Retail Sector Report - Al Rajhi Capital

Retail Sector Report - Al Rajhi Capital

Retail Sector Report - Al Rajhi Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

Saudi Arabia<br />

05 January 2013<br />

January 18, 2010<br />

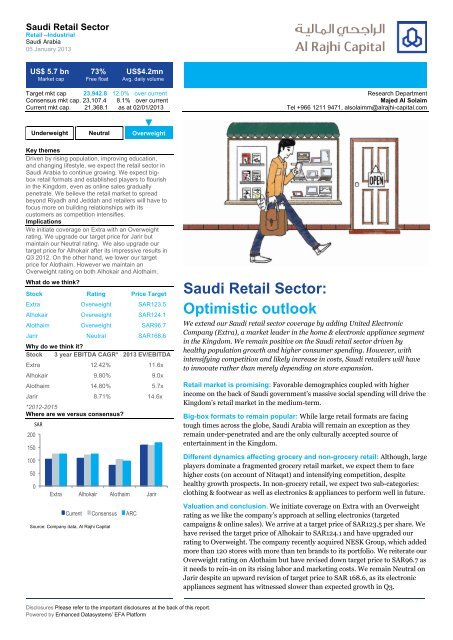

US$ 5.7 bn 73% US$4.2mn<br />

Market cap Free float Avg. daily volume<br />

Target mkt cap 23,942.8 12.0% over current<br />

Consensus mkt cap. 23,107.4 8.1% over current<br />

Current mkt cap. 21,368.1 as at 02/01/2013<br />

Research Department<br />

Majed <strong>Al</strong> Solaim<br />

Tel +966 1211 9471, alsolaimm@alrajhi-capital.com<br />

Underweight Neutral Overweight<br />

Overweight<br />

Key themes<br />

Driven by rising population, improving education,<br />

and changing lifestyle, we expect the retail sector in<br />

Saudi Arabia to continue growing. We expect bigbox<br />

retail formats and established players to flourish<br />

in the Kingdom, even as online sales gradually<br />

penetrate. We believe the retail market to spread<br />

beyond Riyadh and Jeddah and retailers will have to<br />

focus more on building relationships with its<br />

customers as competition intensifies.<br />

Implications<br />

We initiate coverage on Extra with an Overweight<br />

rating. We upgrade our target price for Jarir but<br />

maintain our Neutral rating. We also upgrade our<br />

target price for <strong>Al</strong>hokair after its impressive results in<br />

Q3 2012. On the other hand, we lower our target<br />

price for <strong>Al</strong>othaim. However we maintain an<br />

Overweight rating on both <strong>Al</strong>hokair and <strong>Al</strong>othaim.<br />

What do we think?<br />

Stock Rating Price Target<br />

Extra Overweight SAR123.5<br />

<strong>Al</strong>hokair Overweight SAR124.1<br />

<strong>Al</strong>othaim Overweight SAR96.7<br />

Jarir Neutral SAR168.6<br />

Why do we think it?<br />

Stock 3 year EBITDA CAGR* 2013 EV/EBITDA<br />

Extra 12.42% 11.6x<br />

<strong>Al</strong>hokair 9.80% 9.0x<br />

<strong>Al</strong>othaim 14.80% 5.7x<br />

Jarir 8.71% 14.6x<br />

*2012-2015<br />

Where are we versus consensus?<br />

200<br />

150<br />

100<br />

50<br />

0<br />

SAR<br />

Extra <strong>Al</strong>hokair <strong>Al</strong>othaim Jarir<br />

Current Consensus ARC<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Saudi <strong>Retail</strong> <strong>Sector</strong>:<br />

Optimistic outlook<br />

We extend our Saudi retail sector coverage by adding United Electronic<br />

Company (Extra), a market leader in the home & electronic appliance segment<br />

in the Kingdom. We remain positive on the Saudi retail sector driven by<br />

healthy population growth and higher consumer spending. However, with<br />

intensifying competition and likely increase in costs, Saudi retailers will have<br />

to innovate rather than merely depending on store expansion.<br />

<strong>Retail</strong> market is promising: Favorable demographics coupled with higher<br />

income on the back of Saudi government’s massive social spending will drive the<br />

Kingdom’s retail market in the medium-term.<br />

Big-box formats to remain popular: While large retail formats are facing<br />

tough times across the globe, Saudi Arabia will remain an exception as they<br />

remain under-penetrated and are the only culturally accepted source of<br />

entertainment in the Kingdom.<br />

Different dynamics affecting grocery and non-grocery retail: <strong>Al</strong>though, large<br />

players dominate a fragmented grocery retail market, we expect them to face<br />

higher costs (on account of Nitaqat) and intensifying competition, despite<br />

healthy growth prospects. In non-grocery retail, we expect two sub-categories:<br />

clothing & footwear as well as electronics & appliances to perform well in future.<br />

Valuation and conclusion. We initiate coverage on Extra with an Overweight<br />

rating as we like the company’s approach at selling electronics (targeted<br />

campaigns & online sales). We arrive at a target price of SAR123.5 per share. We<br />

have revised the target price of <strong>Al</strong>hokair to SAR124.1 and have upgraded our<br />

rating to Overweight. The company recently acquired NESK Group, which added<br />

more than 120 stores with more than ten brands to its portfolio. We reiterate our<br />

Overweight rating on <strong>Al</strong>othaim but have revised down target price to SAR96.7 as<br />

it needs to rein-in on its rising labor and marketing costs. We remain Neutral on<br />

Jarir despite an upward revision of target price to SAR 168.6, as its electronic<br />

appliances segment has witnessed slower than expected growth in Q3.<br />

Disclosures Please refer to the important disclosures at the back of this report.<br />

Powered by Enhanced Datasystems’ EFA Platform

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

Saudi economy has benefited<br />

from high oil prices and exports<br />

for most of 2012<br />

<strong>Retail</strong> is promising:<br />

growing despite challenges<br />

A strong economy moving away from oil<br />

The MENA region is expected to remain one of the few bright spots for global GDP growth in<br />

2012, even as the global economic recovery remains uncertain with a deepening financial<br />

crisis in Europe and a slowdown in the US as well as emerging Asian markets like China and<br />

India. According to the IMF’s update in July 2012, GDP growth in the MENA region will be<br />

higher by 200bps y-o-y in 2012 at 5.5% vs. decline of 20bps (advanced economies) to 340bps<br />

(Central and Eastern Europe), mainly due to higher oil production. As the global leader in oil<br />

exports, Saudi Arabia has been a beneficiary of the high crude prices witnessed in the first<br />

half of 2012. <strong>Al</strong>though crude oil production from the Kingdom has moderated after it peaked<br />

in June 2012 at 10.1mbpd, it continues to be at elevated levels.<br />

Figure 1 Crude oil production are at elevated levels<br />

mbpd<br />

10.5<br />

Figure 2 Smaller sectors are growing faster<br />

40%<br />

10.0<br />

20%<br />

9.5<br />

9.0<br />

0%<br />

8.5<br />

-20%<br />

8.0<br />

7.5<br />

Jan-11 Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12<br />

Source: OPEC, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Market Cap 1-year growth<br />

