Full Report - Alliance Trust

Full Report - Alliance Trust

Full Report - Alliance Trust

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

13<br />

During the financial year to 31 January 2004, we invested a net<br />

£8.2m into that portion of our portfolio managed on a global<br />

sector basis. We focused primarily on resources and basic<br />

industries, where we invested £7.9m, encouraged by significant<br />

infrastructure developments in Asia and the consequent demand<br />

for metals and resources. We also added a net £2.9m to<br />

financials, focusing predominantly on the UK. We made net<br />

sales in health care and pharmaceuticals, reducing our exposure<br />

to several US holdings in anticipation of US Medicare reform. In<br />

the information technology sector we increased our exposure to<br />

software and service companies in the US and UK, but this was<br />

offset by sales of some of our hardware related investments.<br />

Investments Managed Regionally<br />

Although more than half our portfolio is managed on a ‘global<br />

sector’ basis, this approach may not be suitable for many sectors<br />

which have a domestic rather than an international bias. A good<br />

example is the retail sector where trading and profits are<br />

closely linked to conditions in the local economy, and where<br />

formats rarely travel well across international boundaries. We<br />

continue to manage these sectors on a geographical basis,<br />

paying particular attention to the expected economic, industrial<br />

and stock market influences in each individual country.<br />

Over the last year we increased our exposure to UK industries<br />

by a net £18.4m, focusing our activity in the media sector<br />

where recent legislation is expected to encourage further<br />

corporate activity. We also increased our exposure to beverage<br />

companies and utilities, both of which offer attractive<br />

opportunities. In Asia, we have been particularly encouraged by<br />

China’s recent and expected economic growth and gained<br />

exposure to this not just through Chinese companies but also<br />

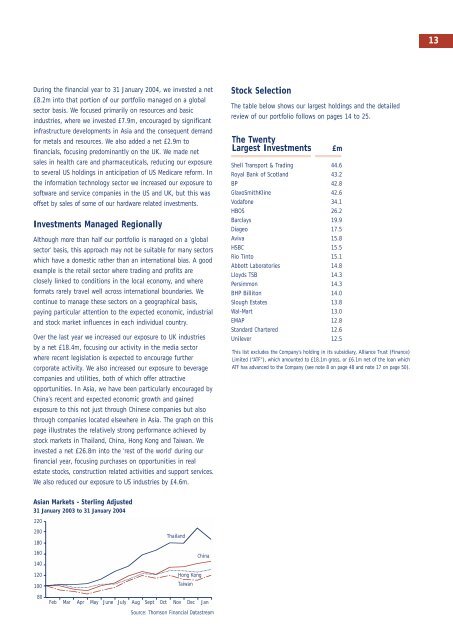

through companies located elsewhere in Asia. The graph on this<br />

page illustrates the relatively strong performance achieved by<br />

stock markets in Thailand, China, Hong Kong and Taiwan. We<br />

invested a net £26.8m into the ‘rest of the world’ during our<br />

financial year, focusing purchases on opportunities in real<br />

estate stocks, construction related activities and support services.<br />

We also reduced our exposure to US industries by £4.6m.<br />

Stock Selection<br />

The table below shows our largest holdings and the detailed<br />

review of our portfolio follows on pages 14 to 25.<br />

The Twenty<br />

Largest Investments £m<br />

Shell Transport & Trading 44.6<br />

Royal Bank of Scotland 43.2<br />

BP 42.8<br />

GlaxoSmithKline 42.6<br />

Vodafone 34.1<br />

HBOS 26.2<br />

Barclays 19.9<br />

Diageo 17.5<br />

Aviva 15.8<br />

HSBC 15.5<br />

Rio Tinto 15.1<br />

Abbott Laboratories 14.8<br />

Lloyds TSB 14.3<br />

Persimmon 14.3<br />

BHP Billiton 14.0<br />

Slough Estates 13.8<br />

Wal-Mart 13.0<br />

EMAP 12.8<br />

Standard Chartered 12.6<br />

Unilever 12.5<br />

This list excludes the Company’s holding in its subsidiary, <strong>Alliance</strong> <strong>Trust</strong> (Finance)<br />

Limited (“ATF”), which amounted to £18.1m gross, or £6.1m net of the loan which<br />

ATF has advanced to the Company (see note 8 on page 48 and note 17 on page 50).<br />

Asian Markets - Sterling Adjusted<br />

31 January 2003 to 31 January 2004<br />

220<br />

200<br />

180<br />

160<br />

140<br />

Thailand<br />

China<br />

120<br />

100<br />

80<br />

Hong Kong<br />

Taiwan<br />

Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan<br />

Source: Thomson Financial Datastream