Suggested Solutions to Assignment 2 - Department of Economics

Suggested Solutions to Assignment 2 - Department of Economics

Suggested Solutions to Assignment 2 - Department of Economics

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

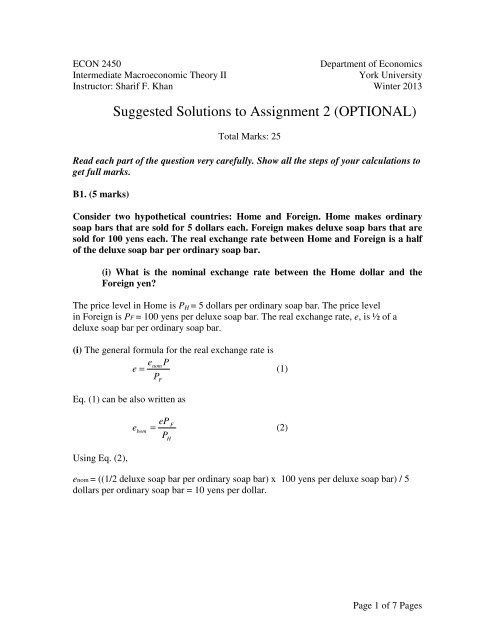

ECON 2450<br />

Intermediate Macroeconomic Theory II<br />

Instruc<strong>to</strong>r: Sharif F. Khan<br />

<strong>Department</strong> <strong>of</strong> <strong>Economics</strong><br />

York University<br />

Winter 2013<br />

<strong>Suggested</strong> <strong>Solutions</strong> <strong>to</strong> <strong>Assignment</strong> 2 (OPTIONAL)<br />

Total Marks: 25<br />

Read each part <strong>of</strong> the question very carefully. Show all the steps <strong>of</strong> your calculations <strong>to</strong><br />

get full marks.<br />

B1. (5 marks)<br />

Consider two hypothetical countries: Home and Foreign. Home makes ordinary<br />

soap bars that are sold for 5 dollars each. Foreign makes deluxe soap bars that are<br />

sold for 100 yens each. The real exchange rate between Home and Foreign is a half<br />

<strong>of</strong> the deluxe soap bar per ordinary soap bar.<br />

(i) What is the nominal exchange rate between the Home dollar and the<br />

Foreign yen?<br />

The price level in Home is P H = 5 dollars per ordinary soap bar. The price level<br />

in Foreign is PF = 100 yens per deluxe soap bar. The real exchange rate, e, is ½ <strong>of</strong> a<br />

deluxe soap bar per ordinary soap bar.<br />

(i) The general formula for the real exchange rate is<br />

enomP<br />

e = (1)<br />

P<br />

Eq. (1) can be also written as<br />

Using Eq. (2),<br />

F<br />

eP<br />

F<br />

e<br />

bom<br />

= (2)<br />

PH<br />

enom = ((1/2 deluxe soap bar per ordinary soap bar) x 100 yens per deluxe soap bar) / 5<br />

dollars per ordinary soap bar = 10 yens per dollar.<br />

Page 1 <strong>of</strong> 7 Pages

(ii) During the following year, Home has 10% domestic inflation and Foreign<br />

has 20% domestic inflation. The real exchange rate remains unchanged. At<br />

the end <strong>of</strong> the year, what has happened <strong>to</strong> the nominal exchange rate? Which<br />

country has had a nominal appreciation? Which has a nominal depreciation?<br />

Inflation in Home is π H = 10%. Inflation in Foreign is π F = 20%. The real exchange rate is<br />

constant.<br />

We can write Eq. (2) in the percentage change form as<br />

∆e<br />

e<br />

nom<br />

nom<br />

=<br />

∆e<br />

∆P<br />

+<br />

e P<br />

F<br />

F<br />

∆P<br />

−<br />

P<br />

=<br />

∆e<br />

+ π<br />

F<br />

− π<br />

e<br />

H<br />

(3)<br />

∆enom<br />

So, = 0 + 0.20 − 0.10 = 0. 10 .<br />

e<br />

nom<br />

Therefore, the nominal exchange rate (yens per dollar) has increased by 10%. The Home<br />

dollar has appreciated, the Foreign yen has depreciated.<br />

B2. (20 marks)<br />

Consider the following Keynesian small open economy:<br />

Desired Consumption: C d = 200 + 0.6( Y − T ) − 200r<br />

Desired Investment:<br />

I d = 300 − 300r<br />

Government Purchases: G = 152<br />

Taxes:<br />

T = 20 + 0. 2Y<br />

Net Exports:<br />

NX = 170 − 0.08Y<br />

− 0. 5e<br />

Real exchange rate: e = 230<br />

Real Money Demand:<br />

L = 0.5Y<br />

− 200r<br />

Money Supply M = 924<br />

Full-employment output: Y = 1000<br />

Net Fac<strong>to</strong>r Payments: NFP = 0<br />

In this economy, the real interest rate does not deviate from the foreign interest rate.<br />

a) Derive the equation for the IS curve as a function <strong>of</strong> Y and e.<br />

