Q&A with Kelli Hueler: - Napfa

Q&A with Kelli Hueler: - Napfa

Q&A with Kelli Hueler: - Napfa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Napfa</strong> advis r<br />

MagaZiNE<br />

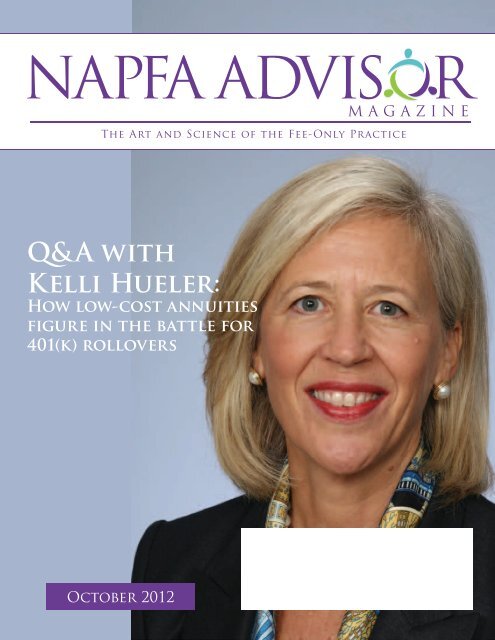

Q& A <strong>with</strong><br />

<strong>Kelli</strong> <strong>Hueler</strong>:<br />

How low-cost annuities<br />

figure in the battle for<br />

401(k) rollovers<br />

october 2012

Looking ARTIO for New Choices in Today’s<br />

Economic Environment?<br />

Artio Total Return Bond Fund (BJBGX • JBGIX)<br />

Purchases US and non-US investment grade securities, no high yield<br />

Artio Global High Income Fund (BJBHX • JHYIX)<br />

Global approach and includes “allied” asset classes<br />

Artio Emerging Markets Local Currency Debt Fund (AEFAX • AEFIX)<br />

Exposure to signifi cant and growing part of world economy<br />

877 77 ARTIO<br />

artioglobal.com/us/intermediaries • advisory.services@artioglobal.com<br />

The Funds’ investment objectives, risks, charges, expenses and other information are described in the prospectus which must be read<br />

and considered carefully before investing and may be obtained by calling 800 387 6977 or visiting www.artiofunds.com.<br />

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longerterm<br />

debt securities. Investments in asset backed and mortgage backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk,<br />

possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investing internationally involves additional risks such as currency fluctuations,<br />

currency devaluations, price volatility, social and economic instability, differing securities regulation and accounting standards, limited publicly available information, changes<br />

in taxation, periods of illiquidity and other factors. These risks are greater in the emerging markets and are fully disclosed in the prospectus. In order to achieve their respective<br />

investment goals and objectives, each Fund may invest in derivatives such as futures, options, and swaps. Derivatives involve risks different from, and in certain cases, greater than<br />

the risks presented by more traditional investments. These risks are fully disclosed in the prospectus.<br />

The securities in which the Artio Global High Income Fund and the Artio Emerging Markets Local Currency Debt Fund invests may be considered more speculative in nature and are sometimes<br />

known as “junk bonds”. These securities tend to offer higher yields than higher rated securities of comparable maturities because the historic financial condition of the issuers of<br />

these securities is usually not as strong as that of other issuers. High yield fixed income securities can present a greater risk of loss of income and principal than higher rated securities.<br />

Investors should understand that these Funds are not appropriate for short-term investment. The Artio Emerging Markets Local Currency Debt Fund is non-diversified, meaning it may<br />

concentrate its assets in fewer individual holdings than a diversified fund, and is more exposed to individual security volatility than a diversified fund. Investments in lower‐rated, nonrated<br />

and distressed securities present a greater risk of loss to principal and interest than higher‐rated securities. These risks are fully disclosed in the prospectus.<br />

Artio Global Investors Inc. is the indirect holding company for Artio Global Management LLC, the Adviser for the Artio Global Funds which are distributed by Quasar Distributors, LLC

Escrow Services<br />

Sunwest Trust, Inc acts as an<br />

impartial third party to keep<br />

record of payments, principal<br />

and interest, and also report to<br />

the IRS as required. We can<br />

provide you <strong>with</strong> an accurate<br />

and undesputable history of the<br />

payments made.<br />

SUNWEST TRUST<br />

1-800-642-7167<br />

Self-Directed IRAs<br />

Sunwest Trust acts as custodian<br />

for self-directed IRAs. If you’re<br />

tired of traditional investments<br />

learn how you are eligible to<br />

invest your retirement account in<br />

real estate, precious metals,<br />

privately traded stock, and so<br />

much more.<br />

Building on your Trust<br />

SunwestTrust.com<br />

Certiicate of Authority - No. 00027

Are your clients’ bond<br />

portfolios ready<br />

for higher rates?<br />

Let YieldQuest help you<br />

find the answer<br />

The fear of rising interest rates is gripping the Independent Advisory community.<br />

YieldQuest has developed many unique and creative strategies to help<br />

Advisors potentially protect fixed income allocations in the face of rising rates.<br />

Please contact YieldQuest today<br />

for a no obligation<br />

portfolio review<br />

1-866-978-3781 or info@yieldquest.com<br />

Securities offered through YieldQuest Securities, LLC (Member FINRA and SIPC.) The investments offered carry<br />

risks, including the potential for principal loss and there can be no guarantee that the strategies offered will be<br />

successful. The information and opinions herein are for general information use only. This material does not<br />

constitute an offer to sell, solicitation of an offer to buy, recommendation to buy or representation as to the<br />

suitability or appropriateness of any security, financial product or instrument, unless explicitly stated <strong>with</strong>in the<br />

report. Any opinions expressed are subject to change <strong>with</strong>out notice. No information, opinion or statements<br />

should be construed or deemed as tax advice.<br />

ADV-0141-001-243<br />

2<br />

<strong>Napfa</strong> advisor ocToBEr 2012

from the Editor<br />

a New feature<br />

<strong>Napfa</strong> coNTacT iNforMaTioN<br />

3250 N. arlington heights road, suite 109<br />

arlington heights, iL 60004<br />

800.366.2732 • 847.483.5400<br />

info@napfa.org www.napfa.org<br />

faX: 847.483.5415<br />

In this issue, we debut a new feature that we<br />

hope will become a very popular part of the<br />

magazine. As the cover photo indicates, we<br />

have an exclusive interview <strong>with</strong> <strong>Kelli</strong> <strong>Hueler</strong>,<br />

president and CEO of <strong>Hueler</strong> Companies, the<br />

developer of an online platform for analyzing and<br />

purchasing low-cost annuities.<br />

The Q&A represents the first in a series of interviews we plan<br />

to publish <strong>with</strong> key members of the financial services industry. In<br />

the months ahead, we will be speaking <strong>with</strong> investment managers,<br />

practice management consultants, insurance professionals, and<br />

others. We hope to get their perspectives on the issues that matter to<br />

Fee-Only advisors.<br />

Conducting these interviews is not as easy as it might seem.<br />

The end product might look as smooth as a financial plan in a fancy<br />

binder—but, just like that financial plan, a lot of work is hidden<br />

below the surface.<br />

The Q&A <strong>with</strong> <strong>Hueler</strong> began in May <strong>with</strong> a suggestion from a<br />

NAPFA staff member. I contacted <strong>Hueler</strong> and gauged her interest,<br />

and she provided me <strong>with</strong> background information, including a<br />

