Full Report - Alliance Trust

Full Report - Alliance Trust

Full Report - Alliance Trust

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

17<br />

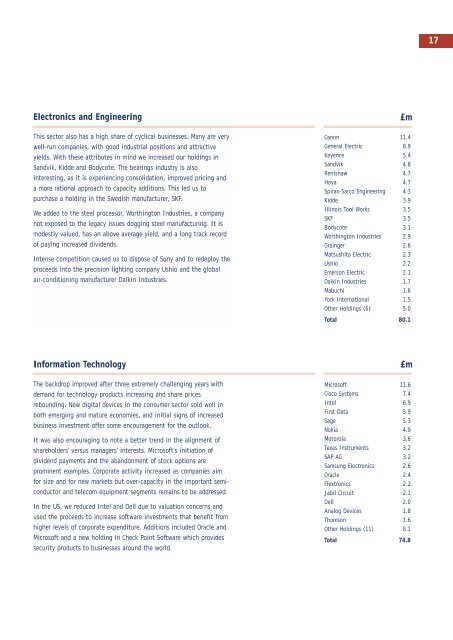

Electronics and Engineering<br />

This sector also has a high share of cyclical businesses. Many are very<br />

well-run companies, with good industrial positions and attractive<br />

yields. With these attributes in mind we increased our holdings in<br />

Sandvik, Kidde and Bodycote. The bearings industry is also<br />

interesting, as it is experiencing consolidation, improved pricing and<br />

a more rational approach to capacity additions. This led us to<br />

purchase a holding in the Swedish manufacturer, SKF.<br />

We added to the steel processor, Worthington Industries, a company<br />

not exposed to the legacy issues dogging steel manufacturing. It is<br />

modestly valued, has an above average yield, and a long track record<br />

of paying increased dividends.<br />

Intense competition caused us to dispose of Sony and to redeploy the<br />

proceeds into the precision lighting company Ushio and the global<br />

air-conditioning manufacturer Daikin Industries.<br />

£m<br />

Canon 11.4<br />

General Electric 8.9<br />

Keyence 5.4<br />

Sandvik 4.8<br />

Renishaw 4.7<br />

Hoya 4.7<br />

Spirax-Sarco Engineering 4.3<br />

Kidde 3.9<br />

Illinois Tool Works 3.5<br />

SKF 3.5<br />

Bodycote 3.1<br />

Worthington Industries 2.9<br />

Grainger 2.6<br />

Matsushita Electric 2.3<br />

Ushio 2.2<br />

Emerson Electric 2.1<br />

Daikin Industries 1.7<br />

Mabuchi 1.6<br />

York International 1.5<br />

Other Holdings (6) 5.0<br />

Total 80.1<br />

Information Technology<br />

£m<br />

The backdrop improved after three extremely challenging years with<br />

demand for technology products increasing and share prices<br />

rebounding. New digital devices in the consumer sector sold well in<br />

both emerging and mature economies, and initial signs of increased<br />

business investment offer some encouragement for the outlook.<br />

It was also encouraging to note a better trend in the alignment of<br />

shareholders’ versus managers’ interests. Microsoft’s initiation of<br />

dividend payments and the abandonment of stock options are<br />

prominent examples. Corporate activity increased as companies aim<br />

for size and for new markets but over-capacity in the important semiconductor<br />

and telecom equipment segments remains to be addressed.<br />

In the US, we reduced Intel and Dell due to valuation concerns and<br />

used the proceeds to increase software investments that benefit from<br />

higher levels of corporate expenditure. Additions included Oracle and<br />

Microsoft and a new holding in Check Point Software which provides<br />

security products to businesses around the world.<br />

Microsoft 11.6<br />

Cisco Systems 7.4<br />

Intel 6.9<br />

First Data 5.9<br />

Sage 5.3<br />

Nokia 4.9<br />

Motorola 3.6<br />

Texas Instruments 3.2<br />

SAP AG 3.2<br />

Samsung Electronics 2.6<br />

Oracle 2.4<br />

Flextronics 2.2<br />

Jabil Circuit 2.1<br />

Dell 2.0<br />

Analog Devices 1.8<br />

Thomson 1.6<br />

Other Holdings (11) 8.1<br />

Total 74.8