Making a Difference - NAPFA

Making a Difference - NAPFA

Making a Difference - NAPFA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

nApFA Advis r<br />

mAgAZine<br />

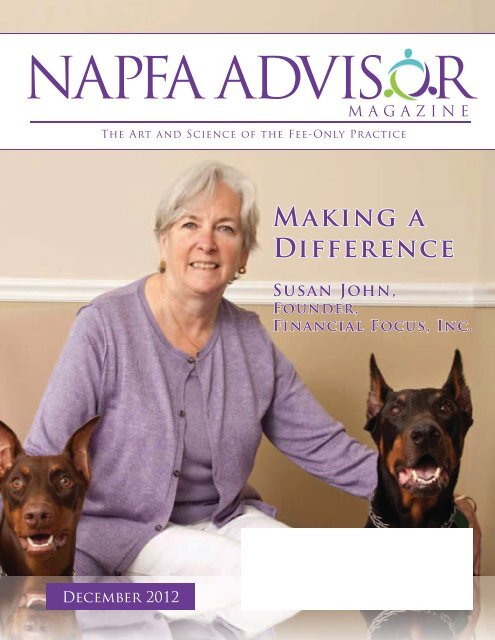

<strong>Making</strong> a<br />

<strong>Difference</strong><br />

Susan John,<br />

Founder,<br />

Financial Focus, Inc.<br />

december 2012

Looking ARTIO for New Choices in Today’s<br />

Economic Environment?<br />

Artio Total Return Bond Fund (BJBGX • JBGIX)<br />

Purchases US and non-US investment grade securities, no high yield<br />

Artio Global High Income Fund (BJBHX • JHYIX)<br />

Global approach and includes “allied” asset classes<br />

Artio Emerging Markets Local Currency Debt Fund (AEFAX • AEFIX)<br />

Exposure to signifi cant and growing part of world economy<br />

877 77 ARTIO<br />

artioglobal.com/us/intermediaries • advisory.services@artioglobal.com<br />

The Funds’ investment objectives, risks, charges, expenses and other information are described in the prospectus which must be read<br />

and considered carefully before investing and may be obtained by calling 800 387 6977 or visiting www.artiofunds.com.<br />

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longerterm<br />

debt securities. Investments in asset backed and mortgage backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk,<br />

possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investing internationally involves additional risks such as currency fluctuations,<br />

currency devaluations, price volatility, social and economic instability, differing securities regulation and accounting standards, limited publicly available information, changes<br />

in taxation, periods of illiquidity and other factors. These risks are greater in the emerging markets and are fully disclosed in the prospectus. In order to achieve their respective<br />

investment goals and objectives, each Fund may invest in derivatives such as futures, options, and swaps. Derivatives involve risks different from, and in certain cases, greater than<br />

the risks presented by more traditional investments. These risks are fully disclosed in the prospectus.<br />

The securities in which the Artio Global High Income Fund and the Artio Emerging Markets Local Currency Debt Fund invests may be considered more speculative in nature and are sometimes<br />

known as “junk bonds”. These securities tend to offer higher yields than higher rated securities of comparable maturities because the historic financial condition of the issuers of<br />

these securities is usually not as strong as that of other issuers. High yield fixed income securities can present a greater risk of loss of income and principal than higher rated securities.<br />

Investors should understand that these Funds are not appropriate for short-term investment. The Artio Emerging Markets Local Currency Debt Fund is non-diversified, meaning it may<br />

concentrate its assets in fewer individual holdings than a diversified fund, and is more exposed to individual security volatility than a diversified fund. Investments in lower‐rated, nonrated<br />

and distressed securities present a greater risk of loss to principal and interest than higher‐rated securities. These risks are fully disclosed in the prospectus.<br />

Artio Global Investors Inc. is the indirect holding company for Artio Global Management LLC, the Adviser for the Artio Global Funds which are distributed by Quasar Distributors, LLC

1-800-642-7167<br />

Escrow Services<br />

Sunwest Trust, Inc acts as an<br />

impartial third party to keep<br />

record of payments, principal<br />

and interest, and also report to<br />

the IRS as required. We can<br />

provide you with an accurate<br />

and undesputable history of the<br />

payments made.<br />

Self-Directed IRAs<br />

Sunwest Trust acts as custodian<br />

for self-directed IRAs. If you’re<br />

tired of traditional investments<br />

learn how you are eligible to<br />

invest your retirement account in<br />

real estate, precious metals,<br />

privately traded stock, and so<br />

much more.<br />

Building on your Trust<br />

SunwestTrust.com<br />

Certiicate of Authority - No. 00027

educe plan costs<br />

with collective investment funds<br />

PARADIGM’S SMALL-CAP COLLECTIVE FUND<br />

IS DESIGNED FOR THE 401(K) MARKET<br />

Recent legislation is causing advisors and plan sponsors to<br />

review their fund line-ups to provide the best balance of<br />

performance, risk control, and cost.<br />

Institutional investment consultants have been using collective<br />

investment funds (CIFs) for years in the mega-plan market.<br />

Advantages include significantly reduced costs, less exposure<br />

to the volatility of retail client flows, and revenue-sharing<br />

agreements customized to fit your business model.<br />

These vehicles are now available on open-architecture platforms<br />

for qualified plans of all sizes.<br />

www.paradigmcapital.com<br />

Supporting the mission of <strong>NAPFA</strong> since 2007.<br />

NEW<br />

paradigm value<br />

collective fund r †<br />

(41023v819)<br />

Total Expense Ratio: 0.98%<br />

paradigm value fund<br />

(pvfax)<br />

Four-star Small-Cap Blend fund<br />

Rated four stars by Morningstar<br />

Total Expense Ratio: 1.51%<br />

Ranking as of 8/31/12<br />

The Paradigm Value Fund strategy<br />

seeks to provide true small-cap exposure<br />

in a moderately concentrated portfolio.<br />

The strategy has a history of lower<br />

volatility than peers and the benchmark<br />

Russell 2000 Value.<br />

Contact Gordon Sacks,<br />

Director, Mutual Funds<br />

at 518-431-3261 or<br />

gsacks@paradigmcapital.com<br />

†<br />

The Paradigm Value Collective Fund is only<br />

available to eligible retirement plans.<br />

The Paradigm Value Collective Fund is a collective investment fund (“CIF”) created by the Hand Composite Employee Benefit Trust and<br />

sponsored by Hand Benefits & Trust Company, a BPAS Company, that invest in the strategies of Paradigm Capital Management, which serves<br />

as the sub-advisor to the CIF. For funds with at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar<br />

Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption<br />

fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars,<br />

the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. An overall<br />

rating for a fund is derived from a weighted average of the performance figures associated with its 3-, 5-, and 10-year (if applicable) Morningstar<br />

Rating Metrics as of the date stated. For funds with at least a three-year history, Morningstar calculates a Morningstar Rating TM based on a<br />

Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges,<br />

loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in<br />

each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10%<br />

receive 1 star. An overall rating for a fund is derived from a weighted average of the performance figures associated with its 3-, 5-, and 10-year<br />

(if applicable) Morningstar Rating Metrics as of the date stated.<br />

Consider the investment objectives, risks, charges, and expenses of each Paradigm Fund carefully before investing. The prospectus and the<br />

statement of additional information contain this and other information about the Funds and are available by calling 800-239-0732. Please read<br />

the prospectus and statement of additional information carefully before investing.<br />

As of 8/31/2012 the number of funds in the Small-Cap Blend category tracked by Morningstar was 588 for the 3 year period and Overall<br />

Ranking, and 510 for the 5 year period. As of 8/31/2012 Paradigm Value Fund did not have a 10 year rating. Not FDIC-Insured. May Lose<br />

