Access to Islamic Hedge Funds - Incisive Media

Access to Islamic Hedge Funds - Incisive Media

Access to Islamic Hedge Funds - Incisive Media

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

fund profile<br />

Western<br />

populations are<br />

on average ageing<br />

rapidly, with the<br />

proportion of the<br />

population aged 65<br />

and over expected<br />

<strong>to</strong> increase by 50%<br />

or more in most<br />

western countries<br />

over the coming<br />

decades.<br />

demographic s<strong>to</strong>ry, as its elderly<br />

population is expected <strong>to</strong> double by<br />

2025, thanks partly <strong>to</strong> the controversial<br />

“one child” policy.<br />

Innovation is a second key growth<br />

driver. New markets are created<br />

over time thanks <strong>to</strong> the ineluctable<br />

progress being made in the scientific<br />

understanding of human diseases.<br />

Innovative new drugs and treatments<br />

inevitably flow from this<br />

greater understanding of disease.<br />

For instance, the recently launched<br />

vaccines for the human papillomavirus<br />

are poised <strong>to</strong> effectively<br />

prevent the vast majority of future<br />

cases of cervical cancer.<br />

There are over 1,000 such potentially<br />

promising products in the<br />

drug industry pipeline currently<br />

under review by OrbiMed. OrbiMed<br />

believes the future is particularly<br />

bright for the biotechnology sec<strong>to</strong>r<br />

as more biotechnology companies<br />

are becoming profitable.<br />

A <strong>to</strong>tal of 73 biotechnology and<br />

emerging drug discovery companies<br />

(including acquisitions) had<br />

attained profitability as of 2007 and<br />

a further 32 companies are expected<br />

<strong>to</strong> achieve profitability by the end of<br />

2009.<br />

Growth drivers<br />

The final growth driver for the<br />

healthcare sec<strong>to</strong>r is the trend<br />

<strong>to</strong>wards rising global affluence. A<br />

disproportionate share of income<br />

growth tends <strong>to</strong> be spent on healthcare<br />

as the newly minted middle<br />

classes in many countries begin<br />

<strong>to</strong> demand quality western-style<br />

healthcare.<br />

This is particularly true in China<br />

and India where there is a rapidly<br />

growing middle class demanding<br />

better medical care.<br />

China’s pharmaceutical market<br />

is growing two <strong>to</strong> four times faster<br />

than western markets. Emerging<br />

markets overall account for more<br />

than one third of recent pharmaceutical<br />

growth.<br />

These fac<strong>to</strong>rs lead OrbiMed <strong>to</strong><br />

believe that investing in healthcare<br />

now is a compelling opportunity.<br />

His<strong>to</strong>rically low valuations and noncyclical<br />

growth companies coupled<br />

with rampant merger and acquisition<br />

activity creates an attractive<br />

entry point for inves<strong>to</strong>rs <strong>to</strong>day.<br />

Pharmaceutical and biotechnology<br />

companies have generally<br />

underperformed the broader<br />

markets by a cumulative margin<br />

of 25%–40% over the past six or<br />

seven years, according <strong>to</strong> Neild. As<br />

a result, valuations for larger biotechnology<br />

companies are now near<br />

his<strong>to</strong>rical lows by measures such as<br />

price/earnings ratios and price/sales<br />

ratios.<br />

Non-cyclical growth opportunities,<br />

such as healthcare companies,<br />

have often rotated in<strong>to</strong> favour<br />

during previous economic recessionary<br />

environments.<br />

For example, the Amex Biotechnology<br />

Index increased 46% in 1990<br />

