F15 Coverage - Repsource - Manulife Financial

F15 Coverage - Repsource - Manulife Financial

F15 Coverage - Repsource - Manulife Financial

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notice of Change of Insurer<br />

Thank you for applying for insurance with us.<br />

We are pleased to inform you that, on December 29, 2004, after receiving regulatory approval,<br />

The Maritime Life Assurance Company (Maritime Life) merged its business and operations with<br />

The Manufacturers Life Insurance Company (<strong>Manulife</strong> <strong>Financial</strong>). As a result, <strong>Manulife</strong> <strong>Financial</strong> has<br />

assumed all the duties, obligations and liabilities of Maritime Life’s insurance business.<br />

You have applied for insurance using a Maritime Life application form. If we issue an insurance contract<br />

in connection with this application, it will be insured by <strong>Manulife</strong> <strong>Financial</strong>. We will ask you to sign an<br />

Application Supplement when you receive the contract to confirm that you agree to this.<br />

When you receive your insurance contract, it will contain references to Maritime Life; however this does<br />

not change the fact that it is insured by <strong>Manulife</strong> <strong>Financial</strong>. Please rest assured that you will retain all the<br />

benefits under this policy that you would have had if it had been issued by Maritime Life.<br />

We are proud of our company, our mutual traditions, our history and the trust that millions of clients<br />

around the world have placed in us. We look forward to building upon the trust you have placed in<br />

Maritime Life as we come together to build the new <strong>Manulife</strong> <strong>Financial</strong>.<br />

Sincerely,<br />

Paul Rooney<br />

Executive Vice President, Individual Insurance<br />

The Manufacturers Life Insurance Company

Life Products<br />

<strong>F15</strong> <strong>Coverage</strong><br />

THE MARITIME LIFE ASSURANCE COMPANY<br />

LIFE INSURANCE

At Maritime Life we believe a solid financial plan<br />

is built one step at a time. So, we designed our<br />

<strong>F15</strong> policy to be that first important step.<br />

Guaranteed for Life<br />

Affordable, long-term protection is one of the highlights of <strong>F15</strong> with all premiums and benefits fully guaranteed for<br />

the life of your child’s policy.<br />

Limited Premium Paying Period<br />

With <strong>F15</strong>, premiums are guaranteed to be payable for only 15 years.<br />

Premium Refund Option<br />

We’ve designed this option to provide you or your child with loan collateral or emergency cash.<br />

Here’s how it works:<br />

If, after 20 years, your child no longer needs the insurance protection provided by <strong>F15</strong>, at least 100% of the basic<br />

premiums* will be refunded. Beyond year 20, the cash value increases in 5 year intervals reaching 200% of the basic<br />

premiums* after year 40. Beyond the later of year 45 and the life insured’s 50th birthday, the cash value will increase<br />

even further.<br />

* Excludes policy fee, modal extras, medical or other underwriting extras, and rider premiums.<br />

% Refunded<br />

Premiums Paid to Date<br />

700%<br />

350%<br />

This graph illustrates the premium refund 0ption<br />

for a 5 year old male, values shown assume<br />

non-smoker status for life. Values beyond<br />

year 45 differ for each issue age.<br />

5 10<br />

15<br />

20<br />

25<br />

30<br />

35<br />

40<br />

45 50 55 60 65<br />

Policy Duration

Automatic <strong>Coverage</strong> Increases<br />

Your child’s coverage will remain level until the later of age 25 or the end of the premium paying period. At this<br />

time, coverage will automatically increase to 250% of the original amount if your child qualifies as a non-smoker<br />

and 150% otherwise.<br />

<strong>Coverage</strong> Continuation<br />

If, for any reason, you are unable to pay premiums, your <strong>F15</strong> policy will provide your child with two years of<br />

extended term coverage for each full annual premium (or modal equivalent) paid.<br />

Waiver of Premium on Death or Disability (WDDP)<br />

If the payor is 50 or under at policy issue, this feature is automatically included with the purchase of an <strong>F15</strong> policy,<br />

subject to underwriting. It provides the payor with the assurance that if he/she becomes disabled or dies before the<br />

end of the premium paying period, the policy will remain intact with premiums waived.<br />

Your independent financial advisor can provide<br />

you with a personalized illustration highlighting<br />

how <strong>F15</strong> can work for you.<br />

<strong>F15</strong> is designed with flexible options to meet<br />

your child’s financial needs as they change over<br />

the years.

