Saudi Ceramic Continued success - Al Rajhi Capital

Saudi Ceramic Continued success - Al Rajhi Capital

Saudi Ceramic Continued success - Al Rajhi Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

RSI10<br />

Vol<br />

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction and Materials –Industrial<br />

SCERCO AB: <strong>Saudi</strong> Arabia<br />

1 August 2010<br />

US$bn0.94bn 63.6% US$4.100mn<br />

Market cap Free float Avg. daily volume<br />

Target price 166.3 18.6% over current<br />

Consensus price n/a<br />

Current price 140.3 as at 31/7/2010<br />

Underweight Neutral Overweight<br />

Key themes<br />

We believe that the ceramics manufacturing industry<br />

will continue to grow. <strong>Saudi</strong> <strong>Ceramic</strong> has a very<br />

strong position in the <strong>Saudi</strong> ceramic market. It is<br />

currently the major local player. We believe that<br />

<strong>Saudi</strong> <strong>Ceramic</strong>’s strategy of increasing production<br />

capacity in the ceramic tiles and water heaters<br />

divisions will boost the company’s growth.<br />

Implications<br />

<strong>Saudi</strong> <strong>Ceramic</strong> is a quality company, which we rate<br />

as Overweight. It is performing well operationally<br />

and offers good growth in the near term at a<br />

reasonable valuation. We believe that growing<br />

dividends, coupled with high transparency will<br />

support the share price.<br />

Performance<br />

140<br />

130<br />

120<br />

110<br />

100<br />

70<br />

30<br />

600 10<br />

400<br />

200<br />

Earnings<br />

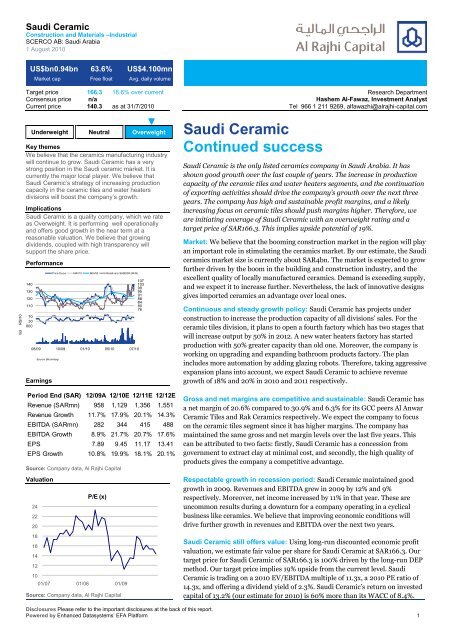

Period End (SAR) 12/09A 12/10E 12/11E 12/12E<br />

Revenue (SARmn) 958 1,129 1,356 1,551<br />

Revenue Growth 11.7% 17.9% 20.1% 14.3%<br />

EBITDA (SARmn) 282 344 415 488<br />

EBITDA Growth 8.9% 21.7% 20.7% 17.6%<br />

EPS 7.89 9.45 11.17 13.41<br />

EPS Growth 10.8% 19.9% 18.1% 20.1%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Valuation<br />

24<br />

22<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

Price Close MAV10 MAV50 Relative to SASEIDX (RHS)<br />

08/09 10/09 01/10 05/10 07/10<br />

Source: Bloomberg<br />

P/E (x)<br />

01/07 01/08 01/09<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

107<br />

103<br />

99<br />

95<br />

91<br />

88<br />

84<br />

80<br />

76<br />

72<br />

<strong>Saudi</strong> <strong>Ceramic</strong><br />

<strong>Continued</strong> <strong>success</strong><br />

Research Department<br />

Hashem <strong>Al</strong>-Fawaz, Investment Analyst<br />

Tel 966 1 211 9269, alfawazhi@alrajhi-capital.com<br />

<strong>Saudi</strong> <strong>Ceramic</strong> is the only listed ceramics company in <strong>Saudi</strong> Arabia. It has<br />

shown good growth over the last couple of years. The increase in production<br />

capacity of the ceramic tiles and water heaters segments, and the continuation<br />

of exporting activities should drive the company’s growth over the next three<br />

years. The company has high and sustainable profit margins, and a likely<br />

increasing focus on ceramic tiles should push margins higher. Therefore, we<br />

are initiating coverage of <strong>Saudi</strong> <strong>Ceramic</strong> with an overweight rating and a<br />

target price of SAR166.3. This implies upside potential of 19%.<br />

Market: We believe that the booming construction market in the region will play<br />

an important role in stimulating the ceramics market. By our estimate, the <strong>Saudi</strong><br />

ceramics market size is currently about SAR4bn. The market is expected to grow<br />

further driven by the boom in the building and construction industry, and the<br />

excellent quality of locally manufactured ceramics. Demand is exceeding supply,<br />

and we expect it to increase further. Nevertheless, the lack of innovative designs<br />

gives imported ceramics an advantage over local ones.<br />

Continuous and steady growth policy: <strong>Saudi</strong> <strong>Ceramic</strong> has projects under<br />

construction to increase the production capacity of all divisions’ sales. For the<br />

ceramic tiles division, it plans to open a fourth factory which has two stages that<br />

will increase output by 50% in 2012. A new water heaters factory has started<br />

production with 50% greater capacity than old one. Moreover, the company is<br />

working on upgrading and expanding bathroom products factory. The plan<br />

includes more automation by adding glazing robots. Therefore, taking aggressive<br />

expansion plans into account, we expect <strong>Saudi</strong> <strong>Ceramic</strong> to achieve revenue<br />

growth of 18% and 20% in 2010 and 2011 respectively.<br />

Gross and net margins are competitive and sustainable: <strong>Saudi</strong> <strong>Ceramic</strong> has<br />

a net margin of 20.6% compared to 30.9% and 6.3% for its GCC peers <strong>Al</strong> Anwar<br />

<strong>Ceramic</strong> Tiles and Rak <strong>Ceramic</strong>s respectively. We expect the company to focus<br />

on the ceramic tiles segment since it has higher margins. The company has<br />

maintained the same gross and net margin levels over the last five years. This<br />

can be attributed to two facts: firstly, <strong>Saudi</strong> <strong>Ceramic</strong> has a concession from<br />

government to extract clay at minimal cost, and secondly, the high quality of<br />

products gives the company a competitive advantage.<br />

Respectable growth in recession period: <strong>Saudi</strong> <strong>Ceramic</strong> maintained good<br />

growth in 2009. Revenues and EBITDA grew in 2009 by 12% and 9%<br />

respectively. Moreover, net income increased by 11% in that year. These are<br />

uncommon results during a downturn for a company operating in a cyclical<br />

business like ceramics. We believe that improving economic conditions will<br />

drive further growth in revenues and EBITDA over the next two years.<br />

<strong>Saudi</strong> <strong>Ceramic</strong> still offers value: Using long-run discounted economic profit<br />

valuation, we estimate fair value per share for <strong>Saudi</strong> <strong>Ceramic</strong> at SAR166.3. Our<br />

target price for <strong>Saudi</strong> <strong>Ceramic</strong> of SAR166.3 is 100% driven by the long-run DEP<br />

method. Our target price implies 19% upside from the current level. <strong>Saudi</strong><br />

<strong>Ceramic</strong> is trading on a 2010 EV/EBITDA multiple of 11.3x, a 2010 PE ratio of<br />

