Full Report - Alliance Trust

Full Report - Alliance Trust

Full Report - Alliance Trust

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

15<br />

Resources and Basic Industries<br />

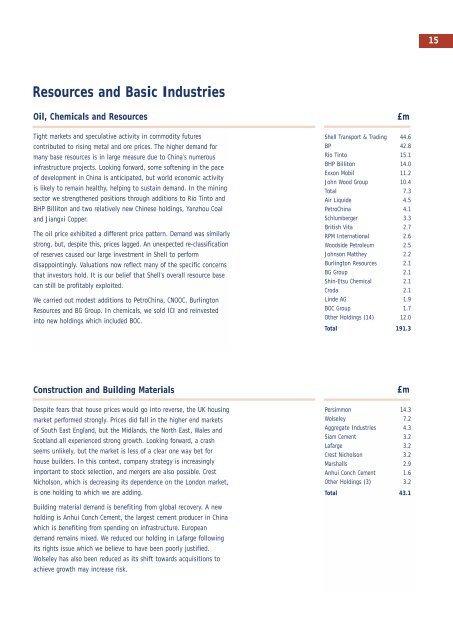

Oil, Chemicals and Resources<br />

£m<br />

Tight markets and speculative activity in commodity futures<br />

contributed to rising metal and ore prices. The higher demand for<br />

many base resources is in large measure due to China’s numerous<br />

infrastructure projects. Looking forward, some softening in the pace<br />

of development in China is anticipated, but world economic activity<br />

is likely to remain healthy, helping to sustain demand. In the mining<br />

sector we strengthened positions through additions to Rio Tinto and<br />

BHP Billiton and two relatively new Chinese holdings, Yanzhou Coal<br />

and Jiangxi Copper.<br />

The oil price exhibited a different price pattern. Demand was similarly<br />

strong, but, despite this, prices lagged. An unexpected re-classification<br />

of reserves caused our large investment in Shell to perform<br />

disappointingly. Valuations now reflect many of the specific concerns<br />

that investors hold. It is our belief that Shell’s overall resource base<br />

can still be profitably exploited.<br />

We carried out modest additions to PetroChina, CNOOC, Burlington<br />

Resources and BG Group. In chemicals, we sold ICI and reinvested<br />

into new holdings which included BOC.<br />

Shell Transport & Trading 44.6<br />

BP 42.8<br />

Rio Tinto 15.1<br />

BHP Billiton 14.0<br />

Exxon Mobil 11.2<br />

John Wood Group 10.4<br />

Total 7.3<br />

Air Liquide 4.5<br />

PetroChina 4.1<br />

Schlumberger 3.3<br />

British Vita 2.7<br />

RPM International 2.6<br />

Woodside Petroleum 2.5<br />

Johnson Matthey 2.2<br />

Burlington Resources 2.1<br />

BG Group 2.1<br />

Shin-Etsu Chemical 2.1<br />

Croda 2.1<br />

Linde AG 1.9<br />

BOC Group 1.7<br />

Other Holdings (14) 12.0<br />

Total 191.3<br />

Construction and Building Materials<br />

£m<br />

Despite fears that house prices would go into reverse, the UK housing<br />

market performed strongly. Prices did fall in the higher end markets<br />

of South East England, but the Midlands, the North East, Wales and<br />

Scotland all experienced strong growth. Looking forward, a crash<br />

seems unlikely, but the market is less of a clear one way bet for<br />

house builders. In this context, company strategy is increasingly<br />

important to stock selection, and mergers are also possible. Crest<br />

Nicholson, which is decreasing its dependence on the London market,<br />

is one holding to which we are adding.<br />

Persimmon 14.3<br />

Wolseley 7.2<br />

Aggregate Industries 4.3<br />

Siam Cement 3.2<br />

Lafarge 3.2<br />

Crest Nicholson 3.2<br />

Marshalls 2.9<br />

Anhui Conch Cement 1.6<br />

Other Holdings (3) 3.2<br />

Total 43.1<br />

Building material demand is benefiting from global recovery. A new<br />

holding is Anhui Conch Cement, the largest cement producer in China<br />

which is benefiting from spending on infrastructure. European<br />

demand remains mixed. We reduced our holding in Lafarge following<br />

its rights issue which we believe to have been poorly justified.<br />

Wolseley has also been reduced as its shift towards acquisitions to<br />

achieve growth may increase risk.