Value. No Bank Guarantee. Distributor: Rafferty Capital Markets, LLC.<br />

2 nApFA Advisor deCember 2012

From the editor<br />

do You do groupon?<br />

nApFA ContACt inFormAtion<br />

3250 n. Arlington heights road, suite 109<br />

Arlington heights, iL 60004<br />

800.366.2732 • 847.483.5400<br />

info@napfa.org www.napfa.org<br />

FAX: 847.483.5415<br />

If you’re a consumer and have spent any time<br />

online in the last two years, you’ve become<br />

aware of the array of discount-certificate services<br />

that have emerged. Groupon and LivingSocial are<br />

probably the two biggest vendors, but there are<br />

scores of competitors, each delivering e-mails of<br />

tantalizingly deep discounts for food, products,<br />

services, travel, and much more.<br />

I’ve been seduced into purchasing a number of these products<br />

and services, and I’ve been satisfied with the results. I haven’t had<br />

a single problem with a merchant refusing to honor my coupon,<br />

and I haven’t piled up so many that I couldn’t use them before their<br />

expiration dates. Still, I wondered whether the time I spent looking at<br />

the offers was worthwhile.<br />

Each of the vendors I’ve used keeps online records for at least<br />

a year. With a few clicks, I was able to come up with this tally:<br />

24 purchases for a total of $1,773. My purchases included several<br />

restaurants, two hotel visits, a rug, and numerous tickets to sporting<br />

events, theater, and movies.<br />

The purchases of $1,773 were “worth” a total of $3,610 to me.<br />

That’s the face value of the coupons that I redeemed, or a savings of<br />

slightly more than 50 percent. In most cases, I think the redeemed<br />

value is accurate. For example, a $50 voucher at a restaurant<br />

(purchased for $25) is really worth $50. On the other hand, a halfprice<br />

room voucher at a hotel with a published rate of $280 is<br />

probably worth less than that because I would have been able to get<br />

some type of discount through some other means.<br />

So, I’m happy. But are the merchants happy? Frustration by<br />

“partners” of the coupon companies has attracted a lot of attention this<br />

year. Merchants say that they get a flood of price-oriented, one-time<br />

customers, rather than attract genuine long-term prospects.<br />

All of this made me think about what would happen if a <strong>NAPFA</strong><br />

member offered a Groupon deal for a comprehensive financial plan<br />

or on hourly advice. Could an advisor deal with an influx of 30 new<br />

clients? Would the firm want to serve those bargain shoppers?<br />

Many advisors who charge an asset-based fee say that financial<br />

plans are loss leaders. If that’s true, then selling the loss leader for<br />

$750 instead of $1,500 isn’t a huge problem. The bigger risk is<br />

attracting clients with few assets to manage, and for whom doing a<br />

plan will not lead to a long-term engagement. But I see silver linings.<br />

An advisor could do a simple plan without implementation of the<br />

recommendations; he’d be helping someone who needs financial<br />

advice and spreading the word about Fee-Only planning. In addition,<br />

those plans would be a great way to train a junior advisor.<br />

For an hourly advisor, three hours at a discounted rate seems like<br />

a great way to find prospects—though it, too, would attract some folks<br />

who would balk at paying the full market rate for additional advice.<br />

Frankly, I’m surprised that Ameriprise or another national-brand<br />

broker has not tested the market. I’d even consider doing it if I were a<br />

<strong>NAPFA</strong> member.<br />

CEO<br />

Ellen Turf turfe@napfa.org<br />

stAFF<br />

Business Development and Membership<br />

Nancy Hradsky hradskyn@napfa.org<br />

Accounting<br />

Laura Maddalone maddalonel@napfa.org<br />

Professional Growth and Education<br />

Robin Gemeinhardt gemeinhardtr@napfa.org<br />

Public Policy and Advocacy<br />

Karen Nystrom nystromk@napfa.org<br />

Executive Assistant to CEO<br />

Mardi Lee leem@napfa.org<br />

Membership<br />

Kristen Vanderploeg vanderploegk@napfa.org<br />

Membership Assistant<br />

Cindy Ganze ganzec@napfa.org<br />

Education Assistant<br />

Rachel Gusek gusekr@napfa.org<br />

Administration<br />

Cassie Cabana cabanac@napfa.org<br />

Consultants<br />

Communications<br />

Benjamin Lewis 301.963.7555 ben@bdlpr.com<br />

<strong>NAPFA</strong> Advisor Managing Editor<br />

Kevin Adler 301.270.2839 kevinadler13@gmail.com<br />

Publisher and Director of Magazine Operations<br />

Eric Haines 732.920.4236 ric.haines@erhassoc.com<br />

<strong>NAPFA</strong> Advisor Production<br />

Eric Georgevich ericgeorgevich@gmail.com<br />

<strong>NAPFA</strong> Advisor Editorial Assistant<br />

Christopher Hale cghale@gmail.com<br />

nApFA Consumer<br />

education Foundation<br />

NCEF Coordinator<br />

Lisa Lenczewski lisal@napfa.org<br />

The <strong>NAPFA</strong> Advisor Magazine issue #12 December 2012 is published<br />

monthly for $85.00 per year by The National Association of Personal Financial<br />

Advisors, 3250 North Arlington Heights Road, Suite 109, Arlington Heights, IL<br />

60004. USPS number 024-735. Periodicals Postage Paid at Arlington Heights,<br />

IL, and additional entry office in Schaumburg and Palatine, IL. Postmaster: Send<br />

address changes to The <strong>NAPFA</strong> Advisor Magazine, 3250 North Arlington Heights<br />

Road, Suite 109, Arlington Heights, IL 60004.<br />

From time to time, <strong>NAPFA</strong> Advisor publishes articles on technical subjects.<br />

<strong>NAPFA</strong> makes no representation as to the accuracy or timeliness of such advice.<br />

Submissions are encouraged but will be edited and published at the discretion of<br />

the editor and/or Board of Directors. All materials should be e-mailed to Kevin<br />

Adler at kevinadler13@gmail.com. Unsolicited material cannot be returned unless<br />

accompanied by a stamped, self-addressed envelope.<br />

<strong>NAPFA</strong> and <strong>NAPFA</strong> Advisor do not guarantee or endorse any product or<br />

