Full Report - Alliance Trust

Full Report - Alliance Trust

Full Report - Alliance Trust

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

7<br />

Capital<br />

The year under review has, once again, been a volatile one with<br />

the seesaw movement of equity markets. By the year end,<br />

equity markets had recovered and our closing net asset value of<br />

£29.21 per ordinary stock unit showed a net increase of 22.5%.<br />

This was the first increase for three years.<br />

A comparison of our net asset value over the year against the<br />

UK FTSE All-Share index, which rose 27%, is less favourable. We<br />

have a substantial proportion of our assets overseas and<br />

currency moves have had a significant effect. In the US, where<br />

we have close to 21% of our assets, the depreciation of the US<br />

Dollar by nearly 11% against Sterling reduced stock market<br />

returns on a currency adjusted basis, from 32% to just 19%. The<br />

movement of Asian currencies, apart from the Japanese Yen,<br />

were kept close to the US Dollar, either by intervention or by<br />

increasingly fragile pegs. In Europe, returns were boosted by the<br />

4% appreciation of the Euro against Sterling, but our exposure<br />

accounts for just 10% of our portfolio, as we have been deterred<br />

by the lack of visible structural reform and high valuations.<br />

The greater influence, however, has been in terms of stock<br />

selection. While we were sufficiently confident to move to full<br />

investment we maintained our focus on companies better placed<br />

in terms of management, market position, cash flow and<br />

dividend paying capability. The companies which had been most<br />

exposed by the last downturn were those which performed best<br />

for much of the year. With hindsight, we were too cautious<br />

about two areas in particular: Japanese banks, where we had no<br />

exposure, and IT hardware, where our exposure was limited. This<br />

adversely affected our relative performance.<br />

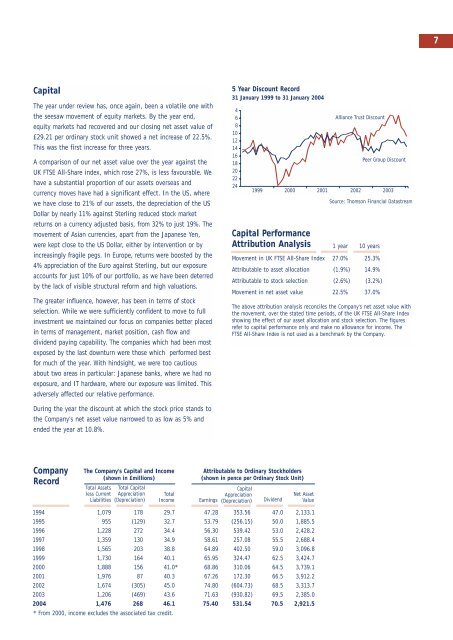

5 Year Discount Record<br />

31 January 1999 to 31 January 2004<br />

4<br />

6<br />

8<br />

10<br />

12<br />

14<br />

16<br />

18<br />

20<br />

22<br />

24<br />

<strong>Alliance</strong> <strong>Trust</strong> Discount<br />

Source: Thomson Financial Datastream<br />

Movement in UK FTSE All-Share Index 27.0% 25.3%<br />

Attributable to asset allocation (1.9%) 14.9%<br />

Attributable to stock selection (2.6%) (3.2%)<br />

Movement in net asset value 22.5% 37.0%<br />

Peer Group Discount<br />

1999 2000 2001 2002 2003<br />

Capital Performance<br />

Attribution Analysis 1 year 10 years<br />

The above attribution analysis reconciles the Company's net asset value with<br />

the movement, over the stated time periods, of the UK FTSE All-Share Index<br />

showing the effect of our asset allocation and stock selection. The figures<br />

refer to capital performance only and make no allowance for income. The<br />

FTSE All-Share Index is not used as a benchmark by the Company.<br />

During the year the discount at which the stock price stands to<br />

the Company’s net asset value narrowed to as low as 5% and<br />

ended the year at 10.8%.<br />

Company<br />

Record<br />

The Company’s Capital and Income<br />

(shown in £millions)<br />

Total Assets<br />

less Current<br />

Liabilities<br />

Total Capital<br />

Appreciation<br />

(Depreciation)<br />

Total<br />

Income<br />

Attributable to Ordinary Stockholders<br />

(shown in pence per Ordinary Stock Unit)<br />

Earnings<br />

Capital<br />

Appreciation<br />

(Depreciation)<br />

Dividend<br />

Net Asset<br />

Value<br />

1994 1,079 178 29.7 47.28 353.56 47.0 2,133.1<br />

1995 955 (129) 32.7 53.79 (256.15) 50.0 1,885.5<br />

1996 1,228 272 34.4 56.30 539.42 53.0 2,428.2<br />

1997 1,359 130 34.9 58.61 257.08 55.5 2,688.4<br />

1998 1,565 203 38.8 64.89 402.50 59.0 3,096.8<br />

1999 1,730 164 40.1 65.95 324.47 62.5 3,424.7<br />

2000 1,888 156 41.0* 68.86 310.06 64.5 3,739.1<br />

2001 1,976 87 40.3 67.26 172.30 66.5 3,912.2<br />

2002 1,674 (305) 45.0 74.80 (604.73) 68.5 3,313.7<br />

2003 1,206 (469) 43.6 71.63 (930.82) 69.5 2,385.0<br />

2004 1,476 268 46.1 75.40 531.54 70.5 2,921.5<br />

* From 2000, income excludes the associated tax credit.