14.3x, and offering a dividend yield of 2.3%. <strong>Saudi</strong> <strong>Ceramic</strong>’s return on invested<br />

capital of 13.2% (our estimate for 2010) is 60% more than its WACC of 8.4%.<br />

Disclosures Please refer to the important disclosures at the back of this report.<br />

Powered by Enhanced Datasystems’ EFA Platform 1

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

Page<br />

3 <strong>Saudi</strong> ceramics market: dominated by imports<br />

3 Opportunities foster optimism, few threats<br />

<strong>Ceramic</strong> products are essential parts of modern buildings. This explains the high<br />

correlation between demand for ceramics and construction markets. The demand for<br />

ceramic products is huge, and we expect it to grow further driven by the booming<br />

construction. <strong>Saudi</strong> ceramics are considered high quality but they have to develop<br />

innovative designs to compete with imported ceramics.<br />

5 <strong>Saudi</strong> <strong>Ceramic</strong>: in expansion mode<br />

5<br />

Continuous and steady growth policy<br />

<strong>Saudi</strong> <strong>Ceramic</strong>’s business contains two divisions: ceramic tiles and bathroom products,<br />

and water heaters. <strong>Al</strong>l divisions have grown strongly recently. We expect further<br />

growth since the company is increasing production capacity. Desert Mines supplies<br />

<strong>Saudi</strong> <strong>Ceramic</strong> and sells clay to local ceramic companies. <strong>Saudi</strong> <strong>Ceramic</strong> sells its<br />

products through four main channels: showrooms, dealers, institutions and exports.<br />

6<br />

<strong>Ceramic</strong> tiles and bathroom goods segment: gradual and<br />

sustainable expansion strategy<br />

<strong>Saudi</strong> <strong>Ceramic</strong> is expanding production capacity of ceramic tiles. It currently has total<br />

production capacity of 34mn m 2 of ceramic tiles, and we expect this to reach 43mn and<br />

52mn m 2 by the end of 2010 and 2011 respectively.<br />

7<br />

Water heaters segment: remarkable growth<br />

<strong>Saudi</strong> <strong>Ceramic</strong> currently has total production capacity of 1.5mn heaters per year. Water<br />

heater segment sales grew by 33% and 21% in 2008 and 2009 respectively. More than<br />

50% of this segment’s production is exported.<br />

8 Profitable business: fine record, returns set to last<br />

8<br />

Gross and net margins are competitive and sustainable<br />

<strong>Saudi</strong> <strong>Ceramic</strong> has a net margin of 20.8% compared to 30.9% and 6.3% for its regional<br />

peers <strong>Al</strong> Anwar <strong>Ceramic</strong> Tiles and Rak <strong>Ceramic</strong>s respectively. We expect the company<br />

to focus on the ceramic tiles segment since it has a higher margin.<br />

8<br />

Respectable growth in recession period<br />

Revenues and EBITDA grew in 2009 by 12% and 9% respectively. Moreover, net<br />

income increased by 11% in that year. We expect that improving economic conditions<br />

will drive further growth in revenues and EBTIDA over the next two years.<br />

10 Valuation: offers good long-term value<br />

10 High economic profit; growth in dividend payout ratio<br />

<strong>Saudi</strong> <strong>Ceramic</strong> achieves a return on invested capital (ROIC) of 12.5-12.6%. We expect<br />

the company to maintain and improve its high returns, and so two-thirds of our<br />

estimated fair enterprise value for <strong>Saudi</strong> <strong>Ceramic</strong> comes from future economic profits.<br />

We estimate fair value per share at SAR166.3, and set this as our target price.<br />

Currently, <strong>Saudi</strong> <strong>Ceramic</strong> offers a dividend yield of 2.3%. The company increased the<br />

paid dividend to 30% of paid-up capital in 2009; however, we expect it to maintain the<br />

same dividend for at least three years. Our rating on <strong>Saudi</strong> <strong>Ceramic</strong> is Overweight.<br />

13 Appendix: investments<br />

14 Financial data<br />

Disclosures Please refer to the important disclosures at the back of this report. 2

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

Corporate summary Share information Valuation<br />

<strong>Saudi</strong> <strong>Ceramic</strong> Company is one of the<br />

Market cap (SAR/US$) 3.502bn / 0.935bn<br />

oldest and leading ceramics producers<br />

52-week range 109.5 - 140.8<br />

in the Middle East. <strong>Saudi</strong> <strong>Ceramic</strong> Daily avg volume (US$)<br />

3.700mn<br />

manufactures and markets ceramic Shares outstanding<br />

25.00mn<br />

products. The company has two major Free float (est) 63.6%<br />

segments: ceramic tiles and bathroom<br />

products, which contribute 77% of Performance: 1M 3M 12M<br />

revenues, and water heaters which Absolute 7.8% -4.5% 2.1%<br />

contributes the remaining 23%.<br />

Relative to index 13.2% 5.1% -4%<br />

Incorporated in 1977 in Riyadh by a<br />

group of prominent businessmen.<br />

Major Shareholder:<br />

General Social Insurance 15.9%<br />

Saleh Abdulaziz <strong>Al</strong> <strong>Rajhi</strong> 14.3%<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

<strong>Saudi</strong> ceramics market<br />

dominated by imports<br />

Period End 12/09A 12/10E 12/11E 12/12E<br />

Revenue (SARmn) 958 1,103 1,230 1,368<br />

EBITDA (SARmn) 282 343 391 447<br />

Net Profit (SARmn) 197 230 252 295<br />

EPS (SAR) 7.89 9.20 10.09 11.78<br />

DPS (SAR) 3.00 3.00 3.00 3.00<br />

EPS Growth 10.8% 16.7% 9.6% 16.8%<br />

EV/EBITDA (x) 13.3 11.3 10.3 9.0<br />

P/E (x) 16.7 14.3 13.1 11.2<br />

P/B (x) 3.8 3.3 2.8 2.3<br />

Dividend Yield 2.3% 2.3% 2.3% 2.3%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

The <strong>Saudi</strong> ceramic market size<br />

is about SAR4bn<br />

70% of the market sales are<br />

imports<br />

With a size of about SAR4bn, the <strong>Saudi</strong> ceramics market is one of the biggest in the MENA<br />

region. We expect the market to grow further, driven by the current boom in the building and<br />

construction industry. The ceramic products include ceramic wall and floor tiles, bathroom<br />

goods and water heaters. The main material used in manufacturing ceramics is clay. The tiles<br />

include many kinds such as porcelain and ceramic tiles. <strong>Ceramic</strong>s are made mainly of clay,<br />

which is extracted locally, and heated in gas kilns and mixed with other exported chemicals.<br />

The porcelain is made of white clay which is imported from Ukraine and Turkey.<br />

The ceramic tiles market is dominated by imports which represent around 70% of the market.<br />

<strong>Saudi</strong> <strong>Ceramic</strong> has a 25% share, and the remaining 5% is divided between small private <strong>Saudi</strong><br />

companies such as <strong>Al</strong>fanar, Future <strong>Ceramic</strong> in Dammam and <strong>Al</strong>-Jawdah <strong>Ceramic</strong>. Many of<br />

the local companies are suffering because of the lack of innovative designs that are an<br />

important feature of modern buildings. Imports, especially from Europe and US, are<br />

characterised by innovative designs, making them more attractive to people despite their<br />

high prices.<br />

Figure 1. <strong>Saudi</strong> ceramics market : market share of ceramic tiles<br />

5%<br />

25%<br />

70%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Imports <strong>Saudi</strong> ceramics others<br />

