Savola Group Close to fair value - Al Rajhi Capital

Savola Group Close to fair value - Al Rajhi Capital

Savola Group Close to fair value - Al Rajhi Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

RSI10<br />

Vol mn<br />

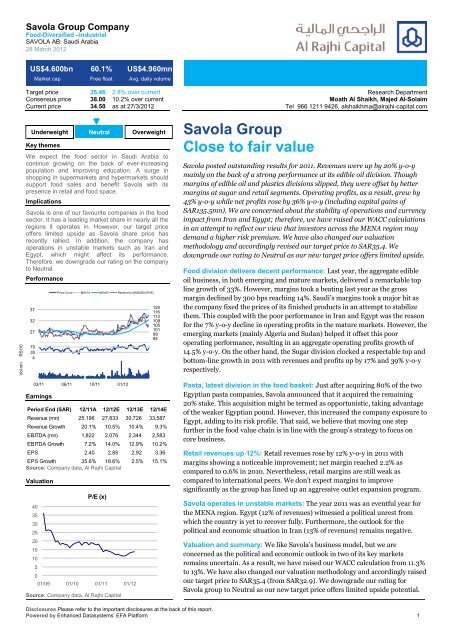

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

SAVOLA AB: Saudi Arabia<br />

28 March 2012<br />

US$4.600bn 60.1% US$4.960mn<br />

Market cap Free float Avg. daily volume<br />

Target price 35.46 2.8% over current<br />

Consensus price 38.00 10.2% over current<br />

Current price 34.50 as at 27/3/2012<br />

Underweight Neutral Overweight<br />

Neutral<br />

Key themes<br />

We expect the food sec<strong>to</strong>r in Saudi Arabia <strong>to</strong><br />

continue growing on the back of ever-increasing<br />

population and improving education. A surge in<br />

shopping in supermarkets and hypermarkets should<br />

support food sales and benefit <strong>Savola</strong> with its<br />

presence in retail and food space.<br />

Implications<br />

<strong>Savola</strong> is one of our favourite companies in the food<br />

sec<strong>to</strong>r. It has a leading market share in nearly all the<br />

regions it operates in. However, our target price<br />

offers limited upside as <strong>Savola</strong> share price has<br />

recently rallied. In addition, the company has<br />

operations in unstable markets such as Iran and<br />

Egypt, which might affect its performance.<br />

Therefore, we downgrade our rating on the company<br />

<strong>to</strong> Neutral.<br />

Performance<br />

37<br />

32<br />

27<br />

22<br />

70<br />

30<br />

-10 4<br />

3<br />

2<br />

1<br />

Earnings<br />

Period End (SAR) 12/11A 12/12E 12/13E 12/14E<br />

Revenue (mn) 25,196 27,833 30,726 33,587<br />

Revenue Growth 20.1% 10.5% 10.4% 9.3%<br />

EBITDA (mn) 1,822 2,076 2,344 2,583<br />

EBITDA Growth 7.2% 14.0% 12.9% 10.2%<br />

EPS 2.40 2.85 2.92 3.36<br />

EPS Growth 35.6% 18.6% 2.5% 15.1%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Valuation<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Price <strong>Close</strong> MAV10 MAV50 Relative <strong>to</strong> SASEIDX (RHS)<br />

03/11 06/11 10/11 01/12<br />

Source: Bloomberg<br />

P/E (x)<br />

01/09 01/10 01/11 01/12<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

120<br />

116<br />

113<br />

109<br />

105<br />

101<br />

98<br />

94<br />

90<br />

<strong>Savola</strong> <strong>Group</strong><br />

<strong>Close</strong> <strong>to</strong> <strong>fair</strong> <strong>value</strong><br />

Research Department<br />

Moath <strong>Al</strong> Shaikh, Majed <strong>Al</strong>-Solaim<br />

Tel 966 1211 9426, alshaikhma@alrajhi-capital.com<br />

<strong>Savola</strong> posted outstanding results for 2011. Revenues were up by 20% y-o-y<br />

mainly on the back of a strong performance at its edible oil division. Though<br />

margins of edible oil and plastics divisions slipped, they were offset by better<br />

margins at sugar and retail segments. Operating profits, as a result, grew by<br />

43% y-o-y while net profits rose by 36% y-o-y (including capital gains of<br />

SAR135.5mn). We are concerned about the stability of operations and currency<br />

impact from Iran and Egypt; therefore, we have raised our WACC calculations<br />

in an attempt <strong>to</strong> reflect our view that inves<strong>to</strong>rs across the MENA region may<br />

demand a higher risk premium. We have also changed our valuation<br />

methodology and accordingly revised our target price <strong>to</strong> SAR35.4. We<br />

downgrade our rating <strong>to</strong> Neutral as our new target price offers limited upside.<br />

Food division delivers decent performance: Last year, the aggregate edible<br />

oil business, in both emerging and mature markets, delivered a remarkable <strong>to</strong>p<br />

line growth of 33%. However, margins <strong>to</strong>ok a beating last year as the gross<br />

margin declined by 300 bps reaching 14%. Saudi’s margins <strong>to</strong>ok a major hit as<br />

the company fixed the prices of its finished products in an attempt <strong>to</strong> stabilize<br />

them. This coupled with the poor performance in Iran and Egypt was the reason<br />

for the 7% y-o-y decline in operating profits in the mature markets. However, the<br />

emerging markets (mainly <strong>Al</strong>geria and Sudan) helped it offset this poor<br />

operating performance, resulting in an aggregate operating profits growth of<br />

14.5% y-o-y. On the other hand, the Sugar division clocked a respectable <strong>to</strong>p and<br />

bot<strong>to</strong>m-line growth in 2011 with revenues and profits up by 17% and 39% y-o-y<br />

respectively.<br />

Pasta, latest division in the food basket: Just after acquiring 80% of the two<br />

Egyptian pasta companies, <strong>Savola</strong> announced that it acquired the remaining<br />

20% stake. This acquisition might be termed as opportunistic, taking advantage<br />

of the weaker Egyptian pound. However, this increased the company exposure <strong>to</strong><br />

Egypt, adding <strong>to</strong> its risk profile. That said, we believe that moving one step<br />

further in the food <strong>value</strong> chain is in line with the group’s strategy <strong>to</strong> focus on<br />

core business.<br />

Retail revenues up 12%: Retail revenues rose by 12% y-o-y in 2011 with<br />

margins showing a noticeable improvement; net margin reached 2.2% as<br />

compared <strong>to</strong> 0.6% in 2010. Nevertheless, retail margins are still weak as<br />

compared <strong>to</strong> international peers. We don’t expect margins <strong>to</strong> improve<br />

significantly as the group has lined up an aggressive outlet expansion program.<br />

<strong>Savola</strong> operates in unstable markets: The year 2011 was an eventful year for<br />

the MENA region. Egypt (12% of revenues) witnessed a political unrest from<br />

which the country is yet <strong>to</strong> recover fully. Furthermore, the outlook for the<br />

political and economic situation in Iran (13% of revenues) remains negative.<br />

Valuation and summary: We like <strong>Savola</strong>’s business model, but we are<br />

concerned as the political and economic outlook in two of its key markets<br />

remains uncertain. As a result, we have raised our WACC calculation from 11.3%<br />

<strong>to</strong> 13%. We have also changed our valuation methodology and accordingly raised<br />

our target price <strong>to</strong> SAR35.4 (from SAR32.9). We downgrade our rating for<br />

<strong>Savola</strong> group <strong>to</strong> Neutral as our new target price offers limited upside potential.<br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report.<br />

Powered by Enhanced Datasystems’ EFA Platform 1

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

Corporate summary Share information Valuation<br />

<strong>Savola</strong>, one of the leading companies<br />

in food and retail industries, is a group<br />

that holds several companies which<br />

operate in different industries. The<br />

<strong>Group</strong> operates its businesses through<br />

three Core Sec<strong>to</strong>rs; these are "<strong>Savola</strong><br />

Foods Sec<strong>to</strong>r", including Edible Oil,<br />

Sugar and Pasta, "<strong>Savola</strong> Retail<br />

Sec<strong>to</strong>r", including Retail (Panda - and<br />

Hyper Panda), and <strong>Savola</strong> Plastics<br />

Sec<strong>to</strong>r. Furthermore, <strong>Savola</strong> has a<br />

major investment in the leading dairy<br />

company in the GCC (<strong>Al</strong>marai) and in<br />

Herfy Foods Company with stakes of<br />

29.9% and 49% respectively.<br />

Edible oil was a key <strong>to</strong>p-line<br />

growth driver in 2011<br />

<strong>Savola</strong> added pasta <strong>to</strong> its<br />

product portfolio<br />

<strong>Savola</strong> expects capital gains of<br />

SAR231mn this year<br />

Market cap (SAR/US$) 17.25bn / 4.600bn<br />

52-week range 23.70 - 35.40<br />

Daily avg volume (US$)<br />

4.960mn<br />

Shares outstanding<br />

500.0mn<br />

Free float (est) 60.1%<br />

Performance: 1M 3M 12M<br />

Absolute 5.5% 21.5% 23.2%<br />

Relative <strong>to</strong> index -3.1% 0.1% 4.1%<br />

Major Shareholder:<br />

Masik Holding Company 12.0%<br />

General Organisation for Social Insurance 10.9%<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Period End 12/11A 12/12E 12/13E 12/14E<br />

