Q&A with Kelli Hueler: - Napfa

Q&A with Kelli Hueler: - Napfa

Q&A with Kelli Hueler: - Napfa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

insurance<br />

By Mark desiderio and John ryan, cfp®<br />

Top 10 Mistakes advisors Make When<br />

Evaluating disability insurance<br />

Understanding disability insurance<br />

is a never-ending challenge.<br />

Since Ryan Insurance Strategy<br />

Consultants started in the disability<br />

insurance industry in 1978, we’ve<br />

analyzed an endless array of policy<br />

options and innovations. We’ve worked<br />

<strong>with</strong> Fee-Only advisors since 1983 (when<br />

NAPFA was started), seeking costeffective,<br />

secure solutions for protecting<br />

individuals and families.<br />

Below are 10 key mistakes that we<br />

have seen advisors make when evaluating<br />

disability insurance. We hope you learn<br />

from these mistakes, as well as from our<br />

tips for avoiding these errors.<br />

Not seeing the shortcomings in<br />

employer-provided group long-term<br />

disability policies. We would all agree<br />

that employer-provided long-term<br />

disability (LTD) is a great value. Often,<br />

however, the benefit is not adequate.<br />

The most common LTD plans<br />

provide 60-percent of monthly earnings<br />

up to a specified maximum benefit,<br />

usually <strong>with</strong> a cap of $10,000 per month.<br />

This means a person making more than<br />

$200,000 per year is likely restricted by<br />

the maximum benefit and would receive<br />

less than 60 percent income replacement.<br />

If the benefit is paid by the employer, it’s<br />

likely to be taxable and, therefore, the<br />

percentage of income replacement is even<br />

lower. If the definition of earnings does<br />

not include bonus or commission income,<br />

a client may discover at the time he<br />

needs support that he is entitled to only a<br />

fraction of his true income replacement.<br />

Plus, clients forget that the policy is lost<br />

if they leave their company.<br />

In sum, to determine the real value<br />

of a group LTD policy, an advisor must<br />

look beyond the definitions of disability,<br />

monthly benefit percentage, and the<br />

maximum benefit, in order to review the<br />

taxability options, define “earnings,” etc.<br />

Not discussing multi-life premium<br />

discounts, especially <strong>with</strong> female clients.<br />

Most disability insurance companies offer<br />

discounts if three or more people from the<br />

same company purchase a policy at the<br />

same time. The discount applies even if<br />

the policies are for completely different<br />

benefit amounts.<br />

When calculating the final cost of<br />

each policy, the companies usually rate<br />

each plan based on unisex ratings, rather<br />

than making distinctions based on gender.<br />

They then provide a 10 percent to 20<br />

percent discount off the unisex rating. The<br />

end result is a 10-percent to 20-percent<br />

discount to men. For woman, on the other<br />

hand, the discount can be upwards of 40<br />

percent off the “street rate.” This means<br />

that a female business owner client can<br />

purchase a policy for herself and two other<br />

employees for substantially less than the<br />

cost of a policy for just herself!<br />

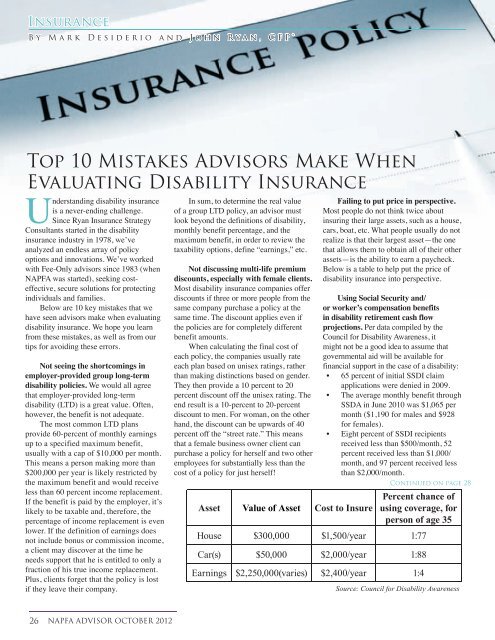

Asset Value of Asset Cost to Insure<br />

Failing to put price in perspective.<br />

Most people do not think twice about<br />

insuring their large assets, such as a house,<br />

cars, boat, etc. What people usually do not<br />

realize is that their largest asset—the one<br />

that allows them to obtain all of their other<br />

assets—is the ability to earn a paycheck.<br />

Below is a table to help put the price of<br />

disability insurance into perspective.<br />

Using Social Security and/<br />

or worker’s compensation benefits<br />

in disability retirement cash flow<br />

projections. Per data compiled by the<br />

Council for Disability Awareness, it<br />

might not be a good idea to assume that<br />

governmental aid will be available for<br />

financial support in the case of a disability:<br />

• 65 percent of initial SSDI claim<br />

applications were denied in 2009.<br />

• The average monthly benefit through<br />

SSDA in June 2010 was $1,065 per<br />

month ($1,190 for males and $928<br />

for females).<br />

• Eight percent of SSDI recipients<br />

received less than $500/month, 52<br />

percent received less than $1,000/<br />

month, and 97 percent received less<br />

than $2,000/month.<br />

continued on page 28<br />

Percent chance of<br />

using coverage, for<br />

person of age 35<br />

House $300,000 $1,500/year 1:77<br />

Car(s) $50,000 $2,000/year 1:88<br />

Earnings $2,250,000(varies) $2,400/year 1:4<br />

Source: Council for Disability Awareness<br />

26<br />

<strong>Napfa</strong> advisor ocToBEr 2012