before the company law board - Company Law Board Mumbai Bench

before the company law board - Company Law Board Mumbai Bench

before the company law board - Company Law Board Mumbai Bench

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

BEFORE THE COMPANY LAW BOARD,<br />

MUMABI BENCH, AT MUMBAI<br />

PRESENT: SHRI KANTHI NARAHARI,MEMBER (JUDICIAL)<br />

COMPANY PETITION NO. 118 of 2009<br />

IN THE MATTER OF THE COMPANIES ACT, 1956,<br />

SECTIONS 111, 397-398,402, 403 read with Sections<br />

237(b),239(b),(c),(d) and 408<br />

AND<br />

IN THE MATTER OF M/S.CAMBATA AVIATION<br />

PRIVATE LIMITED<br />

BETWEEN:<br />

1. Mr.Albert Cambata,<br />

through his constituted attorney<br />

Mr.Rashmikant Mehta<br />

at Via Casarico D,<br />

CH-6932,<br />

Breganzona, Switzerland.<br />

…Petitioner<br />

AND<br />

1. M/s.Cambata Aviation Private Limited,<br />

having its registered office at Hangar No.3A,<br />

Juhu Aerodrome,<br />

Vile Parle (W),<br />

<strong>Mumbai</strong>-400 054.<br />

2. Mr.Nelson Cambata,<br />

3. Mr.Burjor N.Nicholson,<br />

4. Mr.Bruce Cambata,<br />

5. Eros Theatre & Restaurant Pvt.Ltd.<br />

6. Cambata Helicopters Pvt.Ltd.<br />

….Respondents<br />

CP118 of 2009<br />

Cambata

2<br />

PRESENT FOR PARTIES:<br />

Mr.Zal Andhyarujina, Advocate<br />

Mr.Zubin Morris, Advocate<br />

Ms.Pratibha Mehta, Advocate<br />

Ms.Divya, Advocate<br />

Mr.Pradeep Sancheti, Sr.Counsel<br />

Mr. Raj Chakrabarti, Advocate<br />

Mr.Ajit Anekar, Advocate<br />

Mr.Vishal Lohire, Advocate<br />

….For petitioner<br />

….For respondents<br />

O R D E R<br />

1. The present petition is filed by invoking various<br />

provisions of <strong>the</strong> Companies Act, 1956 (‘ <strong>the</strong> Act’) alleging certain<br />

acts of oppression and mismanagement in <strong>the</strong> affairs of <strong>the</strong> R1<br />

<strong>Company</strong> and sought various reliefs as prayed in para 16 of <strong>the</strong><br />

petition.<br />

2. Shri Zal Andhyarujina, Learned Counsel, appearing for<br />

<strong>the</strong> petitioner categorized broadly <strong>the</strong> issues to be decided by this<br />

<strong>Bench</strong> are <strong>the</strong> illegal enhancement of shareholding of R2 and R4,<br />

entered in joint venture with Menzies <strong>the</strong>reby <strong>the</strong> respondents<br />

attempt to siphon off <strong>the</strong> funds of <strong>the</strong> R1 and alleged that <strong>the</strong><br />

petitioner was not provided <strong>the</strong> statutory records of <strong>the</strong> <strong>Company</strong><br />

for inspection etc.. Accordingly, <strong>the</strong> Learned Counsel sought<br />

reliefs to be granted as prayed in <strong>the</strong> petition.<br />

CP 118/2009<br />

Cambata

3<br />

3. He summarized <strong>the</strong> brief facts as follows:<br />

The R1 <strong>Company</strong> was promoted by <strong>the</strong> petitioner’s fa<strong>the</strong>r<br />

Mr.Kershi Cambata. The R1<strong>Company</strong> is engaged in <strong>the</strong> business<br />

of ground handling at various major airports in India. At <strong>the</strong> time<br />

of incorporation i.e. in <strong>the</strong> year 1954 Mr. Kershi Cambatta and Mr.<br />

Rustom Cambata had equal stake of 50% each in <strong>the</strong> <strong>Company</strong>.<br />

The shareholding of <strong>the</strong> R1 <strong>the</strong>reafter changed from time to time.<br />

In <strong>the</strong> years 1998 and 1999 <strong>the</strong> shareholding of <strong>the</strong> R1 was as<br />

follows:<br />

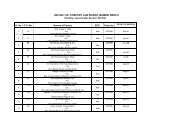

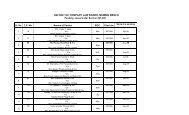

Sr.<br />

No<br />

Name Percentage of<br />

shareholding<br />

No.of shares<br />

1. Mr.Kershi Cambata 39.15% 44025<br />

2. Mr.Nelson Cambata 0.59% 664<br />

3. Mr.Albert Cambata 34.46% 38751<br />

4. Mr.Burjor Nicholson 0.0008% 1<br />

5. Eros Theater & Restaurant 0.0008% 1<br />

Pvt.Ltd.<br />

6. Mr.Bruce Cambata 25.78% 28986<br />

4. The petitioner was made as director of <strong>the</strong> <strong>Company</strong> on<br />

15 th Sept., 1974 by his fa<strong>the</strong>r Mr.Kershi Cambata. He was closely<br />

associated with <strong>the</strong> affairs of <strong>the</strong> R1 until January, 2000 and<br />

CP 118/2009<br />

Cambata

4<br />

actively took part in <strong>the</strong> business of <strong>the</strong> R1 <strong>Company</strong> as a director<br />

and shareholder. The R2 was made as director of R1 on 1 st Sept.,<br />

1983 and R3 was made as director on 3 rd December, 1981. The<br />

petitioner in <strong>the</strong> year 2000 moved to USA and subsequently to<br />

Switzerland. The petitioner in complete faith left <strong>the</strong> affairs of <strong>the</strong><br />

<strong>Company</strong> to be managed and run by his own fa<strong>the</strong>r Mr.Kershi<br />

Cambata and R2 & R3. Mr.Kershi Cambata died in May, 2008.<br />

Upon his fa<strong>the</strong>r’s death <strong>the</strong> petitioner made enquiries with his<br />

bro<strong>the</strong>r R2 and also R3 about <strong>the</strong> business affairs of <strong>the</strong> <strong>Company</strong>.<br />

But <strong>the</strong> said R2 and R3 instead of providing details of <strong>the</strong> business<br />

affairs of <strong>the</strong> <strong>Company</strong> gave evasive and vague replies to <strong>the</strong><br />

petitioner. Sometime in May, 2009 when <strong>the</strong> petitioner visited<br />

<strong>Mumbai</strong> to ascertain <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong>, he was<br />

intentionally not allowed access to <strong>the</strong> books and records of <strong>the</strong><br />

<strong>Company</strong>. Thereafter, on making enquiries <strong>the</strong> petitioner learnt<br />

about <strong>the</strong> illegal, unauthorized acts of oppression and<br />

mismanagement in <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong>.<br />

5. Sometime in May, 2009 <strong>the</strong> petitioner<br />

came to know about <strong>the</strong> Joint Venture Arrangement between<br />

Menzies Aviation and R1. The said Joint Venture arrangement<br />

had obtained a letter of award for ground handling operations at<br />

<strong>the</strong> Delhi International Airport which had subsequently been<br />

withdrawn. Diverse correspondence had been addressed by<br />

CP 118/2009<br />

Cambata

5<br />

Menzies to <strong>the</strong> R1 requesting <strong>the</strong> R1 to fulfill its obligations.<br />

However, <strong>the</strong> R1 had refused to carry on with <strong>the</strong> joint venture<br />

which had been unable to commence operations at <strong>the</strong> Delhi<br />

airport. Due to alleged failure on <strong>the</strong> part of <strong>the</strong> R1 to perform its<br />

obligations, <strong>the</strong> Menzies was in <strong>the</strong> process of initiating suitable<br />

legal action against <strong>the</strong> R1. It is submitted that <strong>the</strong> petitioner as a<br />

shareholder and a Director was never made aware of any such joint<br />

venture with Menzies Aviation. The petitioner by one of its said<br />

letters viz. <strong>the</strong> letter dated 8.7.2009 to <strong>the</strong> Respondents also stated<br />

that after <strong>the</strong> notice received for <strong>the</strong> <strong>Board</strong> Meeting which was to<br />

be held on 12.9.2008 he had not received any notice of any o<strong>the</strong>r<br />

<strong>Board</strong> Meeting. The R2 for <strong>the</strong> first time vide his letter dated<br />

3.8.2009 informed <strong>the</strong> petitioner that <strong>the</strong> authority to deal with<br />

Menzies Aviation and to enter into a Joint venture was given to R2<br />

in its <strong>Board</strong> Meeting dt.12 th Sept., 2008. In <strong>the</strong> meanwhile since no<br />

information from <strong>the</strong> respondents was forthcoming <strong>the</strong> petitioner<br />

was <strong>the</strong>refore left with no option but to question <strong>the</strong> authority of<br />

