Access to Islamic Hedge Funds - Incisive Media

Access to Islamic Hedge Funds - Incisive Media

Access to Islamic Hedge Funds - Incisive Media

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

challenges <strong>to</strong> setting up al safi<br />

(Al Safi) based on Islam’s ancient<br />

laws using ‘old’ <strong>to</strong>ols <strong>to</strong> make it work.<br />

Short arboon<br />

The platform and fund managers<br />

do not sell what they do not own.<br />

By using a prescribed methodology<br />

developed and certified by the Shariah<br />

supervisory board, hedge funds<br />

implement a Shariah compliant short<br />

sale equivalent, known as the short<br />

arboon sale. This alternative method,<br />

which replicates the economic results<br />

of a short sale without using the<br />

borrow-and-sell method of shorting,<br />

needed two steps <strong>to</strong> be possible.<br />

First was the creation and certification<br />

by means of a fatwa of a<br />

Shariah compliant short sale methodology.<br />

The second was the modification<br />

of prime broker documentation<br />

<strong>to</strong> replace conventional short sale<br />

methods with the approved, Shariah<br />

compliant short sale arboon (article,<br />

page 12).<br />

The platform also uses an alternative<br />

set of prime brokerage documentation<br />

for all trades, whether long or<br />

short. This ensures every trade is<br />

done under Shariah rules: no interest,<br />

no prohibited terms and conditions<br />

and no prohibited operations (like<br />

the purchase or sale of prohibited<br />

businesses such as pork or alcohol<br />

production, banks and insurance<br />

companies).<br />

All managers on the platform are<br />

contractually obligated <strong>to</strong> execute<br />

short sales through Barclays Capital<br />

prime brokerage. Managers can<br />

initiate long-only trades with other<br />

brokers, but they need <strong>to</strong> be settled at<br />

Barclays.<br />

Shariah compliant contracts allow<br />

Barclays Capital Prime Brokerage<br />

<strong>to</strong> process trades initiated by hedge<br />

fund managers, avoiding all the prohibited<br />

elements present in prime<br />

brokerage contracts commonly<br />

used for conventional hedge funds.<br />

Another problem the Shariah supervisory<br />

board has <strong>to</strong> deal with is how a<br />

manager can temporarily ‘cash out’ of<br />

a position. The money has <strong>to</strong> be held<br />

in a non-interest bearing account or, if<br />

the term is longer than say, overnight,<br />

the cash needs <strong>to</strong> be invested in a Shariah<br />

compliant, short-term instrument<br />

like a murabahah.<br />

Purification<br />

One potential glitch is what <strong>to</strong> do<br />

when a fund accidentally trades an<br />

unacceptable s<strong>to</strong>ck. While all companies<br />

are screened for unacceptable<br />

primary business activities, a manager<br />

may not realise a s<strong>to</strong>ck being<br />

traded is not on the list until after<br />

the trade is made. When the Shariah<br />

moni<strong>to</strong>ring processes discovers a<br />

profit was made from a non-Shariah<br />

compliant s<strong>to</strong>ck, a few remedial steps<br />

can be taken.<br />

First, the company will be ‘screened<br />

out’ and declared unacceptable for<br />

Shariah compliant investments for<br />

the future. If ‘impure’ revenues from<br />

the transactions are less than 5%,<br />

the s<strong>to</strong>ck can be held, but inves<strong>to</strong>rs<br />

will be responsible for ‘purifying’ the<br />

investment. This is done by giving<br />

an equal proportion of the earnings<br />

<strong>to</strong> charities chosen by the fund.<br />

Different Shariah supervisory<br />

boards have different ways of dealing<br />

with purification. The Al Safi Trust<br />

Shariah supervisory board takes a<br />

practical approach. It offers different<br />

solutions for different managers. The<br />

board studies the strategy and sec<strong>to</strong>r<br />

concentration(s) of each fund on the<br />

platform. If it finds the fund invests<br />

exclusively in a particular sec<strong>to</strong>r in<br />

which there is almost never any need<br />

for purification, such as healthcare,<br />

technology or telecommunications,<br />

then the Shariah board will recommend<br />

there is no need for purification<br />

from that fund other than in a special<br />

situation, like when a trade in a non-<br />

Shariah compliant s<strong>to</strong>ck is made.<br />

If the fund invests in sec<strong>to</strong>rs in<br />

which purification often arises – for<br />

example, retail outlets or REITs – or<br />

if it invests in a variety of sec<strong>to</strong>rs,<br />

the board will recommend a flat purification<br />

rate of, say, 1.5% be applied<br />

<strong>to</strong> the inves<strong>to</strong>r’s net earnings.<br />

If a fund holds s<strong>to</strong>cks that have<br />

especially high revenues from unacceptable<br />

activities (still less than 5%),<br />

the board has the right <strong>to</strong> recommend<br />

a higher purification rate.<br />

If a manager or a trader inadvertently<br />

purchases an unacceptable<br />

s<strong>to</strong>ck, the board will deliberate and<br />

could recommend an appropriate<br />

amount <strong>to</strong> be purified from the fund’s<br />

profits resulting from the oversight.<br />

Inves<strong>to</strong>rs will be <strong>to</strong>ld about all recommendations<br />