Excess demand in bathroom<br />

products market<br />

The bathroom products market is very dominated by imports, with a share of around 90%.<br />

<strong>Saudi</strong> <strong>Ceramic</strong> company has more than 7% of the bathroom products market, and the other<br />

local companies represent 3 % of the market. This market is characterised by excess demand,<br />

which provides an opportunity for local companies to expand their capacity. Regarding the<br />

water heaters markets, <strong>Saudi</strong> <strong>Ceramic</strong> has a share of about 50%. The other local companies<br />

have less than 5% market share, and imports represent the remaining 45% of the market.<br />

Disclosures Please refer to the important disclosures at the back of this report. 3

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

Opportunities foster optimism, few threats<br />

Huge government projects will<br />

boost the demand for ceramics<br />

products<br />

Imports have a competitive<br />

advantage in innovative<br />

designs<br />

Demand is expected to be more<br />

than 200mn m 2 by 2013<br />

Booming construction market<br />

<strong>Ceramic</strong> products including tiles, bathroom products and water heaters are essential parts of<br />

modern buildings. This explains the high correlation between demand for ceramics and<br />

construction markets. The <strong>Saudi</strong> government is constructing huge projects called economic<br />

cities. There are also other big construction projects for the twelve newly created government<br />

universities, and expansion projects for the existing universities. These projects are expected<br />

to increase the demand for ceramic products and support the revenue growth.<br />

Excellent quality, but lack of innovative designs<br />

<strong>Saudi</strong> ceramics are considered high quality since their raw materials, mainly red clay, are<br />

among the best in the world. However, the imported ceramics, especially the European, are<br />

preferred by customers because of the variety of design that fits different people’s needs.<br />

Some of the local companies are trying to overcome this obstacle by producing customised<br />

orders where the customer selects his preferred design. <strong>Saudi</strong> ceramics are cheaper than the<br />

European so they are attractive for low and middle class people.<br />

Demand is exceeding supply<br />

We expect demand for ceramic tiles to be more than 200mn m 2 by 2013 while the current<br />

supply level is about 136mn m 2 . The demand for bathroom products is already exceeding the<br />

quantity supplied. However, supply of water heaters exceeds demand which increases the<br />

export percentage of locally manufactured heaters. Overall, the sales growth potential of<br />

<strong>Saudi</strong> ceramic companies seems very clear.<br />

Disclosures Please refer to the important disclosures at the back of this report. 4

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

<strong>Saudi</strong> <strong>Ceramic</strong><br />

in expansion mode<br />

<strong>Ceramic</strong> tiles and bathroom<br />

products division is the biggest<br />

in <strong>Saudi</strong> <strong>Ceramic</strong><br />

Continuous and steady growth policy<br />

<strong>Saudi</strong> <strong>Ceramic</strong>’s business contains two divisions: ceramic tiles and bathroom products (this is<br />

named by the company as sanitary wares), and water heaters. The company combines<br />

ceramic tiles and bathroom products in one division since they have almost the same<br />

business line and raw materials. 40% of ceramic tiles production is customised. i.e. produced<br />

according to customers’ preferences. In Q2 2010, ceramic tiles contributed 79% of total<br />

revenues whereas water heaters contributed 21%. <strong>Al</strong>l divisions have grown strongly recently;<br />

the water heaters segment showed the greatest year-on-year growth in Q2 2010 since it grew<br />

by 15.3%. The ceramic tiles and bathroom products segment grew by 15% in Q2 2010. The<br />

company’s three year compound annual growth rate (CAGR) in revenues is 24 %.<br />

Figure 2. <strong>Saudi</strong> <strong>Ceramic</strong>: revenues breakdown in Q2 2010<br />

21%<br />

79%<br />

ceramic tiles and bathroom products<br />

water heaters<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

<strong>Saudi</strong> <strong>Ceramic</strong> sells clay to<br />

local ceramic companies<br />

Increase in production capacity<br />

of all segments<br />

Desert Mines has a concession to extract clay<br />

Desert Mines was a department of <strong>Saudi</strong> <strong>Ceramic</strong> Company, and it is in the process of<br />

becoming a separate entity 100% owned by <strong>Saudi</strong> <strong>Ceramic</strong>. Desert Mines has a concession<br />

from the <strong>Saudi</strong> government to extract clay and it is renewed periodically. Desert Mines<br />

supplies <strong>Saudi</strong> <strong>Ceramic</strong> and sells clay to local ceramic companies and other companies that<br />

use clay in their manufacturing process such as ceramic pipes companies. The high quality of<br />

local clay gives the company an opportunity to export its products abroad.<br />

Production capacity is increasing<br />

<strong>Saudi</strong> <strong>Ceramic</strong>’s factories are located in the Second Industrial City in Riyadh. <strong>Saudi</strong> <strong>Ceramic</strong>s<br />

has three ceramic tiles factories, and a fourth is under construction. The fourth tiles factory<br />

project will increase production capacity by 50%. The first stage of the fourth factory is<br />

expected to start commercial production by the end of 2010. The second stage is expected to<br />

run by the end of 2011. The company had already expanded the capacity of the only bathroom<br />

products factory in Q1 2010. The company has two water heater factories. The second factory<br />

started commercial production in Q4 2009 and it has half of the capacity of the first one.<br />

Taking these expansion plans into account and assuming the prices will increase or stay<br />

constant, we expect <strong>Saudi</strong> <strong>Ceramic</strong> to achieve impressive revenue growth of 18% and 20% in<br />

2010 and 2011 respectively.<br />

Disclosures Please refer to the important disclosures at the back of this report. 5

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

Figure 3. <strong>Saudi</strong> <strong>Ceramic</strong>: production capacity for each segment<br />

2007 2008 2009 2010E 2011E<br />

<strong>Ceramic</strong> tiles(mn m2) 21 32 34 43 52<br />

Sanitary wares (tons) 19,200 24,000 27,600 34,500 41,000<br />

Water heaters (heater) 600,000 850,000 1,200,000 1,500,000 1,600,000<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

55% of revenues come from<br />

local dealers<br />

Sales by distribution channels<br />

The company’s sales can be divided based on the distribution channels. The company has 25<br />

showrooms around <strong>Saudi</strong> Arabia that derive 20% of its sales. The exports represent 13% of<br />

sales. The sales of the Dubai office increased by 25% in 2009. The third channel is direct sales<br />

to institutional projects, which make up a 7% share. Most of the sales are driven by company<br />

dealers, which represent 55% of sales.<br />

Figure 4. <strong>Saudi</strong> <strong>Ceramic</strong>: revenues breakdown by distribution channels<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

We expect an increase in<br />

capacity of ceramic tiles of 50%<br />

in 2012<br />

Increased utilisation of<br />

bathroom products factory<br />

We expect revenues to grow by<br />

18% and 22% in 2010 and<br />

2011 respectively<br />

<strong>Ceramic</strong> tiles and bathroom products segment: gradual<br />

and sustainable expansion strategy<br />

<strong>Saudi</strong> <strong>Ceramic</strong> plans to continue expanding its production of ceramic tiles. The company has<br />

replaced the old tiles line in the first tiles factory whose capacity totalled 600,000 m 2 by a<br />

new line whose annual capacity is 2mn m 2 . This project has been completed and production<br />

started on March 2009. The company also lunched a new production line at the first tile<br />

factory with an annual capacity of 1.3mn m 2 , which started production on May 2010.<br />