Revenue (SARmn) 25,196 27,833 30,726 33,587<br />

EBITDA (SARmn) 1,822 2,076 2,344 2,583<br />

Net Profit (SARmn) 1,202 1,426 1,461 1,682<br />

EPS (SAR) 2.40 2.85 2.92 3.36<br />

DPS (SAR) 1.30 1.30 1.30 1.35<br />

EPS Growth 35.6% 18.6% 2.5% 15.1%<br />

EV/EBITDA (x) 9.3 7.8 6.6 6.2<br />

P/E (x) 14.3 12.1 11.8 10.3<br />

P/B (x) 2.2 2.0 1.9 1.7<br />

Dividend Yield 3.8% 3.8% 3.8% 3.9%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

<strong>Savola</strong> <strong>Group</strong><br />

Positive outlook, concerns persist<br />

Creditable performance in 2011<br />

<strong>Savola</strong> ended 2011 with increases of 20% in revenues, 17.8% in gross profit, and 42.6% in<br />

operating profit. Excluding capital gains, net profits were up by almost 9.2% y-o-y, exceeding<br />

our as well as management’s expectations. The robust performance was mainly propelled by<br />

an exceptional performance from the edible oil division, with revenue growth of 33% y-o-y.<br />

Sugar, plastics, and retail divisions also fared well with revenues growing by 17%, 13% and<br />

12% y-o-y respectively. Margins of edible oil and plastics divisions slipped. However, they<br />

were offset by better margins at sugar and retail segments<br />

In 2011, <strong>Savola</strong> acquired two Egyptian pasta companies - <strong>Al</strong>-Farasha and <strong>Al</strong>- Malika - for a<br />

<strong>value</strong> of SAR713.5mn. Despite having limited information about both the companies, we<br />

believe that moving a step further in the food <strong>value</strong> chain is a significant development for the<br />

group and thereby diversifying its food basket.<br />

Further, <strong>Savola</strong> was able <strong>to</strong> turn its edible oil operation in <strong>Al</strong>geria in<strong>to</strong> a profitable business;<br />

the group recorded profits of SAR23.5mn versus a loss of SAR37.5 in 2010. Furthermore,<br />

<strong>Savola</strong> managed <strong>to</strong> sell lands in Riyadh and Jeddah last year, recording handsome capital<br />

gains of SAR153mn. <strong>Savola</strong> also signed a contract with Knowledge Economic City Company<br />

<strong>to</strong> sell its shares in a plot of land located in <strong>Al</strong> Madinah city. <strong>Savola</strong>, as a result, expects <strong>to</strong><br />

record capital gains of SAR231mn this year.<br />

Figure 1 <strong>Savola</strong>: 2011 vs. 2010<br />

(SAR) mn 2010 2011 %chg. Comments<br />

Revenues<br />

Edible oil 7,004 9,312 33.0% Outstanding revenue growth for the year from both mature (32%) and emerging markets (37%)<br />

Sugar 5,023 5,861 16.7% Solid performance for 2011; revenues from Saudi and Egypt rose by 15% and 20% respectively.<br />

Retail 8,183 9,182 12.2% Strong like for like growth of almost 7% in addition <strong>to</strong> opening 4 supermarkets and 3 hypermarkets during the year<br />

Plastics 884 1,002 13.3% Strong <strong>to</strong>p line performance driven by increasing prices and higher utilization rates<br />

Pasta 0 51 N/A Pasta acquisition was completed in Q4 2011<br />

Franchising 44 47 6.8% Company sold this business in 2011<br />

HQ/Elimination/Impairments -153 -259 N/M<br />

Total 20,985 25,196 20.1%<br />

Operating profits<br />

Edible oil 605 693 14.5% Despite having a decline in mature markets, emerging markets drove operating profit growth<br />

Sugar 216 327 51.4% The ability <strong>to</strong> pass higher prices in the local market helped improving the profitability of this division<br />

Retail 154 228 47.8% Solid improvements in margins as many hypermarkets and supermarkets are maturing<br />

Plastics 118 99 -16.1% Declines in operating profits as raw prices increased<br />

Pasta 0 8 N/M Pasta acquisition was completed in Q4 2011<br />

Franchising -1 7 N/M Company sold this business in 2011<br />

HQ/Elimination/Impairments -206 -98<br />

Total 886 1,263 42.6%<br />

Net income 887 1,202 35.6% Excluding capital gains, net profit were up by almost 9.25%<br />

CAPEX 478 453 -5.4% 2011 did not witness huge CAPEX compared <strong>to</strong> previous years<br />

CAPEX/Sales 2.3% 1.8% -0.5% As mentioned above<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 2

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

We are concerned about the<br />

economic outlook for Iran and<br />

Egypt this year<br />

<strong>Savola</strong> operates in unstable markets<br />

The year 2011 was an eventful year for the MENA region. Egypt - which accounts for almost<br />

12% of <strong>Savola</strong>’s revenues - witnessed a political unrest from which the country is yet <strong>to</strong><br />

recover fully. Furthermore, the outlook for the political and economic situation in Iran –<br />

another country contributing 13% <strong>to</strong> the <strong>to</strong>tal revenue- is negative. Many countries, including<br />

Europe and the US, have imposed an oil embargo on Iran. In our view, these developments<br />

will leave an impact on the economic situation in those countries.<br />

Figure 2 <strong>Savola</strong> <strong>Group</strong> geographic revenue breakdown<br />

Figure 3 <strong>Savola</strong> <strong>Group</strong> geographic net profit breakdown<br />

11.9%<br />

Title:<br />

Source:<br />

5.2%<br />

2.6%<br />

Please fill in the 8.2% <strong>value</strong>s above <strong>to</strong> have them entered in your report<br />

12.0%<br />

13.3%<br />

62.9%<br />

84.0%<br />

Saudi Iran revenues Egypt revenues Other<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Saudi Iran revenues Egypt revenues Other<br />

Market consensus suggests<br />

that further depreciation of<br />

Iranian Riyals and Egyptian<br />

Pounds is possible<br />

However, it is pertinent <strong>to</strong> mention that sugar and edible oil are essential products, and<br />

hence the prevailing economic situation should have a limited impact on their demand.<br />

Having said that, the problems in these countries have resulted in<strong>to</strong> a depreciation in their<br />

respective currencies against the US dollar (against the Saudi Riyal also as Riyal is pegged <strong>to</strong><br />

the dollar). Market consensus suggests the possibility of a further depreciation of their<br />

currencies. Therefore, <strong>Savola</strong>’s foreign earnings, in terms of Saudi Riyal, might be affected in<br />

the near future as further depreciation is expected.<br />

Figure 4 Iranian Riyal vs. US Dollars<br />

Figure 5 Egyptian Pounds vs. US Dollars<br />

15,000<br />

14,000<br />

13,000<br />

12,000<br />

6.1<br />

6<br />

5.9<br />

5.8<br />

5.7<br />

Title:<br />

Source:<br />

Please fill in the <strong>value</strong>s above <strong>to</strong> have them entered in your report<br />

11,000<br />

10,000<br />

5.6<br />

5.5<br />

5.4<br />

9,000<br />

Jan-10 Jul-10 Jan-11 Jul-11 Jan-12<br />

5.3<br />

Jan-10 Jul-10 Jan-11 Jul-11 Jan-12<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

IRR/USD<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

EGP/USD<br />

We have raised our WACC <strong>to</strong><br />

reflect inves<strong>to</strong>rs’ demand for<br />

risk premium<br />

In addition, we are concerned about the fund flow between Saudi Arabia and Iran. Though we<br />

are unaware whether <strong>Savola</strong> is facing problems in transferring and receiving its funds from<br />

Iran, we suspect that fund flow wouldn’t be as smooth as it is with other stable countries.<br />

Based on the above, we have raised our WACC for <strong>Savola</strong> from 11.3% previously <strong>to</strong> 13% now<br />

in a bid <strong>to</strong> reflect our view that inves<strong>to</strong>rs in the MENA region may demand a higher risk<br />

premium. We will discuss the WACC calculations in detail later in this report.<br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 3

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

<strong>Savola</strong> now has pasta in its<br />

food basket<br />

<strong>Savola</strong> has also been growing<br />

organically in sugar and retail<br />

segments<br />

<strong>Savola</strong> is reducing its reliance<br />

on capital gains<br />

Expanding through organic and M&A routes<br />

In line with its recent strategy of focusing more closely on its core businesses, <strong>Savola</strong> has<br />

successfully wrapped up several acquisitions in food and retail categories. It has acquired<br />

minority stakes in Afia Egypt, New Marina Plastics Egypt, and Tate & Lyle in the sugar<br />

business. In addition <strong>to</strong> its 80% interest in Giant S<strong>to</strong>res Trading Company, <strong>Savola</strong> has<br />

completed a major retail acquisition by purchasing the assets of Saudi Geant (eleven s<strong>to</strong>res).<br />

