The world's local bank - HSBC

The world's local bank - HSBC

The world's local bank - HSBC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>HSBC</strong> FRANCE<br />

Risk management (continued)<br />

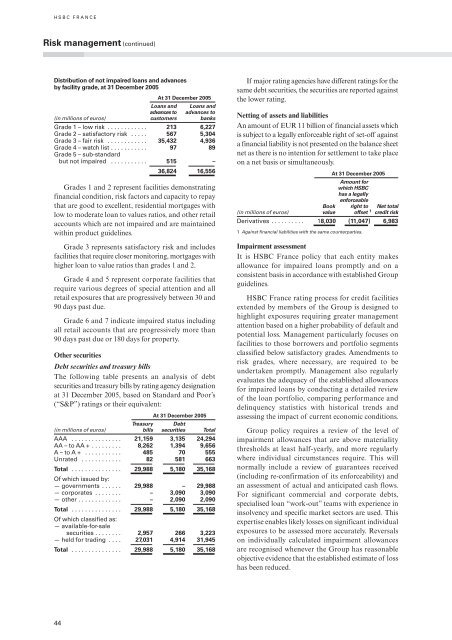

Distribution of not impaired loans and advances<br />

by facility grade, at 31 December 2005<br />

At 31 December 2005<br />

Loans and Loans and<br />

advances to advances to<br />

(in millions of euros) customers <strong>bank</strong>s<br />

Grade 1 – low risk . . . . . . . . . . . . 213 6,227<br />

Grade 2 – satisfactory risk . . . . . 567 5,304<br />

Grade 3 – fair risk . . . . . . . . . . . . 35,432 4,936<br />

Grade 4 – watch list . . . . . . . . . . . 97 89<br />

Grade 5 – sub-standard<br />

but not impaired . . . . . . . . . . . 515 –<br />

36,824 16,556<br />

Grades 1 and 2 represent facilities demonstrating<br />

financial condition, risk factors and capacity to repay<br />

that are good to excellent, residential mortgages with<br />

low to moderate loan to values ratios, and other retail<br />

accounts which are not impaired and are maintained<br />

within product guidelines.<br />

Grade 3 represents satisfactory risk and includes<br />

facilities that require closer monitoring, mortgages with<br />

higher loan to value ratios than grades 1 and 2.<br />

Grade 4 and 5 represent corporate facilities that<br />

require various degrees of special attention and all<br />

retail exposures that are progressively between 30 and<br />

90 days past due.<br />

Grade 6 and 7 indicate impaired status including<br />

all retail accounts that are progressively more than<br />

90 days past due or 180 days for property.<br />

Other securities<br />

Debt securities and treasury bills<br />

<strong>The</strong> following table presents an analysis of debt<br />

securities and treasury bills by rating agency designation<br />

at 31 December 2005, based on Standard and Poor’s<br />

(“S&P”) ratings or their equivalent:<br />

At 31 December 2005<br />

Treasury Debt<br />

(in millions of euros) bills securities Total<br />

AAA . . . . . . . . . . . . . . . 21,159 3,135 24,294<br />

AA – to AA + . . . . . . . . . 8,262 1,394 9,656<br />

A – to A + . . . . . . . . . . . 485 70 555<br />

Unrated . . . . . . . . . . . . 82 581 663<br />

Total . . . . . . . . . . . . . . . 29,988 5,180 35,168<br />

Of which issued by:<br />

— governments . . . . . . 29,988 – 29,988<br />

— corporates . . . . . . . . – 3,090 3,090<br />

— other . . . . . . . . . . . . . – 2,090 2,090<br />

Total . . . . . . . . . . . . . . . 29,988 5,180 35,168<br />

Of which classified as:<br />

— available-for-sale<br />

securities . . . . . . . . 2,957 266 3,223<br />

— held for trading . . . . 27,031 4,914 31,945<br />

Total . . . . . . . . . . . . . . . 29,988 5,180 35,168<br />

If major rating agencies have different ratings for the<br />

same debt securities, the securities are reported against<br />

the lower rating.<br />

Netting of assets and liabilities<br />

An amount of EUR 11 billion of financial assets which<br />

is subject to a legally enforceable right of set-off against<br />

a financial liability is not presented on the balance sheet<br />

net as there is no intention for settlement to take place<br />

on a net basis or simultaneously.<br />

At 31 December 2005<br />

Amount for<br />

which <strong>HSBC</strong><br />

has a legally<br />

enforceable<br />

Book right to Net total<br />

(in millions of euros) value offset 1 credit risk<br />

Derivatives . . . . . . . . . . 18,030 (11,047) 6,983<br />

1 Against financial liabilities with the same counterparties.<br />

Impairment assessment<br />

It is <strong>HSBC</strong> France policy that each entity makes<br />

allowance for impaired loans promptly and on a<br />

consistent basis in accordance with established Group<br />

guidelines.<br />

<strong>HSBC</strong> France rating process for credit facilities<br />

extended by members of the Group is designed to<br />

highlight exposures requiring greater management<br />

attention based on a higher probability of default and<br />

potential loss. Management particularly focuses on<br />

facilities to those borrowers and portfolio segments<br />

classified below satisfactory grades. Amendments to<br />

risk grades, where necessary, are required to be<br />

undertaken promptly. Management also regularly<br />

evaluates the adequacy of the established allowances<br />

for impaired loans by conducting a detailed review<br />

of the loan portfolio, comparing performance and<br />

delinquency statistics with historical trends and<br />

assessing the impact of current economic conditions.<br />

Group policy requires a review of the level of<br />

impairment allowances that are above materiality<br />

thresholds at least half-yearly, and more regularly<br />

where individual circumstances require. This will<br />

normally include a review of guarantees received<br />

(including re-confirmation of its enforceability) and<br />

an assessment of actual and anticipated cash flows.<br />

For significant commercial and corporate debts,<br />

specialised loan “work-out” teams with experience in<br />

insolvency and specific market sectors are used. This<br />

expertise enables likely losses on significant individual<br />

exposures to be assessed more accurately. Reversals<br />

on individually calculated impairment allowances<br />

are recognised whenever the Group has reasonable<br />

objective evidence that the established estimate of loss<br />

has been reduced.<br />

44