<strong>the</strong> Respondent to enter into <strong>the</strong> joint venture with Menzies for<br />

which <strong>the</strong> petitioner did not receive any satisfactory response. The<br />

petitioner <strong>the</strong>refore wrote a letter dated 13 th July, 2009 to Menzies<br />

Aviation. In <strong>the</strong> said letter <strong>the</strong> petitioner inter alia stated that he<br />

was a director and shareholder of <strong>the</strong> R1 and that he had learnt that<br />

Menzies Aviation was entering into some arrangement with <strong>the</strong> R1<br />

CP 118/2009<br />

Cambata

6<br />

for acquiring its business ei<strong>the</strong>r by a joint venture or purchasing<br />

shares of some of <strong>the</strong> existing shareholders of <strong>the</strong> <strong>Company</strong>. On<br />

his requisition made vide his letter dated 8.7.2009 <strong>the</strong> R1 after<br />

much delay decided to hold a meeting of <strong>the</strong> <strong>Board</strong> of Directors in<br />

London on August 26, 2009. The petitioner initially objected to<br />

<strong>the</strong> venue of <strong>the</strong> meeting. However, R2 and R3 vide <strong>the</strong>ir letter<br />

dated July 07, 2009 refused to hold <strong>the</strong> meeting in <strong>Mumbai</strong> and<br />

insisted to hold <strong>the</strong> same in London to suit <strong>the</strong>ir own convenience.<br />

In <strong>the</strong> interest of <strong>the</strong> <strong>Company</strong> <strong>the</strong> petitioner agreed to visit<br />

London to attend <strong>the</strong> meeting. The R1 <strong>the</strong>n circulated <strong>the</strong> Notice<br />

of <strong>the</strong> <strong>Board</strong> Meeting on 17 th August, 2009. The petitioner<br />

requested R1 to postpone <strong>the</strong> meeting through his advocate’s letter<br />

dated 25.8.2009. It is fur<strong>the</strong>r submitted that sometime around<br />

21.8.2009 <strong>the</strong> petitioner was surprised to be served with a copy of<br />

plaint being Suit No. 2266 of 2009 filed by <strong>the</strong> R1 against <strong>the</strong><br />

petitioner inter alia praying for a permanent injunction to restrain<br />

<strong>the</strong> petitioner from communicating, whe<strong>the</strong>r orally or in writing<br />

with <strong>the</strong> employees of <strong>the</strong> R1 and any o<strong>the</strong>r individuals. This act of<br />

R1 itself speaks about <strong>the</strong> motivated intentions of R1 from<br />

preventing <strong>the</strong> petitioner from taking part in <strong>the</strong> business affairs of<br />

<strong>the</strong> <strong>Company</strong>. The issue of ground handling policy and its effect on<br />

<strong>the</strong> business of R1 was discussed in <strong>the</strong> <strong>Board</strong> of Directors<br />

Meeting of R1 held on 12.9.2008. At <strong>the</strong> said meeting <strong>the</strong> <strong>Board</strong><br />

CP 118/2009<br />

Cambata

7<br />

authorized R2 to identify a suitable joint venture partner.<br />

Correspondence <strong>the</strong>reafter ensued between <strong>the</strong> parties. It is <strong>the</strong><br />

petitioner’s contention that he must be provided with all <strong>the</strong><br />

information sought for (and in particular all <strong>the</strong> documents<br />

mentioned in <strong>the</strong> said order of <strong>the</strong> Bombay High Court dated<br />

2.9.2009), and that <strong>the</strong> <strong>Board</strong> meeting must be held in India.<br />

However, <strong>the</strong> respondents insisted to hold <strong>the</strong> <strong>Board</strong> Meeting in<br />

Bahamas and declined to provide all <strong>the</strong> information sought by <strong>the</strong><br />

petitioner. The R1 has failed to comply with <strong>the</strong> order of <strong>the</strong><br />

Hon’ble Bombay High Court dated 2.9.2009.<br />

Despite <strong>the</strong> express directions contained in <strong>the</strong> said order dated<br />

2.9.2009, <strong>the</strong> same have been deliberately and willfully flouted by<br />

<strong>the</strong> respondents. The R1 has insisted on holding <strong>the</strong> meeting of <strong>the</strong><br />

<strong>Board</strong> of Directors at far off place Nassau, Bahamas with a<br />

deliberate view to make it as inconvenient as possible for <strong>the</strong><br />

petitioner to attend and effectively participate <strong>the</strong>rein. The<br />

respondents have sought to frustrate <strong>the</strong> petitioner from having<br />

access to <strong>the</strong> documents. The R1 was not willing to disclose all<br />

documents and give a clear picture of deal with regard to <strong>the</strong> JV<br />

arrangement with Menzies Aviation and/or with one Krystal<br />

Aviation Services Pvt.Ltd.. It is fur<strong>the</strong>r submitted that <strong>the</strong> Notice<br />

of Motion No.3463 of 2009 (filed by <strong>the</strong> petitioner) was mentioned<br />

for circulation on 24.9.2009 <strong>before</strong> <strong>the</strong> Bombay High Court. The<br />

CP 118/2009<br />

Cambata

8<br />

High Court declined to pass any orders <strong>the</strong>rein. However, <strong>the</strong> said<br />

order records that <strong>the</strong> petitioner was at liberty to take out <strong>the</strong><br />

appropriate proceedings in <strong>the</strong> matter, which <strong>the</strong> petitioner has now<br />

done by way of <strong>the</strong> present proceedings. It is fur<strong>the</strong>r submitted that<br />

after making several requisitions to <strong>the</strong> Respondents <strong>the</strong> petitioner<br />

received copies of <strong>the</strong> minutes of <strong>the</strong> AGM from 1994 to March,<br />

10, 2006 and <strong>the</strong> register of shareholders.<br />

6. The petitioner was shocked to learn that from May,<br />

2000 till 2003, soon after he left for USA, <strong>the</strong> R3, R5 and R6<br />

acting at <strong>the</strong> behest of Respondents arbitrarily convened an EOGM<br />

of R1 dated 25.4.2000 and 3.7.2000 and 20.9.2001 whereby <strong>the</strong>y<br />

increased <strong>the</strong> Authorised Capital of Respondents by an aggregate<br />

of Rs.12,50,00,000/- by issuing 1,25,000 shares of face value of<br />

Rs.1000/- each. Subsequently it appears that all but one share of<br />

this increased share capital was allotted to <strong>the</strong> R2 <strong>the</strong>reby illegally<br />

increasing <strong>the</strong> shareholding of <strong>the</strong> R2 from 0.59% to 64.77% by<br />

issuing around 104996 shares to <strong>the</strong> R2 alone and by transferring<br />

around 38,000 shares from Kershi Cambata to R2 . The issuance<br />

of such shares is arbitrary and illegal as no notice in accordance<br />

with Article 74 of <strong>the</strong> Articles of Association of <strong>the</strong> <strong>Company</strong> was<br />

issued to <strong>the</strong> petitioner. The said article 74 strictly requires that<br />

subject to any direction to <strong>the</strong> contrary that may be given by <strong>the</strong><br />

CP 118/2009<br />

Cambata

9<br />

meeting that sanctions <strong>the</strong> increase of capital all new shares shall<br />

be offered to <strong>the</strong> members in <strong>the</strong> proportion to <strong>the</strong> existing equity<br />

shares held by <strong>the</strong>m. Accordingly, pursuant to Article 74 <strong>the</strong><br />

respondent No.1 was bound to offer <strong>the</strong> new shares in proportion<br />

to <strong>the</strong> existing equity shares held by <strong>the</strong> petitioner. No notice in<br />

accordance with Article 74 was issued to <strong>the</strong> petitioner with regard<br />

to <strong>the</strong> new shares to be issued and allotted as <strong>the</strong> said EOGMs and<br />

needless to say no offer has ever been made to <strong>the</strong> petitioner of<br />

such new shares. The petitioner challenging illegal transfer of<br />

shares done in <strong>the</strong> <strong>Board</strong> Meetings and <strong>the</strong> transfer forms are not<br />

available with <strong>the</strong> <strong>Company</strong>. The increase of share capital could<br />

be done in general meetings and not at <strong>the</strong> <strong>Board</strong> meetings, hence<br />

<strong>the</strong> <strong>Board</strong> Meetings are bad in <strong>law</strong>. The respondents increased <strong>the</strong><br />

share capital to marginalize <strong>the</strong> o<strong>the</strong>r group and gain control is an<br />

act of oppression. On this Learned Counsel relief upon <strong>the</strong><br />

following citations:<br />

1) (2002) 1 CLJ Page 552 CLB In <strong>the</strong> matter of Kshounish<br />

Chowdhury & Ors. Vs Kero Rajendra Monolithics Ltd. & Ors.<br />

2) AIR 2005 SC 4074 In re: Sakal Papers.<br />

However, <strong>the</strong> general meetings were held and attended by<br />

only two persons who are very marginal shareholders. The R1<br />

<strong>Company</strong> is a family <strong>Company</strong> and articles provide maintaining<br />