Performance 1-year growth<br />

The Saudi economy, with real GDP at SAR942bn in 2011, (source: IMF with 1999 as base<br />

year) has been growing strong thanks to its rising oil exports even as countries in the<br />

developed world continue to struggle. <strong>Al</strong>though the IMF expects the Kingdom’s real GDP<br />

growth to remain at moderate levels (6% in 2012 vs. 7% in 2011), it remains better than<br />

developed economies and comparable to the emerging economies of Asia. Even at the<br />

regional level, Saudi Arabia has remained relatively unscathed from the uprisings witnessed<br />

in other countries in the MENA region. This is mainly due to the massive social spending<br />

activities worth SAR1.4tn being carried out by the Saudi government over 2010-2014 as per<br />

the ninth five-year development plan.<br />

The Saudi government has<br />

been using its export surpluses<br />

for increased social spending<br />

The Saudi government has allocated SAR250bn for building 500,000 new affordable housing<br />

units for low income Saudis. A new Saudization program (Nitaqat) aimed at increasing the<br />

employment of Saudi citizens in the private sector came into effect in late 2011, which has<br />

been supported by job placement and training schemes. A decree was passed in 2011 to<br />

increase the minimum wages for all public sector employees to SAR3,000 per month. Further,<br />

in January 2012, an unemployment allowance (Hafiz) of SAR2,000 per month was<br />

introduced, which the Ministry of Labor has estimated to cost around SAR5.5bn per annum<br />

for the Saudi government. We believe this massive social spending will generate employment<br />

opportunities leading to higher disposable income levels for Saudi citizens, which will<br />

gradually trickle down to various sectors such as retail.<br />

Apart from the social spending, the surpluses generated from oil exports are also being<br />

ploughed back to diversify the country’s economy. This has led to the development of new<br />

sectors such as agriculture, retail, and real estate which are growing at a faster pace as<br />

compared to other bellwether sectors such as petrochemicals and banking. We view this as a<br />

positive development for the long-term economic growth of the Kingdom. <strong>Al</strong>though this may<br />

indicate slower growth than in the past, it will pave the way for a much more vibrant and<br />

diversified economy.<br />

Disclosures Please refer to the important disclosures at the back of this report. 2

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

Demographics continue to fuel retail growth<br />

Saudi Arabia is the largest market in the GCC region with a population of about 28mn in 2011<br />

(source: Central Department of Statistics and Information). The EIU forecasts this<br />

population to nearly double to 50mn by 2030. Further, it is pertinent to mention that 32% of<br />

the Saudi population is below 15 years of age, while around 50% are in the age group of 15-40<br />

(source: 2010 UN statistics). This young population is exposed to improving educational<br />

opportunities and a changing lifestyle aligned to modern technologies and western culture.<br />

In addition, the country has witnessed a steady growth in personal disposable income level,<br />

which bodes well for consumer sectors such as electronics, grocery and apparel retail. Higher<br />

level of disposable income in the hands of a young population is creating increased demand<br />

for better quality and diversified products, more number of supermarkets and hypermarkets,<br />

and the entry of a slew of foreign brands in the country.<br />

Figure 3 Saudi Arabia has a young population profile<br />

Figure 4 Rising disposable income leading to higher consumption<br />

80+<br />

0.1<br />

US$<br />

10,000<br />

Title:<br />

Source:<br />

60-79<br />

1.0<br />

8,000<br />

Please fill in the values above to have them entered in your report<br />

45-59<br />

3.0<br />

6,000<br />

30-44<br />

6.9<br />

15-29<br />

7.1<br />

4,000<br />

0-14<br />

8.5<br />

0 2 4 6 8 10<br />

Population in mn<br />

2,000<br />

2007 2008 2009 2010 2011E 2012E 2013E 2014E 2015E 2016E<br />

Personal disposable income*<br />

Household consumption<br />

Source: UNSD, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>; Note: Data is as of 2010 Source: EIU, CDSI, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>; Note:*EIU estimates from 2009<br />

<strong>Al</strong>though the Saudi retail sector dwarfs in comparison to other mainstream sectors such as oil<br />

and petrochemicals, the EIU estimates the country’s retail sector sales to be around<br />

US$83.3bn in 2011, which is expected to grow at a healthy CAGR of 9.5% over 2011-2016 to<br />

reach US$131.2bn. Further, the number of supermarkets grew from 80 in 1984 to 450 by<br />

2009 and continues to grow. There are currently around 60 hypermarkets spread across the<br />

major cities of Riyadh, Jeddah and Dammam (source: USDA).<br />

Big-box formats to usher in the next level of growth<br />

Supermarkets and<br />

hypermarkets will grow faster<br />

than small groceries<br />

Small convenience stores will be gradually phased out<br />

The retail sector in Saudi Arabia, though bigger in size, is still evolving as compared to a<br />

country like the UAE, where it is much more developed due to the latter’s history of being a<br />

trading hub. <strong>Al</strong>though big-box retail formats (supermarkets and hypermarkets) have sprungup<br />

in Saudi Arabia, they remain relatively under-penetrated compared to other global<br />

markets. Small convenience stores called “bakalas” currently dominate the retail sector with<br />

around 59% of the market share.<br />

We believe big-box formats will become more popular going forward due to their cost<br />

effectiveness (trading in large volumes lead to better margins) on the supply side and<br />

convenience (availability of diverse products and brands, discounts, comfort to choose) on<br />

the demand side. Savola, <strong>Al</strong>othaim, Fawaz <strong>Al</strong> Hokair (<strong>Al</strong>hokair), Bin Dawood, Tamimi<br />

(Safeway), Saudi Marketing Company (Farm Superstores) and the UAE-based Majid <strong>Al</strong><br />

Futtaim in partnership with France’s Carrefour are among the top retailers in the Kingdom.<br />

Apart from these large players, the market consists of numerous small players, rendering the<br />

retail sector highly fragmented and ripe for consolidation. <strong>Al</strong>hokair’s acquisition of NESK<br />

Group (it operates 120 retail stores across the Kingdom) for SAR730mn in August 2012 is an<br />

indication of this growing trend.<br />

Disclosures Please refer to the important disclosures at the back of this report. 3

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

Figure 5 New format retail stores are under-penetrated<br />

Figure 6 Share of Top 5 players in the retail market<br />

100%<br />

70%<br />

80%<br />

15%<br />

25%<br />

19%<br />

60%<br />

59%<br />

59%<br />

24%<br />

50%<br />

60%<br />

40%<br />

36%<br />

62%<br />

40%<br />

30%<br />

33%<br />

25%<br />

57%<br />

20%<br />

0%<br />

39%<br />

23%<br />

16%<br />

Saudi Arabia Spain UK UAE<br />

Hypermarkets Supermarkets Small groceries<br />

20%<br />

10%<br />

0%<br />

15%<br />

Saudi Arabia Brazil UK<br />

Source: Savola investor presentation<br />

Source: Savola investor presentation<br />

Large formats to gain from the Kingdom’s demography<br />

Sales in big-box stores in the US and developed countries of Western Europe have been<br />

severely impacted with consumers switching to a savings mode due to the macro-economic<br />

slump in these countries. While the baby boomer generation has begun to age, the current<br />

young generation prefers to marry late and delay the arrival of children. These factors have<br />

reduced demand for consumer goods in the developed markets. Moreover, consumers are<br />

using online shopping to make comparisons and avail the best offers from retailers. Hence,<br />

large stores, which were earlier seen as efficient due to their scale of operations, are now<br />

becoming costly due to an inventory pile-up.<br />

Large stores are the only<br />

culturally accepted source of<br />

entertainment in the Kingdom<br />

Saudi Arabia provides one of<br />

the best environments in the<br />

MENA region for international<br />

retailers<br />

However, in Saudi Arabia, we believe the economic and cultural environment is conducive for<br />

large stores to thrive. Apart from the strong growth scenario as discussed earlier, large malls<br />

act as the only source of entertainment in the form of shopping and dining, which is<br />

culturally acceptable in the Kingdom. Supermarkets and hypermarkets with in-house<br />

facilities such as restaurants and theme parks are ideal locations for the Saudi population to<br />

relax along with their families. We believe this cultural connection coupled with the healthy<br />

income of a young population, will bring in more footfalls for the big-box formats over the<br />

medium to long-term. Moreover, there are other factors due to which online retail will take<br />

some time to catch-up in the Kingdom.<br />

International and regional retailers to increase their presence<br />

Leading retailers in the mature markets of the US and Europe are facing declining sales and<br />

profits in their domestic markets, which are their largest source of income. With growth<br />

expected to remain negative or at best at low single-percentage levels in their countries over<br />

the medium-term, retailers can reverse their fortunes only by expanding abroad. This idea is<br />

being promoted by leading built asset consultancy firm EC Harris in its first annual <strong>Retail</strong><br />

