Financial Report Yr Ending 3.. - SHARKIES | Cronulla Sutherland ...

Financial Report Yr Ending 3.. - SHARKIES | Cronulla Sutherland ...

Financial Report Yr Ending 3.. - SHARKIES | Cronulla Sutherland ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL REPORT FOR THE YEAR ENDED 31ST OCTOBER 2011<br />

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 OCTOBER 2011<br />

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)<br />

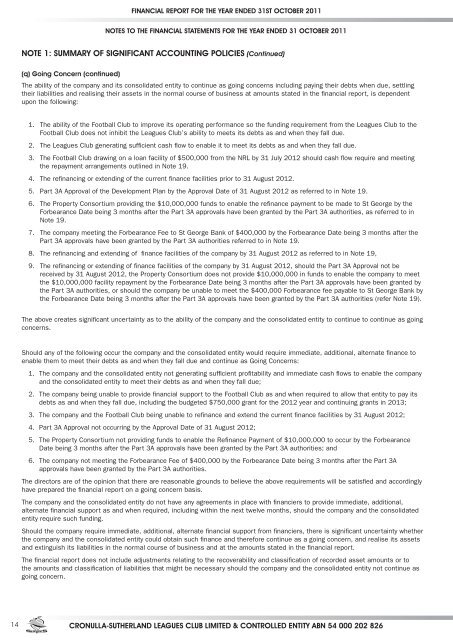

(q) Going Concern (continued)<br />

The ability of the company and its consolidated entity to continue as going concerns including paying their debts when due, settling<br />

their liabilities and realising their assets in the normal course of business at amounts stated in the financial report, is dependent<br />

upon the following:<br />

1. The ability of the Football Club to improve its operating performance so the funding requirement from the Leagues Club to the<br />

Football Club does not inhibit the Leagues Club’s ability to meets its debts as and when they fall due.<br />

2. The Leagues Club generating sufficient cash flow to enable it to meet its debts as and when they fall due.<br />

<strong>3.</strong> The Football Club drawing on a loan facility of $500,000 from the NRL by 31 July 2012 should cash flow require and meeting<br />

the repayment arrangements outlined in Note 19.<br />

4. The refinancing or extending of the current finance facilities prior to 31 August 2012.<br />

5. Part 3A Approval of the Development Plan by the Approval Date of 31 August 2012 as referred to in Note 19.<br />

6. The Property Consortium providing the $10,000,000 funds to enable the refinance payment to be made to St George by the<br />

Forbearance Date being 3 months after the Part 3A approvals have been granted by the Part 3A authorities, as referred to in<br />

Note 19.<br />

7. The company meeting the Forbearance Fee to St George Bank of $400,000 by the Forbearance Date being 3 months after the<br />

Part 3A approvals have been granted by the Part 3A authorities referred to in Note 19.<br />

8. The refinancing and extending of finance facilities of the company by 31 August 2012 as referred to in Note 19,<br />

9. The refinancing or extending of finance facilities of the company by 31 August 2012, should the Part 3A Approval not be<br />

received by 31 August 2012, the Property Consortium does not provide $10,000,000 in funds to enable the company to meet<br />

the $10,000,000 facility repayment by the Forbearance Date being 3 months after the Part 3A approvals have been granted by<br />

the Part 3A authorities, or should the company be unable to meet the $400,000 Forbearance fee payable to St George Bank by<br />

the Forbearance Date being 3 months after the Part 3A approvals have been granted by the Part 3A authorities (refer Note 19).<br />

The above creates significant uncertainty as to the ability of the company and the consolidated entity to continue to continue as going<br />

concerns.<br />

Should any of the following occur the company and the consolidated entity would require immediate, additional, alternate finance to<br />

enable them to meet their debts as and when they fall due and continue as Going Concerns:<br />

1. The company and the consolidated entity not generating sufficient profitability and immediate cash flows to enable the company<br />

and the consolidated entity to meet their debts as and when they fall due;<br />

2. The company being unable to provide financial support to the Football Club as and when required to allow that entity to pay its<br />

debts as and when they fall due, including the budgeted $750,000 grant for the 2012 year and continuing grants in 2013;<br />

<strong>3.</strong> The company and the Football Club being unable to refinance and extend the current finance facilities by 31 August 2012;<br />

4. Part 3A Approval not occurring by the Approval Date of 31 August 2012;<br />

5. The Property Consortium not providing funds to enable the Refinance Payment of $10,000,000 to occur by the Forbearance<br />

Date being 3 months after the Part 3A approvals have been granted by the Part 3A authorities; and<br />

6. The company not meeting the Forbearance Fee of $400,000 by the Forbearance Date being 3 months after the Part 3A<br />

approvals have been granted by the Part 3A authorities.<br />

The directors are of the opinion that there are reasonable grounds to believe the above requirements will be satisfied and accordingly<br />

have prepared the financial report on a going concern basis.<br />

The company and the consolidated entity do not have any agreements in place with financiers to provide immediate, additional,<br />

alternate financial support as and when required, including within the next twelve months, should the company and the consolidated<br />

entity require such funding.<br />

Should the company require immediate, additional, alternate financial support from financiers, there is significant uncertainty whether<br />

the company and the consolidated entity could obtain such finance and therefore continue as a going concern, and realise its assets<br />

and extinguish its liabilities in the normal course of business and at the amounts stated in the financial report.<br />

The financial report does not include adjustments relating to the recoverability and classification of recorded asset amounts or to<br />

the amounts and classification of liabilities that might be necessary should the company and the consolidated entity not continue as<br />

going concern.<br />

14 CRONULLA-SUTHERLAND LEAGUES CLUB LIMITED & CONTROLLED ENTITY ABN 54 000 202 826