The equation for the IS curve is derived from the goods market equilibrium condition for<br />

an open economy, which is<br />

S<br />

d<br />

d<br />

− I = CA = NX + NFP = NX (because, NFP=0). (1)<br />

Page 2 <strong>of</strong> 7 Pages

S d = Y+NFP - C d - G = Y+0 – {200 + 0.6[Y – (20 + 0.2Y)] – 200r} –152<br />

= 0.52Y – 340 +200r<br />

So, S d = 0.52Y – 340 +200r (2)<br />

It is given that<br />

NX = 170 − 0.08Y<br />

− 0. 5e<br />

and I d = 300 − 300r<br />

.<br />

Substituting the functional forms <strong>of</strong> S d ,<br />

d<br />

I , and NX in<strong>to</strong> Eq. (1),<br />

0.52Y – 340 + 200r – (300 – 300r) = 170 – 0.08Y –0.5e.<br />

Rearranging terms and simplifying gives the IS curve:<br />

500r = 810 – 0.5e – 0.6Y<br />

810 5 6<br />

or, r = − e − Y<br />

500 5000 5000<br />

(4) [IS curve]<br />

b) Derive the equation for the LM curve as a function <strong>of</strong> Y, M and P.<br />

The equation for the LM curve is derived from the assets market equilibrium condition<br />

for an open economy, which is<br />

M/P = L (5)<br />

Substituting the given functional form <strong>of</strong> L in<strong>to</strong> Eq. (5),<br />

or,<br />

or,<br />

M/P = 0.5Y – 200r<br />

200r = -M/P +0.5Y<br />

M 5<br />

r = − Y<br />

200 P<br />

2000<br />

(6) [LM curve]<br />

c) What are the general equilibrium (that is, long-run) values <strong>of</strong> output, the real<br />

interest rate, real exchange rate, consumption, investment, net exports, and<br />

the price level? Illustrate the general equilibrium values <strong>of</strong> output and the<br />

real interest rate in the IS-LM-FE diagram.<br />

In the general equilibrium, output equals <strong>to</strong> its full-employment level, which is 1000.<br />

The given general equilibrium value <strong>of</strong> real exchange rate, e = 230.<br />

With e = 230 and Y = 1000, the IS curve (Eq. (4)) gives<br />

r =<br />

810<br />

500<br />

−<br />

5<br />

5000<br />

6<br />

5000<br />

( 230) − ( 1000) = 0. 19<br />

Page 3 <strong>of</strong> 7 Pages

So, the general equilibrium value <strong>of</strong> the real interest rate is 19%.<br />

With r = 0.19 and Y = 1000, the LM curve (Eq. (6)) gives<br />

924<br />

0 .19 = − +<br />

200P<br />

924<br />

⇒ = 2.5 − 0.19<br />

200P<br />

924<br />

⇒ P = = 2<br />

200* 2.31<br />

5<br />

( 1000)<br />

2000<br />

So, the general equilibrium value <strong>of</strong> the price level is 2.<br />

The general equilibrium value <strong>of</strong> net exports,<br />

NX = 170- 0.08*1000-0.5*230= 170 – 80 – 115 = –25.<br />

The general equilibrium value <strong>of</strong> consumption,<br />

C= 200 + 0.6(1000 – 20-0.2*1000) – 200*0.19 = 630<br />

The general equilibrium value <strong>of</strong> investment, / = 300 – 300*0.19 = 243<br />

Figure 4(c) illustrates the general equilibrium values <strong>of</strong> output and the real interest rate in<br />

the IS-LM-FE diagram.<br />

d) Starting from the initial general equilibrium, money supply is increased <strong>to</strong><br />

1024. Assuming flexible exchange rates, what are the effects <strong>of</strong> this change on<br />

output, the real interest rate, the real exchange rate, consumption,<br />

investment, and net exports in the short run? Illustrate the short-run<br />

equilibrium values <strong>of</strong> output and the real interest rate in the IS-LM-FE<br />

diagram.<br />

Start at the general equilibrium derived in part (c), where the general equilibrium real<br />

interest rate is 19%. So, by assumption, the foreign interest rate is fixed at 19% and the<br />

domestic real interest rate does not deviate from this level. That is, r = 0.19 holds at any<br />

short run or long-run equilibrium.<br />

Page 4 <strong>of</strong> 7 Pages

In the short run, the price level remains fixed at 2. M has increased <strong>to</strong> 1024. Substituting<br />

r = 0.19, M = 1024, and P=2 in<strong>to</strong> the LM curve (Eq. (6)), we get<br />

