Annual Report 2009/2010 - Colombo Stock Exchange

Annual Report 2009/2010 - Colombo Stock Exchange

Annual Report 2009/2010 - Colombo Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

(b) Revaluation of Land and Buildings<br />

The freehold land and buildings of the Company have<br />

been revalued and revaluation of these assets are<br />

carried out at least once every five years in order to<br />

ensure that the book values reflect the realisable values.<br />

Any surplus or deficit arising there from is adjusted in<br />

the revaluation reserve.<br />

(c) Subsequent Expenditure<br />

Expenditure incurred to replace a component of<br />

an item of property, plant and equipment that is<br />

accounted for separately is capitalised. Other<br />

subsequent expenditure is capitalised only if it is<br />

probable that the future economic benefits<br />

embodied with the item will flow to the Company<br />

and the cost of the item can be measured<br />

reliable. All other expenditure is recognised<br />

in the income statement as an expense as incurred.<br />

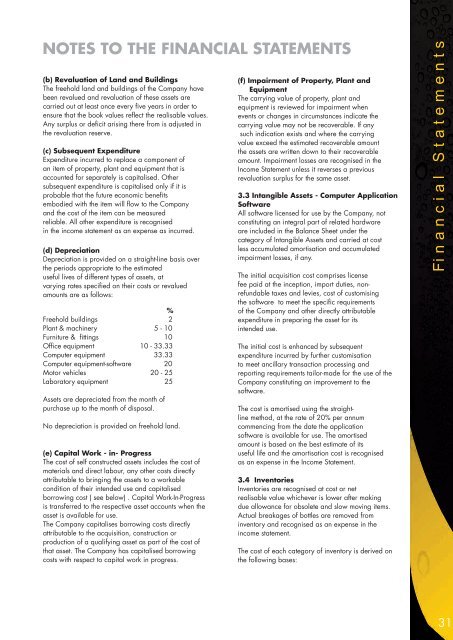

(d) Depreciation<br />

Depreciation is provided on a straight-line basis over<br />

the periods appropriate to the estimated<br />

useful lives of different types of assets, at<br />

varying rates specified on their costs or revalued<br />

amounts are as follows:<br />

%<br />

Freehold buildings 2<br />

Plant & machinery 5 - 10<br />

Furniture & fittings 10<br />

Office equipment 10 - 33.33<br />

Computer equipment 33.33<br />

Computer equipment-software 20<br />

Motor vehicles 20 - 25<br />

Laboratory equipment 25<br />

Assets are depreciated from the month of<br />

purchase up to the month of disposal.<br />

No depreciation is provided on freehold land.<br />

(e) Capital Work - in- Progress<br />

The cost of self constructed assets includes the cost of<br />

materials and direct labour, any other costs directly<br />

attributable to bringing the assets to a workable<br />

condition of their intended use and capitalised<br />

borrowing cost ( see below) . Capital Work-In-Progress<br />

is transferred to the respective asset accounts when the<br />

asset is available for use.<br />

The Company capitalises borrowing costs directly<br />

attributable to the acquisition, construction or<br />

production of a qualifying asset as part of the cost of<br />

that asset. The Company has capitalised borrowing<br />

costs with respect to capital work in progress.<br />

(f) Impairment of Property, Plant and<br />

Equipment<br />

The carrying value of property, plant and<br />

equipment is reviewed for impairment when<br />

events or changes in circumstances indicate the<br />

carrying value may not be recoverable. If any<br />

such indication exists and where the carrying<br />

value exceed the estimated recoverable amount<br />

the assets are written down to their recoverable<br />

amount. Impairment losses are recognised in the<br />

Income Statement unless it reverses a previous<br />

revaluation surplus for the same asset.<br />

3.3 Intangible Assets - Computer Application<br />

Software<br />

All software licensed for use by the Company, not<br />

constituting an integral part of related hardware<br />

are included in the Balance Sheet under the<br />

category of Intangible Assets and carried at cost<br />

less accumulated amortisation and accumulated<br />

impairment losses, if any.<br />

The initial acquisition cost comprises license<br />

fee paid at the inception, import duties, nonrefundable<br />

taxes and levies, cost of customising<br />

the software to meet the specific requirements<br />

of the Company and other directly attributable<br />

expenditure in preparing the asset for its<br />

intended use.<br />

The initial cost is enhanced by subsequent<br />

expenditure incurred by further customisation<br />

to meet ancillary transaction processing and<br />

reporting requirements tailor-made for the use of the<br />

Company constituting an improvement to the<br />

software.<br />

The cost is amortised using the straightline<br />

method, at the rate of 20% per annum<br />

commencing from the date the application<br />

software is available for use. The amortised<br />

amount is based on the best estimate of its<br />

useful life and the amortisation cost is recognised<br />

as an expense in the Income Statement.<br />

3.4 Inventories<br />

Inventories are recognised at cost or net<br />

realisable value whichever is lower after making<br />

due allowance for obsolete and slow moving items.<br />

Actual breakages of bottles are removed from<br />

inventory and recognised as an expense in the<br />

income statement.<br />

The cost of each category of inventory is derived on<br />

the following bases:<br />

Fi n a n c i a l S t a t e m e n t s<br />

31