Untitled - Bharat Petroleum

Untitled - Bharat Petroleum

Untitled - Bharat Petroleum

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

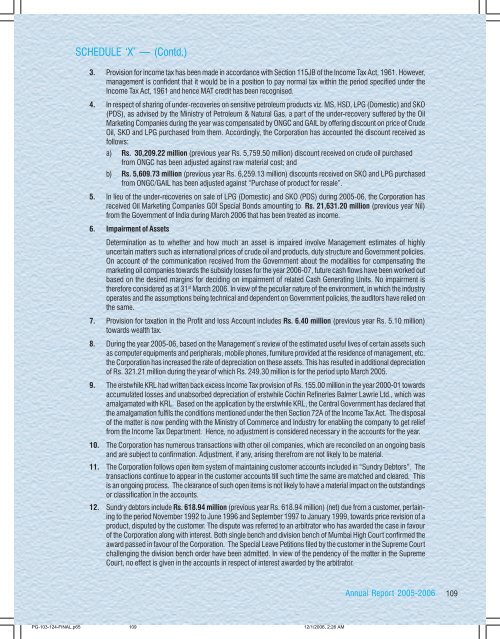

SCHEDULE ‘X’ — (Contd.)<br />

3. Provision for income tax has been made in accordance with Section 115JB of the Income Tax Act, 1961. However,<br />

management is confident that it would be in a position to pay normal tax within the period specified under the<br />

Income Tax Act, 1961 and hence MAT credit has been recognised.<br />

4. In respect of sharing of under-recoveries on sensitive petroleum products viz. MS, HSD, LPG (Domestic) and SKO<br />

(PDS), as advised by the Ministry of <strong>Petroleum</strong> & Natural Gas, a part of the under-recovery suffered by the Oil<br />

Marketing Companies during the year was compensated by ONGC and GAIL by offering discount on price of Crude<br />

Oil, SKO and LPG purchased from them. Accordingly, the Corporation has accounted the discount received as<br />

follows:<br />

a) Rs. 30,209.22 million (previous year Rs. 5,759.50 million) discount received on crude oil purchased<br />

from ONGC has been adjusted against raw material cost; and<br />

b) Rs. 5,609.73 million (previous year Rs. 6,259.13 million) discounts received on SKO and LPG purchased<br />

from ONGC/GAIL has been adjusted against “Purchase of product for resale”.<br />

5. In lieu of the under-recoveries on sale of LPG (Domestic) and SKO (PDS) during 2005-06, the Corporation has<br />

received Oil Marketing Companies GOI Special Bonds amounting to Rs. 21,631.20 million (previous year Nil)<br />

from the Government of India during March 2006 that has been treated as income.<br />

6. Impairment of Assets<br />

Determination as to whether and how much an asset is impaired involve Management estimates of highly<br />

uncertain matters such as international prices of crude oil and products, duty structure and Government policies.<br />

On account of the communication received from the Government about the modalities for compensating the<br />

marketing oil companies towards the subsidy losses for the year 2006-07, future cash flows have been worked out<br />

based on the desired margins for deciding on impairment of related Cash Generating Units. No impairment is<br />

therefore considered as at 31 st March 2006. In view of the peculiar nature of the environment, in which the industry<br />

operates and the assumptions being technical and dependent on Government policies, the auditors have relied on<br />

the same.<br />

7. Provision for taxation in the Profit and loss Account includes Rs. 6.40 million (previous year Rs. 5.10 million)<br />

towards wealth tax.<br />

8. During the year 2005-06, based on the Management’s review of the estimated useful lives of certain assets such<br />

as computer equipments and peripherals, mobile phones, furniture provided at the residence of management, etc.<br />

the Corporation has increased the rate of depreciation on these assets. This has resulted in additional depreciation<br />

of Rs. 321.21 million during the year of which Rs. 249.30 million is for the period upto March 2005.<br />

9. The erstwhile KRL had written back excess Income Tax provision of Rs. 155.00 million in the year 2000-01 towards<br />

accumulated losses and unabsorbed depreciation of erstwhile Cochin Refineries Balmer Lawrie Ltd., which was<br />

amalgamated with KRL. Based on the application by the erstwhile KRL, the Central Government has declared that<br />

the amalgamation fulfils the conditions mentioned under the then Section 72A of the Income Tax Act. The disposal<br />

of the matter is now pending with the Ministry of Commerce and Industry for enabling the company to get relief<br />

from the Income Tax Department. Hence, no adjustment is considered necessary in the accounts for the year.<br />

10. The Corporation has numerous transactions with other oil companies, which are reconciled on an ongoing basis<br />

and are subject to confirmation. Adjustment, if any, arising therefrom are not likely to be material.<br />

11. The Corporation follows open item system of maintaining customer accounts included in “Sundry Debtors”. The<br />

transactions continue to appear in the customer accounts till such time the same are matched and cleared. This<br />

is an ongoing process. The clearance of such open items is not likely to have a material impact on the outstandings<br />

or classification in the accounts.<br />

12. Sundry debtors include Rs. 618.94 million (previous year Rs. 618.94 million) (net) due from a customer, pertaining<br />

to the period November 1992 to June 1996 and September 1997 to January 1999, towards price revision of a<br />

product, disputed by the customer. The dispute was referred to an arbitrator who has awarded the case in favour<br />

of the Corporation along with interest. Both single bench and division bench of Mumbai High Court confirmed the<br />

award passed in favour of the Corporation. The Special Leave Petitions filed by the customer in the Supreme Court<br />

challenging the division bench order have been admitted. In view of the pendency of the matter in the Supreme<br />

Court, no effect is given in the accounts in respect of interest awarded by the arbitrator.<br />

Annual Report 2005-2006<br />

109<br />

PG-103-124-FINAL.p65<br />

109<br />

12/1/2006, 2:26 AM