International Program Expansion (RIPE) Index published in September 2012. According to<br />

the index, Saudi Arabia, Qatar, and the UAE offer attractive opportunities in the Middle East<br />

among international destinations. While these countries ranked 8 th , 11 th and 15 th respectively<br />

globally, they held the 1 st , 2 nd and 3 rd positions in the MENA region.<br />

Further, the presence of strong local trading partners and franchise operators in these<br />

countries implies lower-cost and ease of scalability for western retailers. We believe Saudi<br />

companies such as Savola, <strong>Al</strong>hokair, and <strong>Al</strong>othaim can also provide similar, if not better<br />

benefits and synergies to international retailers, who want to enter Saudi Arabia. Large<br />

regional retailers such as Majid <strong>Al</strong> Futtaim, <strong>Al</strong> Tayer, Landmark Group, Chalhoub Group and<br />

<strong>Al</strong>shaya have also been attracted by the growth opportunities available in the Kingdom. In<br />

June 2012, the EMKE Group opened its popular Lulu brand hypermarket in Riyadh, and is<br />

planning to open more stores over the next couple of years.<br />

Disclosures Please refer to the important disclosures at the back of this report. 4

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

While the increasing presence of international and regional players will intensify competition,<br />

we believe it will lead to an influx of brands, product diversification, attractive pricing and<br />

efficient operations, which will in turn benefit consumers. Large retail formats, that can<br />

house multiple brands under one roof, will be able to capture more market share rather than<br />

smaller stores with limited offerings.<br />

Increasing number of malls will<br />

lead to a decline in rental rates<br />

Steady supply of malls to lower retail rental rates<br />

<strong>Retail</strong> space is expanding in both Riyadh and Jeddah as new large retail malls are set up.<br />

Consequently, we believe rental rates are set to decline slightly, while poorly performing<br />

malls will see higher vacancy rates. This scenario implies lower costs and in turn better profit<br />

margins for those retailers who lease out their space over the next few quarters.<br />

According to Jones Lang LaSalle (JLL), the average rental value of retail space in Riyadh has<br />

increased to SAR2,520 per sq m per annum at the end of Q3 2012 after remaining unchanged,<br />

over the past three quarters, at SAR2,380 per sq m per annum. Rents in the malls located in<br />

prime locations are expected to rise in Q4 2012. However, average retail rental rates are<br />

expected to witness limited increase on account of downward pressure from lower rentals of<br />

malls not located in prime locations. Further, the mixed-use King Abdullah Financial District<br />

(KAFD) and Nakheel Mall are the next major quality retail projects which are expected to be<br />

delivered in 2014. We believe these will keep retail rental as well as occupancy rates in check<br />

in the traditional districts of Olaya, Malaz and Bathaa. Total mall space in Riyadh is expected<br />

to reach 1.5mn sq m by 2015 from 1.2mn sq m currently.<br />

Figure 7 Riyadh retail forecasts at the end of Q3 2012 Figure 8 Jeddah retail forecasts at the end of Q3 2012<br />

'000 sq m<br />

2,000<br />

'000 sq m<br />

1,200<br />

1,600<br />

1,200<br />

800<br />

800<br />

400<br />

400<br />

0<br />

2011 2012E 2013E 2014E 2015E<br />

0<br />

2011 2012E 2013E 2014E 2015E<br />

Completed Stock<br />

Future Supply<br />

Completed Stock<br />

Future Supply<br />

Source: Jones Long LaSalle, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Source: Jones Lang LaSalle, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

At the end of Q3 2012, average rental rates for retail space in Jeddah increased slightly to<br />

SAR2,394 per sq m per annum from SAR2,380 per sq m per annum in Q2 2012(source: JLL).<br />

Apart from the Flamingo Mall on Prince Majid Road (80% pre-leased) with a retail area of<br />

46,000 sq m to be completed by in early 2013, no major retail space is expected to be added.<br />

As a result, average mall vacancy rates have remained quite low at 4% in Jeddah as compared<br />

to 11% in Riyadh due to healthy demand. There remains strong demand in the north and<br />

north-east of Jeddah to cater to the planned residential growth in this area. The central<br />

Jeddah region, such as Tahliyah, is also witnessing good demand on account of the high<br />

population density in the region. Hence, rental rates are expected to appreciate in the nearterm.<br />

However, with more than 70,000 sq m expected to be added to the total retail stock<br />

every year from 2013 onward, rental rates are expected to come down over the long-term.<br />

Religious tourism will provide<br />

support to Saudi retail growth<br />

story<br />

<strong>Retail</strong> growth to spread beyond Riyadh and Jeddah<br />

Apart from the growth in Riyadh and Jeddah, the retail sector is also expected to expand to<br />

other cities in the country spreading the growth more evenly across the country. The twin<br />

holy cities of Mecca and Medina, in particular, will witness considerable growth in retail<br />

space. <strong>Al</strong>though both the holy cities witness an influx of nearly 10mn pilgrims every year,<br />

they have traditionally seen limited retail facilities as compared to Riyadh and Jeddah. This<br />

trend is set to change with large facilities under construction in both the holy cities.<br />

Disclosures Please refer to the important disclosures at the back of this report. 5

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

The Jabal Omar Development Company is developing a massive hotel and retail project on a<br />

2.2mn sq m land in Mecca near the Grand Mosque, which is scheduled to be completed over<br />

the next five years. The project, being the largest in the Kingdom, will be executed in phases<br />

at a cost of SAR20bn and shall add 38 hotel towers and a retail space of 89,000 sq m. In<br />

Medina, the King Abdullah Waqf project will add around 10,000 sq m of retail space. The<br />

store rents in shopping centers such as the Abraj al Bayt in Mecca are already 50-100%<br />

higher than that of premium locations in Riyadh or Jeddah, indicating the attractiveness and<br />

business potential of the holy cities.<br />

Online retail is yet to catch the<br />

fancy of the people due to a<br />

number of factors<br />

Online sales yet to catch-up<br />

Online retail sales still remain under-developed in the Kingdom, restricted to sales of<br />

consumer electronics and home appliances, booking air tickets, and hotel reservations. Some<br />

of the successful online businesses are those of United Electronics Company (under the<br />

brand Extra), mobile handset retailer Axiom Telecom, and sports & health equipment<br />

company U-Mark. <strong>Al</strong>though companies like Savola’s <strong>Al</strong> Azizia Panda and Jarir display<br />

products on the internet, online payment and delivery systems are not available. In the<br />

former’s case, a printout of the shopping list can be taken from the website and processed at<br />

the nearest actual store. <strong>Al</strong>othaim started accepting online payment and making home<br />

delivery in July 2012. However, this service is limited to Riyadh currently.<br />

We believe that it will take some time before online retail sales pick-up rapidly even as a<br />

young Saudi population — who extensively use mobile, internet, and social media tools —<br />

begins to buy products online. The main reason for this delay could be that traditional brick<br />

and mortar retail stores are one of the main sources for entertainment in the Kingdom. Nonreligious<br />

music, cinema, gambling and drinking alcohol are forbidden in the Kingdom.<br />

Outdoor sports and adventure activities are also not possible due to the harsh weather<br />

conditions in the country. As a result, it will be hard to wean away the young population from<br />

retail malls, which are the main source for pastime and social interaction in the country. The<br />

reasons why online sales could pick-up is the convenience that it provides in receiving goods<br />

at home and it allows women to carry out purchases from the comfort of their home.<br />

Other reasons for limited development of online or e-commerce transactions in the Kingdom<br />

are:<br />

<br />

<br />

<br />

Lack of proper infrastructure (no secure payment gateway mechanism, lack of<br />

multiple payment options, limited technical knowledge to design e-commerce<br />

platforms, etc.)<br />

Non-availability of an efficient delivery system (the current postal system uses P.O.<br />

Box systems rather than postal addresses and the new Wasel service, which uses<br />

geographic information systems (GIS) covers only 2% of the Saudi population)<br />