The most recent acquisition - which <strong>to</strong>ok place in 2011 - was acquisition of <strong>Al</strong>-Malika and <strong>Al</strong>-<br />

Farasha companies. Both are Egypt-based companies and are specialized in manufacturing<br />

pasta. The aggregate capacity of both the fac<strong>to</strong>ries is 124,000 MT pa, with a market share of<br />

30%. In our view, this acquisition is an encouraging augury as it not only adds <strong>to</strong> the<br />

company’s basket, but also paves the way for further forward integration in <strong>Savola</strong>’s food<br />

division. We expect revenues from the pasta division <strong>to</strong> reach SAR199mn in 2012.<br />

<strong>Savola</strong> has also been expanding its footprint through the organic route. The company is<br />

carrying out construction work of a beet sugar refinery in <strong>Al</strong>exandria (Egypt) with a capacity<br />

of 0.18mn MT pa, which is scheduled <strong>to</strong> kick-start commercial production in Q1 2013. The<br />

group has also rolled out new Panda s<strong>to</strong>res last year (four hypermarkets and three<br />

supermarkets) and will continue opening new outlets in the coming years as part of its plan <strong>to</strong><br />

operate a <strong>to</strong>tal of 200 outlets by 2015.<br />

We believe that these accomplishments reflect <strong>Savola</strong>’s commitment <strong>to</strong> its strategy and<br />

confidence in its core business. For 2012, we expect profits from core operations of<br />

SAR1,258mn, we also expect <strong>Savola</strong> <strong>to</strong> lock capital gains of SAR168mn this year.<br />

Figure 6 <strong>Savola</strong>: reducing reliance on capital gains<br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

660<br />

753<br />

97<br />

129<br />

168<br />

600<br />

400<br />

852<br />

933<br />

1,074<br />

1,258<br />

200<br />

488 477 496<br />

0<br />

-200<br />

-294<br />

-46<br />

-400<br />

2006 2007 2008 2009 2010 2011 2012E<br />

Net income before capital gain<br />

<strong>Capital</strong> gain<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Fruitful investments<br />

Last year, <strong>Savola</strong> posted respectable income of SAR463mn from its associates. Additionally,<br />

<strong>Savola</strong> recorded dividend income of SAR194mn from <strong>Al</strong>marai and Herfy. As the company<br />

uses equity reporting method for its associates (above 20%), we present below our forecasts<br />

for <strong>Savola</strong>’s income from its associates. In addition, we present the interest income<br />

(dividend) for the group (excluding capital gains) for the coming years. We have used our<br />

own forecasts for <strong>Al</strong>marai and Herfy, both of which are under our coverage. We have also<br />

forecasted dividend payments for both the companies. We further note that we did not<br />

forecast any dividend payment from <strong>Savola</strong>’s other associates (Kinan and others) as we have<br />

inadequate information about them.<br />

Figure 7 <strong>Savola</strong>: income from associates and interest income (mn SAR)<br />

Income from<br />

associates 2010 2011 2012 2013 2014 2015 2016<br />

<strong>Al</strong>marai 384 340 453 535 628 716 816<br />

Herfy 61 72 83 96 107 118 130<br />

Real estate 36 30 27 24 22 20 18<br />

Eliminations and other -19 -30 -39 -46 -53 -60 -67<br />

Total 462 412 524 610 704 794 897<br />

Interest income<br />

<strong>Al</strong>marai 155 155 155 175 201 229 261<br />

Herfy 39 44 44 44 67 67 74<br />

Total 194 199 199 219 267 296 335<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 4

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

Oil division<br />

Tough year ahead<br />

Emerging markets helped offset<br />

poor operating profits from<br />

mature markets<br />

Last year, the aggregate edible oil business, emerging as well as mature markets, posted an<br />

outstanding revenue growth of 33%. However, margins were severely impacted as the gross<br />

margin declined by 300 bps reaching 14%. The Saudi margins <strong>to</strong>ok a massive hit as the<br />

company fixed the prices of its finished products in an attempt <strong>to</strong> stabilize them. This<br />

impacted the margins severely as raw material prices fluctuated throughout the year.<br />

Additionally, Iran’s net margins also declined <strong>to</strong> 6.3% from 7.7% in 2010. This was mainly<br />

due <strong>to</strong> negative currency impact and higher logistics costs. The foregoing issues coupled with<br />

poor profit growth from Egypt and Turkey led <strong>to</strong> operating profits declining in the mature<br />

markets by 7%. However, the emerging markets (mainly <strong>Al</strong>geria and Sudan) helped offset<br />

this poor operating performance; operating profits grew <strong>to</strong> SAR109mn in 2011 as compared<br />

<strong>to</strong> losses of SAR23mn in 2010. This resulted in an aggregate operating profit growth of 14.5%.<br />

Figure 8 Edible oil geographical revenue breakdown (mn SAR)<br />

182<br />

595<br />

1,800<br />

847<br />

2,600<br />

Operations in Saudi, GCC, Yemen & Sham <strong>Savola</strong> Bahshahar Afia Egypt Yudium Turkey <strong>Savola</strong> Kazakhestan<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

As a pure refiner, we question<br />

<strong>Savola</strong>’s decision <strong>to</strong> offer stable<br />

prices in the local market<br />

Declining margins in local market pose a concern<br />

Last year, the local operations chalked up an impressive revenue growth of 38%. However,<br />

the net profit declined by almost 9%. According <strong>to</strong> <strong>Savola</strong>’s annual report, the company<br />

wanted <strong>to</strong> stabilize oil prices in the market. We question <strong>Savola</strong>’s decision <strong>to</strong> do so as this will<br />

expose the company <strong>to</strong> any fluctuations in raw material prices and make the company’s<br />

future profits unstable. Looking ahead, we are unenthusiastic about the local operations<br />

despite having market consensus forecasts relatively lower commodity prices in 2012.<br />

Figure 9 Crude soybean prices (US$c/lb)<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

14-Dec-09 14-Jun-10 14-Dec-10 14-Jun-11 14-Dec-11 14-Jun-12 14-Dec-12<br />

consesus estimates<br />

Crude soybean Usd/lb<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 5

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

We expect the margin pressure<br />

<strong>to</strong> continue in Iran<br />

Uncertain outlook in Iran<br />

As mentioned earlier in this report, the outlook for Iran’s economy is uncertain. Many<br />

countries, including Europe and the US, have imposed an oil embargo on the country. This<br />

has resulted in a depreciation of Iran’s currency against the US dollar. Market consensus<br />

suggests the possibility of a further depreciation of its currency. Therefore, <strong>Savola</strong>’s foreign<br />

earnings, in terms of Saudi Riyal, might be affected in the near future. In addition, we are<br />

concerned about the fund flow between Saudi Arabia and Iran. Last year, revenues from Iran<br />

rose by 29%, while profits only grew by 5%. The management attributes weak profits mainly<br />

<strong>to</strong> currency devaluation and higher logistic costs. As edible oil is an essential product we<br />

expect revenues <strong>to</strong> remain strong; however, margins are likely <strong>to</strong> remain under pressure<br />

Weak profitability in Egypt<br />

Despite 24% hike in revenues, <strong>Savola</strong> did not report any profit growth from Egypt. Given the<br />

<strong>to</strong>ugh economic and political conditions in Egypt, we believe <strong>Savola</strong> managed its operations<br />

well. Looking ahead, we expect the operations in Egypt <strong>to</strong> fare well this year compared <strong>to</strong> last<br />

year. That said, profits will remain under pressure as the political and economic situation<br />

remains unstable.<br />

Emerging markets made the difference<br />

Last year, the company clocked an outstanding revenue and profit growth of 50% and 224%<br />

respectively in Sudan. <strong>Al</strong>geria also dished out a respectable performance as the company<br />

managed <strong>to</strong> turn around its fortunes. Revenues in <strong>Al</strong>geria grew by 46% while profits reached<br />

SAR23.5mn as compared <strong>to</strong> a loss of SAR37.5mn. These remarkable results helped offset the<br />

operating declines from the emerging markets. On the other hand, operations in Morocco<br />

continue <strong>to</strong> encounter problems as the company has failed <strong>to</strong> record profits since 2009.<br />

<strong>Savola</strong> is currently re-evaluating its operations, which implies that exiting this market is<br />

possible.<br />

We are expecting a revenue<br />

growth of 5.8% from the edible<br />

oil division<br />

2012; emerging markets <strong>to</strong> spur growth<br />

Looking ahead, we are not excited about the revenue growth from the mature markets as we<br />

expect it <strong>to</strong> grow by a modest 2.5%. We also expect the pressure on margins <strong>to</strong> continue,<br />

especially in Saudi and Iran. On the other hand, we are positive about the emerging markets<br />

