CLO NEWSLETTER - Sutherland Global Services

CLO NEWSLETTER - Sutherland Global Services

CLO NEWSLETTER - Sutherland Global Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

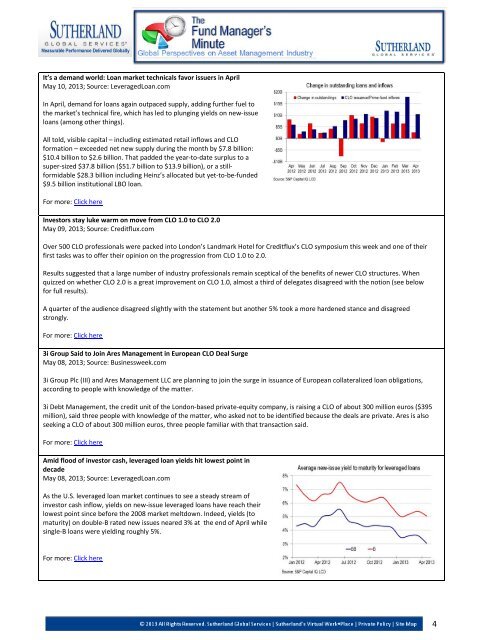

It’s a demand world: Loan market technicals favor issuers in April<br />

May 10, 2013; Source: LeveragedLoan.com<br />

In April, demand for loans again outpaced supply, adding further fuel to<br />

the market’s technical fire, which has led to plunging yields on new-issue<br />

loans (among other things).<br />

All told, visible capital – including estimated retail inflows and <strong>CLO</strong><br />

formation – exceeded net new supply during the month by $7.8 billion:<br />

$10.4 billion to $2.6 billion. That padded the year-to-date surplus to a<br />

super-sized $37.8 billion ($51.7 billion to $13.9 billion), or a stillformidable<br />

$28.3 billion including Heinz’s allocated but yet-to-be-funded<br />

$9.5 billion institutional LBO loan.<br />

For more: Click here<br />

Investors stay luke warm on move from <strong>CLO</strong> 1.0 to <strong>CLO</strong> 2.0<br />

May 09, 2013; Source: Creditflux.com<br />

Over 500 <strong>CLO</strong> professionals were packed into London’s Landmark Hotel for Creditflux’s <strong>CLO</strong> symposium this week and one of their<br />

first tasks was to offer their opinion on the progression from <strong>CLO</strong> 1.0 to 2.0.<br />

Results suggested that a large number of industry professionals remain sceptical of the benefits of newer <strong>CLO</strong> structures. When<br />

quizzed on whether <strong>CLO</strong> 2.0 is a great improvement on <strong>CLO</strong> 1.0, almost a third of delegates disagreed with the notion (see below<br />

for full results).<br />

A quarter of the audience disagreed slightly with the statement but another 5% took a more hardened stance and disagreed<br />

strongly.<br />

For more: Click here<br />

3i Group Said to Join Ares Management in European <strong>CLO</strong> Deal Surge<br />

May 08, 2013; Source: Businessweek.com<br />

3i Group Plc (III) and Ares Management LLC are planning to join the surge in issuance of European collateralized loan obligations,<br />

according to people with knowledge of the matter.<br />

3i Debt Management, the credit unit of the London-based private-equity company, is raising a <strong>CLO</strong> of about 300 million euros ($395<br />

million), said three people with knowledge of the matter, who asked not to be identified because the deals are private. Ares is also<br />

seeking a <strong>CLO</strong> of about 300 million euros, three people familiar with that transaction said.<br />

For more: Click here<br />

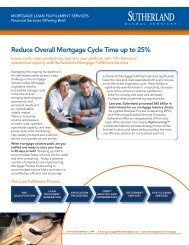

Amid flood of investor cash, leveraged loan yields hit lowest point in<br />

decade<br />

May 08, 2013; Source: LeveragedLoan.com<br />

As the U.S. leveraged loan market continues to see a steady stream of<br />

investor cash inflow, yields on new-issue leveraged loans have reach their<br />

lowest point since before the 2008 market meltdown. Indeed, yields (to<br />

maturity) on double-B rated new issues neared 3% at the end of April while<br />

single-B loans were yielding roughly 5%.<br />

For more: Click here<br />

4