Moreover, work is progressing on implementation of the first stage of the fourth tile factory<br />

project with annual production capacity of 9mn m 2 . This stage is expected to be in operation<br />

by the end of 2010. The second stage of the fourth tiles factory has a capacity of 9mn m 2 , and<br />

the company expects to launch production by the end of 2011. The company currently has a<br />

total production capacity of 34mn m 2 of ceramic tiles, and we expect it to reach 43mn and<br />

52mn m 2 by the end of 2010 and 2011 respectively.<br />

The company has one factory that handles bathroom products production. The current<br />

capacity of 30,000 tons per year equals more than 2mn pieces. The company is planning to<br />

expand its capacity further since demand is huge. The company is working on upgrading and<br />

expanding the bathroom products factory. The plan includes more automation by adding<br />

glazing robots for spraying, high and low pressure casting lines, tunnel and shuttle kilns and<br />

tunnel dryers. Upgrading and expanding will result in an increase of capacity of 50% up to<br />

3mn pieces annually within tow years.<br />

The ceramic tiles and the bathroom products segment sales grew by 41% and 9% in 2008 and<br />

2009 respectively. From the fact that the company’s policy is to produce at full capacity, and<br />

based on the aggressive expansion, we expect that the company’s revenues will grow by 18%<br />

and 22% in 2010 and 2011 respectively.<br />

Disclosures Please refer to the important disclosures at the back of this report. 6

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

Figure 5. <strong>Saudi</strong> <strong>Ceramic</strong>: ceramic tiles and bathroom products segment sales forecasts<br />

1,400<br />

1,320<br />

1,200<br />

1,061<br />

1,189<br />

1,000<br />

867<br />

800<br />

672<br />

734<br />

600<br />

475<br />

400<br />

200<br />

0<br />

FY 07 FY08 FY09 FY10E FY11E FY12E FY13E<br />

sales(mn SAR)<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

50% of water heaters are<br />

exported<br />

We expect revenues to grow by<br />

17.5% and 12% in 2010 and<br />

2011 respectively<br />

Water heaters segment: remarkable growth<br />

<strong>Saudi</strong> <strong>Ceramic</strong> produces porcelain-coated water heaters, which are stainless and safer than<br />

galvanised water heaters. The company sells water heaters under different brand names<br />

based on quality and durability, such as the <strong>Saudi</strong> <strong>Ceramic</strong> brand which is distributed mainly<br />

in the local and GCC market, and “Super Aqua Hot” which is exported to Europe. The<br />

company exports more than 50% of its commercial production of this segment.<br />

<strong>Saudi</strong> <strong>Ceramic</strong> has two water heater factories. The second factory started commercial<br />

production in the last quarter of 2009 with an annual production capacity of 500,000 water<br />

heaters (50% of the first factory capacity). The company currently has a total production<br />

capacity of 1.5mn heaters per year. Water heater segment sales grew by 33% and 21% in 2008<br />

and 2009 respectively. This was driven mainly by huge demand from local customers and<br />

foreign countries. We expect that this demand will continue further. Therefore, we expect the<br />

water heater segment to grow by 18% and 12% in 2010 and 2011 respectively.<br />

Figure 6. <strong>Saudi</strong> <strong>Ceramic</strong>: water heaters segment sales forecasts<br />

400<br />

350<br />

330<br />

366<br />

300<br />

250<br />

224<br />

263<br />

295<br />

200<br />

185<br />

150<br />

140<br />

100<br />

50<br />

0<br />

FY 07 FY08 FY09 FY10E FY11E FY12E FY13E<br />

sales(mn SAR )<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer to the important disclosures at the back of this report. 7

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

Profitable business<br />

good record and sustainable returns<br />

<strong>Saudi</strong> <strong>Ceramic</strong> barely suffered<br />

during the downturn of 2009<br />

Respectable growth in recession period<br />

<strong>Saudi</strong> <strong>Ceramic</strong> maintained good growth in the recessionary year of 2009. Revenues and<br />

EBITDA grew in 2009 by 12% and 9% respectively. Moreover, net income increased also by<br />

11% in that year. These are uncommon results during an economic downturn for a company<br />

operating in a cyclical business like ceramics. We are convinced that the company will<br />

perform better in economic recovery stage. We expect that the improving economic<br />

conditions and the current expansion projects will drive further growth in revenues and<br />

EBTIDA over the next two years.<br />

Figure 7. <strong>Saudi</strong> <strong>Ceramic</strong>: revenues and EBITDA growth<br />

50%<br />

45%<br />

40%<br />

35%<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

FY08 FY09 FY10E FY11E FY12E<br />

revenues<br />

EBITDA<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

As the figure above shows, we expect revenue growth of 18% in 2010 to be followed by growth<br />

of 20% in 2011 and 14% in 2012. Regarding EBITDA, we expect growth of of 22% in 2010 to<br />

be followed by growth of 21% in 2011 and 18% in 2012. We expect the EBITDA margin to<br />

expand from 30% in 2009 to 32% by 2012.<br />

<strong>Saudi</strong> <strong>Ceramic</strong>’s regional peers<br />

are <strong>Al</strong> Anwar <strong>Ceramic</strong> Tiles and<br />

Rak <strong>Ceramic</strong>s<br />

We expect the company to<br />

focus on the ceramic tiles<br />

segment since it has higher<br />

margin<br />

Gross and net margins are competitive and sustainable<br />

<strong>Saudi</strong> <strong>Ceramic</strong>’s regional peers are <strong>Al</strong> Anwar <strong>Ceramic</strong> Tiles and Ras <strong>Al</strong> Khaimah (Rak)<br />

<strong>Ceramic</strong>s. <strong>Al</strong> Anwar <strong>Ceramic</strong> Tiles is listed on the Muscat Securities Market (MSM), and Rak<br />

<strong>Ceramic</strong>s is listed on the Abu Dhabi Securities Market (ADSM). <strong>Al</strong> Anwar <strong>Ceramic</strong> Tiles<br />

enjoys higher gross and net margins than <strong>Saudi</strong> <strong>Ceramic</strong>. This is due mainly to the fact that<br />

<strong>Al</strong> Anwar <strong>Ceramic</strong> Tiles produces only ceramic tiles, which enjoy higher margins than other<br />

ceramic products such as bathroom products and water heaters. However, Rak <strong>Ceramic</strong>s is<br />

below <strong>Saudi</strong> <strong>Ceramic</strong> in terms of the gross and net margin. Rak <strong>Ceramic</strong>s is suffering because<br />

it implemented huge expansion projects in a short period. It has plants in six different<br />

countries around the world, which increased its capex and logistic costs. Moreover, Rak<br />

<strong>Ceramic</strong>s has a high financing cost that reduces its net margin.<br />

<strong>Saudi</strong> <strong>Ceramic</strong> has a net margin of 20.6% compared to 30.9% and 6.3% for <strong>Al</strong> Anwar <strong>Ceramic</strong><br />

Tiles and Rak <strong>Ceramic</strong>s respectively. We expect the company to focus on the ceramic tiles<br />

segment since it has higher margins. We believe that <strong>Saudi</strong> <strong>Ceramic</strong>’s margins are good. This<br />

can be attributed to two facts; firstly, <strong>Saudi</strong> <strong>Ceramic</strong> has a concession from <strong>Saudi</strong> government<br />

to extract clay in a minimal cost; and secondly, the high quality of products gives the<br />

company a competitive advantage and good appearance abroad.<br />

Disclosures Please refer to the important disclosures at the back of this report. 8

