Behind the Veneer - Tasmanian Greens MPs

Behind the Veneer - Tasmanian Greens MPs

Behind the Veneer - Tasmanian Greens MPs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TA ANN: BEHIND THE VENEER<br />

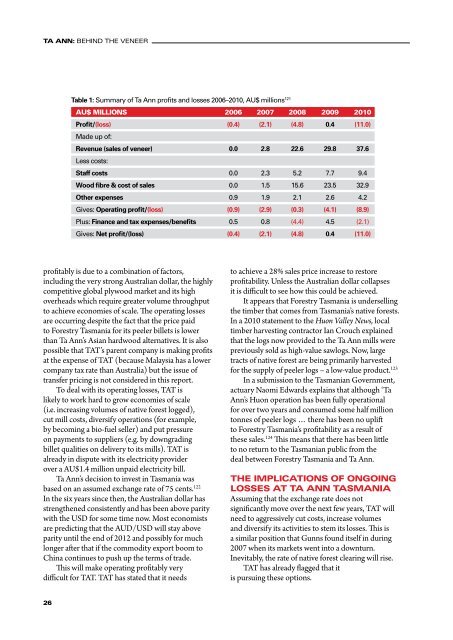

Table 1: Summary of Ta Ann profits and losses 2006–2010, AU$ millions 121<br />

AU$ millions 2006 2007 2008 2009 2010<br />

Profit/(loss) (0.4) (2.1) (4.8) 0.4 (11.0)<br />

Made up of:<br />

Revenue (sales of veneer) 0.0 2.8 22.6 29.8 37.6<br />

Less costs:<br />

Staff costs 0.0 2.3 5.2 7.7 9.4<br />

Wood fibre & cost of sales 0.0 1.5 15.6 23.5 32.9<br />

O<strong>the</strong>r expenses 0.9 1.9 2.1 2.6 4.2<br />

Gives: Operating profit/(loss) (0.9) (2.9) (0.3) (4.1) (8.9)<br />

Plus: Finance and tax expenses/benefits 0.5 0.8 (4.4) 4.5 (2.1)<br />

Gives: Net profit/(loss) (0.4) (2.1) (4.8) 0.4 (11.0)<br />

profitably is due to a combination of factors,<br />

including <strong>the</strong> very strong Australian dollar, <strong>the</strong> highly<br />

competitive global plywood market and its high<br />

overheads which require greater volume throughput<br />

to achieve economies of scale. The operating losses<br />

are occurring despite <strong>the</strong> fact that <strong>the</strong> price paid<br />

to Forestry Tasmania for its peeler billets is lower<br />

than Ta Ann’s Asian hardwood alternatives. It is also<br />

possible that TAT’s parent company is making profits<br />

at <strong>the</strong> expense of TAT (because Malaysia has a lower<br />

company tax rate than Australia) but <strong>the</strong> issue of<br />

transfer pricing is not considered in this report.<br />

To deal with its operating losses, TAT is<br />

likely to work hard to grow economies of scale<br />

(i.e. increasing volumes of native forest logged),<br />

cut mill costs, diversify operations (for example,<br />

by becoming a bio-fuel seller) and put pressure<br />

on payments to suppliers (e.g. by downgrading<br />

billet qualities on delivery to its mills). TAT is<br />

already in dispute with its electricity provider<br />

over a AU$1.4 million unpaid electricity bill.<br />

Ta Ann’s decision to invest in Tasmania was<br />

based on an assumed exchange rate of 75 cents. 122<br />

In <strong>the</strong> six years since <strong>the</strong>n, <strong>the</strong> Australian dollar has<br />

streng<strong>the</strong>ned consistently and has been above parity<br />

with <strong>the</strong> USD for some time now. Most economists<br />

are predicting that <strong>the</strong> AUD/USD will stay above<br />

parity until <strong>the</strong> end of 2012 and possibly for much<br />

longer after that if <strong>the</strong> commodity export boom to<br />

China continues to push up <strong>the</strong> terms of trade.<br />

This will make operating profitably very<br />

difficult for TAT. TAT has stated that it needs<br />

to achieve a 28% sales price increase to restore<br />

profitability. Unless <strong>the</strong> Australian dollar collapses<br />

it is difficult to see how this could be achieved.<br />

It appears that Forestry Tasmania is underselling<br />

<strong>the</strong> timber that comes from Tasmania’s native forests.<br />

In a 2010 statement to <strong>the</strong> Huon Valley News, local<br />

timber harvesting contractor Ian Crouch explained<br />

that <strong>the</strong> logs now provided to <strong>the</strong> Ta Ann mills were<br />

previously sold as high-value sawlogs. Now, large<br />

tracts of native forest are being primarily harvested<br />

for <strong>the</strong> supply of peeler logs – a low-value product. 123<br />

In a submission to <strong>the</strong> <strong>Tasmanian</strong> Government,<br />

actuary Naomi Edwards explains that although ‘Ta<br />

Ann’s Huon operation has been fully operational<br />

for over two years and consumed some half million<br />

tonnes of peeler logs … <strong>the</strong>re has been no uplift<br />

to Forestry Tasmania’s profitability as a result of<br />

<strong>the</strong>se sales. 124 This means that <strong>the</strong>re has been little<br />

to no return to <strong>the</strong> <strong>Tasmanian</strong> public from <strong>the</strong><br />

deal between Forestry Tasmania and Ta Ann.<br />

The implications of ongoing<br />

losses at Ta Ann Tasmania<br />

Assuming that <strong>the</strong> exchange rate does not<br />

significantly move over <strong>the</strong> next few years, TAT will<br />

need to aggressively cut costs, increase volumes<br />

and diversify its activities to stem its losses. This is<br />

a similar position that Gunns found itself in during<br />

2007 when its markets went into a downturn.<br />

Inevitably, <strong>the</strong> rate of native forest clearing will rise.<br />

TAT has already flagged that it<br />

is pursuing <strong>the</strong>se options.<br />

26