CLO NEWSLETTER - Sutherland Global Services

CLO NEWSLETTER - Sutherland Global Services

CLO NEWSLETTER - Sutherland Global Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Compelling case for <strong>CLO</strong> calls<br />

May 16, 2013; Source: Structuredcreditinvestor.com<br />

Equity investors in callable 2010 and 2011 <strong>CLO</strong>s should call them now and take advantage of the low current funding costs in the<br />

new issue market, suggest <strong>CLO</strong> strategists at Morgan Stanley. Many holders of legacy deals would also benefit from exercising call<br />

options, although continuing to hold 2006 and 2007 vintage <strong>CLO</strong>s could offer greater value.<br />

Twenty transactions have been called this year and a further 42 were called in 2012. Of those 62 deals, five are early <strong>CLO</strong> 2.0<br />

transactions from 2010 and 2011.<br />

For more: Click here<br />

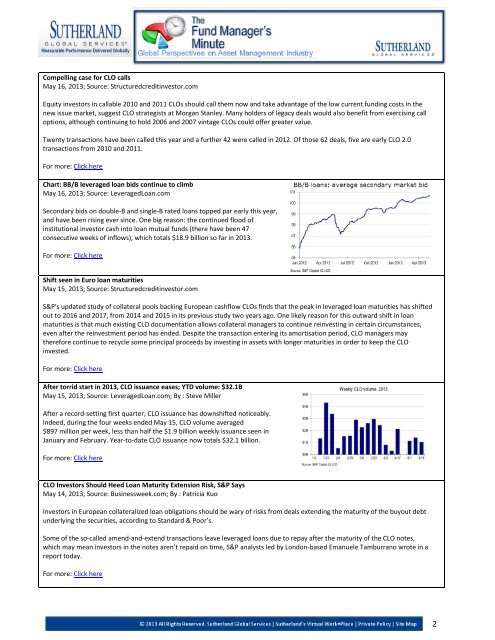

Chart: BB/B leveraged loan bids continue to climb<br />

May 16, 2013; Source: LeveragedLoan.com<br />

Secondary bids on double-B and single-B rated loans topped par early this year,<br />

and have been rising ever since. One big reason: the continued flood of<br />

institutional investor cash into loan mutual funds (there have been 47<br />

consecutive weeks of inflows), which totals $18.9 billion so far in 2013.<br />

For more: Click here<br />

Shift seen in Euro loan maturities<br />

May 15, 2013; Source: Structuredcreditinvestor.com<br />

S&P's updated study of collateral pools backing European cashflow <strong>CLO</strong>s finds that the peak in leveraged loan maturities has shifted<br />

out to 2016 and 2017, from 2014 and 2015 in its previous study two years ago. One likely reason for this outward shift in loan<br />

maturities is that much existing <strong>CLO</strong> documentation allows collateral managers to continue reinvesting in certain circumstances,<br />

even after the reinvestment period has ended. Despite the transaction entering its amortisation period, <strong>CLO</strong> managers may<br />

therefore continue to recycle some principal proceeds by investing in assets with longer maturities in order to keep the <strong>CLO</strong><br />

invested.<br />

For more: Click here<br />

After torrid start in 2013, <strong>CLO</strong> issuance eases; YTD volume: $32.1B<br />

May 15, 2013; Source: LeveragedLoan.com; By : Steve Miller<br />

After a record-setting first quarter, <strong>CLO</strong> issuance has downshifted noticeably.<br />

Indeed, during the four weeks ended May 15, <strong>CLO</strong> volume averaged<br />

$897 million per week, less than half the $1.9 billion weekly issuance seen in<br />

January and February. Year-to-date <strong>CLO</strong> issuance now totals $32.1 billion.<br />

For more: Click here<br />

<strong>CLO</strong> Investors Should Heed Loan Maturity Extension Risk, S&P Says<br />

May 14, 2013; Source: Businessweek.com; By : Patricia Kuo<br />

Investors in European collateralized loan obligations should be wary of risks from deals extending the maturity of the buyout debt<br />

underlying the securities, according to Standard & Poor’s.<br />

Some of the so-called amend-and-extend transactions leave leveraged loans due to repay after the maturity of the <strong>CLO</strong> notes,<br />

which may mean investors in the notes aren’t repaid on time, S&P analysts led by London-based Emanuele Tamburrano wrote in a<br />

report today.<br />

For more: Click here<br />

2