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

Figure 8. <strong>Saudi</strong> <strong>Ceramic</strong> versus <strong>Al</strong> Anwar <strong>Ceramic</strong> Tiles and Rak <strong>Ceramic</strong>s (gross & net<br />

margins)<br />

60.0%<br />

50.0%<br />

50.0%<br />

40.0%<br />

36.8%<br />

30.0%<br />

20.0%<br />

24.2%<br />

30.9%<br />

20.6%<br />

10.0%<br />

6.3%<br />

0.0%<br />

Gross Margin<br />

Net Margin<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

<strong>Al</strong> Anwar <strong>Ceramic</strong> Tiles Rak <strong>Ceramic</strong>s <strong>Saudi</strong> <strong>Ceramic</strong><br />

<strong>Saudi</strong> <strong>Ceramic</strong> maintained the<br />

same gross and net margin<br />

levels over the last five years<br />

<strong>Saudi</strong> <strong>Ceramic</strong>’s gross and net margins look respectable. The company has maintained almost<br />

the same gross and net margin over the last five years. We believe it will be able to improve<br />

its margins or at least maintain the current margins levels, given that the demand is<br />

increasing. However, market risks resulting from local competitors and dumping practices by<br />

some foreign importers, which sell at low prices, may affect the margins.<br />

Disclosures Please refer to the important disclosures at the back of this report. 9

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

Valuation<br />

offers good long-term value<br />

High economic profit of 12.5-<br />

12.6%<br />

High economic profit; growth in dividend payout ratio<br />

By our estimates, over the period 2008-2009 <strong>Saudi</strong> <strong>Ceramic</strong> achieved a return on invested<br />

capital (ROIC) of 12.5-12.6%. This is 60% more than our estimate of the company’s weighted<br />

average cost of capital (WACC) of 8.4%, implying that the company achieved an economic<br />

profit spread (ROIC – WACC) of 4.2-4.3%. We expect <strong>Saudi</strong> <strong>Ceramic</strong>’s economic profit<br />

spread to increase from this year onwards driven by the expected increase in demand.<br />

Figure 9. <strong>Saudi</strong> <strong>Ceramic</strong>: economic profit spread (ROIC-WACC)<br />

7.0%<br />

6.0%<br />

5.5%<br />

6.1%<br />

6.0%<br />

5.0%<br />

4.3%<br />

4.2%<br />

4.9%<br />

4.0%<br />

3.0%<br />

2.0%<br />

1.0%<br />

0.0%<br />

2008 2009 2010 2011 2012 2013<br />

economic profit<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

<strong>Saudi</strong> <strong>Ceramic</strong> currently offers<br />

a dividend yield of around 2.3%<br />

Our key long-run method of<br />

forecasting is discounted<br />

economic profit (DEP)<br />

The company has increased its annual paid dividends from 20% t0 25%of paid-up capital in<br />

2006. Then, it increased the paid dividend to 30% in 2009. However, we expect the company<br />

to maintain the same paid dividend for at least three years given that the company has high<br />

capex. <strong>Saudi</strong> <strong>Ceramic</strong> currently offers a dividend yield of 2.3%. The payout ratio is low in<br />

comparison to the high net margin. However, we expect the company to increase its paid<br />

dividends after 2013 assuming a reduction in capex.<br />

Valuation: summary of our approach and conclusions<br />

Our key method of valuation for <strong>Saudi</strong> <strong>Ceramic</strong> is long-run discounted economic profit<br />

(DEP), sometimes also called discounted long-run EVA (“economic value added”). This is a<br />

simple variation on discounted cash flow, and is mathematically equivalent. In our models,<br />

we make explicit forecasts for income statement, balance sheet and cash flow out to 2021. We<br />

then assume a steady fading of return on invested capital, i.e. excess return, down to the cost<br />

of capital over a period of up to 40 years from end of our period of explicit forecasting. This<br />

approach avoids a common problem in long-run modelling: namely, that the analyst stops<br />

forecasting at some arbitrary point when the company in question is still generating high<br />

returns. In terms of financial theory this is implausible, and excess returns will eventually<br />

disappear through competition, regulation or some other means.<br />

Our DEP valuations are sensitive to many factors, including assumed revenue growth,<br />

EBITDA margin and capex/sales ratio in 2021, i.e. the last year of explicit forecasting.<br />

Another important variable is the assumed duration of the period of competitive advantage,<br />

i.e. the period during which the company generates returns above weighted average cost of<br />

capital (WACC). Deciding on the length of the period of the competitive advantage is<br />

naturally a subjective exercise. We have assumed 30 years for <strong>Saudi</strong> <strong>Ceramic</strong> on the grounds<br />

that it is one of the leaders in its market and that it would take several years for rivals to<br />

challenge it effectively.<br />

We estimate <strong>Saudi</strong> <strong>Ceramic</strong>’s<br />

WACC at 8.4%<br />

However, as with any DCF-based approach, the factor to which the DEP valuation is most<br />

sensitive is WACC; we have assumed a WACC of 8.4% for <strong>Saudi</strong> <strong>Ceramic</strong>. <strong>Saudi</strong> <strong>Ceramic</strong> has<br />

an adjusted Beta of around 0.9 according to Bloomberg. Moreover, <strong>Saudi</strong> <strong>Ceramic</strong> has a low<br />

interest rate on debt which stems from the fact that a significant portion of its loans comes<br />

Disclosures Please refer to the important disclosures at the back of this report. 10

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

from the <strong>Saudi</strong> Industrial Development Fund (SIDF); these loans carry a very low or zero<br />

interest rate.<br />

WACC is in turn highly sensitive to assumed terminal capital structure. Estimating terminal<br />

capital structure is again a rather subjective exercise. We have assumed a terminal debt/(debt<br />

plus equity) ratio of 35% for <strong>Saudi</strong> <strong>Ceramic</strong>, compared to about 45% at present. We expect<br />

the company to redeem some of the debt as more cash is generated and so we expect gearing<br />

to decrease over the long run.<br />

Figure 10. <strong>Saudi</strong> <strong>Ceramic</strong>: weighted average cost of capital (WACC)<br />

Risk-free Rate 3.0%<br />

Expected Mkt Return - Risk-free Rate 8.4%<br />

Adjusted Beta 0.9<br />

Cost of Equity 10.6%<br />

Pre-tax Cost of Debt 4.5%<br />

Effective Tax rate 2.6%<br />

After-tax Cost of Debt 4.4%<br />

Target D/(D+E) 35.0%<br />

WACC 8.4%<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Two-thirds of our estimated fair<br />

enterprise value for <strong>Saudi</strong><br />

<strong>Ceramic</strong> comes from future<br />

economic returns<br />

We estimate fair value per<br />

share at SAR166.3<br />

One of the advantages of discounted economic profit forecasting is that it splits the analyst’s<br />

appraised fair enterprise value for a company between discounted economic profit, i.e. the<br />

present value of the company’s future returns in excess of the cost of capital, and invested<br />

capital, i.e. (in simple terms) the debt and equity funding already invested in the business.<br />

With regard to <strong>Saudi</strong> <strong>Ceramic</strong>, as the table below shows, we calculate discounted economic<br />

profit at SAR3,238mn, i.e. roughly twice the opening invested capital of SAR1,554mn. In<br />

other words, two-thirds of our estimated fair enterprise value for <strong>Saudi</strong> <strong>Ceramic</strong> comes from<br />

discounted economic profit. This means that a large part of the company’s value lies in the<br />

high economic returns that we expect it to continue to generate in the future.<br />