40-page research paper she had co-authored. After I had reviewed<br />

the materials, we conducted a preliminary conversation to exchange<br />

ideas about what might be covered in the Q&A. Then I sent her<br />

a general outline of questions in advance of a phone interview<br />

conducted in September. After the interview, I transcribed the<br />

conversation and selected the most relevant parts. Finally, <strong>Hueler</strong><br />

reviewed the draft in order to correct errors or fix omissions.<br />

The result, I hope, is an illuminating look at developments in the<br />

availability and use of low-cost immediate annuities as part of a<br />

comprehensive financial plan.<br />

Given the long gestation period to produce the Q&A, we won’t<br />

be presenting these interviews in every issue, but we think they<br />

will be worth the wait. We’ve even decided to add another factor<br />

into the mix: NAPFA members who are experts in specific topics<br />

will conduct some of the interviews, as they will be able to ask<br />

questions of greatest relevance to Fee-Only advisors.<br />

Rest of the Issue<br />

While the Q&A is our featured article in this issue of the<br />

Advisor, I’m anticipating that readers will find a great deal of<br />

value in the additional articles, too. John Ryan and Mark Desiderio<br />

contributed an article about how to evaluate long-term disability<br />

insurance offers. NAPFA member Steven Wightman shared his<br />

fascinating perspective on the similarities between being a financial<br />

advisor and a pilot (in his case, a pilot who is aiming to break a<br />

few world records to his credit). Columnist and NAPFA member<br />

Jennifer Lazarus tapped into the experience of numerous NAPFA<br />

members on how to get the most out of a client advisory board.<br />

Enjoy the issue and feel welcome to contact me at any time to<br />

suggest a candidate for a feature Q&A.<br />

CEO<br />

Ellen Turf turfe@napfa.org<br />

sTaff<br />

Managing Editor<br />

Kevin Adler 301.270.2839 kevinadler13@gmail.com<br />

Publisher and Director of Magazine Operations<br />

Eric Haines 732.920.4236 ric.haines@erhassoc.com<br />

Business Development and Membership<br />

Nancy Hradsky hradskyn@napfa.org<br />

Professional Growth and Education<br />

Robin Gemeinhardt gemeinhardtr@napfa.org<br />

Communications<br />

Benjamin Lewis 301.963.7555 ben@bdlpr.com<br />

Public Policy and Advocacy<br />

Karen Nystrom nystromk@napfa.org<br />

Executive Assistant to CEO<br />

Mardi Lee leem@napfa.org<br />

NAPFA Advisor Production<br />

Eric Georgevich ericgeorgevich@gmail.com<br />

Accounting<br />

Laura Maddalone maddalonel@napfa.org<br />

Membership Assistant<br />

Cindy Ganze ganzec@napfa.org<br />

Editorial Assistant<br />

Christopher Hale cghale@gmail.com<br />

Education Assistant<br />

Rachel Gusek gusekr@napfa.org<br />

NCEF Coordinator<br />

Lisa Lenczewski lisal@napfa.org<br />

The NAPFA Advisor Magazine issue #10 October 2012 is published<br />

monthly for $85.00 per year by The National Association of Personal<br />

Financial Advisors, 3250 North Arlington Heights Road, Suite 109,<br />

Arlington Heights, IL 60004. USPS number 024-735. Periodicals<br />

Postage Paid at Arlington Heights, IL, and additional entry office in<br />

Schaumburg and Palatine, IL. Postmaster: Send address changes to The<br />

NAPFA Advisor Magazine, 3250 North Arlington Heights Road, Suite<br />

109, Arlington Heights, IL 60004.<br />

From time to time, NAPFA Advisor publishes articles on technical<br />

subjects. NAPFA makes no representation as to the accuracy or<br />

timeliness of such advice. Submissions are encouraged but will be edited<br />

and published at the discretion of the editor and/or Board of Directors.<br />

All materials should be e-mailed to Kevin Adler at kevinadler13@gmail.<br />

com. Unsolicited material cannot be returned unless accompanied by a<br />

stamped, self-addressed envelope.<br />

NAPFA and NAPFA Advisor do not guarantee or endorse any<br />

product or service advertised in the NAPFA Advisor.<br />

<strong>Napfa</strong> advisor sEpTEMBEr 2012 3

For Fee-Only Eyes Only<br />

Do You<br />

?<br />

It’s no secret.<br />

Fast. No Hassle. Low Rates.<br />

AdvisorTermQuotes.com<br />

• Lowest term life rates in the industry<br />

• More companies, same low rates, and easier to use than<br />

SelectQuote ® , MatrixDirect ® , and other term quote websites.<br />

• Owned and operated by John Ryan, CFP ® and his staff; a<br />

NAPFA Resource Partner and NAPFA supporter since 1983.<br />

• Exclusively for Fee-Only Advisors and their clients<br />

• Term quotes in less than 60 seconds<br />

Working successfully <strong>with</strong> NAPFA<br />

members and their clients since 1983.<br />

The leader in insurance advice for<br />

Fee-Only Advisors since 1983.<br />

4<br />

<strong>Napfa</strong> advisor ocToBEr 2012<br />

Ryan-Insurance.net • Phone: 1-800-796-0909 • Fax: 1-888-337-2291

Table of contents<br />

october 2012 vol. 29, issue 10<br />

Doing Business on a Handshake.<br />

Columnist Richard Sincere discusses<br />

issues of trust that all entrepreneurs<br />

must face. Pages 10-11.<br />

departments<br />

Keeping Up <strong>with</strong> <strong>Napfa</strong> 8<br />

Eye on... Financial Planning 34<br />

Q&A <strong>with</strong> <strong>Kelli</strong> <strong>Hueler</strong>. In an exclusive<br />

interview, <strong>Kelli</strong> <strong>Hueler</strong>, CEO of <strong>Hueler</strong><br />

Companies, explains why advisors<br />

should consider using low-cost annuities<br />

to help clients achieve secure retirement<br />

income, and how access to annuities is<br />

becoming a key part of financial firms’<br />

strategies to capture 401(k) rollover<br />

dollars. Pages 14-18.<br />

in the Limelight 36<br />

features<br />

staying in the game 10<br />

Doing Business on a Handshake<br />

industry Q&a 14<br />

<strong>Kelli</strong> <strong>Hueler</strong>, President and CEO, <strong>Hueler</strong> Companies<br />

How to Check Up on Your Financial Advisor<br />

By Alan Moore, CFP ® , MS<br />

When using FINRA BrokerCheck, look at the following<br />

categories:<br />

Part 1A, Item 5 states how many employees the firm has, the<br />

types of clients it works <strong>with</strong>, and how fees are charged. This is a<br />

great way to double-check a prospective advisor because if they<br />

say they are fee-only, but this site says they accept commissions,<br />

you probably want to move on.<br />

Part 1A, Item 6 identifies if the advisor or firm has any other<br />

business activities, such as being a real estate agent, attorney,<br />

or broker. This will give you insight into potential conflicts of<br />

interest.<br />

Part 1A, Item 11 states if the advisor or firm has had any past<br />

legal troubles.<br />

practice profile: 22<br />

Steven Podnos, Wealth Care LLC<br />

insurance 26<br />

Top 10 Mistakes Advisors Make When<br />

Evaluating Disability Insurance<br />

columns<br />

Message from the Editor 3<br />

A New Feature<br />

Letter from the chair 6<br />

A Time of Change<br />

The Efficient planner 30<br />

Client Advisory Boards<br />

Part 2, look at the “Brochures” on the left-hand menu. The<br />

brochure is a relatively new document that is mandatory for all<br />

advisors. It lays out in common language how the firm operates,<br />

how it charges, conflicts of interest, and more. Fee-based advisors<br />

will have blue links for “Broker” and “Investment Adviser Rep.”<br />

Click on the Broker link and take a look at the right-hand side for<br />

the question, “Are there events disclosed about this broker?” If<br />

the answer is “Yes,” click “Get Detailed Report” to learn more. <strong>Napfa</strong> advisor sEpTEMBEr 2012 5

Lauren Locker, <strong>Napfa</strong> chair<br />

a Time of change<br />

Human nature prevents us from<br />

accepting change <strong>with</strong> open arms.<br />

Change involves a modification, a<br />

challenge to the status quo, a shift in familiar<br />

patterns of thinking. It causes us to alter our<br />

sense of order and, in doing so, to construct a<br />

new, and hopefully improved, reality.<br />

As financial planners, we expect change—<br />

at least when it happens to our clients. Part of our professional<br />

obligation involves anticipating and predicting certain changes<br />

that we know will occur at some point in our clients’ lives. We<br />

often act as agents of change for our clients, as we point them in<br />

new directions and ask them to adopt more rational and profitable<br />

methods of dealing <strong>with</strong> their finances.<br />

In our own professional lives, however, change might not<br />

be a welcomed visitor. Solo practitioners, in particular, may see<br />

little reason to change “the way we’ve done it” until there is no<br />

other alternative. Larger firms can be notorious for their adoption<br />

of “group think” as a way of maintaining stasis. We’d all be wise<br />

to keep in mind that the definition of stasis is a state of stability<br />

in which all forces are equal and opposing, therefore cancelling<br />

each other out!<br />

NAPFA is poised to embark on a period of change, some of<br />

which has been motivated by external forces and some of which<br />

has been internally fermented.<br />

Internally, our method of delivering education to our<br />

membership must be transformed, due to increased competition<br />

from providers and a decrease in conference attendance. Online<br />

learning is fast becoming an appealing alternative to brickand-mortar<br />

conferences. Our technological platforms need to<br />

constantly evolve to keep NAPFA on the cutting edge. We must<br />

implement our Grand Goal in ways that will ensure that we<br />

continue to attract and maintain members.<br />

Externally, we are facing the possible imposition of farreaching<br />

new federal regulations. While the version proposed<br />

by U.S. Rep. Maxine Waters (D-CA) is more palatable and in<br />

line <strong>with</strong> our fiduciary standard, it will nevertheless affect our<br />