<strong>the</strong> parity in <strong>the</strong> shareholding pattern. The respondents have not<br />

CP 118/2009<br />

Cambata

10<br />

given any notice to <strong>the</strong> petitioner inspite of <strong>the</strong> fact that <strong>the</strong><br />

petitioner resides abroad i.e. Switzerland. On <strong>the</strong> point that notice<br />

was not given to <strong>the</strong> petitioner/director, <strong>the</strong> Learned Counsel relied<br />

upon <strong>the</strong> following citations:<br />

1) (2005) 59 SCL page 282 CLB. In <strong>the</strong> matter of Navin R.<br />

Shah Vs Simshah Estates & Training Co.Pvt.Ltd..<br />

2) AIR 2005 SC 4074 In <strong>the</strong> matter of Smt.Claude – Lila<br />

Parulekar Vs Sakal Papers Pvt.Ltd. & Ors.<br />

3) (2002) 39 SCL 943 (CAL) Para 59 In <strong>the</strong> matter of<br />

Bhagirath Agarwala Vs Tara Properties Pvt.Ltd..<br />

4) (2000) 36 CLA Page 214 CLB In <strong>the</strong> matter of Dr.Kamal<br />

K. Dutta & Anr. Vs. Ruby General Hospitals<br />

7. The minutes of <strong>the</strong> meeting dated 25 th April, 2000 and<br />

3 rd July, 2000 whereby additional shares were issued and allotted<br />

to R2 shows that <strong>the</strong> quorum of <strong>the</strong> meeting was not constituted.<br />

The register of R1 shows that on 3.7.2000, 17.9.2001 and<br />

25.11.2003 around 12,000, 24,000 and 70,000 shares respectively<br />

have been allotted to R2. Accordingly an aggregate of around<br />

104996 shares were illegally allotted to R2. No notice of <strong>the</strong><br />

aforesaid meetings of <strong>the</strong> <strong>Board</strong> of Directors has ever been given<br />

to <strong>the</strong> petitioner. The petitioner from time to time by various<br />

letters sought copies of <strong>the</strong> following documents:<br />

CP 118/2009<br />

Cambata

11<br />

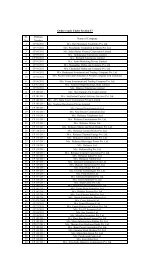

a. Register of Members and Index of Members, b. Transfer<br />

forms of shares since 1994, c. Minutes of all meeting of <strong>the</strong> <strong>Board</strong><br />

of Directors held since 1994 till date along with copies of <strong>the</strong><br />

resolutions that may have been passed, d. Minutes of all <strong>the</strong><br />

General Meetings held since 1994 till date along with <strong>the</strong> copies of<br />

<strong>the</strong> resolutions that may have been passed, e. Last three years’<br />

balance sheets. However, respondents with ulterior motives and<br />

for reasons best known to <strong>the</strong>m with mala fide intentions have, till<br />

date, only provided copies of <strong>the</strong> following documents:<br />

a. Register & Index of Members, b. Register of Directors<br />

c. Register of directors’ shareholding, d. Minutes of <strong>the</strong> General<br />

Meeting upto March10, 2006, e. Request for proposal (REP)<br />

documents issued by <strong>Mumbai</strong> International Airport Private<br />

Limited (MIAL). This shows <strong>the</strong> clear intention of <strong>the</strong><br />

Respondents to keep <strong>the</strong> petitioner out of <strong>the</strong> affairs of <strong>the</strong><br />

<strong>Company</strong> and <strong>the</strong>reby run <strong>the</strong> same arbitrarily and in <strong>the</strong>ir own<br />

high handed manner, and for <strong>the</strong> personal benefit of <strong>the</strong><br />

respondents.<br />

8. It is fur<strong>the</strong>r submitted that <strong>the</strong> respondents have unauthorizedly<br />

and illegally created charge on all <strong>the</strong> assets of <strong>the</strong><br />

<strong>Company</strong> without sanctioning <strong>the</strong> same in any general meeting.<br />

Fur<strong>the</strong>r, <strong>the</strong> remuneration to R2 was significantly increased from<br />

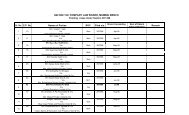

<strong>the</strong> year 2005 to 2008 as follows:<br />

CP 118/2009<br />

Cambata

12<br />

For <strong>the</strong> year 2005 - Rs.27,46,667/-<br />

For <strong>the</strong> year 2006 - Rs.36,66,667/-<br />

For <strong>the</strong> year 2007 – Rs.95,50,000/-<br />

For <strong>the</strong> year 2008 – Rs.1,39,60,000/-<br />

The petitioner has not received any notice of any meeting of <strong>the</strong><br />

<strong>Board</strong> of Directors in which <strong>the</strong> increase in remuneration to <strong>the</strong><br />

directors and parties having a significant interest has been<br />

discussed and/or resolution was passed. The audited accounts for<br />

<strong>the</strong> year 2008 show that an amount of Rs.8,66,50,000/- was<br />

received as loan from a related party. The petitioner is not aware<br />

of any such transaction, being sanctioned in any General Meeting<br />

or General Body. In order to hide this transaction from <strong>the</strong><br />

petitioner <strong>the</strong> respondents deliberately have not provided <strong>the</strong><br />

Minutes of any General Meeting held after March, 10, 2006. It is<br />

fur<strong>the</strong>r submitted that from a search conducted by <strong>the</strong> petitioner on<br />

<strong>the</strong> Internet he for <strong>the</strong> first time learnt that <strong>the</strong> respondents are in<br />

<strong>the</strong> process of incorporating several new companies, some of<br />

which are narrated below:<br />

a, Cambata Aviation Ground Handling Services<br />

<strong>Mumbai</strong> Private Limited. b. Cambata Aviation Ground<br />

Handling Services Delhi Private Limited. c. Cambata<br />

Menzies (Delhi) Handling Private Limited.<br />

CP 118/2009<br />

Cambata

13<br />

9. He fur<strong>the</strong>r submitted that though <strong>the</strong> <strong>Company</strong> has been<br />

making profits over <strong>the</strong> years, <strong>the</strong> petitioner as a shareholder not<br />

received any dividends since 2000 till date. It is also learnt that <strong>the</strong><br />

R1 and Mr.R.C.Shah, are party to criminal complaint filed by one<br />

M/s.Chakshu Enterprises. This has not just exposed <strong>the</strong> R3 and<br />

Mr.R.C.Shah being criminally prosecuted but has also exposed <strong>the</strong><br />

o<strong>the</strong>r directors including <strong>the</strong> petitioner to a potential criminal<br />

liability. In order to hide <strong>the</strong>ir own wrongful, unauthorized and<br />

illegal acts, <strong>the</strong> respondents are restraining <strong>the</strong> petitioner to take<br />

part in <strong>the</strong> affairs of R1. Fur<strong>the</strong>r, <strong>the</strong> respondents do not want <strong>the</strong><br />

petitioner to take part and or get involved in <strong>the</strong> affairs of <strong>the</strong><br />

<strong>Company</strong> and for such o<strong>the</strong>r reasons and/or malafide intentions<br />

best known to <strong>the</strong>m. The same is evident from <strong>the</strong> following<br />

events:<br />

(i) Non production of documents<br />

(ii) Non disclosure of information<br />

(iii) Resistance from attending <strong>the</strong> office<br />

It is fur<strong>the</strong>r submitted that this <strong>Bench</strong> restrained <strong>the</strong> respondents<br />

from removal of petitioner from <strong>the</strong> post of directorship.<br />

The R2 and R4 are residing in <strong>the</strong> United States of America. The<br />

R3 resides in New Zealand. None of <strong>the</strong> o<strong>the</strong>r directors are<br />

personally present on a day to day basis in India to conduct <strong>the</strong><br />

affairs of <strong>the</strong> R1. R1 predominantly conducts its business in India.<br />

CP 118/2009<br />

Cambata

14<br />

The business of <strong>the</strong> R1 is such that it requires <strong>the</strong> personal<br />

supervision of <strong>the</strong> management on a regular if not day to day basis.<br />

Petitioner is presently ready and willing to reside in <strong>Mumbai</strong> to<br />

manage <strong>the</strong> affairs of R1. R1 <strong>Company</strong> is a family <strong>company</strong><br />

which at all material times has been run for <strong>the</strong> benefit of <strong>the</strong><br />

members of <strong>the</strong> Cambata family. The <strong>Board</strong> meetings are to be<br />

held at <strong>the</strong> registered office of <strong>the</strong> <strong>Company</strong> and not outside India.<br />

Presently <strong>the</strong> <strong>Board</strong> Meetings are conducted outside India and <strong>the</strong><br />

petitioner has to travel thousands of kilometers which is an act of<br />

oppression. It is submitted that <strong>the</strong>re is no period of limitation to<br />

approach this <strong>Bench</strong> for <strong>the</strong> acts of oppression and<br />

mismanagement. On <strong>the</strong> point of delay in approaching this <strong>Bench</strong>,<br />

