2012 Benefit Enrollment Guide - Education Management Corporation

2012 Benefit Enrollment Guide - Education Management Corporation

2012 Benefit Enrollment Guide - Education Management Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Brought To You By:<br />

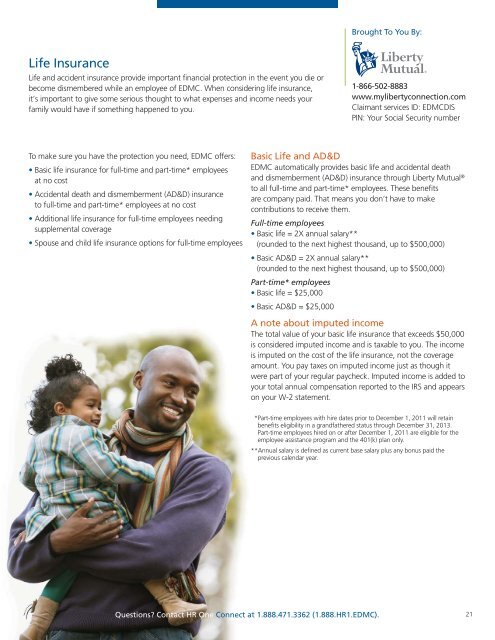

Life Insurance<br />

Life and accident insurance provide important financial protection in the event you die or<br />

become dismembered while an employee of EDMC. When considering life insurance,<br />

it’s important to give some serious thought to what expenses and income needs your<br />

family would have if something happened to you.<br />

1-866-502-8883<br />

www.mylibertyconnection.com<br />

Claimant services ID: EDMCDIS<br />

PIN: Your Social Security number<br />

To make sure you have the protection you need, EDMC offers:<br />

• Basic life insurance for full-time and part-time* employees<br />

at no cost<br />

• Accidental death and dismemberment (AD&D) insurance<br />

to full-time and part-time* employees at no cost<br />

• Additional life insurance for full-time employees needing<br />

supplemental coverage<br />

• Spouse and child life insurance options for full-time employees<br />

Basic Life and AD&D<br />

EDMC automatically provides basic life and accidental death<br />

and dismemberment (AD&D) insurance through Liberty Mutual ®<br />

to all full-time and part-time* employees. These benefits<br />

are company paid. That means you don’t have to make<br />

contributions to receive them.<br />

Full-time employees<br />

• Basic life = 2X annual salary**<br />

(rounded to the next highest thousand, up to $500,000)<br />

• Basic AD&D = 2X annual salary**<br />

(rounded to the next highest thousand, up to $500,000)<br />

Part-time* employees<br />

• Basic life = $25,000<br />

• Basic AD&D = $25,000<br />

A note about imputed income<br />

The total value of your basic life insurance that exceeds $50,000<br />

is considered imputed income and is taxable to you. The income<br />

is imputed on the cost of the life insurance, not the coverage<br />

amount. You pay taxes on imputed income just as though it<br />

were part of your regular paycheck. Imputed income is added to<br />

your total annual compensation reported to the IRS and appears<br />

on your W-2 statement.<br />

*Part-time employees with hire dates prior to December 1, 2011 will retain<br />

benefits eligibility in a grandfathered status through December 31, 2013.<br />

Part-time employees hired on or after December 1, 2011 are eligible for the<br />

employee assistance program and the 401(k) plan only.<br />

**Annual salary is defined as current base salary plus any bonus paid the<br />

previous calendar year.<br />

Questions? Contact HR One Connect at 1.888.471.3362 (1.888.HR1.EDMC).<br />

21