(mainly <strong>Al</strong>geria and Sudan) and expect them <strong>to</strong> fuel growth this year. We expect revenues<br />

from the emerging markets <strong>to</strong> grow by 25%.<br />

We believe poor performance from mature markets will outweigh positive performance from<br />

emerging ones; hence, we expect operating profits from edible oil division <strong>to</strong> decline by 6.8%<br />

next year.<br />

Figure 10 Figure 8 Edible oil forecasts (mn SAR)<br />

(SAR mn) 2010A 2011A y-y% 2012E y-y%<br />

Revenues<br />

Global Afia (mature markets) 6,014 7,958 32.3% 8,153 2.5%<br />

Emerging markets 989 1,354 36.9% 1,695 25.2%<br />

Total 7,003 9,312 33.0% 9,848 5.8%<br />

Operating prift<br />

Global Afia (mature markets) 628 584 -7.0% 505 -13.4%<br />

Emerging markets -23 109 N/M 141 29.1%<br />

Total 605 693 14.5% 646 -6.8%<br />

EBIT% 8.6% 7.4% 6.6%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 6

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

Saudi still imports refined sugar<br />

and we expect local refiners <strong>to</strong><br />

close this deficit<br />

Sugar division<br />

Saturated local market<br />

The Saudi sugar market is one of the biggest ones in the MENA region. According <strong>to</strong> the US<br />

Department of Agriculture, the <strong>to</strong>tal supply of refined sugar in the Saudi market was almost<br />

3mn MT in 2011. Out of the <strong>to</strong>tal supply, local production was almost 86%, which<br />

surprisingly implies that imported refined sugar is still considerably high (around 13%). This<br />

makes no sense as shipping refined sugar is very expensive as compared <strong>to</strong> shipping raw<br />

sugar. Similar <strong>to</strong> edible oil, shipping refined sugar requires hygienic conditions and care.<br />

Figure 11 Saudi sugar market <strong>to</strong>p view<br />

(000) MT 2006 2007 2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Beginning s<strong>to</strong>ck 189 199 644 864 1,194 1,424 1,574 1,655 1,728 1,802 1,866<br />

Raw sugar imports 1,000 1,335 1,245 1,320 1,280 1,150 1,072 1,068 1,061 1,050 1,038<br />

Local production 1,189 1,534 1,889 2,184 2,474 2,574 2672 2759 2845 2926 3017<br />

y-y% 29.0% 23.1% 15.6% 13.3% 4.0% 3.8% 3.3% 3.1% 2.8% 3.1%<br />

Refined sugar imports 260 425 450 380 410 400 392 381 370 357 332<br />

% of <strong>to</strong>t supply 17.9% 21.7% 19.2% 14.8% 14.2% 13.4% 12.8% 12.1% 11.5% 10.9% 9.9%<br />

% of <strong>to</strong>t consumption 35.1% 54.8% 49.2% 42.2% 44.6% 42.1% 40.0% 38.0% 36.0% 34.0% 31.0%<br />

Total supply 1,449 1,959 2,339 2,564 2,884 2,974 3063 3140 3215 3283 3348<br />

Total exports 510 540 560 470 540 450 429 408 386 368 342<br />

Total consumption 740 775 915 900 920 950 979 1,003 1,027 1,049 1,070<br />

y-y% 4.7% 18.1% -1.6% 2.2% 3.3% 3.0% 2.5% 2.4% 2.1% 2.0%<br />

<strong>Savola</strong> local mrkt share% 69.9% 86.7% 84.8% 89.4% 89.0% 88.9% 89.0% 88.9% 89.6%<br />

Population (mn) 24.1 24.9 25.8 26.7 27.6 28.5 29.3 30.1 30.8 31.4 32.1<br />

Population growth 3.4% 3.4% 3.4% 3.4% 3.3% 3.0% 2.5% 2.4% 2.1% 2.0%<br />

consumption per capita (kg pa) 30.7 31.1 35.5 33.8 33.4 33.4 33.4 33.4 33.4 33.4 33.4<br />

Source: Bloomberg, USDA, CDSI, Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Note: USDA figures are combined figure. i.e., it is based on real, estimated and forecasted figures<br />

We expect Saudi’s per capita<br />

sugar consumption <strong>to</strong> stabilize<br />

From a strategic <strong>to</strong>p-down view, we believe that the Saudi sugar market is saturated and<br />

apart from normal population growth, the sole room we see for growth is closing the<br />

imported refined sugar gap or deficit. To put this gap in<strong>to</strong> perspective, it is approximately<br />

40% of <strong>Savola</strong>’s local capacity. We believe in the long run, local refiners will close this gap<br />

gradually. That said, we don’t think <strong>Savola</strong> will expand their capacity as its market share,<br />

based on our calculations, is currently high (90%) and increasing it further might trigger<br />

monopolistic violations. <strong>Al</strong>so, the Saudi per capita consumption is within regional<br />

consumption rates, supporting our view that the Saudi market is mostly saturated.<br />

Figure 12 Global sugar consumption per capita (KG/capita)<br />

Figure 13 Local consumption ( 000 MT) and <strong>Savola</strong>’s market share<br />

60.0<br />

50.0<br />

40.0<br />

30.0<br />

20.0<br />

10.0<br />

0.0<br />

57<br />

45<br />

40 38<br />

35 35 33 33 32 32 32<br />

21 19<br />

10<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

Title:<br />

Source:<br />

95%<br />

90%<br />

Please fill in the <strong>value</strong>s above <strong>to</strong> have them entered in your report85%<br />

2008 2009 2010 2011 2012E 2013E 2014E 2015E 2016E<br />

80%<br />

75%<br />

70%<br />

65%<br />

60%<br />

55%<br />

50%<br />

Consumption/capita<br />

Refined sugar imports Total consumption <strong>Savola</strong> local mrkt share%<br />

Source: Bloomberg, USDA, CDSI, Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Source: Bloomberg, USDA, CDSI, Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 7

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

Problems faced by <strong>Savola</strong>’s sugar division<br />

<strong>Savola</strong> runs three distribution channels for their refined sugar. 1) industrial clients, and2)<br />

repackaging cus<strong>to</strong>mers, where the cost increasing or decreasing is transparent <strong>to</strong> both types<br />

and <strong>Savola</strong> does not face problems passing on any increases in raw cane prices <strong>to</strong> its<br />

cus<strong>to</strong>mers . Finally, 3) retail cus<strong>to</strong>mers, where most of <strong>Savola</strong>’s problems come from. Ideally,<br />

the highest margins for <strong>Savola</strong>’s sugar division should come from retail clients. <strong>Savola</strong> takes a<br />

small refiner premium from industrial and repackaging clients, while the highest margins<br />

accrue from branded refined sugar. However, <strong>Savola</strong> still finds it difficult <strong>to</strong> pass rising prices<br />

<strong>to</strong> retail cus<strong>to</strong>mers due <strong>to</strong> aggressive consumers’ reaction and governments’ restrictions. For<br />

instance, the Egyptian government has a cap on sugar prices. This creates an unlevelled<br />

playing field for <strong>Savola</strong> as they do not receive subsidies from the government like local<br />

players while they are not allowed <strong>to</strong> raise their prices either. The local market is favourable<br />

compared <strong>to</strong> the Egyptian market as we believe <strong>Savola</strong> can pass on most increases in prices <strong>to</strong><br />

its retail cus<strong>to</strong>mers more easily.<br />

We expect <strong>Savola</strong> <strong>to</strong> integrate<br />

its operations by crop growing<br />

and processing beet sugar in<br />

Egypt<br />

As refineries are operating at<br />

close <strong>to</strong> capacity rates, we do<br />

not expect much growth from<br />

the sugar division<br />

Integrated sugar business <strong>to</strong> ease pressure on margins<br />

In contrast <strong>to</strong> edible oil operations, <strong>Savola</strong> is moving <strong>to</strong>ward integrating its sugar business;<br />

the group announced its plan <strong>to</strong> refine beet sugar in Egypt. Until now, the group did not<br />

unveil any plans <strong>to</strong> crop grow or process beet in<strong>to</strong> raw sugar yet; however, we believe that it<br />

will happen soon given the fact that Egypt is considered a source land for beet sugar. Beet<br />

sugar prices are cheaper than cane sugar; therefore, producing beet sugar in a market like<br />

Egypt where the government has caps on refined sugar prices makes perfect sense. In<br />

addition, <strong>Savola</strong> is planning <strong>to</strong> export beet sugar <strong>to</strong> neighbouring countries. We are positive<br />

on the beet sugar plan as it will be easier for <strong>Savola</strong> <strong>to</strong> not only pass on fluctuations in raw<br />

beet prices <strong>to</strong> its cus<strong>to</strong>mers but also secure raw sugar on the long run. The proposed capacity<br />

for the beet refinery is 0.18mn MT pa; the group expects production <strong>to</strong> start in Q1 2013.<br />

Softening in sugar prices <strong>to</strong> boost margins<br />

Last year sugar division witnessed decent performance; revenues grew by almost 17% on the<br />

back of strong performance from Saudi and Egypt. This was mainly due <strong>to</strong> increases in prices<br />

especially in the local market. Bloomberg consensus forecast slightly lower prices for raw<br />

sugar of USd23.6/lb on average for 2012 compared <strong>to</strong> an average of USd26.85/lb in 2011.<br />