Life Products<br />

Marketing <strong>F15</strong><br />

THE MARITIME LIFE ASSURANCE COMPANY<br />

Plan Setup and Administration<br />

Issue Ages<br />

Ages 0 to 18<br />

Issue Limits<br />

Minimums: Minimum coverage is $15,000.<br />

Maximums: Greater of $5,000 annual premium or<br />

modal equivalent and $500,000 initial coverage.<br />

Policy Fee<br />

$50 for primary policy<br />

$25 for each additional policy<br />

Premium Payment Frequency<br />

• Annually<br />

• Semi-annually<br />

• Quarterly<br />

• Monthly (ACS*, Pay Assignment*, Regular Billing)<br />

* Canadian currency only<br />

<strong>Coverage</strong> Continuation<br />

If, for any reason, the client is unable to pay<br />

premiums, the <strong>F15</strong> policy will provide two years of<br />

extended term coverage for each full annual premium<br />

(or modal equivalent) paid, provided no loan is<br />

outstanding. If all 15 premiums are paid, coverage is<br />

guaranteed for life.<br />

Tips for Illustrations<br />

Customer Signature<br />

One purpose of the sales illustration is to promote<br />

customer understanding of the product they are<br />

purchasing. It is clear the better the customer<br />

understands their purchase, the more satisfying the<br />

relationship will be for all of us. Obtaining the<br />

customer’s signature on the illustration is<br />

confirmation the customer has reviewed and<br />

understands the information upon which their<br />

purchasing decision is based.<br />

Compliance Checklist<br />

We have included a compliance checklist in the <strong>F15</strong><br />

software. At present, disclosure of the items identified<br />

in the checklist is only mandatory to customers in<br />

Ontario. We hope you will take their lead and review<br />

the checklist with your customers. We are sure it will<br />

prove extremely beneficial for your customers as well<br />

as give you added documentation for your records.<br />

Non-registered Investment<br />

<strong>F15</strong>, along with a non-registered investment, can be<br />

used as an alternative to an RESP. We have included<br />

the ability to illustrate this arrangement in the <strong>F15</strong><br />

software.<br />

To be detached and given to the client if applicable.<br />

TEMPORARY LIFE INSURANCE<br />

Temporary Life Insurance commences on the date of this agreement and is payable to the beneficiary(ies) named in the application, upon death of any Proposed Life Insured. The Maritime Life<br />

Assurance Company agrees to provide temporary life insurance on any Proposed Life Insured, subject to the conditions of the agreement. It is acknowledged that the sum of<br />

$ __________________ (one total monthly premium or 1/10th of the annual premium, as required) was paid to The Maritime Life Assurance Company at the time of completion of this agreement.<br />

Life Insured’s Name __________________________________________________________________ Payor’s Name ______________________________________________________________<br />

Advisor’s Signature ___________________________________________________________________ Date ______________________________________________________________________<br />

Signed at ___________________________________________________________________________ Province __________________________________________________________________