service advertised in the <strong>NAPFA</strong> Advisor.<br />

nApFA Advisor deCember 2012 3

You’ve worked hard to earn the trust<br />

of your clients.<br />

Don’t lose it when you refer them to<br />

an insurance agent.<br />

For proven results turn to<br />

John Ryan, CFP ® and<br />

Ryan Insurance Strategy Consultants.<br />

Insurance Advice<br />

INDEPENDENT. We research over 100 companies<br />

and their products before making a recommendation.<br />

COMPREHENSIVE. Our detailed policy comparisons<br />

cover all important features.<br />

ON TIME. Proposals are delivered to you within<br />

48 hours.<br />

ACCURATE. We use a proven system of checks and<br />

balances to ensure reliable results.<br />

Visit us on the web at www.Ryan-Insurance.net or call us at 800-796-0909.<br />

Ryan Insurance Strategy Consultants, 5690 DTC Boulevard,<br />

Suite 290-W, Greenwood Village, CO 80111.<br />

Working successfully with <strong>NAPFA</strong><br />

members and their clients since 1983.<br />

4<br />

nApFA Advisor deCember 2012

table of Contents<br />

december 2012 vol. 29, issue 12<br />

<strong>NAPFA</strong> East Conference. Benefit<br />

from the wisdom of Warren Buffett,<br />

John Bogle, and others in our summary<br />

of major investment sessions from the<br />

2012 <strong>NAPFA</strong> East Conference.<br />

Pages 14-17.<br />

Profile: Susan John. Our monthly<br />

Practice Profile looks Susan John’s<br />

career achievements and influence<br />

on <strong>NAPFA</strong> and the financial planning<br />

industry. Pages 22-25.<br />

Dementia. Columnist Linda Leitz<br />

offers tips about judging whether clients<br />

are losing mental capacity and how<br />

advisors can intervene. Pages 26-28.<br />

departments<br />

Keeping Up with nApFA 8<br />

eye on... Social Engagement 34<br />

in the Limelight 36<br />

Features<br />

staying in the game 10<br />

It's About Time<br />

nApFA east 2012 14<br />

Investing Ideas and Concerns Emerge<br />

Financial planning 18<br />

GAO Report Highlights<br />

Women’s Retirement Struggles<br />

practice profile: 22<br />

Susan John, CFP ®<br />

insurance planning 30<br />

Understanding the Tax Impact of<br />

Employer-Owned Life Insurance<br />

Permission to Spend<br />

By Alan Moore, CFP ® , MS<br />

What if you told your clients that having a financial<br />

plan can actually give them permission to spend money?<br />

Many clients are afraid they aren’t saving enough for<br />

their future. They live in fear that every dollar being spent<br />

today is a dollar they may need down the road to help<br />

fund their kids’ college educations, retirement, and health<br />

care. The reason they have this fear is because they don’t<br />

know how much they need to set aside for their financial<br />

goals. When they do spend money, there can be a lot of<br />

guilt about it.<br />

Having a financial plan can help them know how<br />

much they need to save in order to meet their financial<br />

goals, and gives them permission to spend the rest!<br />

Based on an article on figuide.com.<br />

Columns<br />

message from the editor 3<br />

Do You Do Groupon?<br />

Letter from the Chair 6<br />

’Twas a Month...<br />

practice made perfect 26<br />

When Do Clients’ Poor Decisions<br />

Signal Bigger Problems?<br />

nApFA Advisor deCember 2012 5

Lauren Locker, nApFA Chair<br />

’twas a month...<br />

nApFA's mission stAtement<br />

To promote the public interest by advancing the financial<br />

planning profession and supporting our members consistent with<br />

our core values.<br />

Core vALUes<br />

• Competency: Requiring the highest standards of proficiency<br />

in the industry.<br />

• Comprehensive: Practicing a holistic approach to financial<br />

planning.<br />

• Compensation: Using a Fee-Only model that facilitates<br />

objective advice.<br />

• Client-centered: Committing to a fiduciary relationship that<br />

ensures the client’s interest is always paramount.<br />

• Complete Disclosure: Providing an explanation of fees and<br />

potential conflicts of interest.<br />

'Twas a month 'til inauguration<br />

And all through the House<br />

Not a committee was stirring<br />

They’d all stopped to grouse<br />

With Dodd-Frank they had fiddled<br />

But nary a vote<br />

Was scheduled for action<br />

“Why bother?” they’d gloat<br />

“Let’s leave it for others,<br />

We’re lame ducks and small<br />

We needn’t stick heads out<br />

On this one at all”<br />

And so it lay dormant<br />

This significant bill<br />

We don’t know which way<br />

Things will go on the Hill<br />

In the new Congress starting<br />

When New Year’s does pass<br />

We’re all left to wonder<br />

Will FINRA surpass<br />

The old SEC<br />

As our fine regulator<br />

We must call our reps on this<br />

Sooner than later<br />

Don’t wait too long<br />

To express your concern<br />

If things go awry<br />

We all stand to burn<br />

For FINRA can set<br />

Any fees that they choose<br />

Small firms and large<br />

Should react to that news<br />

So gather your ammo<br />

Read up and get smart,<br />

We all need to keep<br />

This theme close to our heart<br />

The new folks in Senate<br />

Chambers can sway<br />

The whole Congress body<br />

Into thinking our way<br />

We don't need SRO powers<br />

We need bipartisan aids<br />

The old filibusters<br />

Must be banished in spades<br />

As FINRA gets ready<br />

To charge in and holler<br />

At <strong>NAPFA</strong> we gather<br />

Our most eloquent power<br />

We lobby and fight<br />

For the fiduciary stand<br />

So that client-first service<br />

Becomes law in this land<br />

Cringe if you must<br />

Over rhyme that is lame<br />

But please pay attention<br />

To this just the same<br />

And I will exclaim<br />

As a new year is in sight<br />

“FINRA is not for us<br />

We are up for the fight!”<br />

vision<br />

The public recognizes that <strong>NAPFA</strong> advocates the highest<br />

standards for personal financial planning and that <strong>NAPFA</strong>-<br />

Registered Financial Advisors are the trusted advisors of choice.<br />

boArd oF direCtors<br />

Chair<br />

Lauren Locker, CFP ®<br />

Little Falls, NJ<br />

lauren.locker@napfa.org<br />

CEO<br />

Ellen Turf<br />

847.483.5400 x101<br />

turfe@napfa.org<br />

Giles Almond, CFP ® , CPA/PFS<br />

Charlotte, NC<br />

giles.almond@napfa.org<br />

Cheryl Costa, CFP ®<br />

Framingham, MA<br />

cheryl.costa@napfa.org<br />

Dr. Raymond Forgue<br />

Easley, SC<br />

ray.forgue@napfa.org<br />

Robert Gerstemeier, CFP ®<br />

Loveland, OH<br />

bob.gerstemeier@napfa.org<br />

Linda Leitz, CFP ®<br />

Colorado Springs, CO<br />

linda.leitz@napfa.org<br />

Mary Malgoire, CFP ® , MBA<br />

Bethesda, MD<br />

mary.malgoire@napfa.org<br />

Carolyn McClanahan, M.D., CFP ®<br />

Jacksonville, FL<br />

carolyn.mcclanahan@napfa.org<br />

Tony Ogorek, Ed.D., CFP ®<br />

Williamsville, NY<br />

tony.ogorek@napfa.org<br />

6<br />

nApFA Advisor deCember 2012<br />

Dana Pingenot, CFP ®<br />

Dallas, TX<br />

dana.pingenot@napfa.org<br />

SEPTEMBER 2006 <strong>NAPFA</strong> ADVISOR

Join Our Academy.<br />

Admission Requirements:<br />

• Fee-only financial advisor (all experience levels)<br />

• Seeking value-added client services<br />

• Desire curriculum that delivers both CEs and valuable action items<br />

you can begin implementing immediately<br />

• Like the idea of an early “Spring Break” in Florida<br />

Register Soon!<br />

The LLIS Insurance Academy is limited to the first 50 participants.<br />

For more information, to register, and to reserve your hotel room,<br />

visit LLIS.com/Education.<br />

FEBRUARY 7-8, 2013 | RENAISSANCE TAMPA HOTEL INTERNATIONAL PLAZA<br />