Further, the volatility of prices since the beginning of the year was low compared <strong>to</strong> the first<br />

quarter of 2011 and 2010. Therefore, we expect EBIT margins <strong>to</strong> improve from 5.6% levels in<br />

2011 <strong>to</strong> 6.1% in 2012. In addition, we expect a revenue growth of little roughly 3.8% this year<br />

as most refineries are running close <strong>to</strong> full capacity.<br />

Figure 14 Raw sugar prices and consensus estimates (US$c/lb)<br />

40<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

02-Jan-09 02-Jul-09 02-Jan-10 02-Jul-10 02-Jan-11 02-Jul-11 02-Jan-12 02-Jul-12 02-Jan-13<br />

Consensus estimates<br />

Raw sugar prices (sugar#11)<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Below we summarize our forecasts for sugar division<br />

Figure 15 <strong>Savola</strong> sugar division forecasts<br />

(SARmn) 2010A 2011A y-y% 2012E y-y%<br />

Revenues<br />

Saudi 3,541 4,082 15.3% 4,160 1.9%<br />

Egypt 1,482 1,779 20.0% 1,921 8.0%<br />

Total 5,023 5,861 16.7% 6,081 3.8%<br />

EBIT 216 327 51.4% 371 13.4%<br />

EBIT margin% 4.3% 5.6% 6.1%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 8

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

Retail segment<br />

Margins <strong>to</strong> make the difference<br />

Boosted by ever-increasing population and changing shopping habits, the grocery retailing<br />

sec<strong>to</strong>r in Saudi Arabia is growing at a steady pace. We expect the grocery market <strong>to</strong> grow at a<br />

CAGR of 3.3% <strong>to</strong> reach SAR99bn by 2016. With a market share of about 10% as per our<br />

estimates, <strong>Al</strong>-Azizia Panda United (owned 74.4% by <strong>Savola</strong>) leads the grocery retail market,<br />

followed by <strong>Al</strong>othaim which occupies a market share of about 4.5%. While we believe that<br />

small convenience s<strong>to</strong>res will continue <strong>to</strong> dominate the market space, we see ample potential<br />

for hypermarkets and supermarkets <strong>to</strong> up its market share as a result of Saudis’ changing<br />

lifestyles and habits.<br />

Figure 16 Saudi grocery retail market size (mn SAR)<br />

Figure 17 Saudi grocery retail: dominated by small groceries<br />

60<br />

50<br />

46 47 48<br />

50<br />

51<br />

53 53 53<br />

Title:<br />

Source:<br />

Please fill in the <strong>value</strong>s above <strong>to</strong> have them entered in your report<br />

40<br />

30<br />

20<br />

15<br />

21<br />

21<br />

25<br />

10<br />

0<br />

FY09 FY10 FY11 FY12E FY13E FY14E FY15E FY16E<br />

Hyper markets Super markets small grocery & other<br />

Source: Euromoni<strong>to</strong>r, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong> estimates<br />

Saudis’ changing lifestyle is<br />

favouring large retailers<br />

Source: Euromoni<strong>to</strong>r, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong> estimates<br />

As mentioned earlier, the grocery retail market is still dominated by small grocery s<strong>to</strong>res. We<br />

estimate its share <strong>to</strong> be about 57%. Hypermarkets and supermarkets constitute around 18%<br />

and 25% respectively. Over the past few years, the hypermarkets clocked the highest growth<br />

rates; we estimate that it grew between 2008 and 2011 at a CAGR of 7.6%. Supermarkets<br />

come in second with a CAGR of 4%, while small groceries grew at a CAGR of only 2.25% over<br />

the same period.<br />

Low penetration for hyper and super markets<br />

We believe that Saudi shopping habits are undergoing a makeover and moving closer <strong>to</strong> a<br />

western pattern. This notion is supported by different facts. Firstly, Saudi Arabia has a young<br />

population which is increasingly shopping in supermarkets and hypermarkets rather than<br />

traditional ones. Secondly, even older people are changing their shopping habits given the<br />

comfortable experience such supermarkets and hypermarkets offer. Finally, as the Saudi<br />

society is generally conservative and places of entertainment are limited, supermarkets and<br />

hypermarkets are seen as a perfect destination <strong>to</strong> unwind. As a result, families tend <strong>to</strong> visit<br />

large s<strong>to</strong>res partly for entertainment. Compared <strong>to</strong> many local grocery retailers, <strong>Al</strong> Azizia<br />

outlets are well positioned as they offer a feel-good experience families are looking for.<br />

Figure 18 International retailing: sub-segment break down<br />

Figure 19 <strong>Savola</strong>: number of supermarkets and hypermarkets<br />

120%<br />

250<br />

Title:<br />

Source:<br />

100%<br />

200<br />

Please fill in the <strong>value</strong>s above <strong>to</strong> have them entered in your report<br />

80%<br />

60%<br />

40%<br />

150<br />

100<br />

81 85 87<br />

120<br />

126<br />

132<br />

139<br />

146<br />

20%<br />

0%<br />

United<br />

Kingdom<br />

Italy Spain United Arab<br />

Emirates<br />

Saudi Arabia<br />

50<br />

0<br />

47 48 51 54<br />

64<br />

1 3 5 8 16<br />

33 34 38 40 46 53 61 70<br />

Hyper markets Super markets small grocery & other<br />

Source: Euromoni<strong>to</strong>r, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Hypermarkets<br />

Supermarkets<br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 9

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

We expect <strong>Savola</strong> <strong>to</strong> operate<br />

200 s<strong>to</strong>res by 2015<br />

More outlets are in the pipeline<br />

We assume that growth in supermarkets and hypermarket will outperform that of small<br />

convenience s<strong>to</strong>res. <strong>Al</strong> Azizia is leading this trend and has outlined a clear strategy of<br />

launching new supermarket and hypermarket outlets. <strong>Savola</strong> announced that it is planning <strong>to</strong><br />

operate a <strong>to</strong>tal of 200 outlets by 2015 (now 131). This aggressive expansion plan will ensure<br />

that Panda will be better placed <strong>to</strong> capture a higher market share in this space in the future.<br />

We estimate that if everything goes as planned, <strong>Savola</strong>’s market share will reach 14% by 2015.<br />

Figure 20 <strong>Savola</strong>: retail revenues vs. sales per sqm per week<br />

Figure 21 <strong>Savola</strong>: retail SSS and EBIT margins<br />

20,000<br />

18,000<br />

16,000<br />

14,000<br />

12,000<br />

10,000<br />

550<br />

500<br />

450<br />

400<br />

14.0%<br />

12.0%<br />

10.0%<br />

8.0%<br />

6.0%<br />

Title:<br />

Source:<br />

Please fill in the <strong>value</strong>s above <strong>to</strong> have them entered in your report<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

8,000<br />

6,000<br />

4,000<br />

350<br />

300<br />

4.0%<br />

2.0%<br />

150<br />

100<br />

50<br />

2,000<br />

FY07 FY08 FY09 FY10 FY11 FY12E FY13E FY14E FY15E FY16E<br />

250<br />

0.0%<br />

FY08 FY09 FY10 FY11 FY12E FY13E FY14E FY15E FY16E<br />

0<br />

Retail revenues (SARmn)<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Sales per sqm (SAR per week) - RHS<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

EBIT (SAR mn) - RHS SSS growth% EBIT margin%<br />

As much as this is encouraging, <strong>Savola</strong>’s retail margins are squeezed. Usually, new<br />

hypermarkets take between 3-4 years <strong>to</strong> reach full utilization, while supermarkets take only 1-<br />

2 years. During the past three years, we estimate that aggregate selling space grew by 13%;<br />

while hypermarkets’ selling space grew by 15% over the same period. Compared <strong>to</strong> 2010, last<br />

year’s retail margins have shown significant improvement. As <strong>Savola</strong> intends <strong>to</strong> embark on an<br />

aggressive expansion program for the next few years, we do not expect any major<br />

improvements in margins.<br />

As hypermarkets mature, we<br />

expect margins <strong>to</strong> improve<br />

Low efficiency compared <strong>to</strong> local and international players<br />

When we compare <strong>Savola</strong>’s retail division with its international peers, we can see its<br />

depressed efficiency ratios. That said, compared <strong>to</strong> local players such as <strong>Al</strong>othaim, Panda’s<br />

efficiency are decent. We believe the western lifestyle makes international players’ sales per<br />

sqm higher than the Saudi ones. In addition, online selling is a major sales channel for<br />

international retailers. Looking ahead, we believe efficiency will improve gradually as hyper<br />

and super markets mature. We expect sales per sqm <strong>to</strong> increase at a CAGR of 4% over the<br />

next 4-5 years.<br />

Figure 22 Comparing <strong>Savola</strong>’s (retail) sales per sqm per week with international peers<br />