Legislations regulating e-commerce retailing are still under development<br />

While online retail may take some time to establish in the Kingdom, we believe it is the way<br />

to go ahead, considering the success stories in developed countries. Hence, retailers who<br />

quickly adapt to technological and logistical requirements as they develop will be able to<br />

capture major the market share in this segment.<br />

Selling products will become a<br />

part of the entire customer<br />

relationship experience<br />

Saudi retailers will have to build relationships<br />

Saudi Arabian consumers are becoming more discerning because of availability of<br />

information on comparable products on the internet. <strong>Al</strong>ong with this, competition has<br />

intensified due to the presence of regional and international players. Hence, Saudi retailers<br />

will have to leverage on their local presence and proximity, and will have to provide<br />

competitive (best prices, discounts, financing arrangements, extended warrantees, etc.) and<br />

value-added services (door delivery, free installation, after-sales support, etc.) to ensure<br />

customer satisfaction and brand loyalty. Customizing products and developing marketing<br />

campaigns to target specific groups would also facilitate long-term growth. For instance,<br />

Extra launched a month-long “Women Festival” in early 2012, where women were offered<br />

products specific to their needs at discounted prices.<br />

Disclosures Please refer to the important disclosures at the back of this report. 6

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

Grocery retail:<br />

promising despite competition<br />

Demand for more diversified and protein-rich forms of food will be driven by an ever<br />

increasing population in the Kingdom and increasing disposable income in the hands of<br />

Saudi citizens. Food is the third most imported commodity by value after machinery and<br />

transport equipments, which highlights its importance. According to the EIU, a major part of<br />

the Saudi retail sales will be driven by sale of food products. The EIU estimates the retail<br />

sales to increase from US$83.3bn in 2011 to US$131.2bn by 2016, of which food sales’<br />

contribution is expected to increase from 50% to 53%.<br />

Figure 9 Food is the third largest imported commodity<br />

Figure 10 Composition of food and non-food in retail sales<br />

SAR bn<br />

500<br />

400<br />

300<br />

200<br />

100<br />

41.7<br />

66.0<br />

53.0<br />

62.2<br />

77.6<br />

13.9<br />

45.2<br />

49.5<br />

56.7<br />

63.2<br />

73.6<br />

13.4<br />

US$ bn<br />

160<br />

120<br />

80<br />

Title:<br />

Source:<br />

Please fill in the values above to have them entered in your report<br />

117.3 99.0<br />

0<br />

2008 2010<br />

40<br />

Machinery, appliances & equipment<br />

Foodstuffs<br />

Metals & their products<br />

Textiles & clothing<br />

Transport equipment<br />

Chemical & metal products<br />

Other goods<br />

0<br />

2007 2008 2009 2010 2011E 2012E 2013E 2014E 2015E 2016E<br />

Non-food retail sales<br />

Food retail sales<br />

Source: SAMA, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Source: EIU, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Large players have an<br />

advantage in a fragmented<br />

market<br />

Opportunities exist but new challenges emerge<br />

Large players maintain a strangle hold on the market<br />

With big-box retail set to play a major role in the Saudi Arabia’s retail sector, we believe large<br />

grocery retailers like Savola, <strong>Al</strong>othaim and Tamimi will remain key players in the sector.<br />

Savola through its Panda brand leads the organized grocery retail market followed by Bin<br />

Dawood and <strong>Al</strong>othaim. Azizia Panda (the retail arm of Savola) opened 4 hypermarkets and 7<br />

supermarkets in 2011 to reach a total of 132 stores in Saudi Arabia. The company plans to<br />

open 5 hypermarkets and 14 supermarkets by the end of 2012. A large chunk of the grocery<br />

retail market (more than 80% as per our estimates) continues to be catered by small stores<br />

and the unorganized sector. Hence, we expect these retailers to continue launching new<br />

stores across the country to capture a larger share of the market over the next few years.<br />

Figure 11 Top five big-box retailers, 2011<br />

Sales area Avg. sales area Grocery sales Market share<br />

Company No. of stores (sq m) (sq m) (US$ mn) (%)<br />

Panda 144 628,500 4,365 1,742 4.2<br />

Bin Dawood 30 205,000 6,833 929 2.3<br />

<strong>Al</strong> Othaim 106 162,440 1,532 879 2.0<br />

Carrefour 17 107,000 6,294 683 1.7<br />

Farm 43 115,850 2,694 327 0.8<br />

Total 340 1,218,790 21,718 4,560 11<br />

Source: EIU, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer to the important disclosures at the back of this report. 7

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

Discount stores is a growth area<br />

The non-Saudi population accounts for around a third of the total population of Saudi Arabia.<br />

This expatriate population has grown over a period of time and looking at the country’s<br />

dependency on employing the expatriate population (58% as of 2011), this population will<br />

remain a substantial portion of the Saudi workforce in future. By analyzing the trend of<br />

remittances made by these expatriates, we find their income/savings levels have steadily<br />

increased. Therefore, retailers cannot afford to ignore this target group. Since most of them<br />

have left their home countries to earn and save as much as possible, these customers tend to<br />

be more price conscious than Saudi citizens. They will be driven by sales, free offers,<br />

discounts, and gifts rather than brands and high quality.<br />

Figure 12 Expatriate population growing among employed<br />

Figure 13 Remittances by expatriates<br />

mn<br />

12<br />

SAR bn<br />

120<br />

Title:<br />

Source:<br />

10<br />

100<br />

Please fill in the values above to have them entered in your report<br />

8<br />

6<br />

4<br />

5.79<br />

4.88<br />

3.88 4.00 4.09 4.14 4.26 4.31<br />

3.49<br />

80<br />

60<br />

40<br />

2<br />

0<br />

3.12 3.30 3.37 3.43 3.60 3.76 3.84 3.96 4.14<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011<br />

Saudi Non-Saudi<br />

20<br />

0<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011<br />

Source: Ministry of Economy and Planning, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Source: SAMA, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Saudi retailers can cater to this segment by opening up discount stores. According to the EIU,<br />

<strong>Al</strong>hokair plans to roll out 200 discount stores under its “Easy” brand. Similarly, in late 2011,<br />

the UAE-based Convenience Arabia announced plans to open 60 “Circle K” stores in Riyadh,<br />

with the option of opening another 400 outlets in <strong>Al</strong>drees petrol stations.<br />

The emphasis on employing<br />

Saudi nationals imply higher<br />

costs for retail companies<br />

Training of Saudi nationals under Nitaqat to entail costs<br />

The private sector in Saudi Arabia currently employs around 6mn non-Saudis, while the<br />

number of Saudi nationals employed barely touch 1mn (source: SAMA 2011 annual report).<br />

At the same time, the Ministry of Labor’s data shows nearly 1mn Saudi nationals are<br />

unemployed. Consequently, the Saudi government rolled out the ‘Nitaqat’ program in<br />

November 2011 to ensure that a specified number of Saudi nationals are employed by the<br />

private sector. Non-compliance would lead to varying levels of restrictions on non-Saudis<br />

already employed by the private companies.<br />

An elaborate traffic lighting system (red, green and yellow) has been developed, which<br />

prescribes varying quota of Saudi nationals for private companies based on their existing<br />

employee strength. If a company falls in red category, then the company’s non-Saudi workers<br />

would lose their work permits. Companies in yellow cannot renew the work permits of non-<br />

Saudi workers after six years, while those in green will have the freedom to employ non-Saudi<br />

workers from other companies.<br />

Figure 14 Saudi nationals to be employed under Nitaqat program<br />

Employee strength Red Yellow Green Excellent<br />

< 10 0% 0% 0% 0%<br />

10-49 0-4% 5-9% 10-26% 27%+<br />

50-499 0-9% 5-16% 17-33% 34%+<br />

500-2,999 0-9% 10-23% 24-34% 35%+<br />

3000 or more 0-9% 10-24% 25-36% 37%+<br />

Source: EIU, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer to the important disclosures at the back of this report. 8

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

While the success of this program remains to be seen, we believe companies in the retail<br />

sector will find it increasingly difficult and expensive to employ Saudi nationals to work on<br />

labor intensive jobs. These jobs are presently carried out by low cost non-Saudi (South Asian<br />

and East Asian) nationals. As a result, these companies will have to incur higher costs for<br />

recruitment, training and retention, which would squeeze their profit margins.<br />

Clothing & footwear and<br />

electronics & appliance to lead<br />

non-grocery retail<br />

International competition is not far behind<br />

An attractive retail market has lured regional players like Majid <strong>Al</strong> Futtaim and EMKE Group<br />