With an Academy Education You Will …<br />

• Learn what fee-only financial advisors need to know about insurance:<br />

term, permanent, annuities, disability, long term care, hybrids<br />

• Recognize when your clients need insurance, and the type(s) of<br />

insurance that match their need<br />

• Benefit from the integrated curriculum - an intense combination of<br />

presentations, case studies, roundtable discussions, interactive sessions<br />

• Better serve your clients with an enhanced insurance planning and risk<br />

management module<br />

• Know the newest insurance tools available to your clients, re-acquaint<br />

yourself with tried-and-true insurance concepts, and enhance your skillset<br />

Registration for this Academy is just $150 per<br />

person, and includes your instruction, networking<br />

opportunities, and associated meals.<br />

TOLL FREE: 877-254-4429 | LLIS.COM<br />

nApFA Advisor deCember 2012 7

Keeping Up With <strong>NAPFA</strong><br />

<strong>NAPFA</strong> Adopts<br />

CFP® Requirement<br />

Effective on Jan. 1, 2013, <strong>NAPFA</strong><br />

will make the CFP ® designation the<br />

only qualifying mark for advisors who<br />

are applying for new membership as a<br />

<strong>NAPFA</strong>-Registered Financial Advisor.<br />

The decision was made after more than<br />

two years of discussion and a membership<br />

comment period conducted in November<br />

2012, which indicated strong support for<br />

the new policy.<br />

“The <strong>NAPFA</strong> National Board and<br />

Public Policy Committee recognized that<br />

our emerging profession has reached<br />

a point where we must rally around<br />

a singular professional designation,”<br />

said <strong>NAPFA</strong> in a press statement. “Our<br />

support of the CFP ® designation as the<br />

standard for financial planning will be a<br />

catalyst in pushing the recognition of this<br />

profession forward.”<br />

Members in good standing who have<br />

other designations, but not a CFP ® , will be<br />

grandfathered in to the organization. The<br />

Board also noted that “the vast majority”<br />

of members already are CFPs and that<br />

since 2010, when the issue was first<br />

raised, new applications for membership<br />

have come virtually exclusively from<br />

professionals with CFP designations or<br />

who are planning to earn a CFP.<br />

<strong>NAPFA</strong> Sets Dates for<br />

Two Conferences in 2013<br />

In 2013, <strong>NAPFA</strong> will sponsor two<br />

major conferences, replacing its past<br />

programming of one major conference<br />

in the spring and two or more region<br />

conferences in the fall. The new structure<br />

reflects <strong>NAPFA</strong>’s plan to focus its efforts<br />

on fewer events with greater impact and<br />

scope, said Tony Ogorek, a <strong>NAPFA</strong> board<br />

member.<br />

The spring conference will be held<br />

on May 7-10 in Las Vegas, and the fall<br />

conference will be held on Oct. 8-11 in<br />

Philadelphia.<br />

<strong>NAPFA</strong>’s Education Committee is<br />

evaluating how and when to produce<br />

another virtual conference, building<br />

on the success of the Forbes-<strong>NAPFA</strong><br />

Advisor iConference, which was held in<br />

August 2012.<br />

<strong>NAPFA</strong> Seeks Nominees<br />

for 2013 Awards<br />

<strong>NAPFA</strong> is now seeking nominations<br />

for its three awards: Robert J. Underwood<br />

Distinguished Service Award, <strong>NAPFA</strong><br />

Special Achievement Award, and <strong>NAPFA</strong><br />

Special Membership Award.<br />

All <strong>NAPFA</strong> members are eligible<br />

to nominate candidates by going to<br />

<strong>NAPFA</strong>’s website and clicking on the<br />

link for the awards. An online nomination<br />

form is available, and the deadline is Jan.<br />

11, 2013. “It takes only a few minutes<br />

to make a nomination, and you will be<br />

showing a colleague how much you value<br />

his or her input to the organization,” said<br />

Ellen Turf, <strong>NAPFA</strong> CEO.<br />

Last year’s winners were Linda<br />

Gadkowski (Membership), Brooksley<br />

Born (<strong>NAPFA</strong> Special Achievement),<br />

and Ellen Turf (Underwood Special<br />

Achievement). This year’s winners will<br />

be announced at the Spring Conference in<br />

May in Las Vegas.<br />

Paul Baumbach Elected<br />

to Delaware Legislature<br />

<strong>NAPFA</strong> member Paul Baumbach<br />

was elected to the Delaware General<br />

Assembly on Nov. 6, winning his first<br />

election with 57.3 percent of the vote.<br />

Long active in the state’s Democratic<br />

Party,<br />

Baumbach<br />

will represent<br />

District 23,<br />

which includes<br />

a significant part<br />

of Newark, the<br />

state’s secondlargest<br />

city.<br />

“I’m driven to have an impact in<br />

the state and in my community,” said<br />

Baumbach, who has been president of<br />

Progressive Democrats of Delaware and<br />

is on the boards of Equality Delaware and<br />

the Newark Housing Authority. “I have<br />

passions and skills that I felt were wellsuited<br />

for the job.”<br />

Indeed, Baumbach said that he found<br />

campaigning had some similarities to<br />

being a financial advisor. “Going doorto-door<br />

on a campaign and asking people<br />

what issues matter to them is not that<br />

different from asking a client about his<br />

goals,” said Baumbach. “Then, when<br />

the client or the voter responds, you<br />

have to be able to think on your feet and<br />

understand their issues. You have to be a<br />

great listener, just like an advisor.”<br />

Delaware’s legislature meets three<br />

days per week for the first half of each<br />

year, and one of its key responsibilities is<br />

passing the state’s annual budget, which<br />

is first proposed by Delaware’s governor.<br />

As a new legislator, Baumbach said that<br />

his input on budget discussions will<br />

likely be minimal this year, but he hopes<br />

to utilize his financial skills in that area<br />

in the future.<br />

Still, even as a part-time legislator,<br />

Baumbach will have to scale back to<br />

80-percent time in the office, or less.<br />

“I promoted Susan Lehnard in our<br />

firm to head of financial planning,<br />

and she will take the lead on some of<br />

our work,” he said. “Also, I intend<br />

to do a lot of my constituent work on<br />

nights and weekends, just like I did my<br />

campaigning.”<br />

8<br />

Napfa Advisor DECember 2012

Are your clients’ bond<br />

portfolios ready<br />

for higher rates?<br />

Let YieldQuest help you<br />

find the answer<br />

The fear of rising interest rates is gripping the Independent Advisory community.<br />

YieldQuest has developed many unique and creative strategies to help<br />

Advisors potentially protect fixed income allocations in the face of rising rates.<br />

Please contact YieldQuest today<br />

for a no obligation<br />

portfolio review<br />

1-866-978-3781 or info@yieldquest.com<br />

Securities offered through YieldQuest Securities, LLC (Member FINRA and SIPC.) The investments offered carry<br />

risks, including the potential for principal loss and there can be no guarantee that the strategies offered will be<br />

successful. The information and opinions herein are for general information use only. This material does not<br />

constitute an offer to sell, solicitation of an offer to buy, recommendation to buy or representation as to the<br />

suitability or appropriateness of any security, financial product or instrument, unless explicitly stated within the<br />

report. Any opinions expressed are subject to change without notice. No information, opinion or statements<br />