As noted, appraised fair enterprise value is the sum of discounted economic profit and<br />

invested capital. From appraised fair enterprise value we subtract net debt to estimate the<br />

fair value of equity. We divided the fair value of equity by the number of shares to arrive at<br />

the intrinsic fair value per share. Based on long-run DEP analysis, and using our core<br />

assumption of a period of competitive advantage of 30 years, we thus estimate fair value per<br />

share for <strong>Saudi</strong> <strong>Ceramic</strong> at SAR166.3.<br />

Figure 11. <strong>Saudi</strong> <strong>Ceramic</strong>: discounted economic profit valuation<br />

(SAR '000)<br />

Discounted economic profit 3,283,376<br />

Opening Invested capital 1,553,867<br />

Appraised value of the enterprise 4,837,243<br />

Value of debt (739,985)<br />

Appraised value of the equity 4,157,269<br />

Number of shares 25,000<br />

Appraised share price 166.3<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

We have considered<br />

comparative multiples analysis<br />

too<br />

We have selected two GCC<br />

ceramic companies as<br />

benchmark for <strong>Saudi</strong> <strong>Ceramic</strong><br />

In addition to long-run DEP, we have considered comparative multiples analysis to value<br />

<strong>Saudi</strong> <strong>Ceramic</strong> in relation to other players in the GCC region. Under this approach we<br />

estimate fair value using comparisons of valuation measures – notably, EV/EBITDA and PE<br />

multiples– with other listed GCC ceramic companies since <strong>Saudi</strong> <strong>Ceramic</strong> is the only listed<br />

ceramic company in <strong>Saudi</strong> Arabia. However, we have taken 100% weight on the long-run<br />

DEP method because it is theoretically more defensible.<br />

Regarding the comparative multiples analysis, we have selected two GCC ceramic companies<br />

as benchmarks. Those two companies are <strong>Al</strong> Anwar <strong>Ceramic</strong> Tiles and Ras <strong>Al</strong> Khaimah (Rak)<br />

<strong>Ceramic</strong>s. We believe that they provide excellent comparables considering that they are<br />

operating in the same region, and face almost the same macroeconomic factors. However, the<br />

relatively low liquidity in the non-<strong>Saudi</strong> GCC markets is a major concern that probably<br />

Disclosures Please refer to the important disclosures at the back of this report. 11

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

reduces the ratios for these companies. In addition, the other non-<strong>Saudi</strong> GCC markets have<br />

been more affected by global economic events over the past couple of years. This has<br />

decreased investors’ confidence in the non-<strong>Saudi</strong> GCC markets and contributed to relatively<br />

cheap stock prices. The table below shows the major valuation ratios for <strong>Al</strong> Anwar <strong>Ceramic</strong><br />

Tiles and Rak <strong>Ceramic</strong>s compared to <strong>Saudi</strong> <strong>Ceramic</strong>’s.<br />

Figure 12. <strong>Saudi</strong> <strong>Ceramic</strong>: comparative multiples analysis<br />

Coompany Market Sector MKT Cap P/E EV/EBITDA<br />

Bloomberg<br />

Code<br />

<strong>Al</strong> Anwar <strong>Ceramic</strong> Tiles MSM Construction & Materials $ 130 9.9 6.5 AACT OM<br />

Rak <strong>Ceramic</strong>s ADSM Real Estate $ 285 4.3 4.4 RAKCEC DH<br />

<strong>Saudi</strong> <strong>Ceramic</strong> KSA-Tadawul Building & construction $ 903 14.3 11.5 SCERCO AB<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

<strong>Saudi</strong> <strong>Ceramic</strong> still offers value<br />

despite its high PE and<br />

EV/EBITDA ratios<br />

We believe that <strong>Saudi</strong> <strong>Ceramic</strong> still offers value despite its high PE and EV/EBITDA ratios<br />

compared to <strong>Al</strong> Anwar <strong>Ceramic</strong> Tiles in Oman. <strong>Al</strong> Anwar produces only ceramic tiles, which<br />

as mentioned earlier enjoy higher margins than other ceramic products such as bathroom<br />

products and water heaters. While this fact probably supports a high valuation, <strong>Saudi</strong><br />

<strong>Ceramic</strong> operates in a larger market, with greater growth potential in a larger number of<br />

businesses; moreover, <strong>Saudi</strong> <strong>Ceramic</strong> is engaged in aggressive expansion that should drive its<br />

growth further. <strong>Saudi</strong> <strong>Ceramic</strong> is well above Rak <strong>Ceramic</strong>s in terms of PE and EV/EBITDA<br />

ratios. Rak <strong>Ceramic</strong>s has almost the same business lines except that it does not manufacture<br />

water heaters, which have low margins. Rak <strong>Ceramic</strong>s is suffering because of apparently<br />

un<strong>success</strong>ful expansion projects in different countries, and high financing costs that reduce<br />

its net margin.<br />

We expect <strong>Saudi</strong> <strong>Ceramic</strong> to concentrate more on ceramic tiles since its return is higher.<br />

Moreover, we expect the company to record an impressive increase in its earnings when its<br />

new expansion projects start commercial production.<br />

Risks associated with our assumptions<br />

It is important to mention that our valuation relies heavily on forecasts which are subject to<br />

errors. We have come up with several assumptions including growth, cost of capital, and<br />

market trend to predict future performance. We have tried to arrive at the most accurate<br />

assumptions; however, reality may deviate from our forecasts depending on new<br />

microeconomic or macroeconomic factors. Competition is another factor that can influence<br />

our assumptions. New entrants or/and transformation of current rivals’ business models<br />

might cause a change in the whole market, and hence in our overall assumptions and<br />

forecasts.<br />

Disclosures Please refer to the important disclosures at the back of this report. 12

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

Appendix:<br />

<strong>Saudi</strong> <strong>Ceramic</strong>’s investments<br />

SAR44.4mn investment in<br />

associate companies<br />

15.87% share in Natural Gas<br />

Distribution<br />

50% share in CPC<br />

CPC and <strong>Saudi</strong> <strong>Ceramic</strong> has<br />

the same input, i.e. clay<br />

<strong>Saudi</strong> <strong>Ceramic</strong> has some investments that are intended to increase the value of the operating<br />

business. <strong>Saudi</strong> <strong>Ceramic</strong> has a total of SAR44.4mn of investment in two associate companies,<br />

which are Natural Gas Distribution Company and <strong>Ceramic</strong> Pipes Company (CPC). The<br />

company does not have a controlling interest in either company. The company also has<br />

investments in available-for-sale securities of SAR9mn.<br />

Natural Gas Distribution Company<br />

Natural Gas Distribution Company is a limited liability company established in 2002 with<br />

paid up capital of SAR15mn. <strong>Saudi</strong> <strong>Ceramic</strong> has 15.87% of the share capital. The main<br />

activities of the associate are to purchase and distribute gas to factories in the Second<br />

Industrial City in Riyadh. Gas is an important material that is used to run kilns where clay is<br />

processed to produce ceramics. The investment is accounted for using the equity method<br />

because the company has significant influence over the investee by major representation in<br />

the board of directors.<br />

<strong>Ceramic</strong> Pipes Company<br />

<strong>Ceramic</strong> Pipes Company (CPC) is a closed joint stock company established in February 2007.<br />