1024 5<br />

0.19 = − + Y<br />

200* 2 2000<br />

1<br />

⇒ 0.19 = −2.56<br />

+ Y<br />

400<br />

1<br />

⇒ Y = 2.75<br />

400<br />

⇒ Y = 1100.<br />

So, the short-run equilibrium value <strong>of</strong> the output is 1100 (output has increased in the<br />

short run).<br />

Substituting r = 0.19 and Y = 1100, and P=2 in<strong>to</strong> the IS curve (Eq. (4)), we get<br />

810 5 6<br />

0.19 = − e − 1100<br />

500 5000 5000<br />

⇒ 0.19 = 1.62 − 0.001e<br />

−1.32<br />

⇒ 0.001e<br />

= 0.11<br />

⇒ e = 110.<br />

So, the short-run equilibrium value <strong>of</strong> real exchange rate, e = 110 (the real exchange rate<br />

has depreciated in the short run).<br />

The short-run equilibrium value <strong>of</strong> net exports,<br />

NX = 170 - 0.08*1100 - 0.5*110 = 27 (net exports have increased in the short run).<br />

The short-run equilibrium value <strong>of</strong> consumption,<br />

C= 200 + 0.6(1100 – 20-0.2*1100) – 200*0.19 = 200 + 0.6(860)-38 = 678 (consumption<br />

has increased in the short run).<br />

The short-run equilibrium value <strong>of</strong> investment, / = 300 – 300*0.19 = 243 (investment has<br />

remained unchanged in the short run).<br />

Figure 4(d) illustrates the short-run equilibrium values <strong>of</strong> output and the real interest rate<br />

in the IS-LM-FE diagram.<br />

Page 5 <strong>of</strong> 7 Pages

e) Using the same information as provided in part (d), in the long run what<br />

would happen <strong>to</strong> output, the real interest rate, the real exchange rate,<br />

consumption, investment, net exports, the nominal money supply, the price<br />

level, and the real money supply? Illustrate the new general equilibrium (that<br />

is, new long-run) values <strong>of</strong> output and the real interest rate in the IS-LM-FE<br />

diagram.<br />

Since at the short-run equilibrium the economy is operating above the full-employment<br />

level, there is an upward pressure on the price level. In the long-run, the price level will<br />

fully adjust and output will return <strong>to</strong> its full-employment level. So, at the new general<br />

equilibrium output will be equal <strong>to</strong> 1000. Substituting r = 0.19, M = 1024, and Y=1000<br />

in<strong>to</strong> the LM curve (Eq. (6)), we get<br />

1024 5<br />

0.19 = − +<br />

200* P<br />

5.12<br />

⇒ 0.19 = − + 2.5<br />

P<br />

5.12<br />

⇒ = 2.31<br />

P<br />

⇒ P = 2.2165.<br />

(1000)<br />

2000<br />

So, the new general equilibrium value <strong>of</strong> the price level is 2.2165 (the price level will<br />

increase in the long run).<br />

In the long run the nominal money supply will remain unchanged at its new level, 1024.<br />

At the initial general equilibrium, the real money supply was 924/2 = 462. At the shortrun<br />

equilibrium, the real money supply increased <strong>to</strong> 1024/2 = 512. At the new general<br />

equilibrium, the real money supply will be 1024 / 2.2165 = 461.9896 ≈ 462.<br />

This means<br />

that in the long-run the real money supply will return <strong>to</strong> its initial level.<br />

Substituting r = 0.19 and Y = 1000 in<strong>to</strong> the IS curve (Eq. (4)), we get<br />

810 5 6<br />

0.19 = − e − 1000<br />

500 5000 5000<br />

⇒ 0.19 = 1.62 − 0.001e<br />

−1.2<br />

⇒ 0.001e<br />

= 0.23<br />

⇒ e = 230.<br />

The new general equilibrium value <strong>of</strong> real exchange rate, e = 230 (the real exchange rate<br />

will remain unchanged in the long run).<br />

The new general equilibrium value <strong>of</strong> net exports,<br />

NX = 170- 0.08*1000-0.5*230= 170 – 80 – 115 = –25 (net exports will remain<br />

unchanged in the long run).<br />

Page 6 <strong>of</strong> 7 Pages

The new general equilibrium value <strong>of</strong> consumption,<br />

C= 200 + 0.6(1000 – 20-0.2*1000) – 200*0.19 = 630 (consumption will remain<br />

unchanged in the long run).<br />

The new general equilibrium value <strong>of</strong> investment, / = 300 – 300*0.19 = 243 (investment<br />

will remain unchanged in the long run).<br />

The results <strong>of</strong> this part <strong>of</strong> the question show that the monetary neutrality holds in the<br />

Keynesian long run. Figure 4(e) illustrates the new general equilibrium values <strong>of</strong> output<br />

and the real interest rate in the IS-LM-FE diagram.<br />

Page 7 <strong>of</strong> 7 Pages