<strong>the</strong> Learned Counsel relied upon a decision reported in (1999) 35<br />

CLA page 97 (Cal) in <strong>the</strong> matter of Smt.Nupur Mitra & Anr. Vs<br />

Basubani Pvt.Ltd. & Ors. The affairs of <strong>the</strong> R1 are being<br />

conducted in a manner which is oppressive to <strong>the</strong> petitioner who is<br />

a minority shareholder and also prejudicial to <strong>the</strong> interest of <strong>the</strong><br />

<strong>Company</strong>. The various acts of oppression and mismanagement by<br />

<strong>the</strong> respondents, who are in control of <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong>,<br />

would justify an order of winding up of <strong>the</strong> <strong>Company</strong> on just and<br />

equitable grounds. However, to wind up <strong>the</strong> <strong>Company</strong> would<br />

unfairly prejudice <strong>the</strong> members of <strong>the</strong> <strong>Company</strong>. In <strong>the</strong> premises<br />

<strong>the</strong> reliefs sought in <strong>the</strong> present petition be granted.<br />

CP 118/2009<br />

Cambata

15<br />

10. The respondents have filed details reply to <strong>the</strong> petition.<br />

Shri Pradeep Sancheti, Learned Senior Counsel<br />

appearing on behalf of respondents submitted that <strong>the</strong> present<br />

petition is frivolous, misconceived and nothing but a ploy adopted<br />

by <strong>the</strong> petitioner with a malafide intention of causing harassment to<br />

<strong>the</strong> R1. The acts complained of pertain to <strong>the</strong> period 2000, 2001<br />

& 2003. It is a known fact that <strong>the</strong> parties live in abroad and <strong>the</strong><br />

petitioner is aware of <strong>the</strong> business all along but suddenly woke up<br />

and alleging <strong>the</strong> acts of <strong>the</strong> R1 <strong>Company</strong> after eight years. The<br />

reliefs which are sought are general and in respect of <strong>the</strong> events<br />

occurred ten years ago. It is an admitted fact that <strong>the</strong> R1 <strong>Company</strong><br />

was promoted by late Mr.Kershi Cambata, i.e. <strong>the</strong> fa<strong>the</strong>r of <strong>the</strong><br />

petitioner and R2 and 4. The day to day affairs of R1 were<br />

managed by R2 & 3 along with Mr.Kershi Cambata who was<br />

based in USA till his death on 10 th May, 2008. After his demise,<br />

R2 & 3 are managing <strong>the</strong> affairs of <strong>the</strong> R1. Petitioner admittedly<br />

residing in Switzerland for <strong>the</strong> last few years, has never shown any<br />

inclination to participate in <strong>the</strong> affairs of R1. Pursuant to<br />

introduction of Ground Handling Policy in 2007, it became<br />

necessary for <strong>the</strong> survival of R1 to negotiate with third parties<br />

(Menzies and/or Krystal) for creating strategic alliances/joint<br />

ventures. This was perceived by <strong>the</strong> petitioner as an opportunity to<br />

CP 118/2009<br />

Cambata

16<br />

interfere in <strong>the</strong> affairs of R1. The petitioner has been attempting to<br />

jeopardize <strong>the</strong> business interests of R1 by causing prejudice in <strong>the</strong><br />

minds of third parties and instigating <strong>the</strong> employees of <strong>the</strong> R1.<br />

Instigation of employee and disruption of <strong>the</strong> joint ventures with<br />

Menzies and/or Krystal is nothing but a ploy adopted by <strong>the</strong><br />

petitioner to settle personal disputes with <strong>the</strong> o<strong>the</strong>r shareholders<br />

and directors of <strong>the</strong> R1. After <strong>the</strong> R1 offered inspection of <strong>the</strong><br />

corporate records to <strong>the</strong> petitioner, a meeting of <strong>the</strong> <strong>Board</strong> of<br />

Directors was held on 26 th August , 2009 in London. The<br />

petitioner was admittedly in London at <strong>the</strong> relevant time, however,<br />

he failed and/or neglected to attend <strong>the</strong> said meeting. Thereafter,<br />

on or around 30 th November, 2009 <strong>the</strong> R1 with a view to amicably<br />

resolve <strong>the</strong> differences between <strong>the</strong> petitioner and his family<br />

members, in good faith offered <strong>the</strong> petitioner <strong>the</strong> position of<br />

“Station Manager, Chennai Airport”. The petitioner however<br />

nei<strong>the</strong>r visited <strong>the</strong> Chennai station nor took an active role in<br />

performing <strong>the</strong> duties of said position. Save and except<br />

participating in very few <strong>Board</strong> meetings, that too upto <strong>the</strong> year<br />

2001, has never actively or o<strong>the</strong>rwise participated in <strong>the</strong><br />

management and/or affairs of R1. The petitioner has no cause of<br />

action for filing <strong>the</strong> present petition. He is questioning <strong>the</strong> acts of<br />

<strong>the</strong> <strong>Company</strong> conducted in <strong>the</strong> year 2000 which is illegal, void and<br />

non-est after a period of 10 years despite <strong>the</strong> fact that he was very<br />

CP 118/2009<br />

Cambata

17<br />

much a party to such acts i.e. resolution passed at <strong>the</strong> meeting of<br />

<strong>Board</strong> of Directors which was duly attended by <strong>the</strong> petitioner. The<br />

alleged cause of action is not continuing as claimed by <strong>the</strong><br />

petitioner and <strong>the</strong>refore <strong>the</strong> petition is required to be dismissed on<br />

<strong>the</strong> ground of limitation alone. The petitioner was never interested<br />

in participating in <strong>the</strong> affairs of <strong>the</strong> R1. Therefore he migrated<br />

initially to USA in <strong>the</strong> year 2000 and <strong>the</strong>reafter to Switzerland<br />

where he is currently residing. The petitioner may be called upon<br />

to produce his passport <strong>before</strong> this <strong>Bench</strong> in order to ascertain as to<br />

how many times he visited India during <strong>the</strong> period from January,<br />

2000 till filing of <strong>the</strong> present petition. Any dispute amongst <strong>the</strong><br />

petitioner and R2 & R3, should not be permitted to affect smooth<br />

and efficient functioning of R1. In any event <strong>the</strong> petitioner is<br />

questioning <strong>the</strong> allotment of or transfer of shares in favour of R2<br />

from <strong>the</strong> period 2000 onwards when in fact he was personally<br />

present during <strong>the</strong> meeting of <strong>the</strong> <strong>Board</strong> of Directors which<br />

approved such transfer/allotment. R1 has not signed any joint<br />

venture agreement with Menzies Aviation Plc (Menzies).<br />

11. It is fur<strong>the</strong>r submitted that on 28 th Sept.,2007 <strong>the</strong><br />

Government of India issued a circular titled “Grant of permission”<br />

for providing ground handling services at airports o<strong>the</strong>r than that<br />

belonging to <strong>the</strong> Airports Authority of India (Ground Handling<br />

CP 118/2009<br />

Cambata

18<br />

Policy). Vide ground handling policy, <strong>the</strong> Government of India<br />

decided that <strong>the</strong> ground handling services at <strong>the</strong> airports o<strong>the</strong>r than<br />

those belonging to <strong>the</strong> Airport Authority of India can be<br />

undertaken by <strong>the</strong> following entities only:<br />

i) The airport operator itself or its joint venture partner;<br />

ii) Subsidy companies of <strong>the</strong> national carrier i.e.<br />

National Aviation <strong>Company</strong> of India Limited or o<strong>the</strong>r joint<br />

ventures specialized in ground handling services. Due to <strong>the</strong><br />

Ground Handling Policy per force, R1 was required to identify a<br />

joint venture partner for conducting <strong>the</strong> operations in <strong>Mumbai</strong> and<br />

Delhi airports and, <strong>the</strong>refore, R1 engaged in discussions with<br />

Menzies for a potential joint venture. However, no definitive joint<br />

venture agreement was ever executed with Menzies and <strong>the</strong> same<br />

is <strong>the</strong> position even today. The petitioner despite notice, did not<br />

participate in <strong>the</strong> meeting of <strong>the</strong> <strong>Board</strong> of Directors of R1 and<br />

never raised any objection or aired his grievances against <strong>the</strong><br />

formation of a joint venture with Menzies. Instead of raising <strong>the</strong><br />

issue in <strong>the</strong> <strong>Board</strong> Meeting, <strong>the</strong> petitioner in a high handed manner<br />

in a complete breach of his duties to R1 addressed a<br />

communication dated 13 th July, 2009 directly to Menzies and tried<br />

to derail <strong>the</strong> ongoing negotiations with Menzies for a potential<br />

joint venture. Despite getting <strong>the</strong> due notice of <strong>the</strong> meeting of <strong>the</strong><br />