practices in ways we can only imagine. A presidential election is<br />

less than a month away, bringing <strong>with</strong> it uncertainty in the market<br />

and the economy. These are just a few of the outside influences<br />

that are causing NAPFA and its members to need to envision and<br />

implement new versions of our practices and our organization as<br />

a whole.<br />

Heraclitus said, “There is nothing constant except change.”<br />

Gandhi called on us to be the change we wish to see in the<br />

world. Margaret Mead believed that a small group of thoughtful<br />

people could change the world. Winston Churchill told us that<br />

to improve is to change, and to be perfect is to change often. All<br />

these great minds must be on to something.<br />

Sincerely,<br />

<strong>Napfa</strong>'s MissioN sTaTEMENT<br />

To promote the public interest by advancing the financial<br />

planning profession and supporting our members consistent <strong>with</strong><br />

our core values.<br />

corE vaLUEs<br />

• Competency: Requiring the highest standards of proficiency<br />

in the industry.<br />

• Comprehensive: Practicing a holistic approach to financial<br />

planning.<br />

• Compensation: Using a Fee-Only model that facilitates<br />

objective advice.<br />

• Client-centered: Committing to a fiduciary relationship that<br />

ensures the client’s interest is always paramount.<br />

• Complete Disclosure: Providing an explanation of fees and<br />

potential conflicts of interest.<br />

visioN<br />

The public recognizes that NAPFA advocates the highest<br />

standards for personal financial planning and that NAPFA-<br />

Registered Financial Advisors are the trusted advisors of choice.<br />

Board of dirEcTors<br />

Chair<br />

Lauren Locker, CFP ®<br />

Little Falls, NJ<br />

lauren.locker@napfa.org<br />

CEO<br />

Ellen Turf<br />

847.483.5400 x101<br />

turfe@napfa.org<br />

Giles Almond, CFP ® , CPA/PFS<br />

Charlotte, NC<br />

giles.almond@napfa.org<br />

Cheryl Costa, CFP ®<br />

Framingham, MA<br />

cheryl.costa@napfa.org<br />

Dr. Raymond Forgue<br />

Easley, SC<br />

ray.forgue@napfa.org<br />

Robert Gerstemeier, CFP ®<br />

Loveland, OH<br />

bob.gerstemeier@napfa.org<br />

Linda Leitz, CFP ®<br />

Colorado Springs, CO<br />

linda.leitz@napfa.org<br />

Mary Malgoire, CFP ® , MBA<br />

Bethesda, MD<br />

mary.malgoire@napfa.org<br />

Carolyn McClanahan, M.D., CFP ®<br />

Jacksonville, FL<br />

carolyn.mcclanahan@napfa.org<br />

Tony Ogorek, Ed.D., CFP ®<br />

Williamsville, NY<br />

tony.ogorek@napfa.org<br />

6<br />

<strong>Napfa</strong> advisor ocToBEr 2012<br />

Dana Pingenot, CFP ®<br />

Dallas, TX<br />

dana.pingenot@napfa.org<br />

SEPTEMBER 2006 NAPFA ADVISOR

We help you and your clients SAVE...<br />

1. TIME<br />

2. MONEY<br />

3. SURPRISES<br />

4. SLEEP<br />

…by providing:<br />

• Pre-underwriting to avoid unexpectedly high premiums<br />

• Salaried employees who “shop” the lowest rates for your clients<br />

• No Load/Low Load products when available<br />

• Advisor insurance education (free webinar CEs)<br />

• Free policy reviews to see if old policies are still efficient<br />

• Policyholder services that include calendaring reconsiderations which can reduce<br />

premiums and remove costly exclusions and riders<br />

Term | Permanent Individual & Survivorship | Annuities | Disability | LTCi | Hybrid Life/LTCi | Hybrid Annuity/LTCi<br />