should be construed or deemed as tax advice.<br />

ADV-0141-001-243<br />

Napfa Advisor DECEmber 2012 9

Staying in the Game<br />

By Richard Sincere<br />

It's about Time<br />

I’ve been thinking about time a<br />

lot lately. Spurred by the passing<br />

away of a close friend, discussions<br />

with advisor friends about succession<br />

planning, and strategically watching<br />

how some people use time as a<br />

non-verbal message, it has been an<br />

interesting exercise.<br />

One of the first attorneys I worked<br />

with in my corporate life, Ann, was a<br />

master at using and manipulating time.<br />

As a young pup in the corporate world,<br />

I would rush if someone from outside<br />

the corporation told me they needed<br />

something immediately. One day, Ann<br />

took me aside and told me that making<br />

someone wait was okay and that it put<br />

you in a position of power. After that, I<br />

never really worried if I made someone<br />

wait. And if they made me wait, that was<br />

okay, too—whatever floated their boat.<br />

In the military, the sense of<br />

obligation to time can be quite the<br />

opposite. During a boot camp mission,<br />

you would be physically penalized<br />

if your group wasn’t at the assigned<br />

location on time. Many push-ups and<br />

laps have been performed in the interest<br />

of promptness.<br />

Punishment in different forms<br />

certainly carries over into the corporate<br />

world. For example, managers use<br />

nonverbal shaming of late arrivals to<br />

meetings by not acknowledging that the<br />

laggards are even in the room. Some of<br />

my mentors were incredibly talented at<br />

making a subordinate feel that he or she<br />

didn’t exist after coming late. I quickly<br />

learned to be at a meeting first, and the<br />

corollary was to be sure not to be last<br />

unless you were the most important<br />

person in the meeting.<br />

A twist on manipulating time that<br />

I recently saw in the corporate world<br />

may become my new favorite. Whoever<br />

schedules the meeting announces at the<br />

last minute (about an hour or two before<br />

the original meeting time) that it will<br />

begin 15 to 30 minutes earlier than the<br />

original time. This causes everyone to<br />

change their schedules to make sure that<br />

they’re not last to arrive—unless, of<br />

course, they decide not to participate in<br />

the “game.” Then, this could backfire.<br />

Building the<br />

Next Gener ation<br />

While I muse over these short-term,<br />

political time games, one day you will<br />

wake up and realize that your personal<br />

clock is getting shorter. Hopefully, this<br />

isn’t a result of an illness, but simply<br />

the realization that there are only so<br />

many years left that you can work.<br />

My uncle was an extremely successful<br />

entrepreneur, and he once told me the<br />

worst work-related mistake he ever<br />

made was retiring at 65. But even if you<br />

push your retirement age out to 70, it<br />

still isn’t that distant for many of us.<br />

It seems everyone is talking about<br />

retirement—their clients’ and their<br />

own—at every conference and meeting<br />

I attend. How many years do we have to<br />

prepare for this inevitability?<br />

<strong>Making</strong> someone<br />

wait is okay, and<br />

it can put you in a<br />

position of power.<br />

After realizing<br />

that, I never really<br />

worried if I made<br />

someone wait. And<br />

if they made me<br />

wait, that was okay,<br />

too—whatever<br />

floated their boat.<br />

It also seems to me that the most<br />

difficult issues are trying to determine:<br />

1) how each of your employees will<br />

mature, and 2) the likelihood that one<br />

of them will be ready to take the helm<br />

in five to 10 years. This isn’t as hard to<br />

judge when you have people over 50<br />

years of age, rather than those only in<br />

their 20s or 30s who are still developing.<br />

Much of the development responsibility<br />

for young proteges falls on your<br />

shoulders as their employer, manager,<br />

and mentor.<br />

One way to develop your staff’s<br />

talent is to get a better understanding<br />

of their personalities and strengths.<br />

Personality testing and analysis can<br />

10<br />

Napfa Advisor DECember 2012

Staying in the Game<br />

be very helpful. Consultant Gayle<br />

Abbott has worked on those issues<br />

with one of the boards on which I sit,<br />

both by conducting sophisticated tests<br />

and then by providing a deep analysis<br />

of the results. More importantly, she<br />

has always been able to evaluate<br />

whether people will work effectively or<br />

ineffectively in a particular group.<br />

Another opportunity for developing<br />

employees is enrolling the best and<br />

brightest in targeted courses on<br />

leadership, organizational behavior,<br />

communications, etc. I think that<br />

<strong>NAPFA</strong> should create a conference that<br />

teaches those skills in the context of<br />

an advisory business. I would host it at<br />

a university, in the same way <strong>NAPFA</strong><br />

held the South Region Conference at<br />

Emory University for several years. We<br />

could bring professors from both the<br />

liberal arts and business school, and<br />

every subject would be targeted towards<br />

developing staff. This would be a nice<br />

change from sessions about trying to<br />

maximize the earnings ratio of the firm.<br />

These are just two examples of<br />

how we can re-think our use of time.<br />

Once someone takes the ball and starts<br />

developing conferences to help groom<br />

our staff for succeeding us in managing<br />

our businesses, then we can move on<br />

to the next fun thing: figuring out what<br />

we’re going to do when we finally grow<br />

out of our firm. We’ll have to find new<br />

things that keep us mentally engaged<br />

and physically in shape, but that’s an<br />

exciting challenge. Yes, the clock is<br />

ticking, but our lives should always be a<br />

race towards fulfillment.<br />

Richard Sincere is chairman and<br />

CEO of Sincere & Co., LLC, a <strong>NAPFA</strong><br />

Resource Partner company based in<br />

Chicago. He can be contacted by phone<br />

at 847.905.0225, or by e-mail at rs@<br />

sincereco.com. His company’s website is<br />

www.sincereco.com.<br />

<strong>NAPFA</strong> Continuing Education Events:<br />

JANUARY 2013<br />

Webinars<br />

Cutting Edge Webinar:<br />

Dynamic Asset Allocation: A Key Element<br />

of Portfolio Risk Management<br />

<strong>NAPFA</strong> University<br />

Investing in a Rebound<br />

Presented by <strong>NAPFA</strong>-Registered Financial<br />

Advisor Scott Leonard<br />

Dean, School of Investments<br />

June<br />

Investments<br />

Alternative Investments in an IRA. The<br />

Potential & Pitfalls of Land, Loans, LLCs &<br />

Llamas in a Self-Directed Retirement Plan<br />

Presented by: Jack M. Callahan, JD, CFP®,<br />

Family Financial Fraud:<br />

Detection and Prevention<br />

Presented by Peggy Tracy, CFP ® , CDFA, CFE<br />

Member fee: $19. Non-members: $49.<br />

September<br />

Ethics Training<br />

Presented by <strong>NAPFA</strong>-Registered Financial<br />

Advisors Linda Gadkowski and Lauren Lindsay<br />

This session fulfills <strong>NAPFA</strong>’s two-hour<br />

requirement in Ethics of Financial Planning,<br />

November<br />

<strong>NAPFA</strong> University<br />

Communication and Counseling<br />

Presented by <strong>NAPFA</strong>-Registered Financial<br />

Advisor Peg Downey, Dean, School of<br />

Communication and Counseling<br />

December<br />

Socially Responsible Investing<br />

Presented by <strong>NAPFA</strong>-Registered Financial<br />

<strong>NAPFA</strong> Genesis Webinar:<br />

Going Boldly Where Most Don’t<br />

Wednesday, January 16, 2013, at 3:00 p.m. ET<br />

Presented by Amy Florian, CEO, Corgenius<br />

009 <strong>NAPFA</strong> Thursday, Janaury Cutting 31, 2012 at 11:00 a.m. Edge CST Webinars*<br />

Presented by Jerry Miccolis, Chief Investment Officer of Brinton Eaton<br />

Amy Florian, CEO of Corgenius, offers her insights<br />

ake the most of your educational opportunities by registering for <strong>NAPFA</strong>’s Cutting Edge webinars. These seminars<br />

re a convenient way to get valuable information about how to run your practice and serve your clients. You will about how young advisors can establish credibility and<br />

Strategic asset allocation and disciplined rebalancing remain the<br />

eceive pre-session information that you can follow online during the course, and there’s always time for Q&A at trust the with clients, especially those a generation or two<br />

nd of the presentation. cornerstones Plus the webinars of sound are long-term an easy way investing. to fi ll your continuing But Jerry education Miccolis, requirements.<br />

ahead. Florian will explain why this requires knowing<br />

April chief investment officer July for Brinton Eaton, believes that the September<br />

about more than finance and investing—it requires<br />

Retirement Planningfinancial advisory Marketing industry and has Practice learned Management from events Estate of recent Planning years<br />

Presented by Mitch Politzer, President and New Media in Your Financial<br />

Creating the Future Care Plan for being Family comfortable with tough discussions that include<br />

CEO, First Ameritus Life that Insurance this foundation Corp. Planning needs Practice to be fortified with more Members proactive with risk Special Needs<br />

Effective retirement income planning. Presented by Benjamin Lewis, president, Perception, Presented by Mary Anne Ehlert of Protected<br />

issues like life transitions, divorce, or death.<br />

management. He believes that Dynamic Asset Allocation is a key<br />

Helping your client financially and<br />

Inc., and PR representative for <strong>NAPFA</strong><br />

Tomorrows<br />

psychologically in a volatile part market. of the solution. Webinar registrants will learn:<br />

• What is Dynamic August<br />

Free for <strong>NAPFA</strong> Genesis members.<br />

Asset Allocation?<br />

May<br />

October<br />

<strong>NAPFA</strong> University<br />

Insurance and Risk Management <strong>NAPFA</strong> Member Fee: $19.<br />

Estate Planning • What are Homeowners the key Insurance external - and internal Dynamic Asset<br />

Long Term Care Planning – Current<br />

Afluenza & Philanthropy<br />

Allocation Property investment and Casualty<br />

Others: $49.<br />

metrics and signals? Trends and Laws<br />

Presented by Rod Zeeb, COO,<br />

Presented by <strong>NAPFA</strong>-Registered Financial<br />

Presented by MAGA Ltd., a NAFPA Resource<br />

The Heritage Institute • How can Advisor advisors Roseann implement Bove, this strategy?<br />

Partner<br />

Dean, School of Risk Management<br />

Go to the Virtual Learning link under the Learning<br />

• And more…<br />

Center on <strong>NAPFA</strong>’s website to register for these great<br />

events.<br />

Napfa Advisor DECEmber 2012 11

Invest wisely.<br />

Performance Summary, cLaSS r SHareS (Sirrx)<br />

Sierra core retirement fund from incePtion 12/24/07 to 10/31/12<br />

Successful portfolio management involves both profiting from sustained uptrends — the past<br />

three years have all been part of the current rising cycle — and limiting drawdown during the<br />

adverse part of the cycle — which Sierra has also done very well for many years.<br />

Year-to-Date<br />

One Year<br />

As of 9/30/2012<br />

Latest Four Years Since Inception 12/24/2007<br />

Cumulative* Annualized Cumulative* Annualized<br />

Sierra core retirement<br />

fund class r (Sirrx)<br />

+5.84% +6.04% +54.10% +11.42% +49.28% +8.77%<br />

S & P 500* +16.44% +30.20% +34.77% +7.80% +8.20% +1.43%<br />

“Cumulative” performance from inception is the total increase in value of an investment in the Class R shares assuming<br />

reinvestment of dividends and capital gains distributions. The S&P 500 Index, a registered trademark of McGraw-Hill<br />

Co., Inc., is a market-capitalization-weighted index of 500 widely-held common stocks. Data here for the S&P includes<br />

dividends.<br />

The performance data quoted here represents past performance for Class R shares (symbol SIRRX), and are net of the total annual<br />

operating expenses of the Class R shares (see below). For performance numbers current to the most recent month end, please<br />

call toll-free 855-556-1295 or visit our website, SierraMutualFunds.com. Current performance may be lower or higher than the<br />

performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an<br />

investment in the Fund will fluctuate, so that investors’ shares, when redeemed, may be worth more or less than their original cost.<br />

The total annual operating expenses including expenses of the underlying funds (estimated at 0.69% per year) are 2.34% for Class<br />