1,400.0<br />

1,200.0<br />

1,000.0<br />

1,315<br />

6.0%<br />

5.5%<br />

5.0%<br />

800.0<br />

600.0<br />

689<br />

4.5%<br />

4.0%<br />

3.5%<br />

400.0<br />

383<br />

3.0%<br />

200.0<br />

2.5%<br />

0.0<br />

Tesco* Sainsbury's <strong>Savola</strong>**<br />

2.0%<br />

Sales per sq mt (SAR weekly)<br />

EBIT%<br />

Source: Companies data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 10

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

Online selling is emerging as<br />

one of the major selling<br />

channels for international<br />

retailers<br />

More work needs <strong>to</strong> be done <strong>to</strong><br />

improve Panda labelling<br />

No movement <strong>to</strong>ward online selling<br />

With above 50% of the Saudi population under 18 years, we strongly believe that online<br />

selling will be one of the main selling channels in Saudi retail space. We have seen the<br />

banking sec<strong>to</strong>r investing heavily in building the adequate infrastructure for it and the number<br />

of online users is increasing rapidly. However, we do not see serious initiatives from most<br />

retailers in Saudi <strong>to</strong>ward improving this channel. We suppose the main reason is the lack of<br />

proper addressing systems. As much as we concur that this is a major concern, we strongly<br />

believe that such problems can be resolved through innovative ways. Online selling is now<br />

one of the major selling channels for international retailers, for example, Sainsbury’s online<br />

sales reached GBP1bn in 2011.<br />

A lot more needs <strong>to</strong> be done <strong>to</strong> improve Panda labelling<br />

Labelling accounted for almost 4-5% of <strong>Savola</strong>’s <strong>to</strong>p-line retail revenues in 2011. In our view,<br />

this is very low compared <strong>to</strong> international grocery retailers, for example, ASDA (UK grocery<br />

retailer) claims that 50% of its revenues are from their own labels. Given Panda’s long his<strong>to</strong>ry<br />

(established in 1978), we consider that Panda’s management was not successful in marketing<br />

their labelled products. We see that the effort Panda puts in expanding its outlets should at<br />

least match its efforts in promoting their own brands. This is critical considering <strong>Savola</strong>’s<br />

retail weak margin; we believe that developing this area coupled with improving efficiency<br />

ought <strong>to</strong> boost retail segment margin <strong>to</strong> a reasonable level compared <strong>to</strong> international peers<br />

2012: Retail is a key growth driver<br />

We expect the retail segment <strong>to</strong> continue its double-digit <strong>to</strong>p-line growth <strong>to</strong> reach SAR10.7bn<br />

(growth of 17%) in 2012. Furthermore, as the company announced its aggressive expansion<br />

plan for the next 3-5 years, we do not expect significant improvement in margins as the<br />

company’s focus is <strong>to</strong> gain market share. Furthermore, we expect sales per sqm <strong>to</strong> steadily<br />

improve over the next few years. Below we summarise our forecast for the retail division for<br />

the next four years.<br />

Figure 23 <strong>Savola</strong>: Retail division forecasts<br />

FY09 FY10 FY11 FY12E FY13E FY14E FY15E FY16E<br />

Hypermarkets 33 37 41 45 50 55 60 61<br />

Supermarkets 81 87 90 101 112 125 140 142<br />

Sales per sqm (SAR per week) 412.2 368.2 382.4 397.9 413.9 430.7 448.1 466.2<br />

Revenues (SAR mn) 7,356 8,183 9,182 10,737 11,741 12,792 13,946 14,711<br />

Revenue growth% 31.1% 11.2% 12.2% 16.9% 9.4% 8.9% 9.0% 5.5%<br />

Same s<strong>to</strong>res sales% 13.0% 5.0% 7.4% 5.9% 5.5% 5.0% 5.0% 5.0%<br />

EBIT% 1.0% 1.9% 2.5% 2.6% 2.7% 2.7% 2.7% 2.8%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 11

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

Plastic division<br />

Charts steady growth path, margins <strong>to</strong><br />

improve<br />

<strong>Savola</strong>’s plastic division was established in 1980 as a supporting unit for the edible oil<br />

division. Currently, only 5% of this division’s revenues are from the edible oil business, while<br />

the remaining 95% is from external cus<strong>to</strong>mers. With a production capacity of about 140k MT<br />

per annum, <strong>Savola</strong>’s plastics division is one of the leaders in the region. <strong>Savola</strong> operates its<br />

plastic division through six manufacturing facilities (four in Saudi and two in Egypt). The<br />

output product range for this division includes film, packaging materials, bottles, closures,<br />

pre-forms, industrial containers, and crates.<br />

Last year, the plastics division witnessed a solid <strong>to</strong>p-line growth of 13%. However, the<br />

margins were squeezed as feeds<strong>to</strong>ck prices rose. This resulted in a decline of almost 9% in<br />

profits. Generally, passing any hikes in raw materials (petrochemical products) is not as<br />

difficult as it’s in sugar and edible oil segments due <strong>to</strong> the fact that the company has no retail<br />

clients for this division and price fluctuations are transparent <strong>to</strong> its clients. However, <strong>Savola</strong>’s<br />

plastics division is under clients’ pressure <strong>to</strong> lower its prices as those clients such as <strong>Al</strong>marai<br />

is unable <strong>to</strong> pass such increases <strong>to</strong> end consumers.<br />

Outlook for this year<br />

The plastics division’s margins are severely affected by rising raw material prices. In our<br />

latest petrochemical report (Diversified companies <strong>to</strong> outperform published on February 20,<br />

2012), we expect average prices for polyethylene and polypropylene in 2012 <strong>to</strong> be relatively<br />

lower than that seen in 2011, despite the recent rise in the last couple of weeks. Based on that,<br />

we expect slight improvement in margins. For <strong>to</strong>p-line growth, we believe revenues will<br />

slightly increase on higher utilization rates. Hence, we expect revenues <strong>to</strong> grow by 12%<br />

reaching SAR1,122mn. Below we summarize our forecasts.<br />

Figure 24 <strong>Savola</strong>: plastic division forecasts<br />

2010 2011 2012E 2013E 2014E 2015E 2016E<br />

Total production (MT pa) 99.0 101.0 106.9 112.8 118.0 122.7 127.7<br />

Utalization rate% 69.5% 70.9% 75.0% 79.1% 82.8% 86.1% 89.6%<br />

Revenues (mn SAR) 884 1,002 1,122 1,204 1,267 1,318 1,371<br />

y-y growth% 18.0% 13.3% 12.0% 7.3% 5.3% 4.0% 4.0%<br />

EBIT (mn SAR) 118 99 116 126 134 145 158<br />

EBIT% 13.3% 9.9% 10.3% 10.5% 10.6% 11.0% 11.5%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 12

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

Valuation<br />

Previously, we <strong>value</strong>d <strong>Savola</strong> <strong>Group</strong> by using two methods - Long-Run DEP and comparative<br />

multiples. Now, we will replace the latter by Sum of The Parts (SoTP) approach. We believe<br />

that valuing each division of the group separately will be more appropriate for <strong>Savola</strong> given<br />

its diverse operations.<br />

For the long-run DEP method of estimating <strong>Savola</strong>’s <strong>fair</strong> <strong>value</strong>, we use a WACC of 13%. We<br />

calculate WACC as shown below.<br />

Figure 25 Cost of <strong>Capital</strong><br />

Risk-free Rate 2.4%<br />

Market Risk Premium 14.2%<br />

Adjusted Beta 0.98<br />

Cost of Equity 16.3%<br />

Pre-tax Cost of Debt 6.2%<br />

Effective Tax rate 13.6%<br />

After-tax Cost of Debt 5.4%<br />

Target D/(D+E) 30.0%<br />

WACC 13.0%<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

We have decreased our previous assumption of a 30-year period of competitive advantage<br />

when we first initiated coverage of <strong>Savola</strong> in 2010 <strong>to</strong> 28 years now. On this basis, we estimate<br />

the <strong>fair</strong> <strong>value</strong> per share at SAR31.<br />

The SoTP approach attempts <strong>to</strong> <strong>value</strong> the constituent segments of <strong>Savola</strong> separately. In an<br />

ideal case, we would use the long-run DCF or DEP analysis for all segments of the business.<br />

However, the fact that many of <strong>Savola</strong>’s companies are unlisted and hence financial<br />

information on these companies as well as overseas operations is limited.<br />

We have therefore decided <strong>to</strong> <strong>value</strong> <strong>Savola</strong>‘s various operations – including its domestic<br />

business – on a comparative basis, using aggregate EV/EBITDA multiples for peer companies<br />

<strong>to</strong> estimate a <strong>fair</strong> enterprise <strong>value</strong> for <strong>Savola</strong>‘s constituent parts. We believe this method<br />

provides a practical and speedy way of valuing <strong>Savola</strong>‘s constituent parts. We have always<br />

preferred EV/EBITDA <strong>to</strong> PE as a valuation measure since it is not affected by differences in<br />

financial structure or tax rate.<br />

Edible oil<br />

We have used a selection of international companies as a base of comparison with <strong>Savola</strong>’s<br />