<strong>Board</strong> of Directors held in London, on 26 th August, 2009, <strong>the</strong><br />

CP 118/2009<br />

Cambata

19<br />

petitioner visited London and met o<strong>the</strong>r directors of R1, but chose<br />

to remain absent in <strong>the</strong> meeting of <strong>the</strong> <strong>Board</strong> of Directors. The<br />

conduct of <strong>the</strong> petitioner itself suggests that he has no concern<br />

about <strong>the</strong> affairs of R1. Admittedly, <strong>the</strong> petitioner resides in<br />

Switzerland and it is more convenient for him to travel to London<br />

in order to attend <strong>the</strong> <strong>Board</strong> Meeting than to travel all <strong>the</strong> way to<br />

<strong>Mumbai</strong> which in any case <strong>the</strong> petitioner rarely does, as can be<br />

ascertained from his passport. He fur<strong>the</strong>r confirmed that <strong>the</strong>re was<br />

no joint venture agreement between R1 and Menzies and <strong>the</strong><br />

allegations made by <strong>the</strong> petitioner that Technical Management<br />

Service Agreement amounts to a joint venture agreement is<br />

nothing but a figment of imagination. The document referred to in<br />

paragraph 8(g)(j) of <strong>the</strong> petition, is merely a Letter of Intent by<br />

virtue of which no rights and/or liabilities were created qua <strong>the</strong> R1<br />

and it was signed by one Sarosh Contractor as authorized signatory<br />

of <strong>the</strong> R1. However, he was inadvertently referred to as a director<br />

on <strong>the</strong> said letter of intent which in any case was not acted upon by<br />

ei<strong>the</strong>r party and was treated as null and void. It is fur<strong>the</strong>r<br />

submitted that R1 never insisted on holding <strong>the</strong> meeting of <strong>the</strong><br />

<strong>Board</strong> of Directors in <strong>the</strong> Bahamas to make it convenient for <strong>the</strong><br />

petitioner to attend <strong>the</strong> same. Since <strong>the</strong> petitioner resides in<br />

Switzerland, it is more convenient for him to travel to Bahamas<br />

than travel to India to attend <strong>the</strong> <strong>Board</strong> Meeting. In any event <strong>the</strong><br />

CP 118/2009<br />

Cambata

20<br />

R1 had offered to reimburse reasonable travel and o<strong>the</strong>r expenses<br />

of <strong>the</strong> petitioner for attending <strong>the</strong> said <strong>Board</strong> Meeting.<br />

12. He submitted that <strong>the</strong> authorized share capital of <strong>the</strong><br />

<strong>Company</strong> was duly increased from time to time and it was within<br />

<strong>the</strong> knowledge of <strong>the</strong> petitioner. The petitioner was aware of <strong>the</strong><br />

fact that <strong>the</strong> paid up share capital of <strong>the</strong> <strong>Company</strong> was required to<br />

be increased from time to time by issuing fresh shares to <strong>the</strong><br />

relevant shareholders. The meeting of <strong>Board</strong> of Directors of R1<br />

dated 3 rd July, 2000 which was attended by <strong>the</strong> petitioner, a<br />

resolution for increase of share capital of R1 was unanimously<br />

passed by <strong>the</strong> <strong>Board</strong>. Even in <strong>the</strong> meeting of <strong>the</strong> <strong>Board</strong> of Directors<br />

held on 17 th Sept., 2001 wherein <strong>the</strong> paid up share capital of R1<br />

was again increased, <strong>the</strong> petitioner was very much present and<br />

never objected to <strong>the</strong> same. Thereafter, <strong>the</strong> petitioner has never<br />

attended any of <strong>the</strong> meetings of <strong>the</strong> <strong>Board</strong> of Directors or general<br />

meetings of <strong>the</strong> R1 as he was not at all concerned about <strong>the</strong> affairs<br />

of <strong>the</strong> R1. Transfer of shares from Kershi Cambata to R2 was<br />

affected during <strong>the</strong> life time of Mr.Kershi Cambata, <strong>the</strong>refore <strong>the</strong><br />

petitioner has no right to question such transfer which was carried<br />

out as per <strong>the</strong> desire of Mr.Kershi Cambata. As per Article 55 of<br />

<strong>the</strong> Articles of Association of <strong>the</strong> R1, any transfer of shares made<br />

by a member to his near relative, in <strong>the</strong> present case his son i.e. R2<br />

CP 118/2009<br />

Cambata

21<br />

was outside <strong>the</strong> purview of <strong>the</strong> right of preemption available to<br />

o<strong>the</strong>r shareholders by virtue of Article 46 of <strong>the</strong> Articles of<br />

Association. In <strong>the</strong> present case <strong>the</strong> petitioner by not objecting to<br />

issue of fresh shares to a particular shareholder to <strong>the</strong> exclusion of<br />

all o<strong>the</strong>rs has waived <strong>the</strong> qualified right available under Article 74<br />

of <strong>the</strong> Articles of Association of <strong>the</strong> R1. The petitioner having<br />

participated in <strong>the</strong> meeting is now acquiescent to raise <strong>the</strong> issue.<br />

On <strong>the</strong> point of waiver and acquiescence, <strong>the</strong> Learned Senior<br />

Counsel relied upon <strong>the</strong> following judgements:<br />

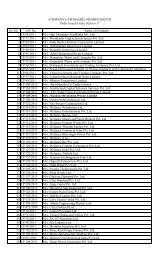

1) (1969) 1 SCR Page 807 In <strong>the</strong> matter of Maharashtra<br />

State Road Transport Corporation Vs Shri Balwant Regular<br />

Motor Service Amaravati & Ors.<br />

2) AIR 1995 SC 1991 In <strong>the</strong> matter of State of Maharashtra<br />

Vs. Dingambar<br />

3) (1970) 1 SCC Page 84 Para 32 & 33 In <strong>the</strong> matter of<br />

Rabindranath Bose & Ors. Vs. The Union of India & Ors.<br />

4) (2008) 146 <strong>Company</strong> Cases 314 (CLB) In <strong>the</strong> matter of<br />

Lilly Uppal Vs Shiva Cemetech Pvt.Ltd. & Ors.<br />

The petitioner is raising all issues after <strong>the</strong> death of <strong>the</strong> fa<strong>the</strong>r<br />

which are after thought. It is fur<strong>the</strong>r submitted that Mr.R.C.Shah<br />

and Mr.Iyengar have been representing M/s. Eros Theatre and<br />

Restaurant Private Limited and M/s. Cambata Helicopters Pvt.Ltd.<br />

which are <strong>the</strong> members of <strong>the</strong> R1 in several general meetings of <strong>the</strong><br />

CP 118/2009<br />

Cambata

22<br />

R1 held from time to time. Mere inadvertent error of recording<br />

incorrect name of <strong>the</strong> member would not invalidate <strong>the</strong> minutes of<br />

<strong>the</strong> general meeting, <strong>the</strong>ir resolutions and <strong>the</strong> o<strong>the</strong>r business<br />

conducted at such general meetings. He submitted that on <strong>the</strong> one<br />

hand <strong>the</strong> petitioner is alleging that charge on all <strong>the</strong> assets of <strong>the</strong><br />

<strong>Company</strong> has been created by <strong>the</strong> respondents, on <strong>the</strong> o<strong>the</strong>r hand<br />

<strong>the</strong> petitioner has failed to produce any of <strong>the</strong> documents under<br />

which such alleged charge has been created. Fur<strong>the</strong>r, <strong>the</strong><br />

remuneration to <strong>the</strong> Directors/Officers of R1 is in accordance with<br />

<strong>the</strong> Articles of Association of <strong>the</strong> <strong>Company</strong>. The increase in <strong>the</strong><br />

remuneration from time to time was approved by <strong>the</strong> <strong>Board</strong> of<br />

Directors of <strong>the</strong> R1. The petitioner was not entitled to receive any<br />

notice of <strong>the</strong> Meeting of <strong>Board</strong> of Directors as he was out of India<br />

and in any case he was not concerned about <strong>the</strong> affairs of <strong>the</strong> R1<br />

ever since he left India in <strong>the</strong> year 2000. R1 is being managed in<br />

most professional and profitable manner. R1 is not involved in any<br />

criminal activities as alleged by <strong>the</strong> petitioner. The proceedings<br />

referred to in para 13 of <strong>the</strong> petition are currently pending <strong>before</strong><br />

<strong>the</strong> competent court and are being duly defended by R1 and no<br />

finding of guilt has been rendered against <strong>the</strong> R1 and <strong>the</strong> matter is<br />

presently sub-judice. The conduct of <strong>the</strong> petitioner is causing<br />

immense loss and prejudice. Hence <strong>the</strong> petition deserves to be<br />

CP 118/2009<br />

Cambata

23<br />

dismissed with exemplary costs. In support of his contentions <strong>the</strong><br />

Learned Senior Counsel relied upon <strong>the</strong> following citations:<br />