(Lulu). Majid <strong>Al</strong> Futtaim has been present in Saudi Arabia through its French partner<br />

Carrefour since 2005, which had 9 hypermarkets in the country at the end of 2011. While the<br />

company owns malls across the UAE, Oman, Bahrain and Egypt, it has none in Saudi Arabia.<br />

Consequently, the management considers Saudi Arabia as a key strategic market for growth<br />

and plans to open several malls in Riyadh over the next few years. Separately, Lulu which has<br />

opened four stores in the country, of which three are in Riyadh, plans to expand further<br />

across the country.<br />

Non-grocery retail:<br />

promising despite competition<br />

We expect the non-grocery retail market to post a healthy growth driven by favorable<br />

demography, changing lifestyle, improving education, and aggressive expansion plans of<br />

large retailers. We expect two sub-categories: clothing & footwear as well as electronics &<br />

appliances to lead the growth in non-grocery retail. While the markets remain attractive for<br />

long-term growth, it will be crucial for players to stay ahead of the intensifying competition,<br />

be it in terms of launching new marketing campaigns or offering products/support services.<br />

Clothing & footwear market: brands will rule<br />

Branded apparel catching fancy of a young generation<br />

Clothing & footwear is the largest non-grocery retail sales category in Saudi Arabia.<br />

According to EIU estimates, this market was worth US$9bn in 2011 and is expected to grow<br />

to US$16bn by 2016. Sales in the clothing & footwear segment tend to be seasonal with peaks<br />

during summer breaks and Saudi religious holidays (Eid El Fitr at the end of Ramadan and<br />

Eid <strong>Al</strong> Adha at the end of Hajj). With high disposable income levels, Saudi consumers prefer<br />

branded products, so pricing takes a backseat. Consequently, designer and high-fashion<br />

branded clothing are witnessing robust demand and this trend is likely to continue,<br />

considering the growing young population in the Kingdom. Sales of clothing for women and<br />

children represent majority of the market. As a result, branded boutiques, especially for<br />

women and children, have gathered pace. <strong>Al</strong>though, women wear the “abaya” (a long black<br />

robe) and veil in public, they wear fashionable clothes and footwear at home. Men wear the<br />

“thobe” (a traditional white dress). However, the younger generation is gradually choosing to<br />

wear formal suits and shoes for work, and jeans and t-shirts for casual gatherings.<br />

Figure 15 <strong>Retail</strong> clothing sales trend in Saudi Arabia<br />

US$ mn<br />

16,000<br />

Figure 16 <strong>Retail</strong> footwear sales trend in Saudi Arabia<br />

US$ mn<br />

1200<br />

1000<br />

12,000<br />

800<br />

8,000<br />

600<br />

400<br />

4,000<br />

200<br />

0<br />

2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

0<br />

2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Source: EIU, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Source: EIU, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer to the important disclosures at the back of this report. 9

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

The potential opportunity for branded products has attracted regional players from the UAE,<br />

a retail hotspot in the GCC region. Prominent among them are the Jashanmal Group and<br />

Western International Group (WIG). While Jashanmal plans to launch stores simultaneously<br />

in Riyadh, Jeddah and Dammam in 2013, WIG has already launched its first “Brandzone”<br />

store in Riyadh and plans to open 50 stores across the country by 2015, apart from the seven<br />

stores under the “Shoe Point” brand in Saudi Arabia launched in 2012.<br />

Changing regulations for women centric retail<br />

For the first time, the Saudi government brought out a law mandating lingerie shops to<br />

employ only women staff for retail sales from January 2012 onward. In March 2012, the<br />

Ministry of Labor ordered closure of 600 outlets that had not complied with this rule. In July<br />

2012, the second phase of the law was enacted, which requires all cosmetic stores to employ<br />

Saudi women as front office staff.<br />

Recently, the Ministry also announced a decision to allow Saudi women to work as<br />

saleswomen in jewelry shops. <strong>Al</strong>though arguments continue in support of and against women<br />

working in the Kingdom, we believe this trend reflects the government’s broadening mindset<br />

to empower women. <strong>Al</strong>lowing women to work could be the first step to provide them with a<br />

wider and equitable role in the Saudi society. Women gaining more social and economic<br />

independence will augur well for the retail sector, since they are the sector’s main target<br />

customers.<br />

Apart from a few large players,<br />

the market remains fragmented<br />

The market remains fragmented led by a few players<br />

The leading clothes retailers in the Kingdom are <strong>Al</strong>hokair, <strong>Al</strong> Bandar Trading Company (<strong>Al</strong><br />

Bandar), <strong>Al</strong>shaya Group and <strong>Al</strong> Sawani Group. Apart from these major companies, the rest of<br />

the market is fragmented. A brief description of the leaders in this market is listed below:<br />

<strong>Al</strong>hokair, the leader in fashion retail, offers a multitude of leading brands (75 franchises)<br />

such as GAP, Zara, Bershka, Marks & Spencer, Massimo Dutti, and Charles & Keith. Further,<br />

its subsidiary, Arabian Centres, has a network of 13 malls (12 in Saudi Arabia and 1 in Egypt),<br />

managing almost 2mn sq m of retail property with a combined gross leasable area (GLA) of<br />

835,710 sq m. The company plans to open 10 more malls by 2014.<br />

<strong>Al</strong> Bandar is part of the larger Landmark Group based out of Bahrain and offers major<br />

brands such as Lee Cooper, Zodiac, Louise Philippe, Reebok, Adidas, Bossini, Splash, Shoe<br />

Mart, and City Max in the Kingdom. The company operates through 300 stores in the country<br />

with more than 400,000 sq m of retail space.<br />

<strong>Al</strong>shaya is a Kuwaiti company with a portfolio of popular brands such as Debenhams,<br />

Mothercare, H&M, Next, Milano and Footlocker. The company also offers leading branded<br />

products such as The Body Shop, Estee Lauder, Boots and Vision Express in cosmetics and<br />

healthcare categories.<br />

<strong>Al</strong> Sawani Group, which was one of the first companies to launch department stores in the<br />

Kingdom, has brought in brands such as Benetton, Guess, Moschino, Marina Rinaldi, Betty<br />

Barclay, La Perla and Esprit. The company is the sole authorized distributor of the Espirit<br />

Brand in MENA region.<br />

Demand for latest electronic<br />

gadgets to grow<br />

Electronics and appliances market: booming market<br />

Smart phones and tablets to drive electronic appliance sales<br />

Absence of cinemas and concerts in the Kingdom has resulted in robust demand for home<br />

entertainment. Evidently, demand for DVDs, high-definition televisions (LCDs and LEDs),<br />

and computers remains healthy. With more than 80% of the population below the age of 40,<br />

the urge to be tech savvy among the youth is high and growing disposable income level<br />

supports this aspiration. This has resulted in rising demand for the latest electronic gadgets<br />

viz. smart phones, tablets and gaming consoles. In fact, smart phones and tablets are set to<br />

replace traditional laptops and desktops as they have advanced features, are portable, and<br />

add to the style quotient.<br />

Disclosures Please refer to the important disclosures at the back of this report. 10

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

Higher internet and mobile<br />

usage will drive smart phone<br />

and tablet sales<br />

Increasing internet and mobile usage to provide support<br />

According to CITC, internet penetration in the country stood at around 50.7% at the end of<br />

H1 2012. <strong>Al</strong>though, this number is better than that of emerging markets, it remains much<br />

lower than developed markets like Japan, Germany and the US (more than 75%). Hence,<br />

there is ample room for growth. We believe that most of the sales growth in the smart phones<br />

and tablets will be driven by the growth in internet penetration. CITC estimates mobile<br />

broadband subscriptions to have reached 12.6mn by the end of H1 2012, implying a<br />

penetration rate of 43.4%. Internet usage will grow with the increasing popularity of social<br />

networking websites, web applications, and online games as well as a rise in e-commerce and<br />

m-commerce transactions. Further, the adoption of new communication technologies like<br />