Policy Reviews | Critical Care | Life Settlements<br />

877-254-4429 LLIS.COM<br />

NAPFA Resource Partner<br />

<strong>Napfa</strong> Advisor SEPTEMBER 2012 7

Keeping Up With NAPFA<br />

Midwest Region Offers<br />

Membership Incentive<br />

For the second consecutive year,<br />

the Midwest Region is offering a $200<br />

incentive for new NAPFA members. Any<br />

newly accepted advisor who applied for<br />

NAPFA membership between Dec. 1,<br />

2012 and Feb. 28, 2013 in the Midwest<br />

Region will receive a discount of $200 on<br />

attendance for NAPFA’s 2013 National<br />

Conference in Las Vegas.<br />

“This program was popular last year,<br />

so we’re repeating it. The idea is not only<br />

to encourage NAPFA membership, but to<br />

get those new members quickly involved<br />

in our educational events,” said Jennifer<br />

Sanchez, a Midwest Region board member<br />

who is in charge of membership.<br />

NAPFA Genesis Rolls Out<br />

New Progr ams<br />

NAPFA Genesis is finding new<br />

ways to support young advisors, build<br />

links between young advisors and more<br />

experienced planners, and even potentially<br />

attract young planners to NAPFA.<br />

On Nov. 9, NAPFA Genesis board<br />

members will participate in a virtual career<br />

fair being organized by InvestmentNews<br />

magazine. “It’s going to be interesting<br />

because broker-dealers will be participating<br />

at the career fair, too,” said David Grant,<br />

chair of NAPFA Genesis. “We’ll be in a<br />

virtual booth right next to a broker-dealer<br />

that’s trying to hire these students and<br />

new planners, and we’ll be offering a<br />

very different, alternative career path. I’m<br />

excited about the event, and I hope we can<br />

open some eyes about Fee-Only planning.”<br />

Meanwhile, Genesis recently received<br />

funding approval from the NAPFA National<br />

Board for a scholarship program. Beginning<br />

in 2013, Genesis will offer scholarships to<br />

cover the cost of taking the CFP ® exam<br />

(currently $600) for candidates who pass<br />

the exam. At least two scholarships will be<br />

awarded, and perhaps as many as four.<br />

Grant said that about half of Genesis<br />

members are students or para-planners<br />

(NAPFA Provisional Members), and most<br />

of them are working towards their CFP.<br />

“We know that a lot of students don’t have<br />

the resources for the cost to study for and<br />

take the CFP exam. Some para-planners<br />

will get reimbursed by their employers,<br />

but for others, the costs are still an issue,”<br />

said Grant. “The scholarships can ease the<br />

burden.”<br />

Also, the Genesis mentoring program<br />

is doing well about six months after<br />

its inception, Grant added. To date, 10<br />

Genesis members <strong>with</strong> at least three years<br />

of advisor experience are mentoring<br />

less-experienced Genesis members. In<br />

addition, more than a dozen other NAPFA<br />

members have indicated that they would<br />

be willing to act as mentors to Genesis<br />

members who want to learn how to start<br />

and run a financial planning firm. “This<br />

is a great chance for young advisors who<br />

have an ownership mentality,” said Grant.<br />

NAPFA Firms Make<br />

AdvisorOne List<br />

Twenty NAPFA member firms were<br />

ranked in the Top 100 Wealth Managers<br />

in 2012 by AdvisorOne.com. The list is<br />

ranked by AUM per-client. Highest on the<br />

list of NAPFA firms was WMS Partners,<br />

LLC (Timothy Chase and Martin Eby),<br />

which came in 33rd <strong>with</strong> $6.2 million<br />

AUM per client. Other NAPFA firms, in<br />

descending order of per-client AUM, were<br />

Abacus Planning Group (Cheryl Holland<br />

and seven Corporate Professional members),<br />

Hewins Financial Advisors (Karl Schwartz),<br />

Bingham, Osborn & Scarborough (Kevin<br />

Dorwin and Clayton Ernst), Homrich Berg<br />

(Andrew Berg, Tony Guinta and seven<br />

Corporate Members), Trinity Financial<br />

Advisors (Ellen Dowling, Nancy Ladd<br />

& John Wimbiscus), Quadrant Capital<br />

Management (Jeffrey Fisher & James<br />

Kearney), JMG Financial Group (David<br />

Morgan, Jason O'Hallen, Michelle Rozsypal,<br />

and 15 Corporate Professionals), Budros,<br />

Ruhlin & Roe (James Budros, Peggy Ruhlin,<br />

and Corporate Professionals), RMB Capital<br />

Management (Seth Davis), Balasa Dinverno<br />

Foltz LLC (Armond Dinverno), Resource<br />

Management, Inc. (Michael Zabalaoui),<br />

Dowling & Yahnkee (Mark Dowling),<br />

Hogan Financial Management (Paula<br />

Hogan), The Monitor Group, Brightworth<br />

(Lisa Brown, Chris Dardaman, Annika<br />

Ferris, Ray Padron, David Polstra, and two<br />

Corporate Professionals), Joel Isaacson<br />

& Co. (Stanley Altmark, Joel Isaacson,<br />

Michael O’Brien, and Matthew Rapoport),<br />

Loretta Nolan Associates (Loretta Nolan),<br />

Integris Wealth Management (Gifford<br />

Lehman), and Briaud Financial Advisors<br />

(Janet Briaud, Natalie Pine, Roger Pine,<br />

Peggy Sherman, and three Corporate<br />

Professionals).<br />

At the NAPFA West Conference in Portland, OR, NAPFA member Joan Parker led<br />

early-morning walks in Washington Park. Joining her one day were (left to right) Jeff<br />

Daniher, William “Ike” Eichenberger, and Bill Bengen. For advisors seeking to add to their<br />

knowledge and/or earn continuing education credits, recordings of conference sessions can<br />

be purchased on NAPFA’s website.<br />

8<br />

<strong>Napfa</strong> Advisor October 2012

educe plan costs<br />

<strong>with</strong> collective investment funds<br />

PARADIGM’S SMALL-CAP COLLECTIVE FUND<br />

IS DESIGNED FOR THE 401(K) MARKET<br />

Recent legislation is causing advisors and plan sponsors to<br />

review their fund line-ups to provide the best balance of<br />

performance, risk control, and cost.<br />

Institutional investment consultants have been using collective<br />

investment funds (CIFs) for years in the mega-plan market.<br />

Advantages include significantly reduced costs, less exposure<br />

to the volatility of retail client flows, and revenue-sharing<br />

agreements customized to fit your business model.<br />

These vehicles are now available on open-architecture platforms<br />

for qualified plans of all sizes.<br />

www.paradigmcapital.com<br />

Supporting the mission of NAPFA since 2007.<br />

NEW<br />

paradigm value<br />

collective fund r †<br />

(cusip)<br />

Total Expense Ratio: 0.98%<br />

paradigm value fund<br />

(pffax)<br />

Four-star Small-Cap Blend fund<br />

Rated four stars by Morningstar<br />

Total Expense Ratio: 1.51%<br />

Ranking as of 8/31/12<br />

The Paradigm Value Fund strategy<br />

seeks to provide true small-cap exposure<br />

in a moderately concentrated portfolio.<br />

The strategy has a history of lower<br />

volatility than peers and the benchmark<br />

Russell 2000 Value.<br />

Contact Gordon Sacks,<br />

Director, Mutual Funds<br />

at 518-431-3261 or<br />

gsacks@paradigmcapital.com<br />

†<br />

The Paradigm Value Collective Fund is only<br />

available to eligible retirement plans.<br />

The Paradigm Value Collective Fund is a collective investment fund (“CIF”) created by the Hand Composite Employee Benefit Trust and<br />

sponsored by Hand Benefits & Trust Company, a BPAS Company, that invest in the strategies of Paradigm Capital Management, which serves<br />

as the sub-advisor to the CIF. For funds <strong>with</strong> at least a three-year history, Morningstar calculates a Morningstar Rating based on a Morningstar<br />

Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges, loads, and redemption<br />

fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars,<br />

the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. An overall<br />

rating for a fund is derived from a weighted average of the performance figures associated <strong>with</strong> its 3-, 5-, and 10-year (if applicable) Morningstar<br />

Rating Metrics as of the date stated. For funds <strong>with</strong> at least a three-year history, Morningstar calculates a Morningstar Rating TM based on a<br />

Morningstar Risk-Adjusted Return measure that accounts for variation in a fund’s monthly performance (including the effects of sales charges,<br />

loads, and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in<br />

each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10%<br />

receive 1 star. An overall rating for a fund is derived from a weighted average of the performance figures associated <strong>with</strong> its 3-, 5-, and 10-year<br />

(if applicable) Morningstar Rating Metrics as of the date stated.<br />

Consider the investment objectives, risks, charges, and expenses of each Paradigm Fund carefully before investing. The prospectus and the<br />

statement of additional information contain this and other information about the Funds and are available by calling 800-239-0732. Please read<br />

the prospectus and statement of additional information carefully before investing.<br />

As of 8/31/2012 the number of funds in the Small-Cap Blend category tracked by Morningstar was 588 for the 3 year period and Overall<br />

Ranking, and 510 for the 5 year period. As of 8/31/2012 Paradigm Value Fund did not have a 10 year rating. Not FDIC-Insured. May Lose<br />