A and Class I, 2.49% for Class A1 and Class I1, 3.09% for Class C, and 2.09% for Class R. Please review the Fund’s prospectus for<br />

more information regarding the Fund’s fees and expenses.<br />

12<br />

Napfa Advisor DECember 2012

aSSet aLLocation aS of octoBer 31, 2012*<br />

High yield corporate<br />

Bond funds<br />

10%<br />

other<br />

Low-Volatility<br />

funds<br />

4%<br />

temporary<br />

Havens**<br />

9%<br />

other<br />

Bond funds<br />

53%<br />

municipal Bond<br />

funds<br />

24%<br />

*NOTE: Holdings can change at any time without notice. **Money Market & ultra short bond funds.<br />

The top ten holdings of the Sierra Core Fund as of the date above is among the extensive information included in a four-page Fact Sheet, which is<br />

updated at least quarterly and can be viewed and printed from our website, SierraMutualFunds.com<br />

Performance By Quarter, cLaSS r SHareS (Sirrx)<br />

Year Q1 Q2 Q3 Q4<br />

Calendar<br />

Year<br />

S&P 500<br />

w/divs<br />

2008 -0.88% +1.27% -3.51% +0.34% -2.82% -37.02%<br />

2009 -2.01% +20.12% +9.14% +1.82% +30.81% +26.49%<br />

2010 +3.61% +0.33% +3.89% +0.07% +8.07% +14.91%<br />

2011 +2.34% +0.88% -0.69% +0.18% +2.63% +1.97%<br />

2012 +1.94% +1.14% +2.57%<br />

The Sierra Core Fund pays a quarterly dividend. Shares are available through TD Ameritrade, Charles Schwab & Co. Inc., Fidelity, Pershing and directly<br />

from the Fund.<br />

The Fund indirectly bears the investment management fees and expenses of the underlying funds in addition to the investment management fees<br />

and expenses of the Fund – all of which however are fully reflected in the above performance information. In some instances it may be less expensive<br />

for an investor to invest in the underlying funds directly. There is also a risk that investment advisers of those underlying funds may make investment<br />

decisions that are detrimental to the performance of the Fund. Investments in underlying funds that own small- and mid-capitalization companies<br />

may be more vulnerable than larger, more established organizations to adverse business or economic developments. Investments in underlying funds<br />

that invest in foreign equity and debt securities could subject the Fund to greater risks including, currency fluctuation, economic conditions, and<br />

different governmental and accounting standards.<br />

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Sierra Core Retirement Fund. This<br />

and other information about the Fund is contained in the prospectus and should be read carefully before investing. The prospectus<br />

can be obtained on our website, SierraMutualFunds.com, or by calling toll free 1-855-556-1295. The Sierra Core Retirement Fund is<br />