1) (1986) 1 SCC 264 In <strong>the</strong> matter of LIC of India Vs<br />

Escorts Ltd. & Ors.<br />

2) AIR 1965 SC 1535 In <strong>the</strong> matter of Shantiprasad Jain<br />

Vs. Kalinga Tubes Ltd..<br />

13. The petitioner filed rejoinder and denied <strong>the</strong> statements<br />

and contents made in <strong>the</strong> counter affidavit and reiterated <strong>the</strong> stand<br />

made in <strong>the</strong> petition. The respondents also filed sur-rejoinder and<br />

denied <strong>the</strong> averments made in <strong>the</strong> rejoinder.<br />

14. Heard <strong>the</strong> Learned Counsel appeared for <strong>the</strong> respective<br />

parties at a length and perused <strong>the</strong> pleadings, documents and<br />

citations relied upon by <strong>the</strong>m. Upon hearing <strong>the</strong>m <strong>the</strong> following<br />

issues are felt for consideration and <strong>the</strong> same are need to be<br />

addressed:<br />

1) Whe<strong>the</strong>r <strong>the</strong> enhancement of shareholding and<br />

allotment of shares to <strong>the</strong> respondents are legal and valid?<br />

2) Whe<strong>the</strong>r entering into joint venture with Menzies<br />

by <strong>the</strong> Respondents has any adverse impact to <strong>the</strong> interest of<br />

<strong>the</strong> petitioner and o<strong>the</strong>r shareholders?<br />

3) Whe<strong>the</strong>r <strong>the</strong> respondents have given full<br />

inspection of <strong>the</strong> statutory records to <strong>the</strong> petitioner.<br />

4) To what relief?<br />

CP 118/2009<br />

Cambata

24<br />

Now I deal with <strong>the</strong> issue No.1<br />

The grievance of <strong>the</strong> petitioner that <strong>the</strong> respondents have increased<br />

<strong>the</strong> capital of <strong>the</strong> <strong>Company</strong> and allotted <strong>the</strong> shares to <strong>the</strong><br />

respondents without allotting to him, <strong>the</strong>reby violated <strong>the</strong> Articles<br />

of Association and sought declaration that <strong>the</strong> EOGMs held on<br />

25.4.2000 and 3.7.2000 are illegal and void. It is contended that<br />

<strong>the</strong> minutes of <strong>the</strong> meetings have been fabricated and no procedure<br />

was followed, hence <strong>the</strong> said meetings are bad and illegal. The<br />

stand of <strong>the</strong> respondents that <strong>the</strong> petitioner challenging <strong>the</strong><br />

allotments made in <strong>the</strong> year 2000 after a lapse of more than eight<br />

years, hence <strong>the</strong> petition is barred by limitation and <strong>the</strong> petitioner<br />

does not have <strong>the</strong> locus-standee to challenge <strong>the</strong> same since <strong>the</strong><br />

allotment of shares done when <strong>the</strong> fa<strong>the</strong>r of <strong>the</strong> petitioner and <strong>the</strong><br />

2 nd respondent was alive and <strong>the</strong> petitioner is full aware of <strong>the</strong><br />

facts. The petitioner has enclosed <strong>the</strong> copy of <strong>the</strong> minutes of <strong>the</strong><br />

EOGM dated 25.4.2000. In <strong>the</strong> said EOGM <strong>the</strong> Authorised<br />

Capital of <strong>the</strong> <strong>Company</strong> has been increased from Rs.12,50,00,000/-<br />

to Rs.15,00,00,000/- and empowered <strong>the</strong> <strong>Board</strong> to issue/offer and<br />

allot <strong>the</strong> equity shares of aggregate amount not exceeding Rs.3<br />

crores to <strong>the</strong> members. Thereafter, ano<strong>the</strong>r EOGM was held and<br />

conducted on 3.7.2000 and in <strong>the</strong> said EOGM <strong>the</strong> Authorised<br />

Capital of <strong>the</strong> <strong>company</strong> was increased from Rs.15 crores to<br />

Rs.21.50 crores and empowered <strong>the</strong> <strong>Board</strong> to issue, allot <strong>the</strong> shares<br />

CP 118/2009<br />

Cambata

25<br />

to <strong>the</strong> members. From <strong>the</strong> perusal of records <strong>the</strong> said increase and<br />

allotment of shares have been recorded and approved in <strong>the</strong><br />

subsequent <strong>Board</strong> Meetings and <strong>the</strong> same has been shown in <strong>the</strong><br />

Annual Returns filed by <strong>the</strong> <strong>Company</strong>. The petitioner himself<br />

admits that he is a shareholder and director of <strong>the</strong> <strong>Company</strong> and<br />

took active participation in <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong> till 2000.<br />

From <strong>the</strong> minutes of <strong>the</strong> general meetings from <strong>the</strong> year 1994, it is<br />

evident that <strong>the</strong> petitioner was present. It is also admitted by <strong>the</strong><br />

petitioner that he shifted to London, <strong>the</strong>reafter to Switzarland.<br />

From <strong>the</strong> minutes of <strong>the</strong> EOGM it is evident that it is not for <strong>the</strong><br />

first time <strong>the</strong> Authorised Capital of <strong>the</strong> <strong>Company</strong> was increased<br />

only on 25.4.2000 and 3.7.2000. The Authorised Capital of <strong>the</strong><br />

<strong>Company</strong> was increased in <strong>the</strong> EOGM held on 4.12.1995 from<br />

Rs.2 crores to Rs.5 crores and in <strong>the</strong> said meeting <strong>the</strong> petitioner<br />

was present. Thereafter, <strong>the</strong> capital was fur<strong>the</strong>r increased from<br />

Rs.5 crores to Rs.7.50 crores in <strong>the</strong> EOGM held on 30 th July, 1997<br />

and <strong>the</strong> petitioner was present at that meeting. Fur<strong>the</strong>r, <strong>the</strong> capital<br />

was increased from Rs.7,50,00,000 to Rs.12,50,00,000/- in <strong>the</strong><br />

EOGM held on 12.1.1998 in which meeting <strong>the</strong> petitioner was<br />

present. Fur<strong>the</strong>r <strong>the</strong> capital was increased from Rs.12.50 crores to<br />

Rs.15 crores in <strong>the</strong> EOGM held on 25.4.2000 and fur<strong>the</strong>r <strong>the</strong><br />

capital was increased from Rs.15 crores to Rs.21.50 crores in <strong>the</strong><br />

EOGM held on 3.7.2000. The Annual Returns filed by <strong>the</strong><br />

CP 118/2009<br />

Cambata

26<br />

<strong>Company</strong> for <strong>the</strong> years 2003-2004, 2004-2005, 2005-2006 and<br />

2006-2007. The increased capital of <strong>the</strong> <strong>Company</strong> was shown and<br />

<strong>the</strong> petitioner’s shares shown as 38,749 for all <strong>the</strong> years. The<br />

petitioner himself stated that he is not actively participated after<br />

2000. From <strong>the</strong> records it is clear that whatever decision taken by<br />

<strong>the</strong> <strong>Company</strong> is on record and has been reflected in <strong>the</strong> statutory<br />

records and with <strong>the</strong> statutory authorities. Once <strong>the</strong> documents are<br />

filed with <strong>the</strong> statutory authorities, <strong>the</strong>y become <strong>the</strong> public<br />

documents. Having non participation in <strong>the</strong> affairs of <strong>the</strong><br />

<strong>Company</strong> , it is not fault of <strong>the</strong> respondents. Moreover, <strong>the</strong><br />

decisions have been taken during <strong>the</strong> life time of his fa<strong>the</strong>r, who<br />

was <strong>the</strong> Chairman of <strong>the</strong> <strong>Company</strong>. I do not find any illegality in<br />

increase of Authorised Capital and allotment of shares. The<br />

petitioner is acquiescent with <strong>the</strong> acts. It is contended by <strong>the</strong><br />

petitioner that <strong>the</strong> said increase in shareholding is ultra vires of<br />

Article 74 of <strong>the</strong> Articles of Association. As per <strong>the</strong> said article,<br />

<strong>the</strong> new shares will be offered on a pro-rata basis. However, <strong>the</strong><br />

petitioner contended that <strong>the</strong> said article was violated and <strong>the</strong><br />

shares were allotted to <strong>the</strong> 2 nd respondent and o<strong>the</strong>rs. It is relevant<br />

to extract <strong>the</strong> Article for better appreciation. The Article expressly<br />

provides that “subject to Article 54 and subject to any discretion to<br />

<strong>the</strong> contrary, that may be given by <strong>the</strong> meeting that sanctions <strong>the</strong><br />

increase of capital, all new shares shall be offered to <strong>the</strong> members<br />

