Q&A with Kelli Hueler: - Napfa

Q&A with Kelli Hueler: - Napfa

Q&A with Kelli Hueler: - Napfa

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

from the Editor<br />

a New feature<br />

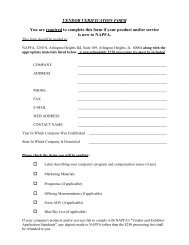

<strong>Napfa</strong> coNTacT iNforMaTioN<br />

3250 N. arlington heights road, suite 109<br />

arlington heights, iL 60004<br />

800.366.2732 • 847.483.5400<br />

info@napfa.org www.napfa.org<br />

faX: 847.483.5415<br />

In this issue, we debut a new feature that we<br />

hope will become a very popular part of the<br />

magazine. As the cover photo indicates, we<br />

have an exclusive interview <strong>with</strong> <strong>Kelli</strong> <strong>Hueler</strong>,<br />

president and CEO of <strong>Hueler</strong> Companies, the<br />

developer of an online platform for analyzing and<br />

purchasing low-cost annuities.<br />

The Q&A represents the first in a series of interviews we plan<br />

to publish <strong>with</strong> key members of the financial services industry. In<br />

the months ahead, we will be speaking <strong>with</strong> investment managers,<br />

practice management consultants, insurance professionals, and<br />

others. We hope to get their perspectives on the issues that matter to<br />

Fee-Only advisors.<br />

Conducting these interviews is not as easy as it might seem.<br />

The end product might look as smooth as a financial plan in a fancy<br />

binder—but, just like that financial plan, a lot of work is hidden<br />

below the surface.<br />

The Q&A <strong>with</strong> <strong>Hueler</strong> began in May <strong>with</strong> a suggestion from a<br />

NAPFA staff member. I contacted <strong>Hueler</strong> and gauged her interest,<br />

and she provided me <strong>with</strong> background information, including a<br />

40-page research paper she had co-authored. After I had reviewed<br />

the materials, we conducted a preliminary conversation to exchange<br />

ideas about what might be covered in the Q&A. Then I sent her<br />

a general outline of questions in advance of a phone interview<br />

conducted in September. After the interview, I transcribed the<br />

conversation and selected the most relevant parts. Finally, <strong>Hueler</strong><br />

reviewed the draft in order to correct errors or fix omissions.<br />

The result, I hope, is an illuminating look at developments in the<br />

availability and use of low-cost immediate annuities as part of a<br />

comprehensive financial plan.<br />

Given the long gestation period to produce the Q&A, we won’t<br />

be presenting these interviews in every issue, but we think they<br />

will be worth the wait. We’ve even decided to add another factor<br />

into the mix: NAPFA members who are experts in specific topics<br />

will conduct some of the interviews, as they will be able to ask<br />

questions of greatest relevance to Fee-Only advisors.<br />

Rest of the Issue<br />

While the Q&A is our featured article in this issue of the<br />

Advisor, I’m anticipating that readers will find a great deal of<br />

value in the additional articles, too. John Ryan and Mark Desiderio<br />

contributed an article about how to evaluate long-term disability<br />

insurance offers. NAPFA member Steven Wightman shared his<br />

fascinating perspective on the similarities between being a financial<br />

advisor and a pilot (in his case, a pilot who is aiming to break a<br />

few world records to his credit). Columnist and NAPFA member<br />

Jennifer Lazarus tapped into the experience of numerous NAPFA<br />

members on how to get the most out of a client advisory board.<br />

Enjoy the issue and feel welcome to contact me at any time to<br />

suggest a candidate for a feature Q&A.<br />

CEO<br />

Ellen Turf turfe@napfa.org<br />

sTaff<br />

Managing Editor<br />

Kevin Adler 301.270.2839 kevinadler13@gmail.com<br />

Publisher and Director of Magazine Operations<br />

Eric Haines 732.920.4236 ric.haines@erhassoc.com<br />

Business Development and Membership<br />

Nancy Hradsky hradskyn@napfa.org<br />

Professional Growth and Education<br />

Robin Gemeinhardt gemeinhardtr@napfa.org<br />

Communications<br />

Benjamin Lewis 301.963.7555 ben@bdlpr.com<br />

Public Policy and Advocacy<br />

Karen Nystrom nystromk@napfa.org<br />

Executive Assistant to CEO<br />

Mardi Lee leem@napfa.org<br />

NAPFA Advisor Production<br />

Eric Georgevich ericgeorgevich@gmail.com<br />

Accounting<br />

Laura Maddalone maddalonel@napfa.org<br />

Membership Assistant<br />

Cindy Ganze ganzec@napfa.org<br />

Editorial Assistant<br />

Christopher Hale cghale@gmail.com<br />

Education Assistant<br />

Rachel Gusek gusekr@napfa.org<br />

NCEF Coordinator<br />

Lisa Lenczewski lisal@napfa.org<br />

The NAPFA Advisor Magazine issue #10 October 2012 is published<br />

monthly for $85.00 per year by The National Association of Personal<br />

Financial Advisors, 3250 North Arlington Heights Road, Suite 109,<br />

Arlington Heights, IL 60004. USPS number 024-735. Periodicals<br />

Postage Paid at Arlington Heights, IL, and additional entry office in<br />

Schaumburg and Palatine, IL. Postmaster: Send address changes to The<br />

NAPFA Advisor Magazine, 3250 North Arlington Heights Road, Suite<br />

109, Arlington Heights, IL 60004.<br />

From time to time, NAPFA Advisor publishes articles on technical<br />

subjects. NAPFA makes no representation as to the accuracy or<br />

timeliness of such advice. Submissions are encouraged but will be edited<br />

and published at the discretion of the editor and/or Board of Directors.<br />

All materials should be e-mailed to Kevin Adler at kevinadler13@gmail.<br />

com. Unsolicited material cannot be returned unless accompanied by a<br />

stamped, self-addressed envelope.<br />

NAPFA and NAPFA Advisor do not guarantee or endorse any<br />

product or service advertised in the NAPFA Advisor.<br />

<strong>Napfa</strong> advisor sEpTEMBEr 2012 3