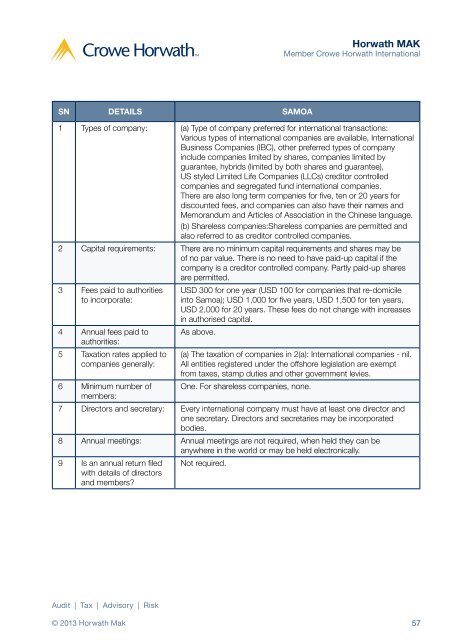

SN DETAILS SAMOA<br />

1 Types of company: (a) Type of company preferred for international transactions:<br />

Various types of international companies are available, <strong>International</strong><br />

Business Companies (IBC), other preferred types of company<br />

include companies limited by shares, companies limited by<br />

guarantee, hybrids (limited by both shares and guarantee),<br />

US styled Limited Life Companies (LLCs) creditor controlled<br />

companies and segregated fund international companies.<br />

There are also long term companies for five, ten or 20 years for<br />

discounted fees, and companies can also have their names and<br />

Memorandum and Articles of Association in the Chinese language.<br />

(b) Shareless companies:Shareless companies are permitted and<br />

also referred to as creditor controlled companies.<br />

2 Capital requirements: There are no minimum capital requirements and shares may be<br />

of no par value. There is no need to have paid-up capital if the<br />

company is a creditor controlled company. Partly paid-up shares<br />

are permitted.<br />

3 Fees paid to authorities<br />

to incorporate:<br />

4 Annual fees paid to<br />

authorities:<br />

5 Taxation rates applied to<br />

companies generally:<br />

6 Minimum number of<br />

members:<br />

USD 300 for one year (USD 100 for companies that re-domicile<br />

into Samoa); USD 1,000 for five years, USD 1,500 for ten years,<br />

USD 2,000 for 20 years. These fees do not change with increases<br />

in authorised capital.<br />

As above.<br />

(a) The taxation of companies in 2(a): <strong>International</strong> companies - nil.<br />

All entities registered under the offshore legislation are exempt<br />

from taxes, stamp duties and other government levies.<br />

One. For shareless companies, none.<br />

7 Directors and secretary: Every international company must have at least one director and<br />

one secretary. Directors and secretaries may be incorporated<br />

bodies.<br />

8 Annual meetings: Annual meetings are not required, when held they can be<br />

anywhere in the world or may be held electronically.<br />

9 Is an annual return filed<br />

with details of directors<br />

and members?<br />

Not required.<br />

Audit | Tax | Advisory | Risk<br />

© 2013 <strong>Horwath</strong> Mak 57