Value. No Bank Guarantee. Distributor: Rafferty Capital Markets, LLC.<br />

<strong>Napfa</strong> Advisor SEPTEMBER 2012 9

Staying in the Game<br />

By Richard Sincere<br />

Doing Business on a Handshake<br />

My wife Deb and I spent a late-<br />

September Saturday in a far<br />

north suburb of Illinois. This<br />

area is known for its farmland and horses,<br />

and as soon as you get off the interstate,<br />

you immediately start to breathe easier.<br />

Sadly, a massive outlet shopping center<br />

has been built among the beautiful<br />

pastures, but most of the area is still<br />

picturesque, long on land and short on<br />

buildings.<br />

While I wish our purpose had been a<br />

picnic or horseback riding, it actually was<br />

to visit a nursery and select some trees for<br />

our property. We have decided that it’s time<br />

to do some landscaping, which we hope<br />

in turn will encourage us to spend more<br />

time in our yard (our landscaper says his<br />

goal is to make it so nice that we’ll never<br />

go to New Hampshire). I wish I could say<br />

that my role at the nursery was to offer my<br />

opinion about which species we liked best,<br />

and then which of those trees looked the<br />

nicest, but I realized that I had nothing to<br />

contribute. Those decisions were left to my<br />

wife and to Mike, landscape designer and<br />

owner of the nursery, while I was relegated<br />

to enjoying the crisp fall air and surveying<br />

the nursery’s many acres.<br />

Given my usual intellectual curiosity,<br />

I began asking Mike about his business.<br />

I was curious about why he started a<br />

nursery and how he found the land. Within<br />

minutes, he was telling me in great length<br />

about how he had met the architect who<br />

lives in the house adjacent to his nursery<br />

and how he approached him about leasing<br />

the land so he could start his own nursery.<br />

The architect initially said no, but after<br />

further consideration decided that he<br />

could benefit by claiming the land for<br />

agricultural use, which would reduce his<br />

taxes significantly. The landowner’s only<br />

caveat was that no lawyers be involved<br />

and that it would be based on a piece of<br />

paper and a handshake.<br />

Mike first consulted an attorney who<br />

crafted a document full of legalese to protect<br />

Mike from what he believed was a deal<br />

destined to fail. Mike knew he couldn’t<br />

present this document to the architect, so<br />

he decided to trust his gut. Mike wrote up<br />

the terms on a piece of paper. Eight years<br />

later, he is extremely proud of the fact that<br />

he built a profitable business based on a<br />

“gentlemen’s agreement” that is still in force.<br />

Despite my belief in the goodness of<br />

people, my cynicism led to my next line of<br />

inquiry: What would happen when Mike<br />

decided to sell the nursery? He smilingly<br />

admitted that he had no one to hand it down<br />

to, that he had more than enough money to<br />

be satisfied, and that in six years he wanted<br />

to retire and move to Italy. I thought that<br />

was a nice position to be in but not really<br />

relevant to most small-business owners—<br />

people who, in my experience, are<br />

dependent on funding their retirement <strong>with</strong><br />

the income from or sale of their business.<br />

Yet, based on our conversation, I<br />

felt that Mike was not a naïve person; he<br />

was, in fact, an intelligent entrepreneur<br />

who had figured out how to balance his<br />

financial needs <strong>with</strong> his quality of life. I’m<br />

sure he anticipates being paid some price<br />

when he sells his business (despite owning<br />

only the plantings on the land but not the<br />

land itself), but that doesn’t diminish his<br />

enjoyment of or passion for his business.<br />

He figures that while he may not be<br />

maximizing the profitability of a nursery<br />

business (as business school teaches us to<br />

do), he’ll get a fair price that will allow<br />

him to at least feel good about what he<br />

created.<br />

It’s interesting to think about how<br />

different entrepreneurs define their quality<br />

of life and come to terms <strong>with</strong> what is<br />

a fair deal. Since Mike and his wife are<br />

financially comfortable and none of their<br />

family or friends will be dependent on<br />

making a living from the business once<br />

he leaves, the decision is a little easier.<br />

However most entrepreneurs (me included)<br />

worry about our employees, family, and/<br />

or heirs who are cheering for our success<br />

and also are successors to our business. My<br />

guess is that Mike’s nursery has a number<br />

of employees who expect to continue<br />

working for the next owner.<br />

My most important takeaway from the<br />

discussion was Mike’s attitude: comfort<br />

about what he’s doing and appreciation<br />

for his business. Mike was the epitome of<br />

someone who was more concerned about<br />

the quality of his product than his profit<br />

margin.<br />

Protecting Yourself as<br />

an Entrepreneur<br />

You would think that Mike’s lack of<br />

concern about maximizing profits would<br />

make running his business relatively stressfree.<br />

After all, if he is willing to walk away<br />

from his nursery in six years, why would<br />

he be concerned about a customer taking<br />

advantage of him? But he described a<br />

recent situation <strong>with</strong> a customer who asked<br />

him to develop a detailed landscaping plan<br />

for her house. He went to great lengths to<br />

diagram the irrigation system, stonework,<br />

trees, flowers, and so on—really making her<br />

home a showpiece. After his presentation,<br />

the customer began hemming and hawing<br />

and asked him to leave the plans for her to<br />

review. He flatly told her no.<br />

Part of being an entrepreneur is<br />

protecting yourself from being taken<br />

advantage of by your customers. We must<br />

trust our customers and clients. But when<br />

our antenna goes up and we feel someone<br />

is trying to take advantage of us, we have<br />

to draw a line in the sand and not allow it to<br />

be crossed. As soon as Mike thought he was<br />

going to be exploited, he pretty much told<br />

his customer that she would have to pay<br />

for his drawings and that he wouldn’t do<br />

anything more until he was compensated.<br />

He wants her and everyone else to respect<br />

that his time is worth as much as or more<br />

than the products he sells.<br />

In contrast, when Deb and I were at<br />

the nursery, Mike gave us all the designs<br />

he had sketched and itemized. He and Deb<br />

10<br />

<strong>Napfa</strong> Advisor October 2012

Staying in the Game<br />

spent hours poring over the details, such as<br />

which tree grew better in the shade or sun,<br />

how tall each grew, and how each face of<br />

the house might have a different theme for<br />

variety and mood. Having worked <strong>with</strong> us<br />

before on a small project, he knew that Deb<br />

was totally engaged and that she wasn’t<br />

going to take his plans and use them <strong>with</strong><br />

someone else.<br />

My belief is that entrepreneurs have a<br />

sixth sense to size up a client and decide who<br />

is a straight shooter and who isn’t. Being an<br />

entrepreneur means having some comfort<br />

that your judgment is right more often than<br />

not. If we don’t trust our judgment, then<br />

there is no way we can run a business.<br />

That means that we must excel in our area<br />

of expertise, but it also means that we can<br />

Micro-Cap Companies<br />

Our Future<br />

Shouldn’t everyone own some?<br />

The Perkins Discovery Fund<br />

The Perkins Discovery Fund uses a combination of fundamental analysis<br />

and technical chart analysis in a “bottom-up” investment style that focuses<br />

on micro-cap companies in its search for long-term appreciation.<br />

Please call for additional information<br />

(800) 998-3190 PDFDX www.perkinscap.com<br />

Average Annualized Total Returns as of September 30, 2012<br />

Inception<br />

Date<br />

Perkins Discovery Fund 04/09/98<br />

DJ Wilshire U.S. Micro-Cap Index<br />

Russell 2000 Index<br />

NASDAQ Composite Index<br />

S&P 500 Index<br />

Gross Expense Ratio - 2.49% Net Expense Ratio - 2.01% 1<br />

Performance data quoted represents past performance; past performance does not guarantee<br />

future results. The investment return and principal value of an investment will fl uctuate so that<br />

an investor’s shares, when redeemed, may be worth more or less than their original cost. Current<br />

performance of the fund may be lower or higher than the performance quoted. Performance data<br />

current to the most recent month end may be obtained by calling 1-800-998-3190. The fund imposes<br />

a 1.00% redemption fee on shares held less than 90 days. Performance data quoted does not refl ect<br />

the redemption fee. If refl ected, total returns would be reduced. Investment performance for the<br />

fund reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.<br />

1<br />

The adviser has contractually agreed to cap expenses to 2.00% indefinitely.<br />

The fund’s investment objectives, risks, charges and expenses must be considered carefully<br />

before investing. The Statutory and Summary Prospectuses contain this and other important<br />

information about the investment company, and may be obtained by calling 800-366-8361,<br />

or visiting www.perkinscapital.com. Read carefully before investing.<br />

Small-capitalization companies tend to have limited liquidity and greater price volatility than<br />

large-capitalization companies. The fund invests in micro-cap and early stage companies<br />

which tend to be more volatile and somewhat more speculative than investments in more<br />

established companies. As a result, investors considering an investment in the Fund should<br />

consider their ability to <strong>with</strong>stand the volatility of the Fund’s net asset value associated <strong>with</strong><br />

the risks of the portfolio.<br />

The Dow Jones Wilshire U.S. Micro-Cap Index is formed by taking the 2,500 smallest<br />

companies, as measured by market capitalization, of the Dow Jones Wilshire 5000 Index.<br />

The Russell 2000 Index is composed of the 2,000 smallest companies in the Russell 3000 Index,<br />

and is widely regarded in the industry as the premier measure of small-cap stocks. The S&P 500<br />

Index is a broad based unmanaged index of 500 stocks widely recognized as representative of the<br />

equity market. The NASDAQ Composite Index is a broad-based capitalization-weighted index of<br />

all NASDAQ national market and small-cap stocks. One cannot invest directly in an index.<br />

