PDF: 21st Annual Corporate Survey Complete Results - Area ...

PDF: 21st Annual Corporate Survey Complete Results - Area ...

PDF: 21st Annual Corporate Survey Complete Results - Area ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

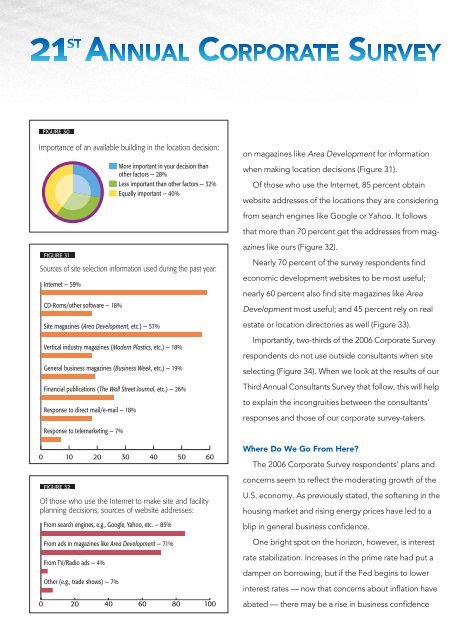

FIGURE 30<br />

Importance of an available building in the location decision:<br />

FIGURE 31<br />

FIGURE 32<br />

Of those who use the Internet to make site and facility<br />

planning decisions, sources of website addresses:<br />

From search engines, e.g., Google, Yahoo, etc. — 85%<br />

From ads in magazines like <strong>Area</strong> Development — 71%<br />

From TV/Radio ads — 4%<br />

Other (e.g., trade shows) — 7%<br />

More important in your decision than<br />

other factors — 28%<br />

Less important than other factors — 32%<br />

Equally important — 40%<br />

Sources of site selection information used during the past year:<br />

Internet — 59%<br />

CD-Roms/other software — 18%<br />

Site magazines (<strong>Area</strong> Development, etc.) — 57%<br />

Vertical industry magazines (Modern Plastics, etc.) — 18%<br />

General business magazines (Business Week, etc.) — 19%<br />

Financial publications (The Wall Street Journal, etc.) — 26%<br />

Response to direct mail/e-mail — 18%<br />

Response to telemarketing — 7%<br />

0 10 20 30 40 50 60<br />

0 20 40 60 80 100<br />

on magazines like <strong>Area</strong> Development for information<br />

when making location decisions (Figure 31).<br />

Of those who use the Internet, 85 percent obtain<br />

website addresses of the locations they are considering<br />

from search engines like Google or Yahoo. It follows<br />

that more than 70 percent get the addresses from magazines<br />

like ours (Figure 32).<br />

Nearly 70 percent of the survey respondents find<br />

economic development websites to be most useful;<br />

nearly 60 percent also find site magazines like <strong>Area</strong><br />

Development most useful; and 45 percent rely on real<br />

estate or location directories as well (Figure 33).<br />

Importantly, two-thirds of the 2006 <strong>Corporate</strong> <strong>Survey</strong><br />

respondents do not use outside consultants when site<br />

selecting (Figure 34). When we look at the results of our<br />

Third <strong>Annual</strong> Consultants <strong>Survey</strong> that follow, this will help<br />

to explain the incongruities between the consultants’<br />

responses and those of our corporate survey-takers.<br />

Where Do We Go From Here?<br />

The 2006 <strong>Corporate</strong> <strong>Survey</strong> respondents’ plans and<br />

concerns seem to reflect the moderating growth of the<br />

U.S. economy. As previously stated, the softening in the<br />

housing market and rising energy prices have led to a<br />

blip in general business confidence.<br />

One bright spot on the horizon, however, is interest<br />

rate stabilization. Increases in the prime rate had put a<br />

damper on borrowing, but if the Fed begins to lower<br />

interest rates — now that concerns about inflation have<br />

abated — there may be a rise in business confidence