Spring Conference Review - reomac

Spring Conference Review - reomac

Spring Conference Review - reomac

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

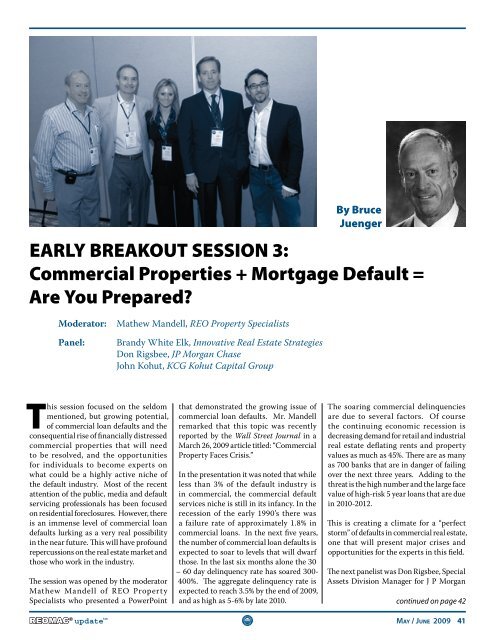

By Bruce<br />

Juenger<br />

EARLY BREAKOUT SESSION 3:<br />

Commercial Properties + Mortgage Default =<br />

Are You Prepared?<br />

Moderator:<br />

Panel:<br />

Mathew Mandell, REO Property Specialists<br />

Brandy White Elk, Innovative Real Estate Strategies<br />

Don Rigsbee, JP Morgan Chase<br />

John Kohut, KCG Kohut Capital Group<br />

This session focused on the seldom<br />

mentioned, but growing potential,<br />

of commercial loan defaults and the<br />

consequential rise of financially distressed<br />

commercial properties that will need<br />

to be resolved, and the opportunities<br />

for individuals to become experts on<br />

what could be a highly active niche of<br />

the default industry. Most of the recent<br />

attention of the public, media and default<br />

servicing professionals has been focused<br />

on residential foreclosures. However, there<br />

is an immense level of commercial loan<br />

defaults lurking as a very real possibility<br />

in the near future. This will have profound<br />

repercussions on the real estate market and<br />

those who work in the industry.<br />

The session was opened by the moderator<br />

Mathew Mandell of REO Property<br />

Specialists who presented a PowerPoint<br />

that demonstrated the growing issue of<br />

commercial loan defaults. Mr. Mandell<br />

remarked that this topic was recently<br />

reported by the Wall Street Journal in a<br />

March 26, 2009 article titled: “Commercial<br />

Property Faces Crisis.”<br />

In the presentation it was noted that while<br />

less than 3% of the default industry is<br />

in commercial, the commercial default<br />

services niche is still in its infancy. In the<br />

recession of the early 1990’s there was<br />

a failure rate of approximately 1.8% in<br />

commercial loans. In the next five years,<br />

the number of commercial loan defaults is<br />

expected to soar to levels that will dwarf<br />

those. In the last six months alone the 30<br />

– 60 day delinquency rate has soared 300-<br />

400%. The aggregate delinquency rate is<br />

expected to reach 3.5% by the end of 2009,<br />

and as high as 5-6% by late 2010.<br />

The soaring commercial delinquencies<br />

are due to several factors. Of course<br />

the continuing economic recession is<br />

decreasing demand for retail and industrial<br />

real estate deflating rents and property<br />

values as much as 45%. There are as many<br />

as 700 banks that are in danger of failing<br />

over the next three years. Adding to the<br />

threat is the high number and the large face<br />

value of high-risk 5 year loans that are due<br />

in 2010-2012.<br />

This is creating a climate for a “perfect<br />

storm” of defaults in commercial real estate,<br />

one that will present major crises and<br />

opportunities for the experts in this field.<br />

The next panelist was Don Rigsbee, Special<br />

Assets Division Manager for J P Morgan<br />

continued on page 42<br />

REOMAC ® update tm Ma y / Jun e 2009 41