Quasar Distributors, LLC, Distributor<br />

Since<br />

Inception<br />

10 year 5 year 3 year 1 year<br />

10.61% 10.94% -1.94% 8.67% 19.81%<br />

7.48% 11.03% 0.68% 10.34% 35.87%<br />

5.29% 10.17% 2.21% 12.99% 31.91%<br />

3.78% 10.27% 2.90% 13.66% 29.02%<br />

3.67% 8.01% 1.05% 13.20% 30.20%<br />

size up people a little better than most. If<br />

we don’t, then a lot of our handshake deals<br />

would be relegated to attorneys. Certainly,<br />

there are plenty of firms that work <strong>with</strong><br />

lawyers in tow, which is fine for them. But<br />

we smaller entrepreneurial firms must start<br />

<strong>with</strong> the belief that when a potential client<br />

meets <strong>with</strong> us, that person is being honest<br />

<strong>with</strong> us. If we have the slightest inkling that<br />

this is not the case, we will subconsciously<br />

try to sabotage the meeting and discourage<br />

the deal.<br />

My wife and I are giving Mike our<br />

business, and we wouldn’t think of going<br />

to someone else. We believe that we are<br />

getting his substantial expertise and that<br />

he is providing great value for what we’ll<br />

receive.<br />

While my first impression was that<br />

Mike wouldn’t ever make it in the financial<br />

services industry, I realize now that our<br />

businesses actually work the same way.<br />

When we sit down <strong>with</strong> a prospect, we<br />

judge how easy or hard this person will<br />

be as a client. We try to decide if we will<br />

have fun working together and if we will<br />

learn something from each other. But, most<br />

importantly, we are trying to decide if the<br />

exchange of dollars for services will be a<br />

fair deal. An aggravating client needs to be<br />

charged more than someone who is easy<br />

to work <strong>with</strong>, or maybe rejected as a client<br />

altogether.<br />

At the end of the day, all relationships<br />

are built on trust. When you decide to<br />

voluntarily engage in a working relationship,<br />

it must have a strong element of trust. Doing<br />

deals in this scenario should allow you to<br />

put the contract in a file and never have to<br />

look at it for years. When the relationship is<br />

forced, then discomfort often follows, and<br />

the contract has to be consulted regularly<br />

to protect oneself. Mike understands that if<br />

he is looking at the contract all the time, he<br />

has much bigger problems than trying to run<br />

his day-to-day his operations. It’s not the<br />

handshake he trusts; it’s the person on the<br />

other end of the handshake.<br />

Richard Sincere is chairman and CEO<br />

of Sincere & Co., LLC, a NAPFA Resource<br />

Partner company based in Chicago. He can<br />

be contacted by phone at 847.905.0225,<br />

or by e-mail at rs@sincereco.com. His<br />

company’s website is www.sincereco.com.<br />

<strong>Napfa</strong> Advisor SEPTEMBER 2012 11

Invest wisely.<br />

PERFORMANCE SUMMARY (SIRRX)<br />

SIERRA CORE RETIREMENT FUND FROM INCEPTION 12/24/07 TO 8/31/12<br />

Successful portfolio management involves both profiting from sustained uptrends — the past<br />

three years have all been part of the current rising cycle — and limiting drawdown during the<br />

adverse part of the cycle — which Sierra has also done very well for many years.<br />

Year-to-Date<br />

One Year<br />

As of 6/30/2012<br />

Latest Four Years Since Inception 12/24/2007<br />

Cumulative* Annualized Cumulative* Annualized<br />

Sierra Core Retirement<br />

Fund Class R<br />

+3.19% +2.66% +44.95% +9.73 +45.61% +8.67%<br />

S & P 500* +9.49% +5.45% +16.36 +3.86% +0.60 +0.13%<br />

“Cumulative” performance from inception is the total increase in value of an investment in the Class R shares assuming<br />

reinvestment of dividends and capital gains distributions. The S&P 500 Index, a registered trademark of McGraw-Hill<br />

Co., Inc., is a market-capitalization-weighted index of 500 widely-held common stocks. Data here for the S&P includes<br />

dividends.<br />

The performance data quoted here represents past performance for Class R shares (symbol SIRRX), and are net of the total annual<br />

operating expenses of the Class R shares (see below). For performance numbers current to the most recent month end, please<br />

call toll-free 855-879-4075 or visit our website, SierraMutualFunds.com. Current performance may be lower or higher than the<br />

performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an<br />

investment in the Fund will fluctuate, so that investors’ shares, when redeemed, may be worth more or less than their original cost.<br />

The total annual operating expenses including expenses of the underlying funds (estimated at 0.69% per year) are 2.34% for Class<br />

A and Class I, 2.49% for Class A1 and Class I1, 3.09% for Class C, and 2.09% for Class R. Please review the Fund’s prospectus for<br />

more information regarding the Fund’s fees and expenses.<br />

12<br />

<strong>Napfa</strong> Advisor October 2012

ASSET ALLOCATION AS OF AUGUST 31, 2012*<br />

Currency<br />

4%<br />

Other<br />

Low-Volatility<br />

Funds<br />

4%<br />

Temporary<br />

Havens**<br />

11%<br />

High Yield Corporate<br />

Bond Funds<br />

10%<br />

Other<br />

Bond Funds<br />

71%<br />

*NOTE: Holdings can change at any time <strong>with</strong>out notice.<br />

**Money Market & ultra short bond funds.<br />

PERFORMANCE BY QUARTER (SIRRX)<br />

Year Q1 Q2 Q3 Q4<br />

Calendar<br />

Year<br />

S&P 500<br />

w/divs<br />

2008 -0.88% +1.27% -3.51% +0.34% -2.82% -37.02%<br />

2009 -2.01% +20.12% +9.14% +1.82% +30.81% +26.49%<br />

2010 +3.61% +0.33% +3.89% +0.07% +8.07% +14.91%<br />

2011 +2.34% +0.88% -0.69% +0.18% +2.63% +1.97%<br />

2012 +1.94% +1.14%<br />

The Sierra Core Fund pays a quarterly dividend. Shares are available through TD Ameritrade, Charles Schwab & Co. Inc., Fidelity, Pershing and directly<br />

from the Fund.<br />

The Net Expense Ratio is the Total Annual Fund Operating expenses less fees and expenses, of the underlying funds, which are estimated at 0.69%<br />

per year. The Fund’s investment adviser has voluntarily contracted to reduce its fees and/or absorb expenses until at least February 28, 2013 under<br />

certain circumstances. The Fund invests in mutual funds and ETFs (“underlying funds”). The Fund indirectly bears investment management fees of<br />

the underlying funds in addition to the investment management fees and expenses of the Fund – all of which however are fully reflected in the above<br />

performance information. In some instances it may be less expensive for an investor to invest in the underlying funds directly. There is also a risk that<br />

investment advisers of those underlying funds may make investment decisions that are detrimental to the performance of the Fund. Investments in<br />

underlying funds that own small- and mid-capitalization companies may be more vulnerable than larger, more established organizations to adverse<br />

business or economic developments. Investments in underlying funds that invest in foreign equity and debt securities could subject the Fund to<br />

greater risks including, currency fluctuation, economic conditions, and different governmental and accounting standards.<br />

Investors should carefully consider the investment objectives, risks, charges, and expenses of the Sierra Core Retirement Fund. This<br />

and other information about the Fund is contained in the prospectus and should be read carefully before investing. The prospectus<br />

can be obtained on our website, SierraMutualFunds.com, or by calling toll free 1-855-879-4075. The Sierra Core Retirement Fund is<br />