<strong>F15</strong> Rates<br />

Per $1000 of coverage<br />

Age M Age F Rate<br />

0 0-2 6.70<br />

1 3 6.79<br />

2 4 6.90<br />

3 5 7.06<br />

4 6 7.23<br />

5 7 7.41<br />

6 8 7.71<br />

7 9 8.07<br />

8 10 8.49<br />

9 11 8.88<br />

10 12 9.28<br />

11 13 9.70<br />

12 14 10.13<br />

13 15 10.57<br />

14 16 11.02<br />

15 17 11.51<br />

16 18 11.83<br />

17 12.06<br />

18 12.29<br />

Modal Factors<br />

Frequency Sask & NS NFLD PEI Quebec<br />

Other<br />

Provinces<br />

Annual 1.010 1.020 1.015 1.004 1.000<br />

Semi-annual .530 .535 .533 .527 .525<br />

Quarterly .271 .273 .272 .269 .268<br />

Monthly .091 .092 .091 .090 .090<br />

Minimums<br />

Minimum coverage is $15,000.<br />

Maximums<br />

Greater of $5,000 annual premium or modal equivalent<br />

and $500,000 initial coverage.<br />

Cash Values<br />

<strong>F15</strong> accrues cash value according to the following<br />

schedule, less fees, modal extras, rider premiums<br />

and medical extras.<br />

Benefit Year<br />

Percent Refunded<br />

1 5%<br />

2 10%<br />

3 15%<br />

4 20%<br />

5 25%<br />

6 30%<br />

7 35%<br />

8 40%<br />

9 45%<br />

10 50%<br />

11 55%<br />

12 60%<br />

13 65%<br />

14 70%<br />

15 75%<br />

16 80%<br />

17 85%<br />

18 90%<br />

19 95%<br />

20 100%<br />

21-25 100%<br />

26-30 125%<br />

31-35 150%<br />

No Cash Value is available after the Extended<br />

Term Provision has been continuously in effect<br />

for more than five years.<br />

Please add a $50 policy fee. A reduced fee of $25<br />

applies when <strong>F15</strong> is purchased in addition to another<br />

Maritime Life insurance plan (e.g. Intrepid II, Term Life<br />

Series, Architect Summit II).<br />

TEMPORARY LIFE INSURANCE AGREEMENT/CONDITIONS<br />

Amount: The amount of Temporary Life Insurance provided under this agreement is the total of the amounts provided for in this application and any other temporary life insurance agreement<br />

with The Maritime Life Assurance Company subject to a maximum amount of $200,000 on each life.<br />

Benefits: No insurance is provided for under any accidental death or disability benefit.<br />

Insurability: Questions 8, 9 and 10 must all have been correctly answered NO for a proposed life to be insured.<br />

Age Limitation: The age of the Life Insured must not exceed 18 years as of their last birthday.<br />

Misrepresentation, Non-Disclosure or Self Destruction: The Maritime Life Assurance Company declares this Agreement to be null and void if any Proposed Life Insured dies by his or her own<br />

act, whether sane or insane or if any of the answers or details pertaining to this Agreement or the application are false. Any payment made with this Agreement will be refunded to the Owner.<br />

Premium Payment: Post dated cheques are not acceptable. One monthly premium or one-tenth of the annual premiums must be collected with the application.<br />

Modification: No representative of The Maritime Life Assurance Company has the authority to modify this Temporary Life Insurance Agreement in any way.<br />

Termination: Insurance coverage provided by this Agreement will terminate automatically on the date the insurance applied for becomes effective or ninety days from the date this receipt was<br />

signed, whichever is earlier. The Maritime Life Assurance Company may terminate this Agreement by mailing a notice to that effect addressed to the Owner, in which event any money paid will<br />

be refunded. Termination will be effective at midnight of the mailing date. Termination will be effective the date and time of the application whenever any payment of the initial premium is<br />

not honored.

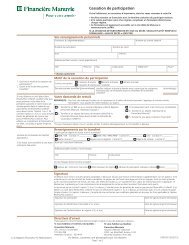

<strong>F15</strong> Application for Insurance<br />

(Please Print)<br />

1. Life Insured<br />

Name: ____________________________________________________________________________________________________________________ ! Male ! Female<br />

First Initial Last<br />

Date of Birth: ________________________ at __________________________________________________________________________________________________________________________<br />

DD / MM / YY Country<br />

Address: _________________________________________________________________________________________________________________________________________________________<br />

Street City Province Postal Code<br />

Occupation (if applicable): _____________________________________________________________________________<br />

2. Beneficiary<br />

Name: _______________________________________________________________________________________________<br />

Name of Trustee: ______________________________________________________________________________________<br />

(If Beneficiary is a Minor)<br />

Quebec Cases Only: Irrevocable: ! Yes ! No<br />

3. Owner (Applicant)<br />

Annual Income: ___________________________________________<br />

Relationship:______________________________________________<br />

Relationship:______________________________________________<br />

Name: ____________________________________________________________________________________________________________________ Date of Birth:_________________________<br />

First Initial Last DD / MM / YY<br />

Address: _________________________________________________________________________________________________________________________________________________________<br />

Street City Province Postal Code<br />

Phone: ____________________________________________________<br />

Relationship to Insured: _______________________________________________________________________________<br />

Occupation: __________________________________________________________________________________________<br />

Annual Income: ___________________________________________<br />

Contingent Owner: ________________________________________________________________________________________________________________________________________________<br />

