Spring Conference Review - reomac

Spring Conference Review - reomac

Spring Conference Review - reomac

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

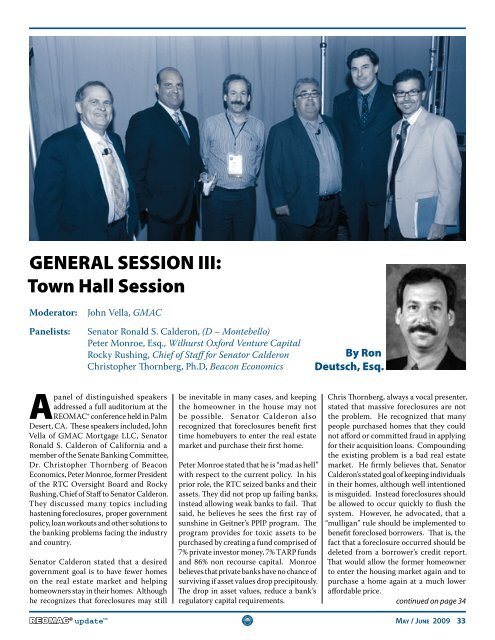

GENERAL SESSION III:<br />

Town Hall Session<br />

Moderator:<br />

Panelists:<br />

John Vella, GMAC<br />

Senator Ronald S. Calderon, (D – Montebello)<br />

Peter Monroe, Esq., Wilhurst Oxford Venture Capital<br />

Rocky Rushing, Chief of Staff for Senator Calderon<br />

Christopher Thornberg, Ph.D, Beacon Economics<br />

By Ron<br />

Deutsch, Esq.<br />

A<br />

panel of distinguished speakers<br />

addressed a full auditorium at the<br />

REOMAC® conference held in Palm<br />

Desert, CA. These speakers included, John<br />

Vella of GMAC Mortgage LLC, Senator<br />

Ronald S. Calderon of California and a<br />

member of the Senate Banking Committee,<br />

Dr. Christopher Thornberg of Beacon<br />

Economics, Peter Monroe, former President<br />

of the RTC Oversight Board and Rocky<br />

Rushing, Chief of Staff to Senator Calderon.<br />

They discussed many topics including<br />

hastening foreclosures, proper government<br />

policy, loan workouts and other solutions to<br />

the banking problems facing the industry<br />

and country.<br />

Senator Calderon stated that a desired<br />

government goal is to have fewer homes<br />

on the real estate market and helping<br />

homeowners stay in their homes. Although<br />

he recognizes that foreclosures may still<br />

be inevitable in many cases, and keeping<br />

the homeowner in the house may not<br />

be possible. Senator Calderon also<br />

recognized that foreclosures benefit first<br />

time homebuyers to enter the real estate<br />

market and purchase their first home.<br />

Peter Monroe stated that he is “mad as hell”<br />

with respect to the current policy. In his<br />

prior role, the RTC seized banks and their<br />

assets. They did not prop up failing banks,<br />

instead allowing weak banks to fail. That<br />

said, he believes he sees the first ray of<br />

sunshine in Geitner’s PPIP program. The<br />

program provides for toxic assets to be<br />

purchased by creating a fund comprised of<br />

7% private investor money, 7% TARP funds<br />

and 86% non recourse capital. Monroe<br />

believes that private banks have no chance of<br />

surviving if asset values drop precipitously.<br />

The drop in asset values, reduce a bank’s<br />

regulatory capital requirements.<br />

Chris Thornberg, always a vocal presenter,<br />

stated that massive foreclosures are not<br />

the problem. He recognized that many<br />

people purchased homes that they could<br />

not afford or committed fraud in applying<br />

for their acquisition loans. Compounding<br />

the existing problem is a bad real estate<br />

market. He firmly believes that, Senator<br />

Calderon’s stated goal of keeping individuals<br />

in their homes, although well intentioned<br />

is misguided. Instead foreclosures should<br />

be allowed to occur quickly to flush the<br />

system. However, he advocated, that a<br />

“mulligan” rule should be implemented to<br />

benefit foreclosed borrowers. That is, the<br />

fact that a foreclosure occurred should be<br />

deleted from a borrower’s credit report.<br />

That would allow the former homeowner<br />

to enter the housing market again and to<br />

purchase a home again at a much lower<br />

affordable price.<br />

continued on page 34<br />

REOMAC ® update tm Ma y / Jun e 2009 33