Edible oil division.<br />

Figure 26 <strong>Savola</strong>: comparables for edible oil business<br />

Comparables Bloomberg Ticker Market Cap (mn SAR) Country name EV (mn SAR) EBITDA (mn SAR) EV/EBITDA<br />

2011A 2012E 2011A 2012E<br />

Tiger Brands LTD TBS SJ Equity 24,780 Johannseburg 25,734 1,958 2,066 13.1 12.5<br />

Archer Daniels Midland ADM US Equity 79,501 New York 107,914 12,320 12,190 8.8 8.9<br />

China Agri-Industries 606 HK Equity 10,354 Hong Kong 25,560 2,119 2,503 12.1 10.2<br />

Aggregate 159,208 16,397 16,758 9.7 9.5<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>, as of 26 th March, 2012<br />

Sugar<br />

We have used a selection of international companies as a base of comparison with <strong>Savola</strong>’s<br />

Sugar division.<br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 13

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

Figure 27 <strong>Savola</strong>: comparables for sugar business<br />

Comparables Bloomberg Ticker Market Cap (mn SAR) Country name EV (mn SAR)<br />

2011A 2012E 2011A 2012E<br />

Tongaat Hulett TON SJ Equity 5,376 Johannseburg 8,218 943 994 8.7 8.3<br />

Suedzucker AG SZU GY Equity 22,422 Germany 33,136 5,092 5,035 6.5 6.6<br />

TATE & LYLE PLC TATE LN Equity 19,943 London 22,631 3,186 2,697 7.1 8.4<br />

Cosan SA Industria CSAN3 BZ Equity 29,098 Brazil 37,938 4,468 5,474 8.5 6.9<br />

Aggregate 101,922 13,689 14,200 7.4 7.2<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>, as of 26 th March, 2012<br />

Figure 28 <strong>Savola</strong>: comparables for plastic business<br />

EBITDA (mn SAR)<br />

EV/EBITDA<br />

Plastics<br />

We have used a selection of international companies as a base of comparison with <strong>Savola</strong>’s<br />

Plastic division. We have also included Takween (which was recently added <strong>to</strong> the Saudi s<strong>to</strong>ck<br />

market) in<strong>to</strong> our comparison universe.<br />

Comparables Bloomberg Ticker Market Cap (mn SAR) Country name EV (mn SAR)<br />

2011A 2012E 2011A 2012E<br />

Takween TAKWEEN AB Equity 1,913 Saudi 2,153 131 N/A 16.4 N/A<br />

Ball Corp BLL US Equity 24,316 New York 36,081 4,381 4,591 8.2 7.9<br />

Amcor LTD AMCRY US Equity 34,213 Australia 47,874 4,824 6,143 9.9 7.8<br />

Aggregate 86,108 9,336 10,734 9.2 8.0<br />

Source: Bloomberg, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong>, as of 26 th March, 2012<br />

Figure 29 <strong>Savola</strong>: comparables for retail business<br />

EBITDA (mn SAR) EV/EBITDA<br />

Retail<br />

<strong>Savola</strong>’s biggest division in terms of revenue share is retail. It is considered the leader in the<br />

Saudi market and has minor retail operations outside the Kingdom. It has one s<strong>to</strong>re in the<br />

UAE and eleven s<strong>to</strong>res in Lebanon. Saudi operations account for 94% of the <strong>to</strong>tal retail<br />

turnover. We have used a selection of companies in the local and international markets as a<br />

base of comparison with <strong>Savola</strong>’s retail division.<br />

Comparables Bloomberg Ticker Market Cap (mn SAR) Country name EV (mn SAR)<br />

2011A 2012E 2011A 2012E<br />

<strong>Al</strong>othaim Markets AOTHAIM AB Equity 2,070 Saudi 2,357 219 266 10.7 8.9<br />

Tesco PLC TSCO LN Equity 163,074 London 217,825 30,320 31,437 7.2 6.9<br />

Wall-Mart WMT US Equity 786,031 New York 978,518 130,090 136,242 7.5 7.2<br />

Sainsbury PLC SBRY LN Equity 35,910 London 48,697 7,130 7,751 6.8 6.3<br />

Aggregate 1,247,398 167,759 175,696 7.4 7.1<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Figure 30 <strong>Savola</strong>: comparables for pasta business<br />

EBITDA (mn SAR) EV/EBITDA<br />

Pasta<br />

We have used a selection of international companies as a base of comparison with <strong>Savola</strong>’s<br />

pasta division.<br />

Comparables Bloomberg Ticker Market Cap (mn SAR) Country name EV (mn SAR)<br />

2011A 2012E 2011A 2012E<br />

Ebro Foods Sa EBRO SM Equity 11,082 Spain 12,917 1,519 1,541 8.5 8.4<br />

M Dias Branco SA MDIA3 BZ Equity 11,230 Brazil 12,173 1,081 1,263 11.3 9.6<br />

Aggregate 25,090 2,601 2,804 9.6 8.9<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

EBITDA (mn SAR) EV/EBITDA<br />

Investments<br />

<strong>Savola</strong>’s main investments are in <strong>Al</strong>marai and Herfy; both companies are listed on the Saudi<br />

S<strong>to</strong>ck exchange and will be included in our valuations at their market <strong>value</strong>. Currently, we are<br />

Overweight on <strong>Al</strong>marai and Neutral on Herfy. Had we rated any of these investments as<br />

underweight, we would have used our estimated <strong>fair</strong> <strong>value</strong> for it. Other <strong>Savola</strong>’s investments<br />

include real estate and private equity investments. We will include these investments as their<br />

book <strong>value</strong>s due <strong>to</strong> limited available information.<br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 14

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

<strong>Savola</strong>: Sum of the parts (SoTP) valuation<br />

Using the above basis of comparison, we calculate SoTP <strong>fair</strong> <strong>value</strong> for <strong>Savola</strong> as follows:<br />

Figure 31 <strong>Savola</strong>: SoTP valuation<br />

EBITDA 2011 2012<br />

Enterprise Value<br />

(SAR mn) Method 2011 2012E (x) (x) Interest in EV 2011 2012E<br />

Retail business Comparables 483.0 553.4 7.4 7.1 74.4% 2,672.0 2,922.9<br />

Oil business Comparables 809.0 823.5 9.7 9.5 86.7% 6,814.3 6,786.4<br />

Sugar business Comparables 417.0 462.2 7.4 7.2 72.9% 2,263.8 2,418.7<br />

Plastics business Comparables 153.0 182.9 9.2 8.0 100% 1,411.1 1,467.2<br />

Pasta business Comparables (started Q4 2011) 8.0 31.2 9.6 8.9 100% 77.2 279.4<br />

Total Enterprise Value 13,238.4 13,874.7<br />

Associates Method Ownership Value<br />

<strong>Al</strong>marai Market price (SAR111.75) 29.9% 7,685.0<br />

Herfy Market price (SAR88.5) 49.0% 1,301.0<br />

Kinan Real Estate Devalopment Book <strong>value</strong> at 1.0x 30.0% 507.6<br />

Other Book <strong>value</strong> at 1.0x <strong>value</strong> at YE 2011 832.8<br />

Enterprise Value YE 2011 13,238.4 13,874.7<br />

Net debt 5,019 4,233<br />

Equity <strong>value</strong> at YE 2011 8,219.4 9,641.3<br />

Associates and other investments 10,326.4 10,326.4<br />

Total Equity Value 18,545.8 19,967.7<br />

Shares outstanding (mn) 500 500<br />

Price per Share 37.1 39.9<br />

Source: <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

<strong>Al</strong>marai and Herfy 26 th March closing prices<br />

On SoTP basis, we estimate<br />

<strong>fair</strong> <strong>value</strong> at SAR39.9<br />

On a comparative SoTP basis, we therefore estimate the <strong>fair</strong> <strong>value</strong> per share for <strong>Savola</strong> at<br />

SAR39.9. As mentioned earlier, we are Overweight on <strong>Al</strong>marai and Neutral on Herfy, had we<br />

been underweight on any of them we would have replaced the market <strong>value</strong> with our<br />

estimated <strong>fair</strong> <strong>value</strong>. We believe our calculations represent a <strong>fair</strong> <strong>value</strong> of <strong>Savola</strong>’s share price.<br />

The chart below presents a breakdown of our estimated <strong>fair</strong> enterprise <strong>value</strong> for <strong>Savola</strong>.<br />

Figure 32 breakdown of estimated <strong>fair</strong> enterprise <strong>value</strong> using SoTP<br />

2.0%<br />

10.6%<br />

21.1%<br />

17.4%<br />

48.9%<br />

Source: <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Retail business Oil business Sugar business Plastics business Pasta business<br />

To recap, we estimate the <strong>fair</strong> <strong>value</strong> per share for <strong>Savola</strong> on a long-run DEP basis at SAR31,<br />

but on a SoTP basis at SAR39.9. The two methods are both valid, thus we gave an equal<br />

weight for both. Our new target price for <strong>Savola</strong> is SAR35.47.<br />