and over 190% in 1991, a period<br />

similar <strong>to</strong> <strong>to</strong>day’s economic environment.<br />

Merger and acquisition activity<br />

is strong. The large pharmaceutical<br />

companies need <strong>to</strong> pay high prices<br />

for biotechnology acquisitions.<br />

A dozen significant acquisitions<br />

have been announced in the past few<br />

months, including a $7 billion offer<br />

for Imclone Systems from Eli Lilly<br />

and a $44 billion offer for Genentech<br />

from Roche.<br />

Lack of competition<br />

The business of investment in the<br />

healthcare sec<strong>to</strong>r has become far<br />

less competitive over the past few<br />

years thanks <strong>to</strong> a significant amount<br />

of attrition among the group of specialist<br />

hedge funds focused on the<br />

healthcare sec<strong>to</strong>r.<br />

Less competition provides the<br />

survivors, such as OrbiMed, with<br />

greater market inefficiencies and<br />

less competition for new ideas.<br />

For all these reasons Neild<br />

believes that OrbiMed’s long/short<br />

specialist healthcare fund, Caduceus<br />

Capital, will continue <strong>to</strong> prosper<br />

as it has over the past 15 years.<br />

Neild believes a long/short equity<br />

strategy has significant advantages<br />

in making healthcare investments<br />

that are not available <strong>to</strong> a long-only<br />

static approach.<br />

Wide dispersion<br />

First, there is a wide dispersion of<br />

returns for companies within the<br />

biotechnology and pharmaceutical<br />

sec<strong>to</strong>rs because these companies<br />

generally have a ‘binary’ nature<br />

<strong>to</strong> their development. Either their<br />

therapies work, and the s<strong>to</strong>cks go<br />

up, or the therapies fail along with<br />

the s<strong>to</strong>cks.<br />

A long/short equity fund can<br />

make money from either type of<br />

outcome and is not solely depending<br />

on playing the ‘winners’.<br />

Additional, the ability <strong>to</strong> manage<br />

tactically net market exposure is<br />

also advantageous in the healthcare<br />

sec<strong>to</strong>r, as volatility, particularly for<br />

biotechnology s<strong>to</strong>cks, can be high.<br />

The impact of inves<strong>to</strong>r sentiment<br />

changes and retail inves<strong>to</strong>r money<br />

flows combine <strong>to</strong> create high volatility<br />

and frequently over-bought or<br />

over-sold market conditions.<br />

A long/short equity fund is<br />

capable of altering net market exposure<br />

in response <strong>to</strong> these market<br />

cycles in order <strong>to</strong> seek additional<br />

alpha generation possibilities.<br />

But this sec<strong>to</strong>r is not <strong>to</strong> be entered<br />

lightly through generalist funds<br />

who lack deep scientific and medical<br />

research experience.<br />

The highly technical nature of<br />

analysis of emerging drug and<br />

medical device products requires a<br />

highly specialised research team.<br />

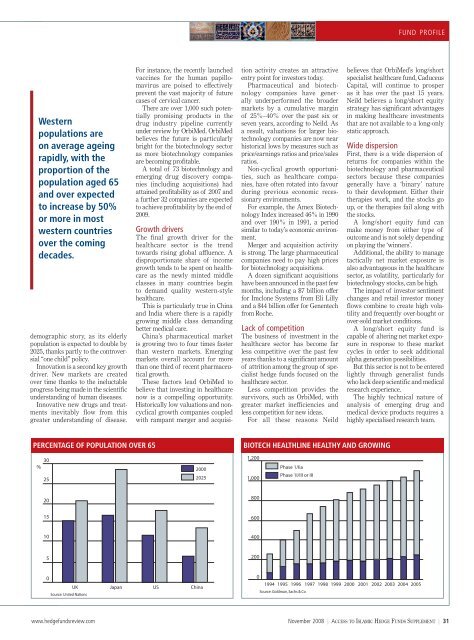

percentage of population over 65<br />

biotech healthline healthy and growing<br />

30<br />

%<br />

25<br />

2000<br />

2025<br />

1,200<br />

1,000<br />

Phase 1/Iia<br />

Phase 1I/III or III<br />

20<br />

800<br />

15<br />

600<br />

10<br />

400<br />

5<br />

200<br />

0<br />

Source: United Nations<br />

UK Japan US China<br />

0<br />

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005<br />

Source: Goldman, Sachs & Co<br />

www.hedgefundsreview.com November 2008 | <strong>Access</strong> <strong>to</strong> <strong>Islamic</strong> <strong>Hedge</strong> <strong>Funds</strong> Supplement | 31