CP 118/2009<br />

Cambata

27<br />

in proportion to <strong>the</strong> existing equity shares held by <strong>the</strong>m and such<br />

offer shall be made by notice specifying <strong>the</strong> number of shares to<br />

which <strong>the</strong> member is entitled and limited a time within which <strong>the</strong><br />

offer if not accepted will be deemed to be declined and after <strong>the</strong><br />

expiration of such time, or on receipt of an intimation from <strong>the</strong><br />

member to whom such notice is given, that he declines to accept<br />

<strong>the</strong> shares offered, <strong>the</strong> directors may dispose off <strong>the</strong> same in such<br />

manner as <strong>the</strong>y think most beneficial to <strong>the</strong> <strong>Company</strong>.” From <strong>the</strong><br />

plain reading of <strong>the</strong> Article, it is clear that if <strong>the</strong> EOGM approves<br />

<strong>the</strong> increase of authorized capital and empowers <strong>the</strong> <strong>Board</strong> to allot<br />

<strong>the</strong> shares to <strong>the</strong> members in absolute discretion, it can do so. In<br />

both <strong>the</strong> EOGMs <strong>the</strong> resolutions were passed empowering <strong>the</strong><br />

<strong>Board</strong> to take decision. The <strong>Board</strong> has taken decision accordingly.<br />

I do not find any violation of articles. The <strong>Company</strong> also<br />

transferred 38,000 shares from <strong>the</strong> fa<strong>the</strong>r of <strong>the</strong> petitioner to <strong>the</strong> 2 nd<br />

respondent and <strong>the</strong> same was approved by <strong>the</strong> <strong>Board</strong> of Directors<br />

in <strong>the</strong> meeting held on 27 th Feb., 2000. The issue is answered<br />

accordingly.<br />

Now I deal with <strong>the</strong> Issue No.2<br />

It is contended by <strong>the</strong> petitioner that <strong>the</strong> Respondents<br />

have without <strong>the</strong> knowledge of <strong>the</strong> petitioner entered into Joint<br />

Ventures agreement with <strong>the</strong> Menzies. The petitioner through his<br />

CP 118/2009<br />

Cambata

28<br />

advocate addressed letter dated 13.7.2009 to <strong>the</strong> Menzies Aviation<br />

wherein it is stated that <strong>the</strong>y learnt that <strong>the</strong> Menzies Aviation is<br />

negotiating to enter with some arrangement with <strong>the</strong> <strong>Company</strong> for<br />

acquiring its business or purchasing <strong>the</strong> shares to <strong>the</strong> existing<br />

shareholders. It is stated in <strong>the</strong> letter that no person has been<br />

authorized to negotiate with <strong>the</strong> Menzies. From <strong>the</strong> documents<br />

filed by <strong>the</strong> petitioner it is evident that <strong>the</strong>re was lot of<br />

correspondence between <strong>the</strong> petitioner’s advocate and <strong>the</strong><br />

respondent’s advocate. The respondent <strong>company</strong> vide <strong>the</strong>ir letter<br />

dated 16.7.2009 through <strong>the</strong>ir advocate addressed to <strong>the</strong><br />

petitioner’s advocate, where in it is denied that <strong>the</strong> <strong>Company</strong><br />

sought to enter into a joint venture agreement. It was stated that <strong>the</strong><br />

purported joint venture being referred to was, in <strong>the</strong> context of<br />

ground handling policy of <strong>the</strong> Government of India which was to<br />

come into effect on 1.1.2009. It was stated that <strong>the</strong> said policy<br />

was made to known to <strong>the</strong> officers and <strong>the</strong> directors of <strong>the</strong><br />

<strong>company</strong> and petitioner had full knowledge of <strong>the</strong> same and<br />

refused to attend <strong>the</strong> <strong>Board</strong> Meeting wherein due authority was<br />

conferred on R2 in that regard. The respondents have categorically<br />

stated in <strong>the</strong> reply that <strong>the</strong> proposal for joint venture became<br />

necessary in view of <strong>the</strong> impending policy of <strong>the</strong> Government of<br />

India . It is also stated by <strong>the</strong> respondents that <strong>the</strong> bids have not<br />

been processed and <strong>the</strong>refore, <strong>the</strong>re is no proposal for <strong>the</strong> joint<br />

CP 118/2009<br />

Cambata

29<br />

venture with <strong>the</strong> Menzies and <strong>the</strong>, Respondent No.1 <strong>company</strong> has<br />

not entered into JV with Menzies Aviation and <strong>the</strong> said JV has<br />

come to an end. In view of <strong>the</strong> categorical statement made by <strong>the</strong><br />

respondents that <strong>the</strong> joint venture come to an end and I do not find<br />

it fit to consider to go into <strong>the</strong> details of this issue in view of <strong>the</strong><br />

above and <strong>the</strong>re is no necessity to give any finding.<br />

Now I deal with <strong>the</strong> issue No.3 & 4.<br />

The petitioner alleges that <strong>the</strong> respondents have not provided <strong>the</strong><br />

inspection of <strong>the</strong> statutory records inspite of <strong>the</strong> order of this<br />

<strong>Bench</strong>. There was sequence of correspondence between <strong>the</strong><br />

petitioner and <strong>the</strong> respondents with regard to <strong>the</strong> inspection of <strong>the</strong><br />

documents. In one of <strong>the</strong> letters of <strong>the</strong> petitioner, it has been stated<br />

that in compliance of <strong>the</strong> order dated 22.10.2009 made by this<br />

<strong>Bench</strong>, <strong>the</strong> petitioner recorded receipt of documents in detail. It<br />

also recorded that <strong>the</strong> respondents have not furnished <strong>the</strong><br />

documents forming part of exhibit ‘D’. The respondents have<br />

categorically stated that <strong>the</strong> statutory records are available at <strong>the</strong><br />

registered office of <strong>the</strong> <strong>Company</strong> for inspection and it is also stated<br />

that <strong>the</strong> Annual Returns including directors’ report, profit & loss<br />

account, balance sheet of <strong>the</strong> <strong>Company</strong>, were filed with <strong>the</strong><br />

Registrar of Companies, on a year to year basis and <strong>the</strong> same are<br />

public documents. Fur<strong>the</strong>r, it is submitted that <strong>the</strong> petitioner has<br />

been given inspection of all <strong>the</strong> statutory records including <strong>the</strong><br />

CP 118/2009<br />

Cambata

30<br />

minutes of <strong>the</strong> meetings of <strong>the</strong> <strong>Board</strong> of Directors, <strong>the</strong> minutes of<br />

<strong>the</strong> AGMs, <strong>the</strong> minutes of <strong>the</strong> EOGMs. From <strong>the</strong> perusal of<br />

documents it is seen that most of <strong>the</strong> documents have been filed by<br />

<strong>the</strong> petitioner himself. The petitioner being a shareholder and<br />

director of <strong>the</strong> <strong>Company</strong> is entitled to inspect <strong>the</strong> records of <strong>the</strong><br />

<strong>Company</strong>. The rights are vested in <strong>the</strong> statute itself. The o<strong>the</strong>r<br />

allegation of <strong>the</strong> petitioner is that no notices have been given for<br />

<strong>the</strong> <strong>Board</strong> Meetings and <strong>the</strong> <strong>Board</strong> Meetings have been conducted<br />

outside India and <strong>the</strong> petitioner has to travel thousands of<br />

kilometers to attend <strong>the</strong> meetings. The defense of <strong>the</strong> respondents<br />

is that <strong>the</strong> petitioner had attended earlier <strong>Board</strong> Meetings which<br />

have been held outside India and he has not raised any disputes in<br />

respect of <strong>the</strong> <strong>Board</strong> Meetings which have been conducted outside<br />

India. It is an admitted fact that <strong>the</strong> petitioner himself stated that<br />

he is now residing in Switzarland. From <strong>the</strong> documents filed by<br />

<strong>the</strong> petitioner it is evident that in <strong>the</strong> <strong>Board</strong> Meetings held from <strong>the</strong><br />

year 1994 till 1999, <strong>the</strong> petitioner was present. It presumes that <strong>the</strong><br />

petitioner had notice of <strong>the</strong> said meetings. It appears that some of<br />

<strong>the</strong> meetings have been held at <strong>the</strong> registered office of <strong>the</strong><br />

<strong>Company</strong> in which <strong>the</strong> petitioner was present. It is not <strong>the</strong> case of<br />

<strong>the</strong> petitioner that <strong>the</strong> notices have not been given since he become<br />

a director. From <strong>the</strong> documents it is evident that <strong>the</strong> petitioner was<br />

present in <strong>the</strong> <strong>Board</strong> Meeting held on 27.2.2000 which was held at<br />

CP 118/2009<br />

Cambata

31<br />

London. In <strong>the</strong> said <strong>Board</strong> meeting <strong>the</strong> transfer of 38,000 equity<br />

shares in favour of R2 has been approved. Fur<strong>the</strong>r, <strong>the</strong> petitioner<br />

was also present in <strong>the</strong> <strong>Board</strong> meetings held on 2.6.2000 at<br />

Virginia and also <strong>the</strong> <strong>Board</strong> Meeting held on 12.7.2000 at Virginia.<br />

