Financial Report - Comptel

Financial Report - Comptel

Financial Report - Comptel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

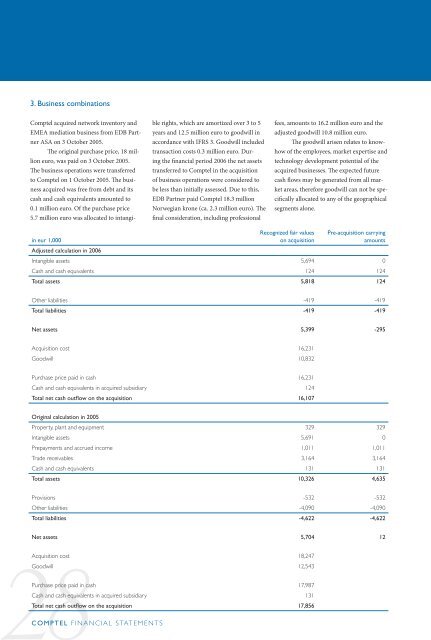

3. Business combinations<br />

<strong>Comptel</strong> acquired network inventory and<br />

EMEA mediation business from EDB Partner<br />

ASA on 3 October 2005.<br />

The original purchase price, 18 million<br />

euro, was paid on 3 October 2005.<br />

The business operations were transferred<br />

to <strong>Comptel</strong> on 1 October 2005. The business<br />

acquired was free from debt and its<br />

cash and cash equivalents amounted to<br />

0.1 million euro. Of the purchase price<br />

5.7 million euro was allocated to intangible<br />

rights, which are amortized over 3 to 5<br />

years and 12.5 million euro to goodwill in<br />

accordance with IFRS 3. Goodwill included<br />

transaction costs 0.3 million euro. During<br />

the financial period 2006 the net assets<br />

transferred to <strong>Comptel</strong> in the acquisition<br />

of business operations were considered to<br />

be less than initially assessed. Due to this,<br />

EDB Partner paid <strong>Comptel</strong> 18.3 million<br />

Norwegian krone (ca. 2.3 million euro). The<br />

final consideration, including professional<br />

fees, amounts to 16.2 million euro and the<br />

adjusted goodwill 10.8 million euro.<br />

The goodwill arisen relates to knowhow<br />

of the employees, market expertise and<br />

technology development potential of the<br />

acquired businesses. The expected future<br />

cash flows may be generated from all market<br />

areas, therefore goodwill can not be specifically<br />

allocated to any of the geographical<br />

segments alone.<br />

in eur 1,000<br />

Recognized fair values<br />

on acquisition<br />

Pre-acquisition carrying<br />

amounts<br />

Adjusted calculation in 2006<br />

Intangible assets 5,694 0<br />

Cash and cash equivalents 124 124<br />

Total assets 5,818 124<br />

Other liabilities -419 -419<br />

Total liabilities -419 -419<br />

Net assets 5,399 -295<br />

Acquisition cost 16,231<br />

Goodwill 10,832<br />

Purchase price paid in cash 16,231<br />

Cash and cash equivalents in acquired subsidiary 124<br />

Total net cash outfl ow on the acquisition 16,107<br />

Original calculation in 2005<br />

Property, plant and equipment 329 329<br />

Intangible assets 5,691 0<br />

Prepayments and accrued income 1,011 1,011<br />

Trade receivables 3,164 3,164<br />

Cash and cash equivalents 131 131<br />

Total assets 10,326 4,635<br />

Provisions -532 -532<br />

Other liabilities -4,090 -4,090<br />

Total liabilities -4,622 -4,622<br />

Net assets 5,704 12<br />

8<br />

Acquisition cost 18,247<br />

Goodwill 12,543<br />

Purchase price paid in cash 17,987<br />

Cash and cash equivalents in acquired subsidiary 131<br />

Total net cash outfl ow on the acquisition 17,856<br />

COMPTEL FINANCIAL STATEMENTS