Six German Retail Properties - the Louis Group International ...

Six German Retail Properties - the Louis Group International ...

Six German Retail Properties - the Louis Group International ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

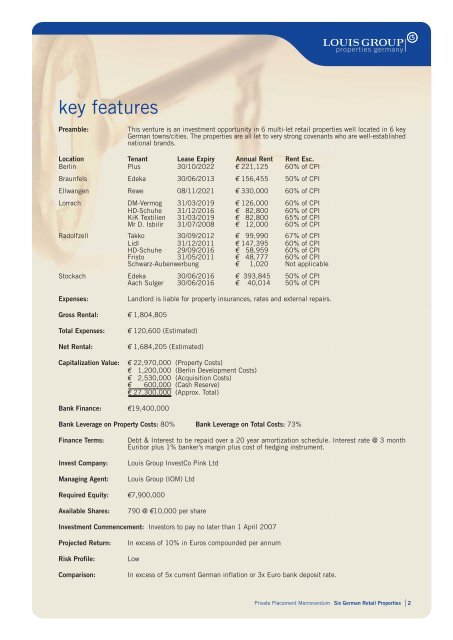

key features<br />

properties germany<br />

Preamble: This venture is an investment opportunity in 6 multi-let retail properties well located in 6 key<br />

<strong>German</strong> towns/cities. The properties are all let to very strong covenants who are well-established<br />

national brands.<br />

Location Tenant Lease Expiry Annual Rent Rent Esc.<br />

Berlin Plus 30/10/2022 € 221,125 60% of CPI<br />

Braunfels Edeka 30/06/2013 € 156,455 50% of CPI<br />

Ellwangen Rewe 08/11/2021 € 330,000 60% of CPI<br />

Lorrach DM-Vermog<br />

HD-Schuhe<br />

31/03/2019<br />

31/12/2016<br />

€ 126,000<br />

€ 82,800<br />

60% of CPI<br />

60% of CPI<br />

KiK Textilien 31/03/2019 € 82,800 65% of CPI<br />

Mr D. Isbilir 31/07/2008 € 12,000 60% of CPI<br />

Radolfzell Takko 30/09/2012 € 99,990 67% of CPI<br />

Lidl 31/12/2011 € 147,395 60% of CPI<br />

HD-Schuhe 29/09/2016 €€ 58,959 60% of CPI<br />

Fristo 31/05/2011 € 48,777 60% of CPI<br />

Schwarz-Aubenwerbung € 1,020 Not applicable<br />

Stockach Edeka 30/06/2016 € 393,845 50% of CPI<br />

Aach Sulger 30/06/2016 € 40,014 50% of CPI<br />

Expenses: Landlord is liable for property insurances, rates and external repairs.<br />

Gross Rental: € 1,804,805<br />

Total Expenses: € 120,600 (Estimated)<br />

Net Rental: € 1,684,205 (Estimated)<br />

Capitalization Value: € 22,970,000 (Property Costs)<br />

€ 1,200,000 (Berlin Development Costs)<br />

€ 2,530,000 (Acquisition Costs)<br />

€ 600,000 (Cash Reserve)<br />

€ 27,300,000 (Approx. Total)<br />

Bank Finance: €19,400,000<br />

Bank Leverage on Property Costs: 80% Bank Leverage on Total Costs: 73%<br />

Finance Terms: Debt & Interest to be repaid over a 20 year amortization schedule. Interest rate @ 3 month<br />

Euribor plus 1% banker's margin plus cost of hedging instrument.<br />

Invest Company: <strong>Louis</strong> <strong>Group</strong> InvestCo Pink Ltd<br />

Managing Agent: <strong>Louis</strong> <strong>Group</strong> (IOM) Ltd<br />

Required Equity: €7,900,000<br />

Available Shares: 790 @ €10,000 per share<br />

Investment Commencement: Investors to pay no later than 1 April 2007<br />

Projected Return: In excess of 10% in Euros compounded per annum<br />

Risk Profile: Low<br />

Comparison: In excess of 5x current <strong>German</strong> inflation or 3x Euro bank deposit rate.<br />

Private Placement Memorandum <strong>Six</strong> <strong>German</strong> <strong>Retail</strong> <strong>Properties</strong><br />

2