distributed by Northern Lights Distributors, LLC, Member FINRA.<br />

1803-NLD-11/7/2012<br />

Napfa Advisor DECEmber 2012 13

East Conference Review<br />

By Kevin Adler<br />

Investing Ideas and Concerns<br />

Emerge at <strong>NAPFA</strong> East Conference<br />

Despite some signs of optimism,<br />

advisors should remain very<br />

cautious about the investment<br />

environment in the U.S. and the<br />

world, said speakers at the <strong>NAPFA</strong><br />

East Conference in Baltimore in<br />

early November. The weak economic<br />

recovery has left the experts pessimistic<br />

about when market returns will again<br />

consistently reach long-term historical<br />

averages.<br />

Warren Buffett’s Way<br />

Warren Buffett did not speak at<br />

<strong>NAPFA</strong>’s conference, but his biographer,<br />

Alice Schroeder, gave a keynote<br />

presentation in which she explained some<br />

of his underlying investment beliefs.<br />

Schroeder, a Wall Street analyst who<br />

became an award-winning financial<br />

journalist, described Buffett as the most<br />

intensely focused person she has met,<br />

and able to use his intensity to discern<br />

trends ahead of the crowd. “Warren<br />

is opportunistic…not wanting to be<br />

hemmed in by the economy,” she said,<br />

in contrast to most investors who move<br />

with the tides of economic growth and<br />

contraction.<br />

A prime example of Buffett’s<br />

creative thinking is that he thinks about<br />

cash differently than many investment<br />

managers. “Most money managers<br />

are under pressure not to hold cash,<br />

especially when it has very low or<br />

even negative returns,” Schroeder said.<br />

“Warren likes cash. He views it as<br />

holding a call option on every asset class,<br />

with no expiration date and any strike<br />

price. It gives him ultimate choice in his<br />

investments, and the cost of holding that<br />

call option right now is very low.”<br />

With flexibility to invest his cash<br />

when he sees an opportunity, Buffett can<br />

utilize his judgment about long-range<br />

trends to make major investments. He<br />

“Most money<br />

managers are under<br />

pressure not to<br />

hold cash, especially<br />

when it has very low<br />

or even negative<br />

returns. Warren<br />

Buffett likes cash. He<br />

views it as holding<br />

a call option on<br />

every asset class,<br />

with no expiration<br />

date and any strike<br />

price. It gives him<br />

ultimate choice in his<br />

investments, and the<br />

cost of holding that<br />

call option right<br />

now is very low.”<br />

-Alice Schroeder<br />

seems to have an uncanny ability to<br />

“recognize the dominant economic reality<br />

of the times, and to get there first,” said<br />

Schroeder. For example, he invested<br />

heavily in media companies in the 1970s<br />

and financial services companies in the<br />

1980s.<br />

Another Buffett principle is that,<br />

despite his willingness to go against the<br />

consensus in his investments, he is very<br />

aware of risk. According to Schroeder,<br />

he has long been a proponent of looking<br />

at risk as the loss of capital, rather than<br />

as the volatility of an investment. That’s<br />

a distinction that few money managers<br />

understood until the recession began in<br />

2008. “Warren looks at risk as having<br />

a cumulative property. He believes<br />

that the 95-percent probability of<br />

something going right is not the same as<br />

100-percent certainty. To put it another<br />

way, eventually that 5-percent ‘bad’ event<br />

will happen,” Schroeder said. Given his<br />

perspective, Buffett believes an investor<br />

should not “bet” more than he is willing<br />

to lose if any of the negative events<br />

occur, rather than betting that none of the<br />

highly improbable events will occur.<br />

Using the insights she has gleaned<br />

from her years of conversations with<br />

Buffett, Schroeder wrapped up with her<br />

perspective on the U.S. economy and<br />

opportunities that exist for investors:<br />

• Risk management. “Risk<br />

management is the great growth<br />

industry of the 21st century,” she<br />

said. “Risk management will grow<br />

faster than risk.” She said that risk<br />

management is being built into<br />

everything, from the use of credit<br />

rating data on individuals to the rise<br />

in temporary staffing agencies that<br />

reduce an employer’s risk of having<br />

too many employees.<br />

• Technology. The computer<br />

revolution is far from over, and<br />

14<br />

Napfa Advisor DECember 2012

Notes: Sales loads not included.<br />

Source: Strategic Insight SimFund, Vanguard 10/23/2012<br />

East Conference Review<br />

7<br />

Schroeder said that economists<br />

“underrate” the impact of emergent<br />

technologies. She cited near-term<br />

prospects for digital printing and<br />

artificial intelligence, and generally<br />

she suggested this mantra: “Go long<br />

on any business that does not rely<br />

on physics, and go short on stuff<br />

and places that sell stuff.”<br />

• Services. In addition to going<br />

short on physical goods,<br />

Schroeder suggested going short<br />

on services because technology<br />

is commoditizing many jobs that<br />

previously were thought to need<br />

steady amounts of human input.<br />

Bogle Sounds Alarms<br />

Like Warren Buffett, Vanguard<br />

founder John Bogle also believes in<br />

minimizing investment risk. But the<br />

outspoken leader of the low-cost, indexinvesting<br />

revolution does not believe<br />

that individual investors can minimize<br />

their risk through careful selection of<br />

individual stocks or even market sectors.<br />

By acting on his beliefs, he has built his<br />

career and a giant company, as well as<br />

helped to support the growth of Fee-Only<br />

advisors.<br />

John Bogle<br />

on Fiduciary Duty<br />

John Bogle, founder<br />

of Vanguard, believes<br />

that investment fees are<br />

inextricably linked to the<br />

fiduciary duty to clients held<br />

by providers of financial<br />

services. He explained<br />

to the audience at the <strong>NAPFA</strong> East<br />

Conference that, in his opinion, it’s a simple<br />

mathematical calculation: Every dollar the<br />

provider receives is a dollar the client does<br />

not get.<br />

“How are the rewards of investing<br />

divided between the providers of financial<br />

services and their clients who put up their<br />

capital?” he asked. “Because for investors<br />

as a group, gross returns in the financial<br />

markets, minus the costs of financial service<br />

providers, equals the net returns that are<br />

actually delivered to investors.”<br />

$ billions<br />

Equity Fund Cash Flow Since 2007<br />

Index funds have taken in over $600 billion;<br />

active funds have lost almost $300 billion<br />

$ 800<br />

600<br />

400<br />

200<br />

0<br />

-200<br />

-400<br />

Index Funds<br />

Active Funds<br />

140 136<br />

95<br />

-209<br />

As feisty as ever, Bogle used his<br />

luncheon address at the conference to<br />

cement his relationship with fiduciary<br />

advisors and to reiterate the justification<br />

for Vanguard-style passive investing.<br />

“I’ve always believed that Vanguard was<br />

the natural partner and ally for nearly<br />

all RIAs,” said the 1999 recipient of<br />

<strong>NAPFA</strong>’s Special Achievement Award.<br />

Bogle observed that using a lowcost<br />

Vanguard index fund, plus paying<br />

the typical 1 percent AUM fee of an<br />

advisor, basically matches the nationalaverage<br />

mutual fund fee of 1.3 percent.<br />

Essentially, the client of the advisor is<br />

getting an advisor’s services for the same<br />

price as purchasing an active fund—“and<br />

there’s no point I can see in the client<br />

paying that higher mutual fund fee,” he<br />

said.<br />

The importance of fees is magnified<br />

in today’s low-yield environment, and<br />

Bogle predicted that yields are not likely<br />

to rebound soon. “Historic returns are<br />

irrelevant. Put away your Monte Carlo<br />

[investment projections], or at least<br />

adjust them for today’s yields,” he said.<br />

“Returns are half of the historic averages<br />

of the last 50 years.”<br />

Bogle backed his outlook with an<br />

explanation of how the equity price-toearnings<br />

(P/E) ratio created the outsize<br />

83 108 93 98<br />

-5 -7<br />

-86 -63<br />

659<br />

-275<br />

2007 2008 2009 2010 2011 YTD 2012 2007-12<br />

Source: Vanguard<br />

returns of the 1990s. During the ’90s, the<br />

P/E ratio surged well above its historic<br />

average, and it carried stock prices with<br />

it. Now that it’s back in the normal range,<br />

it will not provide any fuel for growth in<br />

equity values, so that growth will be tied<br />

to earnings growth and dividend yield.<br />

Here’s his math for the next decade:<br />

Assume a 7-percent equity growth<br />

annually, based on 5-percent earnings<br />

growth and 2-percent dividends. Assume<br />

a 3-percent bond yield. An investor with<br />

a 60-40 stock-bond portfolio would<br />

receive a 5.5-percent nominal return.<br />

Then, subtract inflation, taxes, and<br />

investment fees, and Bogle said the result<br />

“is not enough for income-starved clients.<br />

They need to reduce their spending, use<br />

junk bonds for higher yields, raise their<br />

ratio of stocks, or borrow against their<br />

house and invest the money. These are<br />

not good choices.”<br />

This is why index funds have taken<br />

market share from active funds in the last<br />

five years (see graph).<br />

Given the low yields, investors and<br />

advisors are tempted to look for the<br />

investment manager who can outperform<br />

the market. But that’s a fool’s errand,<br />

said Bogle. He observed that half of the<br />

mutual funds operating today will fail in<br />

the next decade. Of those that survive,<br />

7<br />

Napfa Advisor DECEmber 2012 15

east Conference review<br />

they will, on average, switch managers<br />

every five years. “So how can you<br />

possibly pick the successful managers<br />

time after time?” he asked.<br />

Keeping fees low is a better solution,<br />

he said. Even ETFs, which many advisors<br />

see as the low-cost solution for their<br />

clients, came in for Bogle’s criticism<br />

(and even though Vanguard has become<br />

a significant player in that market). From<br />

his perspective, ETF fees are still too<br />

high, and the loyalties of ETF sponsors<br />

are mixed. Speaking of the CEO of one<br />

leading ETF provider that competes with<br />

Vanguard, Bogle said, “He has a fiduciary<br />

duty to shareholders to maximize his<br />

profit, but he also has a fiduciary duty to<br />

his clients. He’s on the horns of a nasty<br />

dilemma.”<br />

Social Investing<br />

With social media on the minds<br />

of most advisors for marketing and<br />

communications purposes, Hardeep<br />

Walia, CEO of Motif Investing, offered<br />

his firm’s vision of how social media<br />

could affect investing. Investors can<br />

communicate with each other with<br />

unprecedented ease, and “social<br />

investors” enjoy the give-and-take of<br />

debating their best investing ideas with<br />

others. These investors do not rely solely<br />

on professional managers and might be<br />

the types of clients who come to Fee-<br />

Only advisors for validation of their<br />

ideas, he said.<br />

Motif Investing has launched itself<br />

into the world of social investors by<br />

creating a platform for purchasing a<br />

“motif,” which is a portfolio of up to 30<br />

individual stocks. They can be arranged<br />

around themes as diverse as cleanup<br />

and recovery from Hurricane Sandy,<br />

the housing rental industry, or women<br />

CEOs. “Motifs are thematically weighted<br />

portfolios…that enable individuals to<br />

share their expertise about the world,”<br />

he said. “They are a way to analyze and<br />

capture the wisdom of the crowd.”<br />