made by the board on<br />

purification through the Al Safi Trust<br />

administra<strong>to</strong>r.<br />

The Al Safi Trust and hedge fund<br />

managers are not responsible for<br />

portfolio purification. Inves<strong>to</strong>rs are.<br />

This way inves<strong>to</strong>rs can donate purification<br />

money <strong>to</strong> the charities of their<br />

choice. Although the platform will<br />

recommend how much should go <strong>to</strong><br />

charity, inves<strong>to</strong>rs make the final allocations<br />

themselves.<br />

Dealing with cash and purification<br />

Clear investment guidelines have<br />

been given <strong>to</strong> all the hedge fund managers<br />

on the platform on how <strong>to</strong> deal<br />

with cash. Cash is never <strong>to</strong> be deposited<br />

in interest-earning accounts or<br />

instruments. If a manager needed <strong>to</strong><br />

“cash out” temporarily a position, the<br />

money will be held in a non-interest<br />

bearing account or, if the term is<br />

likely <strong>to</strong> be longer, invested in a Shariah<br />

compliant, short-term instrument<br />

like a murabahah.<br />

Another area hedge funds may<br />

find unusual is the purification<br />

process. Although all the company<br />

s<strong>to</strong>cks traded are screened for unacceptable<br />

primary business activities,<br />

there are some companies with<br />

acceptable primary businesses, like<br />

the manufacture of spare parts for<br />

cars for example, that might own or<br />

engage in unacceptable businesses,<br />

like the sale of alcohol at company<br />

canteens or restaurants they own<br />

and operate at their fac<strong>to</strong>ries.<br />

When the Shariah moni<strong>to</strong>ring<br />

processes show that revenues from<br />

an unacceptable source exceed 5%<br />

of <strong>to</strong>tal revenue, then the company<br />

will be screened out and declared<br />

unacceptable for Shariah compliant<br />

investments.<br />

But if the ‘impure’ revenues are<br />

less than 5%, the s<strong>to</strong>ck may be held.<br />

Inves<strong>to</strong>rs will be responsible for<br />

purifying the investment by giving a<br />

commensurate portion of fund earnings<br />

<strong>to</strong> charities of their choice.<br />

While different Shariah supervisory<br />

boards have different ways of dealing<br />

with purification, the Al Safi Trust<br />

Shariah supervisory board takes a<br />

practical approach, offering different<br />

solutions for different managers.<br />

S<strong>to</strong>ck dividends is another area<br />

where there are special rules. While<br />

many Shariah compliant funds calculate<br />

purification liabilities and then<br />

pay the them from dividends, this is<br />

not the practice of the Al Safi Trust<br />

or its sub-trust managers. There are<br />

three main reasons. Not all s<strong>to</strong>cks<br />

pay dividends. <strong>Hedge</strong> fund managers<br />

are active traders of s<strong>to</strong>cks and many<br />

only occasionally hold s<strong>to</strong>cks long<br />

enough <strong>to</strong> collect dividends. Finally,<br />

the Al Safi Trust Platform funds<br />

have already been given a purification<br />

formula by the Shariah supervisory<br />

board. So inves<strong>to</strong>rs should not<br />

be troubled by dividends and complex<br />

purification formulas. n<br />

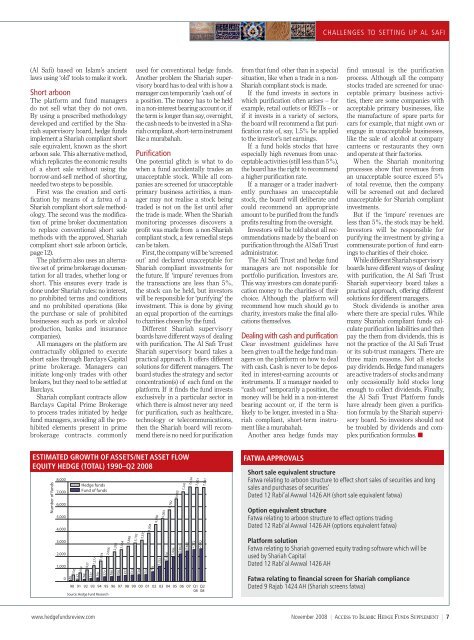

estimated growth of assets/net asset flow<br />

equity hedge (<strong>to</strong>tal) 1990–Q2 2008<br />

Number of funds<br />

8,000<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

80 530<br />

127 694<br />

168 937<br />

<strong>Hedge</strong> funds<br />

Fund of funds<br />

237 1,277<br />

291 1,654<br />

377 2,006<br />

426 2,564<br />

389 2,392<br />

477<br />

2,848<br />

515<br />

3,102<br />

538<br />

90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 Q1 Q2<br />

08 08<br />

Source: <strong>Hedge</strong> Fund Research<br />

3,335<br />

550<br />

3,904<br />

781<br />

4,598<br />

1,232<br />

5,065<br />

5,782<br />

6,665<br />

7,241<br />

7,634<br />

1,654<br />

1,996<br />

2,462<br />

2,462<br />

2,572<br />

7,601<br />

2,642<br />

7,591<br />

fatwa approvals<br />

Short sale equivalent structure<br />

Fatwa relating <strong>to</strong> arboon structure <strong>to</strong> effect short sales of securities and long<br />

sales and purchases of securities’<br />

Dated 12 Rabi’al Awwal 1426 AH (short sale equivalent fatwa)<br />

Option equivalent structure<br />

Fatwa relating <strong>to</strong> arboon structure <strong>to</strong> effect options trading<br />

Dated 12 Rabi’al Awwal 1426 AH (options equivalent fatwa)<br />

Platform solution<br />

Fatwa relating <strong>to</strong> Shariah governed equity trading software which will be<br />

used by Shariah Capital<br />

Dated 12 Rabi’al Awwal 1426 AH<br />

Fatwa relating <strong>to</strong> financial screen for Shariah compliance<br />

Dated 9 Rajab 1424 AH (Shariah screens fatwa)<br />

www.hedgefundsreview.com<br />

November 2008 | <strong>Access</strong> <strong>to</strong> <strong>Islamic</strong> <strong>Hedge</strong> <strong>Funds</strong> Supplement |