3.5G (HSPA) and 4G should lead to increased demand for new and better electronic devices<br />

for high-definition mobile TV, video conferencing and 3D TV.<br />

Figure 17 Internet usage has been growing rapidly<br />

Figure 18 Mobile subscriptions have also surged<br />

mn<br />

16<br />

60%<br />

mn<br />

60<br />

Title:<br />

Source:<br />

200%<br />

12<br />

50%<br />

50<br />

Please fill in the values above to have them entered in your report<br />

160%<br />

40%<br />

40<br />

120%<br />

8<br />

30%<br />

30<br />

20%<br />

20<br />

80%<br />

4<br />

10%<br />

10<br />

40%<br />

0<br />

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 H1<br />

2012<br />

0%<br />

0<br />

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 H1<br />

2012<br />

0%<br />

Source: CITC, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Internet users<br />

Penetration (RHS)<br />

Source: CITC, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Post-paid Pre-paid Penetration (RHS)<br />

Home appliance sales to also witness growth<br />

The home appliances market has witnessed a steady growth with total sales reaching<br />

SAR6.8bn in 2010 (source: Extra Prospectus). Addition of new housing units is bound to<br />

drive the consumption of home appliances, especially split air conditioners, top and front<br />

load washing machines, and dryers. New ventures are being forged between private<br />

developers and government entities to meet the target of building 500,000 affordable<br />

housing units. According to JLL, 115,000 new residential units will be added in Riyadh, while<br />

76,000 units are expected to be added in Jeddah over the 2012-2015 period. Implementation<br />

of the recently approved mortgage law will provide further impetus.<br />

Electronics market is fragmented and ripe for consolidation<br />

Extra is the largest player in the electronics and appliances market and had a 9.3% market<br />

share in 2010 (Source: Extra prospectus). Jarir was second, trailing far behind with a market<br />

share of 4.7%. Axiom Telecom, Savola (through Hyper Panda) and <strong>Al</strong> Bandar (through E-<br />

Max) follow with a market share ranging between 2-2.6%. We believe that their share will<br />

have increased over the next couple of years. However, their ranking remains the same.<br />

Extra has been able to scale up aggressively in the Kingdom with 29 branches since 2003<br />

and has ambitious plans to launch 40 branches by 2015. The company offers 12,000 products<br />

from leading international brands. Products are offered in big-box retail formats as well as<br />

online sites, along with providing extensive after-sales services. Consequently, Extra has been<br />

able to overtake well established players like Jarir and become the market leader.<br />

Jarir, which started as a stationery and school book supplier, has diversified to office<br />

equipments, portable consumer electronics (smart phones, tablets and e-readers), computers<br />

and peripherals. The company, established in 1979, has been able to build a strong brand<br />

among Saudi nationals. At the end of 2011, the company had 30 retail (23 are leased) and five<br />

wholesale stores, apart from a central warehousing and distribution center. Jarir plans to<br />

open eight new stores by 2014, of which two will be located in Kuwait.<br />

Disclosures Please refer to the important disclosures at the back of this report. 11

Saudi <strong>Retail</strong> <strong>Sector</strong><br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

The UAE-based Axiom Telecom has a strong presence across the GCC countries, UK and<br />

India with more than 500 outlets. The company retails all leading brands of mobile handsets,<br />

tablets and mobile accessories. Further, the company has a strategic partnership with<br />

telecom players du in the UAE and Mobily in Saudi Arabia.<br />

The Saudi electronics retail market is heating up with regional companies increasing their<br />

presence. <strong>Al</strong> Bandar’s “Emax” stores, Majid <strong>Al</strong> Futtaim’s “Best E-City” stores (which it<br />

acquired from <strong>Al</strong>hokair in 2009), and Egypt-based Itsalat International’s “i2” are retailers<br />

from the MENA region, which are viewed as potential competitors in the segment. However,<br />

they have very low market share as compared to Extra.<br />

Investment in education<br />

remains a priority for the<br />

government<br />

Emphasis on a knowledge economy to boost book sales<br />

The Saudi government has placed high emphasis on education for its nationals. The<br />

Kingdom’s goal of creating a knowledge-based society has led the Ministry of Economy and<br />

Planning to allocate SAR732bn toward human resources in the ninth five-year development<br />

plan, which includes education and training. <strong>Al</strong>though the percentage of allocation has<br />

reduced from 56% in the eighth five-year development plan to the current 51%, it still<br />

remains a major area of focus.<br />

The ninth five-year development plan envisages increasing the number of students enrolled<br />

at each academic stage – elementary, intermediate, technical and vocational, graduate, and<br />

post-graduate levels. A number of new educational facilities (25 technology colleges, 28<br />

technical institutes, and 50 industrial training institutes) will be built. The plan also targets to<br />

monitor the implementation of projects under the first five-year plan of the National Policy<br />

for Science, Technology and Innovation, and will provide SAR900mn in grants for research<br />

projects each year. Further, initiatives include the launch of 10 research centers, 15<br />

technological innovation centers affiliated to King Abdullah City for Science and Technology<br />

(KACST), and at least 8 technology incubators at KACST and other universities. We believe<br />

this emphasis on education will provide a boost for book sales and stationeries benefitting<br />

retailers like Jarir — which has diversified to selling electronics (laptops, smart phones, and<br />

gaming equipment) and even has the motto “Not just a bookstore”.<br />

Figure 19 Education and heath are of prime importance<br />

SAR bn<br />

1600<br />

Figure 20 Spending is high on basic and college education<br />

SAR bn<br />

800<br />

1200<br />

Municipal & Housing<br />

Services<br />

Transport &<br />

Communications<br />

600<br />

Institute of Public<br />

Administration<br />

Science, Tech. & Innovation<br />

800<br />

Economic Resources<br />

Health<br />

400<br />

Technical & Vocational<br />

Higher Education<br />

400<br />

Human Resources<br />

(Education)<br />

200<br />

General Education<br />

0<br />

Eighth Plan (2005-09) Ninth Plan (2010-14)<br />

0<br />

Eighth Plan (2005-09) Ninth Plan (2010-14)<br />

Source: Ministry of Economy and Planning, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Source: Ministry of Economy and Planning, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer to the important disclosures at the back of this report. 12

RSI10<br />

Vol mn<br />

United Electronics Company<br />

<strong>Retail</strong><br />

EXTRA AB: Saudi Arabia<br />

05 January 2013<br />

US$0.7bn 40% US$1.14mn<br />

Market cap Free float Avg. daily volume<br />

Target price 123.5 19% over current<br />

Consensus price 123.4 19% over current<br />

Current price 103.75 as at 02/01/2013<br />

Underweight Neutral Overweight<br />

Overweight<br />

Key themes<br />

We expect rising population, improving education,<br />

and changing lifestyle to continue to drive the retail<br />

sector in Saudi Arabia. We believe the electronic<br />

retail segment, to which Extra caters, has immense<br />

potential not only in the Saudi Arabia but also in the<br />

GCC, thanks to the latent demand electronic<br />

gadgets and home appliances.<br />

Implications<br />

Extra is our preferred stock in the retail sector. Extra<br />

has become a leader in a very short time thanks to<br />

its aggressive expansion plans backed by an<br />

attention to all aspects of setting up an efficient<br />

business. We expect the stock to perform well in<br />

future, benefitting from the young demography and<br />

higher disposable income levels.<br />

Performance<br />

103<br />

Earnings<br />

Period End (SAR) 12/11A 12/12E 12/13E 12/14E<br />

Revenue (mn) 2,462 2,850 3,302 3,830<br />

Revenue Growth 38.4% 15.8% 15.8% 16.0%<br />

EBITDA (mn) 158 180 199 218<br />

EBITDA Growth 33.6% 13.8% 10.9% 9.3%<br />

EPS 5.51 6.17 6.81 7.31<br />

EPS Growth -4.2% 12.0% 10.3% 7.4%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Valuation<br />

18.0<br />

16.0<br />

14.0<br />

12.0<br />

10.0<br />

8.0<br />

6.0<br />

4.0<br />

2.0<br />

93<br />

83<br />

73<br />

70<br />

30<br />

-104<br />

3<br />

2<br />

1<br />

Price Close<br />

P/E (x)<br />

MAV10<br />

12/11 04/12 07/12 10/12<br />

Source: Bloomberg<br />

0.0<br />

01/09 01/10 01/11 01/12<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

136<br />

129<br />

122<br />

115<br />

107<br />

100<br />

93<br />

86<br />

Research Department<br />

Majed <strong>Al</strong>solaim,<br />

Tel +966 1211 9471, alsolaimm@alrajhi-capital.com<br />

Extra<br />

Ushering in the digital age<br />

Extra is the market leader in the home & electronic appliance segment in the<br />

