Financial Report Yr Ending 3.. - SHARKIES | Cronulla Sutherland ...

Financial Report Yr Ending 3.. - SHARKIES | Cronulla Sutherland ...

Financial Report Yr Ending 3.. - SHARKIES | Cronulla Sutherland ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL REPORT FOR THE YEAR ENDED 31ST OCTOBER 2011<br />

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 OCTOBER 2011<br />

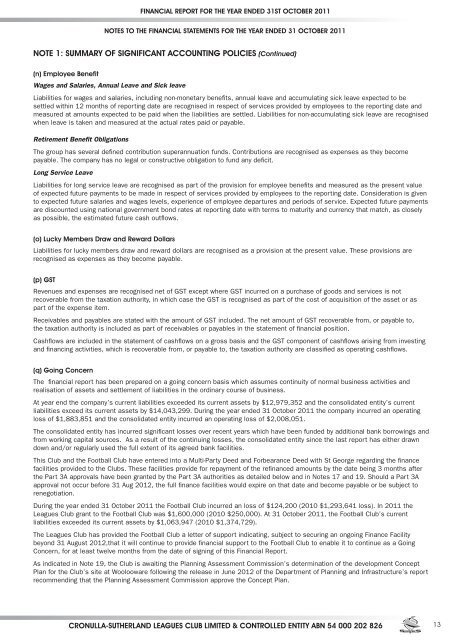

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)<br />

(n) Employee Benefit<br />

Wages and Salaries, Annual Leave and Sick leave<br />

Liabilities for wages and salaries, including non-monetary benefits, annual leave and accumulating sick leave expected to be<br />

settled within 12 months of reporting date are recognised in respect of services provided by employees to the reporting date and<br />

measured at amounts expected to be paid when the liabilities are settled. Liabilities for non-accumulating sick leave are recognised<br />

when leave is taken and measured at the actual rates paid or payable.<br />

Retirement Benefit Obligations<br />

The group has several defined contribution superannuation funds. Contributions are recognised as expenses as they become<br />

payable. The company has no legal or constructive obligation to fund any deficit.<br />

Long Service Leave<br />

Liabilities for long service leave are recognised as part of the provision for employee benefits and measured as the present value<br />

of expected future payments to be made in respect of services provided by employees to the reporting date. Consideration is given<br />

to expected future salaries and wages levels, experience of employee departures and periods of service. Expected future payments<br />

are discounted using national government bond rates at reporting date with terms to maturity and currency that match, as closely<br />

as possible, the estimated future cash outflows.<br />

(o) Lucky Members Draw and Reward Dollars<br />

Liabilities for lucky members draw and reward dollars are recognised as a provision at the present value. These provisions are<br />

recognised as expenses as they become payable.<br />

(p) GST<br />

Revenues and expenses are recognised net of GST except where GST incurred on a purchase of goods and services is not<br />

recoverable from the taxation authority, in which case the GST is recognised as part of the cost of acquisition of the asset or as<br />

part of the expense item.<br />

Receivables and payables are stated with the amount of GST included. The net amount of GST recoverable from, or payable to,<br />

the taxation authority is included as part of receivables or payables in the statement of financial position.<br />

Cashflows are included in the statement of cashflows on a gross basis and the GST component of cashflows arising from investing<br />

and financing activities, which is recoverable from, or payable to, the taxation authority are classified as operating cashflows.<br />

(q) Going Concern<br />

The financial report has been prepared on a going concern basis which assumes continuity of normal business activities and<br />

realisation of assets and settlement of liabilities in the ordinary course of business.<br />

At year end the company’s current liabilities exceeded its current assets by $12,979,352 and the consolidated entity’s current<br />

liabilities exceed its current assets by $14,043,299. During the year ended 31 October 2011 the company incurred an operating<br />

loss of $1,883,851 and the consolidated entity incurred an operating loss of $2,008,051.<br />

The consolidated entity has incurred significant losses over recent years which have been funded by additional bank borrowings and<br />

from working capital sources. As a result of the continuing losses, the consolidated entity since the last report has either drawn<br />

down and/or regularly used the full extent of its agreed bank facilities.<br />

This Club and the Football Club have entered into a Multi-Party Deed and Forbearance Deed with St George regarding the finance<br />

facilities provided to the Clubs. These facilities provide for repayment of the refinanced amounts by the date being 3 months after<br />

the Part 3A approvals have been granted by the Part 3A authorities as detailed below and in Notes 17 and 19. Should a Part 3A<br />

approval not occur before 31 Aug 2012, the full finance facilities would expire on that date and become payable or be subject to<br />

renegotiation.<br />

During the year ended 31 October 2011 the Football Club incurred an loss of $124,200 (2010 $1,293,641 loss). In 2011 the<br />

Leagues Club grant to the Football Club was $1,600,000 (2010 $250,000). At 31 October 2011, the Football Club’s current<br />

liabilities exceeded its current assets by $1,063,947 (2010 $1,374,729).<br />

The Leagues Club has provided the Football Club a letter of support indicating, subject to securing an ongoing Finance Facility<br />

beyond 31 August 2012,that it will continue to provide financial support to the Football Club to enable it to continue as a Going<br />

Concern, for at least twelve months from the date of signing of this <strong>Financial</strong> <strong>Report</strong>.<br />

As indicated in Note 19, the Club is awaiting the Planning Assessment Commission’s determination of the development Concept<br />

Plan for the Club’s site at Woolooware following the release in June 2012 of the Department of Planning and Infrastructure’s report<br />

recommending that the Planning Assessment Commission approve the Concept Plan.<br />

CRONULLA-SUTHERLAND LEAGUES CLUB LIMITED & CONTROLLED ENTITY ABN 54 000 202 826<br />

13