distributed by Northern Lights Distributors, LLC, Member FINRA.<br />

1375-NLD-9/7/2012<br />

<strong>Napfa</strong> Advisor SEPTEMBER 2012 13

industry Leader interview<br />

By Kevin Adler<br />

Q&a <strong>with</strong> <strong>Kelli</strong> hueler<br />

<strong>Kelli</strong> <strong>Hueler</strong> is president and CEO of<br />

<strong>Hueler</strong> Companies and developer<br />

of Income Solutions ® , an online<br />

platform for analyzing and purchasing<br />

low-cost annuities. This platform was the<br />

first of its kind to offer NAPFA advisors<br />

annuities <strong>with</strong> no commissions, level fees<br />

across multiple annuity providers, and full<br />

disclosure of distributor fees.<br />

In this Q&A, <strong>Hueler</strong> discusses how to<br />

change the mindset of financial advisors<br />

about annuities and the distribution of<br />

annuity products through 401(k) providers.<br />

She explains why annuities should be part<br />

of a comprehensive financial plan and how<br />

they can be incorporated.<br />

Question: Just days before we conducted<br />

this Q&A, your company announced a new<br />

partnership <strong>with</strong> the Southwest Airlines<br />

Pilots’ Association (SWAPA) that will give<br />

its members access to the <strong>Hueler</strong> Income<br />

Solutions ® platform for its 401(k) plan.<br />

The SWAPA plan has about $2.4 billion in<br />

assets. What does this partnership signify<br />

about the interest in annuities in general?<br />

<strong>Hueler</strong>: Southwest Airlines pilots have<br />

a terrific 401(k) plan, which BrightScope<br />

ranked as the top defined contribution<br />

plan in the country. However, members<br />

don’t have a traditional pension. SWAPA<br />

leadership is very aware that its members<br />

will need to turn a portion of their<br />

retirement savings into lifetime income,<br />

or create a “paycheck for life.” This new<br />

program allows pilots who are approaching<br />

retirement to convert some of their assets<br />

into a secure retirement income stream.<br />

Most workers in America are confronting<br />

this same challenge.<br />

SWAPA also wanted a low-cost<br />

arrangement <strong>with</strong> easy-to-understand<br />

choices for building retirement income.<br />

This is an important part of what the<br />

Income Solutions ® platform offers to<br />

individuals. Members can also talk <strong>with</strong> a<br />

qualified non-commissioned professional<br />

as they work through decisions about how<br />

much to annuitize, when to annuitize,<br />

and so on. The platform for SWAPA will<br />

initially include fixed deferred, single<br />

premium immediate, and longevity annuity<br />

offerings. <strong>Hueler</strong> believes 401(k) plans will<br />

continue to add new product alternatives,<br />

and our platform supports this approach.<br />

Low-cost annuity products serve as<br />

the baseline for pension-type income or<br />

as the foundation for a secure retirement<br />

income stream. However, it’s not the only<br />

solution for retirement; it is only part of<br />

the answer. As participants make decisions<br />

about retirement, we believe advisors play<br />

a very important role in constructing and<br />

implementing a comprehensive financial<br />

plan. In fact, our staff will ask an individual<br />

if he or she has an advisor, and we will<br />

encourage them to get objective financial<br />

advice. We often refer people to NAPFA’s<br />

website to help them find a Fee-Only<br />

advisor.<br />

Question: You believe that advisors can<br />

work <strong>with</strong> clients as they transition into the<br />

spend-down phase to blend annuities into<br />

the retirement income plan. But how do<br />

advisors feel about annuities?<br />

<strong>Hueler</strong>: Some advisors have already<br />

successfully incorporated annuities into<br />

their practices, and others are climbing the<br />

learning curve and are starting to embrace<br />

annuities. Unfortunately, we still see a large<br />

number of advisors who are uncomfortable.<br />

We struggle at times to break through the<br />

traditional viewpoint that an annuity is<br />

just giving all of your client’s money to<br />

an insurance company, rather than seeing<br />

the value of transferring certain risk—<br />

particularly longevity risk—to an insurer.<br />

There’s a perception that annuitization<br />

is a bad deal. And sometimes it is. There are<br />

well-known problems <strong>with</strong> how annuities<br />

have been packaged and sold to individuals,<br />

but this clouds the picture today. Advisors<br />

are stuck in the traditional risk-reward,<br />

Efficient Frontier paradigm that doesn’t<br />

include helping clients understand how<br />

to take advantage of risk transfer and the<br />

benefits low-cost annuities have to offer.<br />

annuities can be used<br />

effectively where and<br />

when it makes sense to<br />

stabilize income, guard<br />

against market volatility,<br />

and/or transfer<br />

longevity and other<br />

risks. The key is to pay for<br />

only those features that<br />

are needed.<br />

Question: Tell us about this new flexible<br />

approach or the new ways of using<br />

traditional annuity tools.<br />

<strong>Hueler</strong>: An annuity has certain<br />

parameters in terms of to whom and how<br />

it pays income. These parameters include<br />

single life only or single life <strong>with</strong> a period<br />

of certain payments if you die earlier than<br />

anticipated; joint life for yourself and<br />

partner; fixed guaranteed income increase<br />

per year or payments that move <strong>with</strong><br />

inflation; and so on. The annuity terms can<br />

be structured to fit an individual’s personal<br />

circumstances.<br />

continued on page 16<br />

14<br />

<strong>Napfa</strong> advisor ocToBEr 2012

Advanced technology?<br />

Great.<br />

Advancing the way I do<br />

business? Even better.<br />

Looking for technology designed to help you achieve more for<br />

your clients? Veo, ® our innovative platform for advisors, is built to<br />

transform the way you do business. Its award-winning open access<br />

architecture seamlessly integrates <strong>with</strong> the industry’s most soughtafter<br />

programs and tools, introducing a new level of ease and<br />

efficiency to everything you do. TD Ameritrade Institutional.<br />

Your success is our business.<br />

Call us at 800-934-6124 or explore our technologies at<br />

tdainstitutional.com/tech<br />

Follow Us<br />

Named 2011’s “Best Tech for Advisors” by Bill Winterberg, technology columnist for MorningstarAdvisor.com.<br />

TD Ameritrade Institutional, Division of TD Ameritrade, Inc., member FINRA/SIPC/NFA. TD Ameritrade<br />

is a trademark jointly owned by TD Ameritrade IP Company, Inc., and The Toronto-Dominion Bank.<br />

©2012 TD Ameritrade IP Company, Inc. All rights reserved. Used <strong>with</strong> permission.<br />

