CLO NEWSLETTER - Sutherland Global Services

CLO NEWSLETTER - Sutherland Global Services

CLO NEWSLETTER - Sutherland Global Services

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

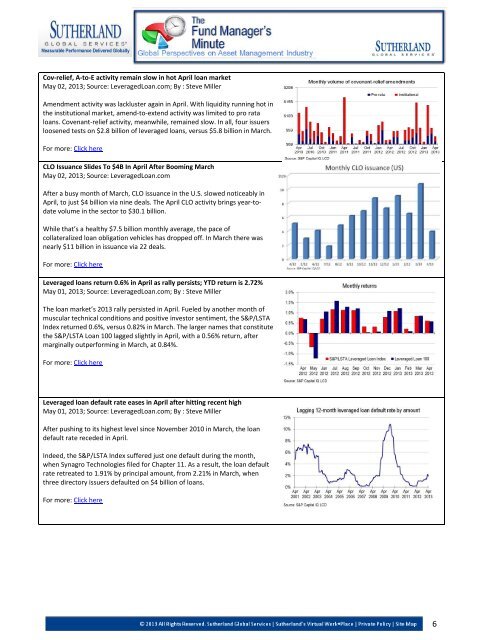

Cov-relief, A-to-E activity remain slow in hot April loan market<br />

May 02, 2013; Source: LeveragedLoan.com; By : Steve Miller<br />

Amendment activity was lackluster again in April. With liquidity running hot in<br />

the institutional market, amend-to-extend activity was limited to pro rata<br />

loans. Covenant-relief activity, meanwhile, remained slow. In all, four issuers<br />

loosened tests on $2.8 billion of leveraged loans, versus $5.8 billion in March.<br />

For more: Click here<br />

<strong>CLO</strong> Issuance Slides To $4B In April After Booming March<br />

May 02, 2013; Source: LeveragedLoan.com<br />

After a busy month of March, <strong>CLO</strong> issuance in the U.S. slowed noticeably in<br />

April, to just $4 billion via nine deals. The April <strong>CLO</strong> activity brings year-todate<br />

volume in the sector to $30.1 billion.<br />

While that’s a healthy $7.5 billion monthly average, the pace of<br />

collateralized loan obligation vehicles has dropped off. In March there was<br />

nearly $11 billion in issuance via 22 deals.<br />

For more: Click here<br />

Leveraged loans return 0.6% in April as rally persists; YTD return is 2.72%<br />

May 01, 2013; Source: LeveragedLoan.com; By : Steve Miller<br />

The loan market’s 2013 rally persisted in April. Fueled by another month of<br />

muscular technical conditions and positive investor sentiment, the S&P/LSTA<br />

Index returned 0.6%, versus 0.82% in March. The larger names that constitute<br />

the S&P/LSTA Loan 100 lagged slightly in April, with a 0.56% return, after<br />

marginally outperforming in March, at 0.84%.<br />

For more: Click here<br />

Leveraged loan default rate eases in April after hitting recent high<br />

May 01, 2013; Source: LeveragedLoan.com; By : Steve Miller<br />

After pushing to its highest level since November 2010 in March, the loan<br />

default rate receded in April.<br />

Indeed, the S&P/LSTA Index suffered just one default during the month,<br />

when Synagro Technologies filed for Chapter 11. As a result, the loan default<br />

rate retreated to 1.91% by principal amount, from 2.21% in March, when<br />

three directory issuers defaulted on $4 billion of loans.<br />

For more: Click here<br />

6