Kingdom and has maintained solid revenue growth over the past few years on<br />

account of Saudi Arabia’s strong demographics. We expect the company to post<br />

healthy revenue growth over the next few years due to new store openings.<br />

<strong>Al</strong>though, the company’s margins are lower as compared to its peers, we<br />

attribute it to the selling and distribution costs. We believe that high SGA<br />

expenses are justified, given that the company is in a rapid expansion mode.<br />

We initiate Extra with an Overweight rating and a target price of SAR123.5,<br />

implying an upside potential of 19%.<br />

Favorable market conditions: We believe that Saudi Arabia’s retail sector will<br />

benefit immensely in the coming years on account of a young (80% below 40)<br />

and rapidly growing population. Apart from the Kingdom, neighboring GCC<br />

countries also have a similar demographic profile. While improving income<br />

levels, low internet penetration levels and an attraction to modern lifestyle will<br />

lead to a surge in demand for electronic devices, an increase in housing units will<br />

ensure steady demand for home appliances. Extra, being a market leader in the<br />

Kingdom, is positioned to reap rich dividends from this trend.<br />

Growth to come from rapid store expansion: Extra is planning to set up 42<br />

stores in the country by 2015 from 29 stores currently. Given the fact that Extra<br />

has been expanding rapidly over the past couple of years, we believe that it is<br />

capable of adding 4-5 stores every year for the next couple of years, implying<br />

double-digit revenue growth over the near-term.<br />

Aggressive sales pitch: Extra has been conducting huge sales events like the<br />

“Women Festival” and the recently concluded “Mega Sale” to capture the<br />

attention of Saudi consumers. The financials also point to the fact that Extra’s<br />

selling and distribution expenses are very high as compared to its peer Jarir and<br />

thus have impacted profit margins. However, we believe this is mainly due to<br />

Extra’s rapid expansion plans.<br />

Financials are supportive for growth: <strong>Al</strong>though inventory value has grown<br />

considerably (+86% y-o-y) at the end of Q3 2012 and represents a chunk of the<br />

balance sheet (around 55%), we believe the company can easily tide over any<br />

working capital issues. Our belief stems from the fact that Extra has zero debt on<br />

its balance sheet and hence can raise debt if required.<br />

Valuation: We like Extra’s business for its growth potential and its approach at<br />

selling electronic products (targeted sales campaigns and online sales) in the<br />

Kingdom. We feel the company will ride on the retail wave in the Kingdom as<br />

well as the GCC region at large and expect it to witness high revenue and profit<br />

growth in future. We have conservatively kept selling expenses at the same level<br />

in the forecast period, but we understand that this could reduce substantially in<br />

future, boosting margins. We initiate coverage on the stock with and Overweight<br />

rating and arrive at a target price of SAR123.5 per share using a blend of long<br />

run discounted economic profit (DEP) method (70% weight) along with<br />

comparable P/E and EV/EBITDA multiples of Extra’s peers (30%).<br />

Disclosures Please refer to the important disclosures at the back of this report.<br />

Powered by Enhanced Datasystems’ EFA Platform 13

United Electronics Company<br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

Corporate summary Share information Valuation<br />

Extra is one of the fastest growing<br />

electronic retail companies in Saudi<br />

Arabia with plans to expand to the<br />

GCC. The company retails electronic<br />

products under different categories.<br />

The company has established 29 stores<br />

in the Kingdom and targets to reach 42<br />

by 2015. Extra has become a leader in<br />

a very short time thanks to its<br />

aggressive expansion plans backed by<br />

an attention to all aspects of setting up<br />

an efficient business.<br />

Market cap (SAR/US$) 2.484bn / 0.662bn<br />

52-week range 78.00 - 104.3<br />

Daily avg volume (US$)<br />

1.061mn<br />

Shares outstanding<br />

24.00mn<br />

Free float (est) 40%<br />

Performance: 1M 3M 12M<br />

Absolute 11% 8.1% 35.3%<br />

Relative to index 8.4% 8.4% 27.9%<br />

Major Shareholder:<br />

Fawzan Holding Company 45.4%<br />

Abdulaziz <strong>Al</strong>saghyir Investment Company 14.9%<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Period End 12/11A 12/12A 12/13E 12/14E<br />

Revenue (SARmn) 2,462 2,850 3,302 3,830<br />

EBITDA (SARmn) 158 180 199 218<br />

Net Profit (SARmn) 132 148 163 176<br />

EPS (SAR) 5.51 6.17 6.81 7.31<br />

DPS (SAR) 2.50 2.50 2.50 4.39<br />

EPS Growth -4.2% 12.0% 10.3% 7.4%<br />

EV/EBITDA (x) 15.3 13.2 11.6 10.3<br />

P/E (x) 18.8 16.8 15.2 14.2<br />

P/B (x) 6.6 5.4 4.4 3.8<br />

Dividend Yield 2.4% 2.4% 2.4% 4.2%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

A fresh look at electronics<br />

growing fast organically<br />

Extra continues to expand at a<br />

fast pace<br />

Extra has been busy over the past couple of years setting up stores rapidly across the<br />

Kingdom. Extra added 7 stores in 2011 and has added 5 more by the end of Q3 2012 with the<br />

total number reaching 29. The company plans to take this number to 42 by 2015, which<br />

implies and addition of 4-5 stores every year for the next couple of years. Considering the<br />

bright outlook for retail in Saudi Arabia and the low rental rates for retail property expected<br />

over the next few years (refer to our discussion on steady supply of malls in Page 5), we<br />

believe that Extra will be able to expand rapidly given that most of the company’s stores are<br />

rented rather than owned.<br />

Apart from expansion within the country, Extra also has plans to establish stores in the GCC.<br />

The first store outside Saudi Arabia will come up in the Bausher region in Muscat, Oman with<br />

a retail space of 4,000 sq m. Further, the company has entered into a partnership agreement<br />

with Qatar-based <strong>Al</strong> Meera Holding Company to open a big-box store in Qatar in 2013.<br />

According to a statement made by the Chairman of Extra in May 2012, the company also has<br />

plans to expand into Bahrain in future. The rapid expansion plans of the company seem to<br />

have borne fruit with the company rising to the top in a very fragmented market, overtaking<br />

experienced players like Jarir.<br />

Figure 21 Market share by value<br />

Brand Name Company 2008 2009 2010<br />

eXtra United Electronics Company 6.7% 8.0% 9.3%<br />

Jarir Bookstore Jarir Marketing Co 3.3% 4.0% 4.7%<br />

Axiom Axiom Telecom LLC 2.3% 2.5% 2.6%<br />

Hyper Panda <strong>Al</strong>-Azizia Panda United Inc 2.2% 2.2% 2.3%<br />

E-max <strong>Al</strong> Bandar Trading Co 1.5% 1.8% 2.0%<br />

Electro Advanced Electronics Company 1.2% 1.3% 1.3%<br />

Carrefour Majid <strong>Al</strong> Futtaim Hypermarkets LLC 1.6% 1.3% 1.1%<br />

Best E-City <strong>Al</strong> Futtaim Group LLC 0.4% 0.4% 0.3%<br />

Others 80.7% 78.5% 76.3%<br />

Source: Euromonitor, Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

While Jarir is into electronics<br />

and stationeries, Extra is into<br />

electronics and home<br />

appliances<br />

While Jarir has diversified from selling books, stationeries and school & office supplies to<br />

also selling electronic items, Extra’s product portfolio comprises of electronic items<br />

(computers, gaming devices, smart phones, and cameras) as well as home appliances<br />

(television, kitchen appliances, refrigerators, air conditioners, etc.). Considering the young<br />

demographic profile and the high disposable income levels, we believe Extra has timed it<br />

right to enter a segment which will witness robust growth at least for another couple of years.<br />

