Spring Conference Review - reomac

Spring Conference Review - reomac

Spring Conference Review - reomac

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

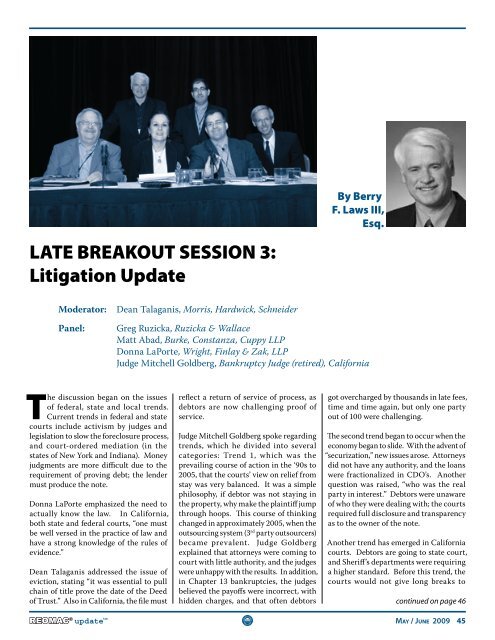

By Berry<br />

F. Laws III,<br />

Esq.<br />

LATE BREAKOUT SESSION 3:<br />

Litigation Update<br />

Moderator:<br />

Panel:<br />

Dean Talaganis, Morris, Hardwick, Schneider<br />

Greg Ruzicka, Ruzicka & Wallace<br />

Matt Abad, Burke, Constanza, Cuppy LLP<br />

Donna LaPorte, Wright, Finlay & Zak, LLP<br />

Judge Mitchell Goldberg, Bankruptcy Judge (retired), California<br />

The discussion began on the issues<br />

of federal, state and local trends.<br />

Current trends in federal and state<br />

courts include activism by judges and<br />

legislation to slow the foreclosure process,<br />

and court-ordered mediation (in the<br />

states of New York and Indiana). Money<br />

judgments are more difficult due to the<br />

requirement of proving debt; the lender<br />

must produce the note.<br />

Donna LaPorte emphasized the need to<br />

actually know the law. In California,<br />

both state and federal courts, “one must<br />

be well versed in the practice of law and<br />

have a strong knowledge of the rules of<br />

evidence.”<br />

Dean Talaganis addressed the issue of<br />

eviction, stating “it was essential to pull<br />

chain of title prove the date of the Deed<br />

of Trust.” Also in California, the file must<br />

reflect a return of service of process, as<br />

debtors are now challenging proof of<br />

service.<br />

Judge Mitchell Goldberg spoke regarding<br />

trends, which he divided into several<br />

categories: Trend 1, which was the<br />

prevailing course of action in the ‘90s to<br />

2005, that the courts’ view on relief from<br />

stay was very balanced. It was a simple<br />

philosophy, if debtor was not staying in<br />

the property, why make the plaintiff jump<br />

through hoops. This course of thinking<br />

changed in approximately 2005, when the<br />

outsourcing system (3 rd party outsourcers)<br />

became prevalent. Judge Goldberg<br />

explained that attorneys were coming to<br />

court with little authority, and the judges<br />

were unhappy with the results. In addition,<br />

in Chapter 13 bankruptcies, the judges<br />

believed the payoffs were incorrect, with<br />

hidden charges, and that often debtors<br />

got overcharged by thousands in late fees,<br />

time and time again, but only one party<br />

out of 100 were challenging.<br />

The second trend began to occur when the<br />

economy began to slide. With the advent of<br />

“securization,” new issues arose. Attorneys<br />

did not have any authority, and the loans<br />

were fractionalized in CDO’s. Another<br />

question was raised, “who was the real<br />

party in interest.” Debtors were unaware<br />

of who they were dealing with; the courts<br />

required full disclosure and transparency<br />

as to the owner of the note.<br />

Another trend has emerged in California<br />

courts. Debtors are going to state court,<br />

and Sheriff’s departments were requiring<br />

a higher standard. Before this trend, the<br />

courts would not give long breaks to<br />

continued on page 46<br />

REOMAC ® update tm Ma y / Jun e 2009 45