4. Existing or Pending <strong>Coverage</strong> on Life Insured: $ __________________________________<br />

Company: ____________________________________________________________________________________________<br />

Year of Issue: ______________________________________________<br />

Amount on Other Children: $ ________________________________________________________________________________________________________________________________________<br />

Total Amount on Applicant: $________________________________________________________________________________________________________________________________________<br />

Is this insurance intended to replace or change existing coverage: ! Yes ! No<br />

If Yes, Company? __________________________________________________________________________________________________________________________________________________<br />

(Please complete replacement form and include with this application)<br />

Amount of <strong>F15</strong> applied for:<br />

Amount $ __________________________________________________ Annual Premium $ ______________________________________________ Modal Premium $_______________________<br />

Payment Frequency: ! Annual ! Semi-Annual ! Quarterly ! Monthly<br />

! ACS ! Other ________________________<br />

Is this policy to be billed with any other policy with this Company: ! Yes ! No<br />

If so, policy number(s)______________________________________________________________________________________________________________________________________________<br />

*Payor ___________________________________________________________________________________________________________________________________________________________<br />

Name Address Date of Birth<br />

*Note: Waiver on death or disability applies to payor. To qualify, the payor must be age 50 or below. Maiden Name of Payor (if applicable) _________________________________________<br />

AUTHORIZED CHEQUING SERVICE (ACS) Where the monthly payment frequency has been chosen, I/We authorize The Maritime Life Assurance Company to make Pre-Authorized Cheque<br />

Withdrawals from the payor’s bank account for the purpose of paying the premiums as due. If premiums change for the insurance policy issued from this Application, I/We authorize The<br />

Maritime Life Assurance Company to amend the amount of the automatic withdrawals. This payment method may be cancelled by providing 10 days’ written notice to the Head Office of The<br />

Maritime Life Assurance Company.<br />

_______________________________________________________________ ____________________ __________________________________________________ ___________________<br />

Owner’s Signature Date Payor’s Signature Date<br />

Type of Account ____________________________________________________________________________________________________________________________________________________<br />

(attach an encoded cheque sample marked “VOID”)<br />

Name of <strong>Financial</strong> Institution, Transit No. and Branch Address: ____________________________________________________________________________________________________________<br />

__________________________________________________________________________________________________________________________________________________________________<br />

Special Withdrawal date, if required: ___________________________________________________________________________________________________________________________________<br />

AUTHORIZATION TO RELEASE INFORMATION<br />

I/We hereby authorize any licensed physician, medical practitioner, hospital, clinic or other medical or medically related facility, insurance company, the Medical Information Bureau, or other<br />

organization, institution or person, that has records or knowledge of me/us or my/our insurability to give The Maritime Life Assurance Company or its reinsurers any such information. A<br />

photographic copy of the signed authorization to obtain this information will be as legally valid as the original.<br />

(please print)<br />

Life Insured’s Name __________________________________________________________________ Payor’s Name ____________________________________________________________________<br />

Life Insured’s/Guardian’s Signature _____________________________________________________ Payor’s Signature _________________________________________________________________<br />

Date _______________________________________________________________________________

<strong>F15</strong> Application for Insurance (Cont’d)<br />

5. Personal Information<br />

(Please circle) Life Insured Payor Please provide full details to any “Yes” responses<br />

Height/Weight ______/______ ______/______<br />

Gained or lost more than 10 lbs during the past year? Yes No Yes No<br />

6. Have you in the past 5 years<br />

• engaged in hazardous sports or activities or intend to do so? Yes No Yes No<br />

• flown other than on a regularly scheduled flight? Yes No Yes No<br />

Have you been convicted or charged with any moving violation<br />

with respect to motor vehicle operation within the past 2 years? Yes No Yes No<br />

If Yes, driver’s license number: ___________ ___________<br />

7. Have you:<br />

• used tobacco products within the past 12 months? Yes No Yes No<br />

Date of last use: ____________ ____________<br />

Have you:<br />

• used cannabis or other drugs other than as prescribed by a physician? Yes No Yes No<br />