<strong>Napfa</strong> advisor sEpTEMBEr 2012 15

Industry Leader Interview<br />

Continued from page 14<br />

Annuities can be used effectively<br />

where and when it makes sense to stabilize<br />

income, guard against market volatility,<br />

and/or transfer longevity and other risks.<br />

The key is to pay for only those features<br />

that are needed. Strip out the bells and<br />

whistles that carry significant cost and are<br />

not of value.<br />

This is where the Income Solutions ®<br />

platform can be a very effective tool for<br />

non-commissioned advisors. The quote<br />

tool is easy to use and allows advisors<br />

to quickly customize every annuity<br />

quote. An advisor can select only those<br />

features she wants to consider and can run<br />

multiple scenarios. The quotes are realtime<br />

and are presented in a standardized<br />

grid that facilitates easy comparisons and<br />

presentation to clients. The distribution<br />

cost is lower than other available channels,<br />

is fully disclosed, and is level across<br />

all insurance companies. Every quote<br />

request is submitted to insurers through<br />

an automated competitive-auction format<br />

among multiple insurers. Clients can be<br />

confident that their advisor gave them<br />

access to the best available market price<br />

<strong>with</strong> the highest available monthly income<br />

for the features they selected.<br />

Question: With the Income Solutions ®<br />

platform, a person can buy a low-cost<br />

annuity. Does that complement—or even<br />

replace—the comprehensive financial plan<br />

that a NAPFA member would produce and<br />

manage?<br />

<strong>Hueler</strong>: From our perspective,<br />

successful advisors use annuities as only<br />

one component of a comprehensive<br />

financial plan, and they educate clients<br />

about why they are being used. They<br />

understand that annuities do not require<br />

locking up all of a client’s money, or even<br />

a lot of it. The annuities used are low-cost,<br />

super-streamlined products that can be<br />

bought in small increments. They fit in<br />

when a client needs it, whether that’s in<br />

their early 60s or late in life. They empower<br />

advisors by giving them a tool to preserve<br />

clients’ income and protect their wealth.<br />

It’s about building a personal pension.<br />

Some money will be annuitized, some will<br />

be in stocks, some in CDs, and so on. Every<br />

financial advisor needs to know how to<br />

build these pension-like income streams for<br />

their clients. Annuities can offer real value<br />

in terms of risk transfer and secure income.<br />

We even see annuities as a complement<br />

to bond ladders that many advisors use.<br />

The annuities have advantages such as<br />

tax deferral, inflation protection that’s not<br />

available in corporate bonds, and an income<br />

stream that lasts a lifetime.<br />

From our<br />

perspective,<br />

successful<br />

advisors use<br />

annuities<br />

as only one<br />

component<br />

of a comprehensive<br />

financial plan, and they<br />

educate clients about<br />

why they are being used.<br />

Question: When it’s put in those terms, it<br />

seems like a logical extension of what a<br />

comprehensive advisor does. But yet, it<br />

still seems like it might require a change in<br />

mindset for an advisor, or at least a change<br />

in terminology.<br />

<strong>Hueler</strong>: Yes, it is a logical extension<br />

for some advisors and, hopefully, for more<br />

in the future. We see advisors becoming<br />

“income security specialists,” and annuities<br />

are just part of that equation. We believe<br />

that advisors can charge for their advice<br />

when they are providing income counseling<br />

as one of their services. From my<br />

perspective, that’s exactly what they should<br />

be doing for clients.<br />

The advisors we see who are<br />

successful look at a client’s overall picture,<br />

and they do not view advice as a single<br />

event. They build a ladder of income for a<br />

client’s retirement and educate them about<br />

the process of building income. This might<br />

take 10 years or more, maybe by allocating<br />

some income each year into an annuity for<br />

the retirement income bucket. The point is<br />

that advisors should have a fee model that<br />

compensates them for what, we believe,<br />

is an extremely important service and<br />

may be what actually determines whether<br />

or not clients will have sufficient assets<br />

to maintain their standard of living in<br />

retirement.<br />

Question: Earlier you mentioned the idea<br />

of not locking up all of a client’s money in<br />

an annuity. How much are you suggesting<br />

should be annuitized?<br />

<strong>Hueler</strong>: Obviously, it’s always<br />

an individual decision, based on many<br />

factors. We have data on annuity purchases<br />

made through Income Solutions ® , and<br />

it contradicts many assumptions that<br />

people have. First, people are not overannuitizing,<br />

despite claims that they will.<br />

They annuitize, on average, about 25<br />

percent of their assets, and they see this as<br />

income replacement for their retirement.<br />

Second, they are purchasing annuities in<br />

the active-retirement phase of their lives,<br />

their 60s and 70s, and not much later, as<br />

is often promoted when plan advisors are<br />

conflicted.<br />

Question: What else have you learned<br />

about people’s tendencies when buying<br />

annuities?<br />

<strong>Hueler</strong>: Individuals who buy annuities<br />

through us <strong>with</strong>out advisors typically buy<br />

the highest level of nominal income they<br />

can purchase today. That is, they don’t seek<br />

inflation protection. Financial advisors<br />

are much more astute about the impact of<br />

inflation, and they will seek annuities that<br />

protect against it. This is very important.<br />

When we started the Income Solutions ®<br />

platform in 2004, some plan sponsor<br />

clients had very generous pensions for<br />

their retirees. These sponsors often told us<br />

that they believed their participants would<br />

not need much annuitization because the<br />

pensions were so generous. But what we<br />

learned after folks had retired is that they<br />

would buy annuities for additional income,<br />

and they needed inflation protection<br />

because their costs such as healthcare had<br />

gone up more than they expected.<br />

Continued on page 18<br />

16<br />

<strong>Napfa</strong> Advisor October 2012

Cohen & Steers<br />

25 years of<br />

Leadership<br />

Expertise<br />

Innovation<br />

cohen and steers Aug<br />

As pioneers of REIT investing, Cohen & Steers has fostered a culture of knowledge,<br />

innovation and advocacy on behalf of our clients. Today we are a global asset<br />

manager focused on specialty asset classes and committed to delivering superior<br />

investment solutions.<br />

Real assets<br />

Global real estate<br />

Global infrastructure<br />

Preferred securities<br />

Large cap value<br />

Private real estate multimanager strategies<br />

NEW YORK • LONDON • BRUSSELS • HONG KONG • TOKYO • SEATTLE<br />

cohenandsteers.com 800 330 7348<br />

<strong>Napfa</strong> Advisor SEPTEMBER 2012 17

Industry Leader Interview<br />

Continued from page 16<br />

Question: It also seems that, as longevity<br />

increases, the challenge of inflation gets<br />

worse. Combine that <strong>with</strong> being fearful<br />

about investing in a volatile stock market,<br />

and you’ve got problems.<br />

<strong>Hueler</strong>: People don’t become<br />

confident investors until their basic needs<br />

are met. People who are not fearful are<br />

better investors, and those investors will<br />

have better prospects for the long term. To<br />

the extent an annuity provides underlying<br />

security, it can make people more confident<br />

investors <strong>with</strong> the rest of their assets.<br />

The other issue that one of our plan<br />

sponsor clients talks about is the “miser<br />

effect.” It’s the fear people have that they<br />

won’t be able to maintain their lifestyle<br />

in retirement and that their accumulated<br />

wealth won’t last. Because of this, they<br />

don’t live the retirement they could live.<br />

Having that built-in income floor will give<br />

them the confidence and freedom to do<br />

great things <strong>with</strong> the rest of their lives.<br />

Question: Moving in another direction,<br />

let’s talk about annuities from a perspective<br />

of independent RIAs. Advisors are<br />

constantly hearing that they are in a fight<br />

<strong>with</strong> other types of financial advisors<br />

for 401(k) rollover assets. How does the<br />

marketing of annuities today fit into the<br />

rollover environment?<br />

<strong>Hueler</strong>: This is something we’ve<br />

studied and addressed in a paper I cowrote<br />

<strong>with</strong> Anna Rappaport, FSA,<br />

MAAA, called “The Role of Guidance in<br />

the Annuity Decision-making Process,”<br />

that was presented earlier this year at the<br />

Pension Research Council Symposium<br />

hosted by the Wharton School. Some of<br />

the information in the paper was presented<br />

again before the ERISA Advisory Council<br />

in June.<br />

We found that some asset gatherers and<br />

certain retirement plan administrators have<br />

created clear barriers to the use of low-cost<br />

annuities. The plan administration business<br />

is not profitable based on administrative<br />

fees alone; instead, success depends on<br />

administrators earning fees for a variety of<br />

other services. Sometimes this occurs in<br />

conjunction <strong>with</strong> advice providers. These<br />

advice providers offer managed accounts<br />

and reallocation services for 50 or 60 basis<br />

points per year and facilitate only late-inlife<br />

deferred annuities.<br />

When an advisor’s and/or<br />

administrator’s revenue model is dependent<br />

on keeping assets in the managed account<br />

until participants reach age 80 to 85 and/or<br />

selling retail-priced annuities in lieu of lowcost<br />

alternatives, this creates a dangerous<br />

conflict of interest. What we see in these<br />

situations is participants being given the<br />

advice that they should not annuitize until<br />

late in life, even though purchase data<br />

clearly shows people’s preference for<br />

partial annuitization throughout their 60s<br />

and 70s.<br />

When a plan administrator offers retail<br />

annuities rather than low-cost alternatives,<br />

data tells us that participants are being<br />

dissuaded from rolling over to the low-cost<br />

programs offered by plan sponsors or other<br />

distributors. Instead, participants are being<br />

encouraged to buy higher-margin annuity<br />

products that benefit the administrator<br />

rather than the individual.<br />

Employers want to look out for their<br />

employees’ interests, but they might<br />

not be aware of the agenda of their plan<br />

administrator and/or advice provider.<br />

Here’s where NAPFA members come in,<br />

because they are objective and are experts<br />

at differentiating between investment<br />

options that are in the best interest of<br />

their clients, instead of in the interests<br />

of distributors or manufacturers. The<br />

other difference is that a fiduciary RIA<br />

is not trying to capture rollover dollars<br />

through financial products. The objective<br />

advisor’s job is to help the client use his<br />

or her resources to the greatest advantage.<br />

Sometimes that is under the advisor’s<br />

management, and sometimes it includes<br />

going elsewhere for financial products.<br />

We have been very fortunate to<br />

partner <strong>with</strong> Vanguard in delivering lowcost<br />

annuity alternatives to their clients.<br />

Vanguard’s Annuity Access program that<br />

is powered by Income Solutions ® not only<br />

makes low-cost annuitization available but<br />

encourages staged or partial annuitization<br />

that can be integrated <strong>with</strong> other lifetime<br />

income options. Vanguard also makes the<br />

program available to advisors, and they<br />

have licensed professionals available to<br />

assist both advisors and individuals.<br />

Question: Given consumers’ interest in<br />

secure income, do you think annuities<br />

will become more important in the 401(k)<br />

rollover world?<br />

<strong>Hueler</strong>: Yes. Look at the trend. A<br />

number of financial services firms and<br />

insurance companies are aggressively<br />

selling retirement income services as a very<br />

effective means of capturing IRA rollover<br />

assets. Their pitch is “retirement income,”<br />

and annuitization is a key aspect of that<br />

pitch.<br />

My question is where are advisors<br />

going to be if they do not have the<br />

knowledge and tools to compete? An<br />

independent advisor, at a minimum, will<br />

have to rethink his or her strategy around<br />

building retirement income and what<br />

services are being provided to clients.<br />

To be successful, advisors will have<br />

to show that they are knowledgeable,<br />

independent, and have access to low-cost<br />

lifetime income products. To combat the<br />

flashy advertisements and glossy product<br />

brochures, independent advisors need<br />

to demonstrate that, <strong>with</strong> their objective<br />

advice and cost-effective retirement income<br />

strategies, a better outcome can be created<br />

for the client.<br />

Question: Concluding observations?<br />

<strong>Hueler</strong>: In investing, everything is<br />

a tradeoff. If you strip off the labels from<br />

the various retirement products and just<br />

look at the underlying characteristics of<br />

each—such as volatility, liquidity, security,<br />

provider credit quality, cost and so on—<br />

then you could really look at how the<br />

individual product can work in a person’s<br />

total portfolio. I believe that if you could<br />

get to a place where labels weren’t the<br />

focus, but rather product characteristics,<br />

you would have advisors behaving<br />

differently, and the simplicity of having<br />

an annuity for some amount of baseline<br />

income would be highly appealing.<br />

18<br />