Disclosures Please refer to the important disclosures at the back of this report. 14

United Electronics Company<br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

Adoption of new technologies<br />

will boost the demand for smart<br />

phones and tablets<br />

Portable electronic devices and gaming to drive growth<br />

We believe sales of tablets and smart phones will overtake PCs and witness high growth levels<br />

going forward. According to recent estimates by Gartner, around 820mn smart phones and<br />

tablets will be sold globally in 2012 and it will reach 1.2 billion by 2013, which indicates a<br />

46% growth y-o-y. Gartner predicts mobile phones to overtake PCs as the most common web<br />

access device worldwide by 2013 and more than 80% percent of the handsets sold in mature<br />

markets to be smart phones by 2015. It also estimates tablet sales to surge from 13mn units<br />

worldwide in 2012 to 53mn by 2016.<br />

According to CITC data, while mobile subscriptions reached 181% in the Kingdom, mobile<br />

broadband subscriptions reached 11.7mn at the end of Q3 2012, representing a population<br />

penetration rate of 40%. Hence, we believe the demand for new handsets is likely to surge<br />

with the increasing popularity of social networking websites, online games and development<br />

of m-commerce transactions. In the case of tablets, we expect their portability and sleek<br />

features to make them popular over traditional desktop PCs and laptops in future.<br />

With the increasing popularity of bringing your own device to office, consumer preferences<br />

will dictate corporate choice and although this trend is just catching up, we believe it won’t be<br />

long before we see this development in Saudi Arabia. <strong>Al</strong>ready, Extra is eyeing business to<br />

business sales in the Kingdom and sees it as a potential market, especially those involved<br />

with government initiatives. Currently, corporate sales account for a mere 1-1.5% of total<br />

sales on a monthly basis.<br />

Both online and offline gaming<br />

is catching up and represent a<br />

huge market for electronic<br />

retailers<br />

With more than 80% of the population below 40 in the Kingdom, gaming is another market<br />

where we see potential growth for companies like Extra. According to Turkey-based Peak<br />

Games, a social gaming company which competes with top global players like Zynga,<br />

King.com and EA Sports, more than two-thirds of the internet users in Saudi Arabia are<br />

playing games online and the country has one of the highest average revenue per user<br />

(ARPU) rates in social gaming. According to the company, daily ARPU rates in Gulf countries<br />

average around eight cents which is higher as compared to around six cents in developed<br />

markets like the US and Europe. Apart from online gaming, offline sales through gaming<br />

equipments like Sony’s Play Station 3 and Microsoft’s X-box 360 are also expected to be<br />

robust, especially with the popularity of regional Arabic titles. While online gaming will drive<br />

the sales for tablets and smart phones, offline gaming will drive the sales for gaming devices.<br />

Figure 22 Extra: Revenue growth trend<br />

SAR bn<br />

5<br />

50%<br />

4.2<br />

4<br />

3.8<br />

40%<br />

3.3<br />

3<br />

2.5<br />

2.9<br />

30%<br />

2<br />

20%<br />

1<br />

10%<br />

0<br />

2011 2012E 2013E 2014E 2015E<br />

0%<br />

Revenue<br />

Y-o-Y growth (LHS)<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Considering the young population of Saudi Arabia, we believe that Extra can accelerate its top<br />

line by catering to these specific product categories. We expect sales of smart phones, tablets<br />

and gaming devices to complement Extra’s aggressive store expansion plans. We estimate<br />

Extra to achieve revenue growth of around 16% in 2012 and expect the company to maintain<br />

healthy growth over the next three years, though we have been very conservative regarding<br />

store expansions post 2014.<br />

Disclosures Please refer to the important disclosures at the back of this report. 15

United Electronics Company<br />

<strong>Retail</strong> –Industrial<br />

05 January 2013<br />

Extra has been aggressively<br />

promoting its products by<br />

conducting special events<br />

Aggressive sales pitch<br />

Extra has been periodically conducting events to attract the attention of Saudi consumers,<br />

apart from ramping up its stores aggressively. The company received the “<strong>Retail</strong> Marketing<br />

Initiative of the Year” in June 2012 from the Middle East <strong>Retail</strong> Academy in recognition of its<br />

month-long marketing campaign called “Women Festival,” held in the Kingdom. During the<br />

period, diverse marketing channels were employed to market products specifically used by<br />

women. Targeting women customers through extensive marketing efforts is unprecedented in<br />

the Kingdom. As a result, the company’s sales in March 2012 increased by 17% compared to<br />

the previous month.<br />

The company has also been conducting an event called the “Mega Sale” for the past eight<br />

years and the recent one was held in October 2012 for five days. It can be considered as one<br />

of the largest consumer electronics and home appliances event in the Middle East going by<br />

the numbers in 2011. In 2011, the “Mega Sale” attracted 1.2mn visitors to Extra’s stores and<br />

website (a 40% increase y-o-y) and double the volume of sales witnessed in the “GITEX<br />

Technology Week”, one of the largest ICT events held every year in Dubai. While these events<br />

promote brand visibility they also result in higher footfalls and revenue growth. It helps to lay<br />

the foundation for a strong reputation, which is very precious for repeat sales in a country<br />

like Saudi Arabia.<br />

Consumers have been kept in<br />

mind right from product pricing<br />

to after sales service<br />

Extra’s beauty lies in its eye for details<br />

Consumers have been kept in mind at all stages of the sales cycle<br />

Pricing and Products: Majority of Extra’s target customers comprise the middle and high<br />

income segments of both the Saudi and non-Saudi population. Product categories have been<br />

built to cover all price points, from the basic entry level to the high end luxury level, making a<br />

deep penetration into the mobile consumer segment. Extra also provides a comprehensive<br />

range among specific consumer groups. For instance, the company offers a variety of kitchen<br />

appliances under various leading brands to cater to its female customers, while it offers the<br />

top brands of gaming devices, iPods, MP3/MP4 players to the young customers.<br />

Payment: Extra became the first retailer in the Kingdom to join SAMA’s SADAD payment<br />

system in August 2012. SADAD is a single electronic payment platform that links different<br />

billers and banks, enabling consumers to pay electronically through any bank in the<br />

Kingdom. Various banking channels including internet banking, phone banking and ATMs<br />

can be used, providing consumers with the maximum flexibility in terms of how they choose<br />

to pay.<br />

After-Sales: We also like the fact that Extra has taken efforts in sales and after sales<br />

services. The company allows customers to purchase online and receive delivery at home, a<br />

feature available only by a handful of retailers in Saudi Arabia. Further, it provides a<br />

comprehensive list of programs including extended warranties, 24/7 remote technical<br />

support, computer servicing, and mobile upgrading services (Jawwaly). This differentiates<br />

Extra from the others and shows that the company is keen to nurture a long-standing<br />

relationship with its customers rather than merely increasing sales.<br />

Most of the stores are rented,<br />

which allows the company to<br />

focus only on inventory<br />

management<br />

Stores have been set up at minimal costs<br />

The company has been careful in setting up its stores with most of them being leased (only 3<br />

out of 24 stores were owned at the end of 2011) and in stand-alone locations. According to the<br />

company, stand alone stores typically have lower rentals and service charges compared to<br />

those based in shopping malls, which results in lower costs and facilitate aggressive pricing.<br />

Further, this allows the company to focus on its core operations of only managing inventory<br />

levels as well as expand at a fast pace.<br />

While Extra has established large stores with sales space averaging around 5,000 sq m in<br />

large cities such as Riyadh, Jeddah and Khobar, more than 75% of the company’s stores are<br />

small with a sales space averaging around 2,000 sq m. This shows that the company has been<br />

spreading its base across the Kingdom and not focusing only on the major cities.<br />

Multiple warehouses keep<br />

inventory levels at manageable<br />

levels and allow smooth<br />

operations<br />

Strategically placed warehouses<br />

Extra operates three central warehouses located in Riyadh, Jeddah and Khobar, which supply<br />

to the retail stores in specific regions. The Jeddah and Khobar warehouses have the capacity<br />

to receive direct imports and break it down for smaller deliveries to retail stores across the<br />