Motif Investing offers nearly<br />

100 portfolios today, and it’s adding<br />

new portfolios on a regular basis. It<br />

developed some of them, but it also<br />

considers motifs proposed by outsiders.<br />

At least one <strong>NAPFA</strong> member, Tom<br />

Nowak, CFP ® , has created a motif.<br />

Nowak’s motif is based on the model<br />

presented in his book that was published<br />

earlier this year, Low-Fee Socially<br />

Responsible Investing (see the May 2012<br />

Advisor for a review of the book).<br />

Motifs even share Bogle’s vision<br />

of a low-cost investment future, even<br />

though motifs represent a more active<br />

management strategy. “It’s a low-cost,<br />

disruptive model,” said Walia. “You<br />

can buy a motif today for $9.95, but we<br />

foresee that pricing will go to zero, along<br />

with the rest of stock trades some day.”<br />

Is Pleased to announce the launch<br />

of theIr<br />

ON-LINE LIBRARY<br />

for FAMILY-OWNED<br />

COMPANIES<br />

VIsIt www.claytoncaPItalPartners.com/lIbrary<br />

for a comPlete lIstIng of books, blogs, Industry<br />

PublIcatIons, and more.<br />

st. louIs • denVer • dallas<br />

www.claytoncaPItalPartners.com • (314) 725-9939<br />

mergers and acquIsItIons sPecIalIsts<br />

16<br />

nApFA Advisor deCember 2012

East Conference Review<br />

Assessing Investment Counterparty Risk<br />

By Kevin Adler, <strong>NAPFA</strong> Editor<br />

As if advisors don’t have enough to worry about, <strong>NAPFA</strong><br />

member John Henry Low made a presentation at the <strong>NAPFA</strong><br />

East Conference highlighting a risk that most advisors don’t<br />

even realize exist: Are the custodians of your client assets really<br />

as safe as they seem? Low’s presentation, “Counter-Party Risk:<br />

The Biggest Risk You Didn’t Know You Were Taking with<br />

Your Client’s Money,” raised more than a few eyebrows.<br />

Low began his talk by reviewing the circumstances of a<br />

little-remembered Friday in 1974 when Bankhaus I. D. Herstatt,<br />

a small private bank in Germany, almost brought the world’s<br />

financial system to its knees. After regulators closed the bank’s<br />

doors on a Friday afternoon for an enforced shutdown, the bank<br />

had outstanding foreign exchange transaction commitments<br />

with banks around the world that could no longer be settled<br />

in New York. If not for a frantic weekend of transoceanic<br />

negotiations by the Federal Reserve and some of the biggest<br />

banks in the world, the financial markets might not have been<br />

able to open on Monday, said Low.<br />

Today, safeguards are in place to avoid a recurrence of that<br />

specific problem, but unexpected new problems will emerge,<br />

he predicted. Of significant interest to advisors is the fact that<br />

broker/dealers, which act as custodians for many advisors, are<br />

far from foolproof. More than 300 B/Ds failed or merged under<br />

financial duress during the mid-1970s alone, with plenty more<br />

since, and investors lost their life savings in some cases, he<br />

said. In other cases, clients have had to wait six or seven years<br />

for their settlements, sometimes at 20 cents or 30 cents on the<br />

dollar. “Could your clients wait that long for access to their<br />

retirement funds?” he asked.<br />

Perhaps surprisingly, full-service B/Ds are probably riskier<br />

than discount B/Ds because they are engaged in numerous lines<br />

of riskier business beyond being custodians (such as trading for<br />

their own accounts or creating financial products), so there’s a<br />

chance that their other business lines can drag down the entire<br />

firm, including the custodial side, he said. Even though they<br />

are supposed to keep client custodial assets in safer “segregated<br />

accounts,” custodians often are allowed to lend against client<br />

accounts. “If you check the margin box or the check-writing<br />

box on an account application, you are allowing your broker to<br />

take your account out of their ‘segregated account’ and lend out<br />

those assets,” he said.<br />

Unfortunately, those loans and investments can go bad.<br />

An extreme example is MF Global, which had a balance<br />

sheet of about $30 billion in liabilities, but only $8 billion in<br />

segregated custodial accounts, when it went bankrupt in 2012.<br />

Those “safe, segregated custodian accounts” were allegedly<br />

“borrowed” and used by MF Global to make profits for its<br />

own account. “Predictably, those bets went wrong, and even<br />

the segregated account custodial funds went missing and are<br />

now tied up in bankruptcy,”<br />

Low said.<br />

“Breaking the buck” in<br />

a money market account is<br />

another example of what can<br />

and has gone wrong. When<br />

Lehman Brothers collapsed<br />

in 2008, many money market<br />

funds found themselves holding John Henry Low<br />

now-worthless Lehman Brothers<br />

commercial paper. Lehman’s The Reserve Primary Money<br />

Market Fund, the oldest and one of the country’s top-ranked<br />

money market funds, had quietly diverged from its stated<br />

strategy of not investing in commercial paper. In early 2006,<br />

the Reserve Fund’s SEC filings confirmed that position, “but<br />

just two months later,” said Low, “they had 5.7 percent in<br />

commercial paper and kept adding to it in order to increase<br />

yield. It caused a huge cataclysm.” In the end, the Reserve Fund<br />

broke the buck and let its money market fund value fall below<br />

$1.00 per share. Low contrasted that event with another money<br />

market fund that also was caught in the Lehman collapse, but<br />

whose executives publicly stated that they would stand behind<br />

their money market funds and maintain their value at $1.00.<br />

“Who would your rather work with?” he asked.<br />

Safety Solutions<br />

What’s the solution? First, due diligence. Low<br />

recommended looking at the custodian’s or other counterparty’s<br />

regulatory filings, in particular the Focus Report and<br />

other financial reports. The Focus Report carries a great deal<br />

of information about the full scope of the firm’s business, so<br />

an advisor can judge whether custodian accounts might be<br />

exposed by a firm’s other activities.<br />

Second, Low favors using a custodian for whom the<br />

custody of client assets is its main business. Within that<br />

category, he suggested using trust companies to custody assets<br />

because: 1) their custody accounts are completely segregated<br />

from the company’s other lines of business, and 2) those<br />

accounts are not part of the creditor pool should the trust<br />

company fail (unlike at a B/D).<br />

Third, consider the corporate culture of the custodian,<br />

keeping an eye on how the vendor resolves the inevitable<br />

mistakes that occur.<br />

And fourth, don’t mistake SIPC (Securities Investor<br />

Protection Corporation) coverage for being a safety net like<br />

the FDIC. SIPC coverage has limits and can take many years<br />

to provide payouts to clients who are harmed. “Perhaps more<br />

importantly, work with first-class counter parties, where you<br />

won’t have to rely on insurance at all,” he said.<br />

Napfa Advisor DECEmber 2012 17

Financial Planning<br />

By Bridget McCrea<br />

GAO Report Highlights<br />

Women’s Retirement Struggles<br />

Elderly women comprise a growing<br />

portion of the U.S. population and<br />

have historically been at greater<br />

risk of living in poverty than elderly men.<br />

Several factors contribute to the higher<br />

rate of poverty among elderly women,<br />

such as their tendencies to have lower<br />

lifetime earnings, to take time out of the<br />

workforce to care for family members, and<br />

to outlive their spouses. Outside factors<br />

like economic downturns and changes<br />

in employer retirement plans also play a<br />

role in the financial insecurity of older<br />

American women.<br />

While none of this would be<br />

surprising to financial advisors, solving<br />

the problem is an immense challenge.<br />

Even advisors working with wealthier<br />

retired women or younger women need to<br />

speak with their clients about these issues.<br />

In light of these circumstances, the<br />

U.S. Government Accountability Office<br />

(GAO) was asked to examine the following<br />

four key areas: how women’s access to<br />

and participation in employer-sponsored<br />

retirement plans compares to men’s and<br />

how these plans have changed over time;<br />

how women’s retirement income compares<br />

to men’s and how the composition of<br />

their income—the proportion of income<br />

coming from different sources—changed<br />

with economic conditions and trends in<br />

pension design; how later-in-life events<br />

affect women’s retirement income security;<br />

and what policy options are available to<br />

help increase women’s retirement income<br />

security.<br />

For financial advisors, the GAO study<br />

shows how challenging the circumstances<br />

are for many women in retirement and<br />

provides additional evidence that early<br />

planning and aggressive saving are essential<br />

to meeting retirement-income needs.<br />

Pinpointing Important<br />

retirement Trends<br />

It’s well-known that women outlive<br />

men. What’s less obvious is the way that<br />

effect shows up in the upper ranges of the<br />

age scale and the financial implications<br />

of longevity for women. Today, of those<br />

individuals aged 65 and older, one-sixth<br />

of American women and one-tenth of men<br />

are 85 or older, and this share is projected<br />

to grow to almost one-quarter of women<br />

and one-fifth of men by 2050. For these<br />

people, the threat of<br />

poverty in old age is most<br />

severe as they deplete<br />

their savings and have<br />

to rely solely on Social<br />

Security for income.<br />

Although the income<br />

composition for women<br />

65 and older did not vary<br />

greatly over the period<br />

examined by the GAO<br />

(1998 to 2009), women<br />

continued to have less<br />

retirement income on<br />

average and live in higher<br />

rates of poverty than men<br />

in that age group. The<br />

GAO found that women,<br />

especially widows and<br />

en and Men Age 65 and Over Did Not Fluctuate Greatly Over Time<br />

f Household Change Income in Sources for Women of Household and Men Age Income 65 and for Over Women Did Not Fluctuate Greatly Over Time<br />

those 80 and older, depended on Social<br />

Security benefits for a larger percentage<br />

of their income than did men (see graph).<br />

For example, in 2010, 16 percent of<br />

women 65 and older depended solely on<br />

Social Security for income, compared to<br />

12 percent of men. Moreover, women’s<br />

median income was approximately 25<br />

percent lower than men’s over the last<br />

decade, and the poverty rate for women in<br />

this age group was nearly two times higher<br />

than men’s in 2010.<br />

Retirement income also is dependent<br />

on savings in defined contribution plans, as<br />

most employers have phased out definedbenefit<br />

pension-style plans. Women born in<br />

the baby boom generation are much more<br />

likely to be in the workforce than women<br />

in preceding generations, so their access to<br />

and participation in employer-sponsored<br />

retirement plans has increased. Women’s<br />

participation rates in defined-contribution<br />

plans increased slightly between 1998<br />

and 2009, while men’s participation<br />

fell, thereby narrowing the participation<br />

difference between men and women to<br />

1 percentage point. However, women<br />

contributed to their plans at lower levels<br />

than men.<br />

Overall, the composition of women’s<br />

income varied only slightly during the<br />

time period of the study. This is a good<br />

news/bad news situation. Women’s main<br />

income sources (Social Security and<br />

defined-benefit retirement plans) were<br />

shielded from fluctuations in the stock<br />

market, and the share of household income<br />