Our new target offers limited upside potential <strong>to</strong> the current price; therefore we change our<br />

rating <strong>to</strong> Neutral. We further note the group trades at an EV/EBITDA of 7.8 and P/E multiple<br />

of 12.1.<br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 15

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

We are expecting revenues for<br />

2012 <strong>to</strong> reach SAR27.8mn<br />

Income Statement (SARmn) 12/10A 12/11A 12/12E 12/13E 12/14E<br />

Revenue 20,985 25,196 27,833 30,726 33,587<br />

Cost of Goods Sold (17,614) (21,225) (23,357) (25,578) (28,104)<br />

Gross Profit 3,370 3,971 4,475 5,148 5,483<br />

Government Charges<br />

S.G. & A. Costs (2,485) (2,707) (3,062) (3,533) (3,695)<br />

Operating EBIT 886 1,263 1,414 1,615 1,788<br />

Cash Operating Costs (19,286) (23,374) (25,756) (28,382) (31,003)<br />

EBITDA 1,699 1,822 2,076 2,344 2,583<br />

Depreciation and Amortisation (813) (558) (662) (729) (795)<br />

Operating Profit 886 1,263 1,414 1,615 1,788<br />

Net financing income/(costs) (218) (317) (388) (376) (376)<br />

Forex and Related Gains - - - - -<br />

Provisions - - - - -<br />

Other Income 782 690 926 798 934<br />

Other Expenses (284) (35) - - -<br />

Net Profit Before Taxes 1,166 1,601 1,951 2,037 2,347<br />

Taxes (140) (132) (190) (199) (219)<br />

Minority Interests (139) (266) (336) (377) (446)<br />

Net profit available <strong>to</strong> shareholders 887 1,202 1,426 1,461 1,682<br />

Dividends (625) (650) (650) (650) (673)<br />

Transfer <strong>to</strong> <strong>Capital</strong> Reserve - - - - -<br />

We assume a dividend payout<br />

ratio above 40% for the next<br />

three year<br />

We are expecting net profit<br />

growth of 18.6% this year<br />

We expect improvement in<br />

retail and sugar margins <strong>to</strong><br />

boost overall margins<br />

12/10A 12/11A 12/12E 12/13E 12/14E<br />

Adjusted Shares Out (mn) 500.0 500.0 500.0 500.0 500.0<br />

CFPS (SAR) 3.68 4.05 4.85 5.13 5.85<br />

EPS (SAR) 1.773 2.405 2.852 2.922 3.364<br />

DPS (SAR) 1.250 1.300 1.300 1.300 1.346<br />

Growth 12/10A 12/11A 12/12E 12/13E 12/14E<br />

Revenue Growth 17.1% 20.1% 10.5% 10.4% 9.3%<br />

Gross Profit Growth 8.5% 17.8% 12.7% 15.0% 6.5%<br />

EBITDA Growth 19.6% 7.2% 14.0% 12.9% 10.2%<br />

Operating Profit Growth -6.3% 42.6% 11.9% 14.2% 10.8%<br />

Net Profit Growth -6.8% 35.6% 18.6% 2.5% 15.1%<br />

EPS Growth -6.8% 35.6% 18.6% 2.5% 15.1%<br />

Margins 12/10A 12/11A 12/12E 12/13E 12/14E<br />

Gross profit margin 16.1% 15.8% 16.1% 16.8% 16.3%<br />

EBITDA margin 8.1% 7.2% 7.5% 7.6% 7.7%<br />

Operating Margin 4.2% 5.0% 5.1% 5.3% 5.3%<br />

Pretax profit margin 5.6% 6.4% 7.0% 6.6% 7.0%<br />

Net profit margin 4.2% 4.8% 5.1% 4.8% 5.0%<br />

Other Ratios 12/10A 12/11A 12/12E 12/13E 12/14E<br />

ROCE 8.1% 10.6% 10.6% 11.1% 11.2%<br />

ROIC 10.5% 17.2% 14.6% 16.9% 18.7%<br />

ROE 12.7% 16.3% 17.6% 16.5% 17.2%<br />

Effective Tax Rate 12.0% 8.2% 9.7% 9.8% 9.3%<br />

Capex/Sales 2.3% 4.1% 3.8% 4.7% 4.8%<br />

Dividend Payout Ratio 70.5% 54.1% 45.6% 44.5% 40.0%<br />

<strong>Savola</strong> trades on a forward PE<br />

of 12.1<br />

Valuation Measures 12/10A 12/11A 12/12E 12/13E 12/14E<br />

P/E (x) 19.5 14.3 12.1 11.8 10.3<br />

P/CF (x) 9.4 8.5 7.1 6.7 5.9<br />

P/B (x) 2.5 2.2 2.0 1.9 1.7<br />

EV/Sales (x) 0.8 0.7 0.6 0.5 0.5<br />

EV/EBITDA (x) 9.3 9.3 7.8 6.6 6.2<br />

EV/EBIT (x) 17.8 13.5 11.4 9.6 9.0<br />

EV/IC (x) 2.3 1.9 1.9 1.8 1.5<br />

Dividend Yield 3.6% 3.8% 3.8% 3.8% 3.9%<br />

Source: Company data, <strong>Al</strong> <strong>Rajhi</strong> <strong>Capital</strong><br />

Disclosures Please refer <strong>to</strong> the important disclosures at the back of this report. 16

<strong>Savola</strong> <strong>Group</strong> Company<br />

Food-Diversified –Industrial<br />

28 March 2012<br />

<strong>Savola</strong>’s balance sheet is<br />

expanding<br />

Balance Sheet (SARmn) 12/10A 12/11A 12/12E 12/13E 12/14E<br />

Cash and Cash Equivalents 533 1,214 2,028 3,141 2,916<br />

Current Receivables 1,503 1,816 1,928 2,128 3,090<br />

Inven<strong>to</strong>ries 2,527 3,152 3,262 3,078 3,359<br />

Other current assets 1,348 1,592 1,432 1,432 1,432<br />

Total Current Assets 5,911 7,774 8,651 9,780 10,798<br />

Fixed Assets 4,739 5,384 5,660 6,377 7,194<br />

Investments 6,107 5,332 5,804 5,804 5,804<br />

Goodwill 1,025 1,302 1,341 1,341 1,341<br />

Other Intangible Assets - - - - -<br />

Total Other Assets - 309 309 309 309<br />

Total Non-current Assets 11,871 12,328 13,114 13,831 14,648<br />

Total Assets 17,782 20,101 21,765 23,610 25,446<br />

Short Term Debt 2,779 3,412 3,410 3,410 3,410<br />

Accounts Payable 2,076 2,719 2,847 3,241 3,493<br />

Accrued Expenses 1,550 1,429 1,898 2,161 2,284<br />

Dividends Payable - - - - -<br />

Other Current Liabilities 200 181 - - -<br />

Total Current Liabilities 6,605 7,740 8,155 8,812 9,187<br />

Long-Term Debt 2,395 2,821 2,852 2,852 2,852<br />

Other LT Payables 292 58 284 284 284<br />

Provisions 276 410 307 307 307<br />

Total Non-current Liabilities 2,962 3,290 3,442 3,442 3,442<br />

Minority interests 1,195 1,348 1,699 2,076 2,522<br />

Paid-up share capital 5,000 5,000 5,000 5,000 5,000<br />

Total Reserves 2,020 2,722 3,468 4,280 5,295<br />

Total Shareholders' Equity 7,020 7,722 8,468 9,280 10,295<br />

Total Equity 8,215 9,071 10,167 11,356 12,816<br />

Total Liabilities & Shareholders' Equity 17,782 20,101 21,765 23,610 25,446<br />

Ratios 12/10A 12/11A 12/12E 12/13E 12/14E<br />

Net Debt (SARmn) 4,641 5,019 4,233 3,121 3,345<br />

Net Debt/EBITDA (x) 2.73 2.76 2.04 1.33 1.29<br />

Net Debt <strong>to</strong> Equity 56.5% 55.3% 41.6% 27.5% 26.1%<br />

EBITDA Interest Cover (x) 7.8 5.7 5.3 6.2 6.9<br />

BVPS (SAR) 14.04 15.44 16.94 18.56 20.59<br />

Cashflow Statement (SARmn) 12/10A 12/11A 12/12E 12/13E 12/14E<br />

Net Income before Tax & Minority Interest 1,166 1,601 1,951 2,037 2,347<br />

Depreciation & Amortisation 813 558 662 729 795<br />

Decrease in Working <strong>Capital</strong> (137) (187) 116 641 (868)<br />

Other Operating Cashflow 12 (398) (190) (199) (219)<br />

Cashflow from Operations 1,853 1,573 2,540 3,208 2,055<br />

<strong>Capital</strong> Expenditure (478) (1,025) (1,056) (1,446) (1,612)<br />

New Investments (497) 152 - - -<br />

Others (164) 104 - - -<br />

Cashflow from investing activities (1,139) (768) (1,056) (1,446) (1,612)<br />

Net Operating Cashflow 714 805 1,483 1,763 443<br />

Dividends paid <strong>to</strong> ordinary shareholders (623) (498) (650) (650) (667)<br />

Proceeds from issue of shares - - - - -<br />