<strong>Saudi</strong> <strong>Ceramic</strong> Company holds 50% of the share capital. The authorised and fully subscribed<br />

share capital is SAR100mn in which SAR80mn is paid up. The company has paid its share by<br />

contributing SAR25mn in cash and SAR15mn in kind, representing the value of a plot of land.<br />

The investment is accounted for using the equity method.<br />

The main activity of the company is manufacturing of clay pipes, which are used in<br />

connecting sewage systems. The sole customer of the company is the government. Clay pipes<br />

are expected to experience high demand because of the construction of government’s huge<br />

economic cities. However, there are other local competitors in the market such as <strong>Saudi</strong><br />

Vitrified Clay Pipe Company (SVCP), which is listed in <strong>Saudi</strong> stock market. CPC is purchasing<br />

clay from Desert Mines Company, which is a division of <strong>Saudi</strong> <strong>Ceramic</strong>. The company’s<br />

production capacity is 100,000 tons per year. We expect the company to start commercial<br />

production by the end of 2010. However, we expect the contribution of CPC to net income to<br />

be minor in 2010 and 2011.<br />

Disclosures Please refer to the important disclosures at the back of this report. 13

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

We expect revenues to reach<br />

SAR1,103mn this year<br />

Income Statement (SARmn) 12/08A 12/09A 12/10E 12/11E 12/12E<br />

Revenue 857 958 1,129 1,356 1,551<br />

Cost of Goods Sold (537) (605) (708) (841) (946)<br />

Gross Profit 321 352 421 515 605<br />

Government Charges<br />

S.G. & A. Costs (138) (156) (177) (217) (248)<br />

Operating EBIT 183 197 245 298 357<br />

Cash Operating Costs (598) (675) (786) (941) (1,062)<br />

EBITDA 259 282 344 415 488<br />

Depreciation and Amortisation (77) (86) (99) (117) (131)<br />

Operating Profit 183 197 245 298 357<br />

Net financing income/(costs) 2 4 (2) (12) (13)<br />

Forex and Related Gains<br />

Provisions - - - - -<br />

Other Income<br />

Other Expenses<br />

Net Profit Before Taxes 185 200 243 286 344<br />

Taxes (7) (3) (6) (7) (9)<br />

Minority Interests<br />

Net profit available to shareholders 178 197 236 279 335<br />

Dividends (63) (75) (75) (75) (75)<br />

Transfer to <strong>Capital</strong> Reserve<br />

We expect steady dividends for<br />

the next three years<br />

We expect <strong>Saudi</strong> <strong>Ceramic</strong> to<br />

maintain its strong sales growth<br />

over the next three years<br />

Consistent margins and strong<br />

margins<br />

12/08A 12/09A 12/10E 12/11E 12/12E<br />

Adjusted Shares Out (mn) 25.00 25.00 25.00 25.00 25.00<br />

CFPS (SAR) 10.18 11.32 13.41 15.83 18.67<br />

EPS (SAR) 7.12 7.89 9.45 11.17 13.41<br />

DPS (SAR) 2.500 3.000 3.000 3.000 3.000<br />

Growth 12/08A 12/09A 12/10E 12/11E 12/12E<br />

Revenue Growth 39.4% 11.7% 17.9% 20.1% 14.3%<br />

Gross Profit Growth 42.2% 10.0% 19.5% 22.3% 17.4%<br />

EBITDA Growth 47.0% 8.9% 21.7% 20.7% 17.6%<br />

Operating Profit Growth 55.2% 7.6% 24.4% 21.9% 19.5%<br />

Net Profit Growth 39.5% 10.8% 19.9% 18.1% 20.1%<br />

EPS Growth 39.5% 10.8% 19.9% 18.1% 20.1%<br />

Margins 12/08A 12/09A 12/10E 12/11E 12/12E<br />

Gross profit margin 37.4% 36.8% 37.3% 38.0% 39.0%<br />

EBITDA margin 30.3% 29.5% 30.4% 30.6% 31.5%<br />

Operating Margin 21.3% 20.5% 21.7% 22.0% 23.0%<br />

Pretax profit margin 21.6% 20.9% 21.5% 21.1% 22.2%<br />

Net profit margin 20.8% 20.6% 20.9% 20.6% 21.6%<br />

Other Ratios 12/08A 12/09A 12/10E 12/11E 12/12E<br />

ROCE 16.4% 15.5% 16.1% 16.3% 16.8%<br />

ROIC 15.9% 13.9% 15.3% 15.4% 15.8%<br />

ROE 26.6% 24.9% 25.2% 24.9% 24.8%<br />

Effective Tax Rate 3.8% 1.5% 2.6% 2.5% 2.5%<br />

Capex/Sales 28.7% 28.0% 24.9% 26.0% 23.0%<br />

Dividend Payout Ratio 35.1% 38.0% 31.7% 26.9% 22.4%<br />

We expect EV/EBITDA &<br />

EV/sales to decline<br />

Valuation Measures 12/08A 12/09A 12/10E 12/11E 12/12E<br />

P/E (x) 19.7 17.8 14.8 12.6 10.5<br />

P/CF (x) 13.8 12.4 10.5 8.9 7.5<br />

P/B (x) 4.8 4.1 3.4 2.9 2.4<br />

EV/Sales (x) 4.6 4.1 3.6 3.1 2.8<br />

EV/EBITDA (x) 15.1 13.9 11.8 10.2 8.8<br />

EV/EBIT (x) 21.5 19.9 16.6 14.2 12.0<br />

EV/IC (x) 2.8 2.5 2.2 1.9 1.7<br />

Dividend Yield 1.8% 2.1% 2.1% 2.1% 2.1%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer to the important disclosures at the back of this report. 14

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

Expanding balance sheet due<br />

to expansion in operations<br />

Debt/equity is quite high but<br />

financing cost is relatively low<br />

<strong>Saudi</strong> <strong>Ceramic</strong>’s cash flow<br />

position is strong<br />

We estimate capex/sales at<br />

around 23-28% over the next<br />

three years<br />

Balance Sheet (SARmn) 12/08A 12/09A 12/10E 12/11E 12/12E<br />

Cash and Cash Equivalents 25 36 124 90 100<br />

Current Receivables 108 109 120 170 202<br />

Inventories 351 357 421 509 558<br />

Other current assets 28 28 35 35 35<br />

Total Current Assets 512 530 701 804 895<br />

Fixed Assets 1,004 1,176 1,358 1,594 1,819<br />

Investments 47 60 52 52 52<br />

Goodwill<br />

Other Intangible Assets - - - - -<br />

Total Other Assets 2 2 2 2 2<br />

Total Non-current Assets 1,053 1,237 1,412 1,648 1,873<br />

Total Assets 1,565 1,767 2,113 2,452 2,768<br />

Short Term Debt 281 289 364 364 364<br />

Trade Payables<br />

Dividends Payable - - - - -<br />

Other Current Liabilities<br />

Total Current Liabilities 423 469 558 582 605<br />

Long-Term Debt 392 406 500 611 643<br />

Other LT Payables 1 0 1 1 1<br />

Provisions 25 33 36 36 36<br />

Total Non-current Liabilities 418 439 537 647 679<br />

Minority interests<br />

Paid-up share capital 250 250 250 250 250<br />

Total Reserves 474 609 769 973 1,234<br />

Total Shareholders' Equity 724 859 1,019 1,223 1,484<br />

Total Equity 724 859 1,019 1,223 1,484<br />

Total Liabilities & Shareholders' Equity 1,565 1,767 2,113 2,452 2,768<br />

Ratios 12/08A 12/09A 12/10E 12/11E 12/12E<br />

Net Debt (SARmn) 647 659 740 885 907<br />

Net Debt/EBITDA (x) 2.49 2.33 2.15 2.13 1.86<br />

Net Debt to Equity 89.3% 76.8% 72.6% 72.3% 61.1%<br />

EBITDA Interest Cover (x) (120.2) (80.7) 161.4 34.7 38.5<br />

BVPS (SAR) 28.97 34.35 40.76 48.93 59.35<br />

Cashflow Statement (SARmn) 12/08A 12/09A 12/10E 12/11E 12/12E<br />

Net Income before Tax & Minority Interest 184.9 200.2 242.6 286.4 344.0<br />

Depreciation & Amortisation 76.7 85.8 99.0 116.7 131.5<br />

Decrease in Working <strong>Capital</strong> (90.4) 15.2 (64.6) (113.4) (57.2)<br />

