Securitization

Securitization

Securitization

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

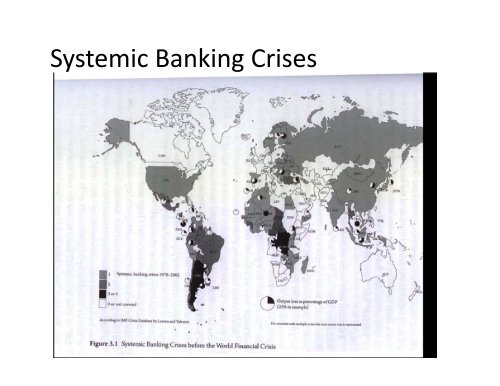

Systemic Banking Crises

Financial Crisis Timeline

<strong>Securitization</strong> of Bank Credit Risk

Shadow Bank and Traditional Bank Liabilities

Shadow Bank and Traditional Bank Liabilities, II

Breakdown of Most Common Collateral Used in Repo

Average Weekly Repo Agreements Outstanding,<br />

2002-2011

Repurchases of Most Common Collateral, Year-End Outstanding

Ratio of Total Private <strong>Securitization</strong>s to Total Bank Loans

ABS in the 1990’s by type

Quarterly ABS Issuance ($ Billions)

Traditional Banking

Shadow Banking

Schematic of Repo Transaction

Repurchase Agreement<br />

No haircut

Repurchase at Maturity<br />

7 <br />

i repo<br />

.05($10,000,000) <br />

360<br />

<br />

$9,722.22

Broker‐Dealer Assets Grew, Repo

Schematic of <strong>Securitization</strong> Transaction

Simple <strong>Securitization</strong> Example

Pooling

Tranching

Correlation Data

Pricing of Tranches

Question?

Perfect Correlation

Prices Change

The Waterfall

Pattern of <strong>Securitization</strong>

Cash Flows in a Collateralized Mortgage Obligation (CMO)

The Organization of a CDO

De Beers Sight Boxes

US Corporate Debt and <strong>Securitization</strong>

US Mortgage‐Related Securities Issuance

RMBS and CMBS Issuance

Types of Assets as Share of Total Financial Assets

Typical Subprime CMO tranche structure

Subprime and <strong>Securitization</strong>

Key Players and Frictions in Subprime Credit <strong>Securitization</strong><br />

Warehouse<br />

Lender<br />

Credit Rating<br />

Agency<br />

3. adverse<br />

selection<br />

Arranger<br />

Servicer<br />

5. moral hazard<br />

Asset<br />

Manager<br />

2. mortgage fraud<br />

Originator<br />

6. principal-agent<br />

Investor<br />

7. model<br />

error<br />

1. predatory lending<br />

Mortgagor<br />

4. moral hazard

Change in Moody’s Share Price versus Major Investment Banks

Ratings Agencies<br />

• A conversation between two ratings analysts at<br />

S&P:<br />

– Rahul Dilip Shah: btw: that deal is ridiculous<br />

Shannon Mooney: I know right ... model def does<br />

not capture half of the risk<br />

– Rahul Dilip Shah: we should not be rating it<br />

Shannon Mooney: we rate every deal<br />

– Shannon Mooney: it could be structured by cows<br />

and we would rate it

Result: Collapse of CDS Prices

Average Repo Haircut on Structured<br />

Debt

Repo Haircuts: Various Structured Products

Overnight Spreads Before and During the Crisis:<br />

Spreads over FF target rates

Money Market Spreads and Two Breakpoints

Runs on Asset Backed Commercial Paper Programs

RMBS

CDO’s

Capital Structure of GSAMP Trust 2006-NC2

S&P/Case-Shiller Monthly Composite-20 Home Price Index

S&P/Case-Shiller Quarterly Home Price Index

House Price Appreciation, selected countries

Spain Housing Price Index

Ireland

Portugal

US Mortgage Originations

Mortgage Delinquencies by Vintage year

Issuance of MBS Securities

Subprime Origination

Ratings Agency Profitability

Risk Profile of Subprime Mortgage Loans<br />

(source UBS)

ABX.HE Indices

ABX 06-1 Prices

ABX Indexes

ABX Index 2006 Issue, during 2008

ABX BBB prices

ABX 06-1 Implied Spreads<br />

over Libor, in thousands of basis points

ABX AAA CDSI S7-1 PRC Corp

ABX AAA CDSI S6-2 PRC Corp

ABX BBB S6-1 Jan 2008 – Jan 2009

Typical Capital Structure of Subprime and Alt A MBS

CDO vs Underlying Collateral Rating

Home Equity ABS Issuance Volume

Insured Portion of U.S. Home Equity ABS Issuance

Home Equity ABS Yield Spreads over Swaps/LIBOR and Annual<br />

Structured Finance CDO Funded Issuance Volume

Ameriquest Mortgage Securities, 2005-R2

Structured Asset Investment Loan Trust 2006-2

E. coli

Sensitivity of CDO’s to Changes in Default Correlation

Sensitivity of CDO 2 to Changes in Default Correlation

Sensitivity of CDO to changes in Default Probability

Sensitivity of CDO 2 to changes in Default Probability

Mea Copula

9<br />

Midterm Two Scores<br />

8<br />

7<br />

mean = 87.9<br />

std dev = 7.96<br />

6<br />

5<br />

Score<br />

4<br />

3<br />

2<br />

1<br />

0<br />

60 63 66 69 72 75 78 81 84 87 90 93 96 99 100