Financial Report Yr Ending 3.. - SHARKIES | Cronulla Sutherland ...

Financial Report Yr Ending 3.. - SHARKIES | Cronulla Sutherland ...

Financial Report Yr Ending 3.. - SHARKIES | Cronulla Sutherland ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL REPORT FOR THE YEAR ENDED 31ST OCTOBER 2011<br />

NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 OCTOBER 2011<br />

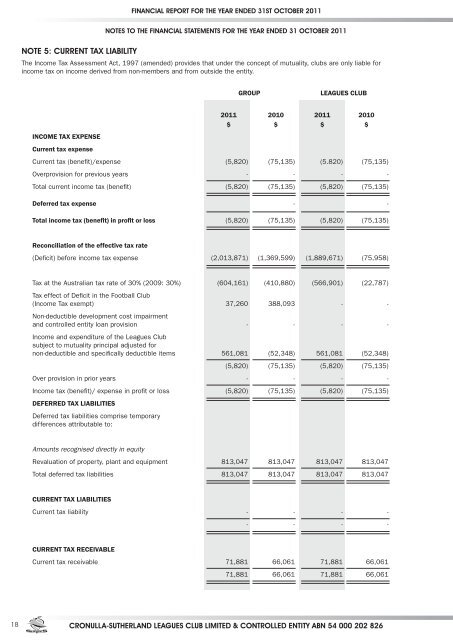

NOTE 5: CURRENT TAX LIABILITY<br />

The Income Tax Assessment Act, 1997 (amended) provides that under the concept of mutuality, clubs are only liable for<br />

income tax on income derived from non-members and from outside the entity.<br />

GROUP<br />

LEAGUES CLUB<br />

INCOME TAX EXPENSE<br />

Current tax expense<br />

2011 2010 2011 2010<br />

$ $ $ $<br />

Current tax (benefit)/expense (5,820) (75,135) (5.820) (75,135)<br />

Overprovision for previous years - - - -<br />

Total current income tax (benefit) (5,820) (75,135) (5,820) (75,135)<br />

Deferred tax expense - -<br />

Total income tax (benefit) in profit or loss (5,820) (75,135) (5,820) (75,135)<br />

Reconciliation of the effective tax rate<br />

(Deficit) before income tax expense (2,013,871) (1,369,599) (1,889,671) (75,958)<br />

Tax at the Australian tax rate of 30% (2009: 30%) (604,161) (410,880) (566,901) (22,787)<br />

Tax effect of Deficit in the Football Club<br />

(Income Tax exempt) 37,260 388,093 - -<br />

Non-deductible development cost impairment<br />

and controlled entity loan provision - - - -<br />

Income and expenditure of the Leagues Club<br />

subject to mutuality principal adjusted for<br />

non-deductible and specifically deductible items 561,081 (52,348) 561,081 (52,348)<br />

(5,820) (75,135) (5,820) (75,135)<br />

Over provision in prior years - - - -<br />

Income tax (benefit)/ expense in profit or loss (5,820) (75,135) (5,820) (75,135)<br />

DEFERRED TAX LIABILITIES<br />

Deferred tax liabilities comprise temporary<br />

differences attributable to:<br />

Amounts recognised directly in equity<br />

Revaluation of property, plant and equipment 813,047 813,047 813,047 813,047<br />

Total deferred tax liabilities 813,047 813,047 813,047 813,047<br />

CURRENT TAX LIABILITIES<br />

Current tax liability - - - -<br />

- - - -<br />

CURRENT TAX RECEIVABLE<br />

Current tax receivable 71,881 66,061 71,881 66,061<br />

71,881 66,061 71,881 66,061<br />

18 CRONULLA-SUTHERLAND LEAGUES CLUB LIMITED & CONTROLLED ENTITY ABN 54 000 202 826