Other Operating Cashflow (3.4) 2.7 (4.5) (7.2) (8.6)<br />

Cashflow from Operations 167.8 303.8 272.5 282.5 409.6<br />

<strong>Capital</strong> Expenditure (246.3) (268.1) (281.7) (352.6) (356.6)<br />

New Investments (23.8) 1.5 11.2 0.0 0.0<br />

Others<br />

Cashflow from investing activities (270.1) (266.5) (270.5) (352.6) (356.6)<br />

Net Operating Cashflow (102.3) 37.3 2.0 (70.0) 53.0<br />

Dividends paid to ordinary shareholders (62.1) (64.5) (75.9) (75.0) (75.0)<br />

Proceeds from issue of shares<br />

Effects of Exchange Rates on Cash<br />

Other Financing Cashflow (1.8) 0.0 0.0 0.0 0.0<br />

Cashflow from financing activities 106.7 (26.9) 86.7 35.5 (43.0)<br />

Total cash generated 4.5 10.4 88.8 (34.5) 10.0<br />

Cash at beginning of period 20.9 25.3 35.7 124.5 90.0<br />

Implied cash at end of year 25.3 35.7 124.5 90.0 100.0<br />

Ratios 12/08A 12/09A 12/10E 12/11E 12/12E<br />

Capex/Sales 28.7% 28.0% 24.9% 26.0% 23.0%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer to the important disclosures at the back of this report. 15

<strong>Saudi</strong> <strong>Ceramic</strong><br />

Construction & Materials –Industrial<br />

1 August 2010<br />

Disclaimer and additional disclosures for Equity Research<br />

Disclaimer<br />

This research document has been prepared by <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong> Company (“<strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>”) of Riyadh, <strong>Saudi</strong> Arabia. It has been prepared<br />

for the general use of <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>’s clients and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or<br />

manner, without the express written consent of <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>. Receipt and review of this research document constitute your agreement<br />

not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion, or information contained in this document prior to<br />

public disclosure of such information by <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>. The information contained was obtained from various public sources believed to be<br />

reliable but we do not guarantee its accuracy. <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong> makes no representations or warranties (express or implied) regarding the<br />

data and information provided and <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong> does not represent that the information content of this document is complete, or free<br />

from any error, not misleading, or fit for any particular purpose. This research document provides general information only. Neither the<br />

information nor any opinion expressed constitutes an offer or an invitation to make an offer, to buy or sell any securities or other investment<br />

products related to such securities or investments. It is not intended to provide personal investment advice and it does not take into account<br />

the specific investment objectives, financial situation and the particular needs of any specific person who may receive this document.<br />

Investors should seek financial, legal or tax advice regarding the appropriateness of investing in any securities, other investment or<br />

investment strategies discussed or recommended in this document and should understand that statements regarding future prospects may<br />

not be realized. Investors should note that income from such securities or other investments, if any, may fluctuate and that the price or value<br />

of such securities and investments may rise or fall. Fluctuations in exchange rates could have adverse effects on the value of or price of, or<br />

income derived from, certain investments. Accordingly, investors may receive back less than originally invested. <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong> or its<br />

officers or one or more of its affiliates (including research analysts) may have a financial interest in securities of the issuer(s) or related<br />

investments, including long or short positions in securities, warrants, futures, options, derivatives, or other financial instruments. <strong>Al</strong> <strong>Rajhi</strong><br />

<strong>Capital</strong> or its affiliates may from time to time perform investment banking or other services for, solicit investment banking or other business<br />

from, any company mentioned in this research document. <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>, together with its affiliates and employees, shall not be liable for<br />

any direct, indirect or consequential loss or damages that may arise, directly or indirectly, from any use of the information contained in this<br />

research document.<br />

This research document and any recommendations contained are subject to change without prior notice. <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong> assumes no<br />

responsibility to update the information in this research document. Neither the whole nor any part of this research document may be altered,<br />

duplicated, transmitted or distributed in any form or by any means. This research document is not directed to, or intended for distribution to<br />

or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such<br />

distribution, publication, availability or use would be contrary to law or which would subject <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong> or any of its affiliates to any<br />

registration or licensing requirement within such jurisdiction.<br />

Additional disclosures<br />

1. Explanation of <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>’s rating system<br />

<strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong> uses a three-tier rating system based on absolute upside or downside potential for all stocks under its coverage except<br />

financial stocks and those few other companies not compliant with Islamic Shariah law:<br />

"Overweight": Our target price is more than 15% above the current share price, and we expect the share price to reach the target on a 6-9<br />

month time horizon.<br />

"Neutral": We expect the share price to settle at a level between 5% below the current share price and 15% above the current share price<br />

on a 6-9 month time horizon.<br />

"Underweight": Our target price is more than 5% below the current share price, and we expect the share price to reach the target on a 6-9<br />

month time horizon.<br />

2. Definitions<br />

"Time horizon": Our analysts make recommendations on a 6-9 month time horizon. In other words, they expect a given stock to reach their<br />

target price within that time.<br />

"Fair value": We estimate fair value per share for every stock we cover. This is normally based on widely accepted methods appropriate to<br />

the stock or sector under consideration, e.g. DCF (discounted cash flow) or SoTP (sum of the parts) analysis.<br />

"Target price": This may be identical to estimated fair value per share, but is not necessarily the same. There may be very good reasons<br />

why a share price is unlikely to reach fair value within our time horizon. In such a case we set a target price which differs from estimated fair<br />

value per share, and explain our reasons for doing so.<br />

Please note that the achievement of any price target may be impeded by general market and economic trends and other external factors, or<br />

if a company’s profits or operating performance exceed or fall short of our expectations.<br />

Contact us<br />

Dr. Saleh <strong>Al</strong>suhaibani<br />

Head of Research<br />

Tel : +966 1 2119434<br />

alsuhaibanis@alrajhi-capital.com<br />

<strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Research Department<br />

Head Office, King Fahad Road<br />

P.O. Box 5561<br />

Riyadh 11432<br />

Kingdom of <strong>Saudi</strong> Arabia<br />

Email: research@alrajhi-capital.com<br />

<strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>, a subsidiary of <strong>Al</strong> <strong>Rajhi</strong> Bank, is licensed by the <strong>Saudi</strong> Arabian <strong>Capital</strong> Market<br />

Authority, License No. 07068/37.<br />

Disclosures Please refer to the important disclosures at the back of this report. 16