• been treated or counselled for alcohol or drug usage? Yes No Yes No<br />

Indicate weekly consumption of alcohol and type: ____________ ____________<br />

8. Have you ever applied for insurance which was declined,<br />

postponed, or modified in any way? Yes No Yes No<br />

9. Have you ever had or been advised you had a disease or disorder of:<br />

a) cardiovascular, circulatory or respiratory systems? Yes No Yes No<br />

b) diabetes, kidney, liver, intestine or stomach disorder? Yes No Yes No<br />

c) nervous system including epilepsy or any other brain or spinal cord problem? Yes No Yes No<br />

d) cancer, tumor or cysts? Yes No Yes No<br />

e) immune system disorders, including but not limited to AIDS related problems? Yes No Yes No<br />

f) mental problems, including anxiety, depression, etc. Yes No Yes No<br />

g) any other disease or condition not included above? Yes No Yes No<br />

10. Have you ever been advised to have testing or treatment related<br />

to your health which was not done? Yes No Yes No<br />

11. Name and Address of your personal physician<br />

12. Date and reason last consulted<br />

MEDICAL INFORMATION BUREAU<br />

Pre-Notice to Applicants regarding the Medical Information Bureau. Information regarding your insurability will be treated as confidential. The Maritime Life Assurance Company or its reinsurers may,<br />

however, make a brief report thereon to the Medical Information Bureau, a non-profit membership organization of life insurance companies, which operates an information exchange on behalf of its<br />

members. If you apply to another Bureau member company for life or health insurance coverage, or a claim for benefits is submitted to such a company, the Bureau, upon request, will supply such<br />

company with the information in its file. Upon receipt of a request from you, the Bureau will arrange disclosure of any information it may have on your life. If you question the accuracy of information in<br />

the Bureau’s file, you may contact the Bureau and seek a correction. The address of the Bureau’s information office is 330 University Avenue, Toronto, Ontario, M5G 1R7, telephone (416) 597-0590.<br />

The Maritime Life Assurance Company or its reinsurers may also release information in its file to other life insurance companies to whom you may apply for life or health insurance, or to whom a claim for<br />

benefits may be submitted.<br />

DECLARATION AND AGREEMENT<br />

The Applicant, Payor and Proposed Life Insured hereby declare and agree that:<br />

1. All statements and answers in connection with this application are true and complete. Insurance is a contract based on trust. Failure to fully disclose facts material to this application could make your<br />

contract void.<br />

2. The application and declaration together with any other statements made to the Company in connection with this application shall form the basis of this contract.<br />

3. This application provides no insurance coverage prior to final approval and issue of the policy, and payment of the full modal premium. The coverage will take effect when the policy is delivered and the<br />

final premium is paid, provided the health of the Proposed Life Insured and Payor has not changed materially since the application date.<br />

4. Acceptance of a policy issued on this application shall constitute ratification of the amendments made by the Company under “Amendments by the Company” attached to the policy.<br />

5. We understand that the Independent Advisor is a representative of The Maritime Life Assurance Company. The Independent Advisor is compensated for the sale of this contract by the payment of a<br />

commission by The Maritime Life Assurance Company.<br />

6. We request this policy be issued in English. Nous demandons que notre police soit rédigée en anglais.<br />

7. We have received the information stub describing the function of the Medical Information Bureau.<br />

I authorize Maritime Life to collect, use, and disclose personal information concerning me and/or my dependant(s) (where applicable) for the purpose of determining eligibility for Maritime Life products<br />

and services; underwriting and administration of coverage; the adjudication and payment of claims and other relevant purposes, all of which are described in more detail in Maritime Life's Privacy Policy<br />

and Privacy Information Package, available at www.maritimelife.ca or by request.<br />

! I agree to the gathering of information for future marketing purposes concerning other products and services.<br />

SIGNATURES<br />

Life Insured/Guardian _________________________________________________________________ Payor ___________________________________________________________________________<br />

Owner _______________________________________________________________________________________________________________________________________________________________<br />

Signed in the City of __________________________________________________________________ in the Province of ________________________________________________________________<br />

Witness (Advisor) ____________________________________________________________________ Date ____________________________________________________________________________

The Maritime Life Assurance Company<br />

Head Office<br />

PO Box 1030<br />

Halifax, Nova Scotia<br />

B3J 2X5<br />

Halifax<br />

Montreal<br />

Toronto<br />

Kitchener<br />

Calgary<br />

Vancouver<br />

Visit our website at www.maritimelife.ca<br />

E1462 (01/2004)