All those meetings held outside India and <strong>the</strong> petitioner did not<br />

raise any issue of that. Thus, it is clear that <strong>the</strong> petitioner did<br />

receive <strong>the</strong> notices for <strong>the</strong> said <strong>board</strong> meetings held outside India<br />

and outside <strong>the</strong> registered office of <strong>the</strong> <strong>Company</strong>. The Learned<br />

Counsel for <strong>the</strong> petitioner relied upon <strong>the</strong> judgements to show that<br />

failure to give notice reflects a conduct lacking in probity as<br />

decided in Dr.Kamal K.Dutta Vs. Rubi General Hospitals<br />

Pvt.Ltd.. The judgements cited by <strong>the</strong> Learned Counsel for <strong>the</strong><br />

petitioner are not of much assistance to <strong>the</strong> facts of <strong>the</strong> case. The<br />

<strong>Company</strong> registered in India, however <strong>the</strong> <strong>Board</strong> meetings are held<br />

outside India. The petitioner as well o<strong>the</strong>r directors also reside<br />

outside India. As per Sec.286 (1), notice of every meeting of <strong>the</strong><br />

<strong>Board</strong> of Directors of a <strong>Company</strong> shall be given in writing to every<br />

director for <strong>the</strong> time being in India and at his usual address in India<br />

to every o<strong>the</strong>r director. According to <strong>the</strong> said provision <strong>the</strong> notice<br />

is to be given to directors who reside in India, at <strong>the</strong>ir usual address<br />

in India. In <strong>the</strong> present case all <strong>the</strong> directors reside outside India.<br />

Having attended some <strong>Board</strong> Meetings outside India, <strong>the</strong> petitioner<br />

now cannot allege that he has not received notices for <strong>the</strong> said<br />

CP 118/2009<br />

Cambata

32<br />

<strong>Board</strong> meetings and <strong>the</strong>re is no substantial evidence to prove that<br />

<strong>the</strong> notices have not been received by him. In absence of <strong>the</strong> same,<br />

I do not accept <strong>the</strong> stand of <strong>the</strong> petitioner. Fur<strong>the</strong>r, I do not find any<br />

force in <strong>the</strong> allegations of <strong>the</strong> petitioner. Hence I negate <strong>the</strong> issue.<br />

The petitioner prayed this <strong>Bench</strong> that he will look after <strong>the</strong> affairs<br />

of <strong>the</strong> <strong>Company</strong> residing in <strong>Mumbai</strong>/India on <strong>the</strong> ground that none<br />

of <strong>the</strong> directors is residing in India. The <strong>Board</strong> of Directors is<br />

competent to decide who is to manage <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong>.<br />

It is <strong>the</strong>ir exclusive domain and this <strong>Bench</strong> will not interfere in <strong>the</strong><br />

affairs of <strong>the</strong> <strong>Company</strong>. The o<strong>the</strong>r allegation of <strong>the</strong> petitioner that<br />

he was not provided <strong>the</strong> documents and he was non accessible to<br />

<strong>the</strong> records <strong>the</strong>reby he contended that <strong>the</strong> respondents have<br />

excluded him from <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong>. The petitioner<br />

being a member/shareholder and director of <strong>the</strong> <strong>Company</strong> is<br />

entitled to inspect <strong>the</strong> statutory records of <strong>the</strong> <strong>Company</strong> as per <strong>law</strong>.<br />

Mere non providing <strong>the</strong> copies of documents and non accessible to<br />

records does not imply that he was excluded from <strong>the</strong> affairs of <strong>the</strong><br />

<strong>Company</strong>. Prior to 2009 <strong>the</strong>re is no iota of evidence that he wanted<br />

to inspect <strong>the</strong> records and <strong>the</strong> respondents have refused <strong>the</strong> same.<br />

Fur<strong>the</strong>r, <strong>the</strong> petitioner alleged that he was not paid dividend inspite<br />

of <strong>the</strong> fact that <strong>the</strong> <strong>Company</strong> is making profits. This allegation has<br />

come for <strong>the</strong> first time in <strong>the</strong> petition. It is for <strong>the</strong> <strong>Board</strong> to decide<br />

and declare <strong>the</strong> dividend to its shareholders. This <strong>Bench</strong> will not<br />

CP 118/2009<br />

Cambata

33<br />

interfere in <strong>the</strong> matter of dividend. Thus, <strong>the</strong> issue 3 & 4 answered<br />

accordingly. On <strong>the</strong> overall, <strong>the</strong> petitioner has not made out any<br />

case ei<strong>the</strong>r on oppression or mismanagement and <strong>the</strong> petition is<br />

liable to be dismissed. Accordingly, <strong>the</strong> petition is dismissed. No<br />

orders as to costs. All <strong>the</strong> interim orders stand vacated and all <strong>the</strong><br />

applications stand disposed off.<br />

15. The Learned Counsel for <strong>the</strong> petitioner relied upon <strong>the</strong><br />

following citations. Now I deal with <strong>the</strong> same.<br />

In <strong>the</strong> matter of Navin R.Shah, (supra) <strong>the</strong> CLB was of<br />

<strong>the</strong> view that <strong>the</strong>re was no attendance register to substantiate that<br />

<strong>the</strong> petitioner was present in <strong>the</strong> meeting. However, in <strong>the</strong> present<br />

case <strong>the</strong> challenge to <strong>the</strong> allotment was made in <strong>the</strong> year 2009<br />

pertains to <strong>the</strong> year 2000 and <strong>the</strong> petitioner is aware of those facts<br />

and had not challenged <strong>the</strong> same at appropriate time and <strong>the</strong> same<br />

is being under challenge belatedly and it is held that <strong>the</strong> petitioner<br />

is acquiescent of <strong>the</strong> same. Hence <strong>the</strong> said decision is not of much<br />

assistance to <strong>the</strong> facts of this case. In re: Sakal Papers, <strong>the</strong> Apex<br />

Court ordered compensation in lieu of rectification of register. The<br />

facts of that case are entirely different and are not of much<br />

assistance to <strong>the</strong> facts of this case.<br />

In <strong>the</strong> matter of Tara Properties, it was <strong>the</strong> case of <strong>the</strong><br />

petitioners that <strong>the</strong> respondents acted with an object to grab control<br />

CP 118/2009<br />

Cambata

34<br />

of <strong>Company</strong> and its assets and properties. In <strong>the</strong> present case,<br />

<strong>the</strong>re is no such case made out by <strong>the</strong> petitioner that <strong>the</strong><br />

respondents try to grab <strong>the</strong> <strong>Company</strong>. Hence <strong>the</strong> said decision is<br />

not applicable. The o<strong>the</strong>r citations relied upon by <strong>the</strong>m are on <strong>the</strong><br />

issue of notice. Since <strong>the</strong> petitioner himself admits that he is not<br />

actively participated in <strong>the</strong> affairs of <strong>the</strong> <strong>Company</strong> from 2000<br />

onwards and <strong>the</strong> respondents have categorically stated that <strong>the</strong><br />

petitioner is aware of <strong>the</strong> meetings and one of <strong>the</strong> <strong>Board</strong> Meeting<br />

held on 26.8.2009 <strong>the</strong> petitioner was present in London but did not<br />

participate. I do not see any reason that <strong>the</strong> petitioner is not aware<br />

of <strong>the</strong> <strong>Board</strong> Meetings.<br />

16. The citations relied upon by <strong>the</strong> respondents on <strong>the</strong><br />

point of acquiescence/waiver are much assistance on <strong>the</strong> legal<br />

point, more particularly, (1995) Supreme Court 1991 wherein <strong>the</strong><br />

Apex Court held that no person is entitled to obtain <strong>the</strong> equitable<br />

relief under 226 of <strong>the</strong> Constitution of India, if his conduct is<br />

blameworthy because of latches, undue delay, acquiescence,<br />

waiver and <strong>the</strong> like. As already held <strong>the</strong> petitioner is aware of <strong>the</strong><br />

facts about <strong>the</strong> allotment of shares and transfer of shares in favour<br />

of <strong>the</strong> respondents during <strong>the</strong> lifetime of fa<strong>the</strong>r of <strong>the</strong> petitioner. It<br />

is also a fact that <strong>the</strong> said allotments made in <strong>the</strong> EOGMs have<br />

been approved in <strong>the</strong> <strong>Board</strong> Meetings held later to that. It is also a<br />

fact that <strong>the</strong> <strong>Company</strong> has filed its statutory returns with <strong>the</strong><br />

CP 118/2009<br />

Cambata

35<br />

authorities, reflecting <strong>the</strong> increase of capital and allotment/transfer<br />

of shares in <strong>the</strong> year 2000. Hence, I do not accept <strong>the</strong> stand of <strong>the</strong><br />

petitioner that he knew such allotments only in <strong>the</strong> year 2009.<br />

Dated this <strong>the</strong> 16 th day of May, 2011<br />

(KANTHI NARAHARI)<br />

MEMBER<br />

CP 118/2009<br />

Cambata